Mexico based Vista Energy (NYSE: VIST / FRA: 1CIA / BMV: VISTAA)’s main asset in Argentina is the largest shale oil and shale gas play under development outside North America. Shares have risen from the $3 level in 2021 to the $20 level as of May 2023.

The WSJ recently mentioned the stock in an article (As Oil Giants Retreat Globally, Smaller Players Rush In) about how the oil majors are still developing a handful of big oil and gas fields in Latin America. But increasingly, it is smaller, little-known oil firms who are moving into risky lesser explored regions and getting the fossil fuels out of the ground. These smaller oil players have lower costs and can quickly recoup their investment before the next oil price downturn.

OVERVIEW:

- Vista Energy was founded in 2017 by Miguel Galuccio, the former CEO of Argentina’s state-owned oil company YPF. Their IPO raised $650M. The Company has acquired several exploration and production contracts for oil and gas.

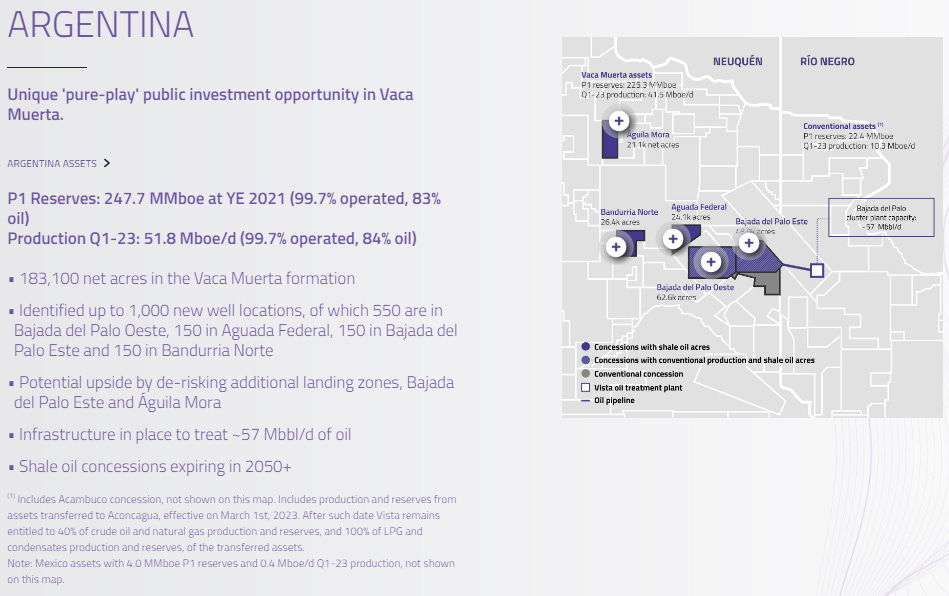

- Today, Vista Energy is a leading independent operator, with its main assets in Vaca Muerta (Argentina), the largest shale oil and shale gas play under development outside North America. The company was listed as a SPAC in Mexico in 2017 and subsequently listed on the NYSE in 2019, after having purchased two companies with a full operating platform in Argentina in 2018.

- Vista’s investment thesis is to develop its high-return shale oil drilling inventory of up to 1,000 wells spanning 183,100 Vaca Muerta acres, with focus on cost efficiency and low carbon intensity production.

- Since 2018, Vista ignited a strong growth trajectory, showing solid production results to date. By March 2023, the company had tied-in 74 wells in Vaca Muerta delivering best-in-basin productivity, proving the top-quality of its acreage and its growth capabilities.

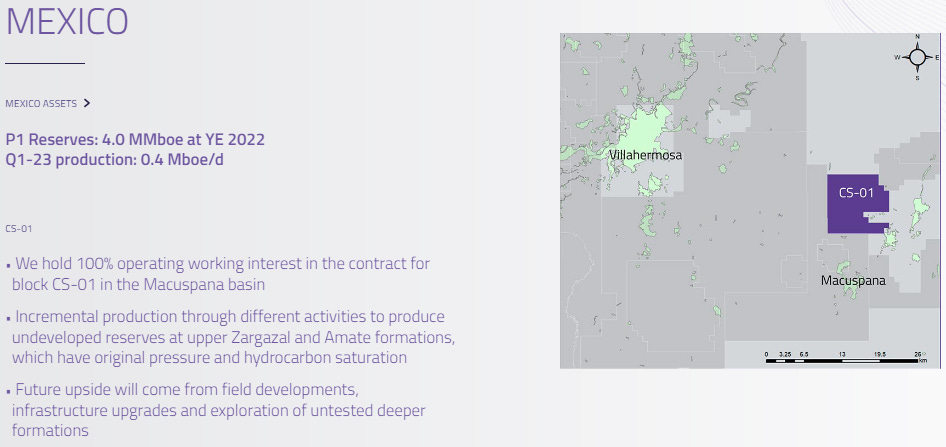

- In Mexico, Vista acquired a 100% interest of the contract for block CS-01 in the Macuspana basin.

RECENT FINANCIALS / NEWS:

- Earnings Release Q1 2023 (PDF File) and Earnings Presentation Q1 2023 (PDF File)

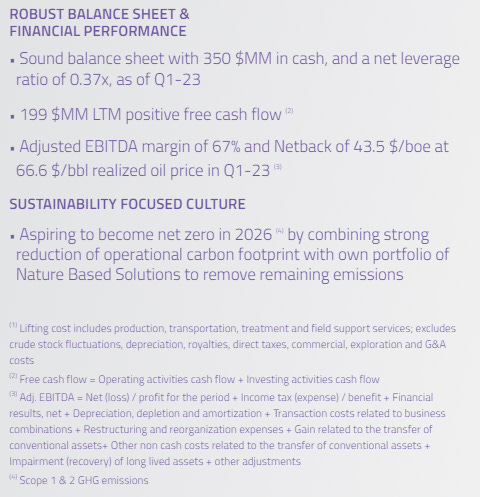

- Revenues in Q1 2023 were 303.2 $MM, 46% above the 207.9 $MM generated in Q1 2022, driven by an increase in production and realized prices. During Q1 2023, revenues from oil and gas exports were 181.7 $MM, a 128% increase y-o-y and representing 60% of total revenues. Oil exports were 169.0 M 0.99%↑ M and represented 60% of oil revenues.

- In Q1 2023, the average realized crude oil price was 66.6 $/bbl, a 4% increase compared to the average realized crude oil price of Q1 2022.

- Realized natural gas price for Q1 2023 was 4.7 $/MMBtu, resulting in a 54% increase y-o-y driven by exports to Chile at 8.9 $/MMBtu (30% of total gas sales volumes).

- Lifting cost in Q1 2023 was 6.4 $/boe, representing an 18% decrease compared to Q1 2022, driven by the transaction to fully-focus on shale oil operations as of March 1, 2023.

- In Q1 2023, the Company recorded a positive free cash flow of 34.7 $MM. Cash flow generated by operating activities was 158.8 $MM, while cash flow used in investing activities reached 124.0 $MM for the quarter. Cash flow generated by financing activities totaled 71.1 $MM, mainly driven by proceeds from borrowings of 135.0 $MM and partially offset by the payment of a 22.5 $MM installment of our term-loan.

- Q1 2023 total production was 52,207 boe/d, a 19% increase compared to Q1 2022. Oil production in Q1 2023 increased 24% y-o-y to 44,048 bbl/d, mainly driven by a solid well performance in Vista’s development hub in Vaca Muerta (Bajada del Palo Oeste, Aguada Federal and Bajada del Palo Este blocks).

- Vista Energy CEO on Argentina’s Energy Ambitions (Bloomberg Video) February 2023 (7:19 Minutes)

- Vista Energy Chairman and CEO Miguel Galuccio explains why Argentina may be poised to regain its status as one of the world’s major energy exporters.

- Vista builds oil momentum in Argentina, seeks dollars under promotional regime (BNA Americas) February 2023

- Vista is Argentina’s third-biggest oil producer after national oil company YPF and Pan American Energy. But it is the second-biggest producer, after YPF, at the Vaca Muerta unconventional hydrocarbons formation, where it is focusing investment.

- Mexico-listed Vista is exporting around half of the oil it produces, partly spurred by favorable export prices of around US$74/b in Q4, compared with roughly US$63/b obtained in the domestic market. The local barrel price results from agreements reached by the government, refiners and producers, the latter urging export parity prices. With 2023 an election year, local pump prices would be unlikely to undergo any significant increase.

RECENT STOCK ANALYSIS:

- Vista Energy Is Still Undervalued (NYSE:VIST) (Seeking Alpha) April 2023

- The most recent quarter witnessed a net margin expansion to 42.4%.

- The last 4 quarters of operations have a combined annual return on capital of 29.55%.

- The company has a forward P/E of 5.54x, a trailing PEG of 0.01x, and a forward Price/Cash Flow of 2.47x.

- It has low debt and improving equity.

- Vista Energy stock is still a Buy.

- Vista Energy Stock Analysis | VIST Stock Analysis | Best Stock to Buy Now? (Youtube) 12:06 Minutes (March 2023)

KEY RATIOS:

- P/E (Google Finance): n/a / Forward P/E (Finviz): 4.70 / Forward P/E (Yahoo! Finance): 4.90

- Dividend Yield (Google Finance): n/a / Dividend Yield (Finviz): n/a / Forward Dividend & Yield (Yahoo! Finance): n/a

1 YEAR CHART:

LONG TERM CHART:

ADDITIONAL RESOURCES:

- Website

- Investor Relations

- Wikipedia (Spanish)

- Operations

- Earnings Release Q1 2023 (PDF File) and Earnings Presentation Q1 2023 (PDF File)

- Vista Energy CEO on Argentina’s Energy Ambitions (Bloomberg Video) February 2023 (7:19 Minutes)

- Vista builds oil momentum in Argentina, seeks dollars under promotional regime (BNA Americas) February 2023

- Vista Energy Is Still Undervalued (NYSE:VIST) (Seeking Alpha) April 2023

- Vista Energy Stock Analysis | VIST Stock Analysis | Best Stock to Buy Now? (Youtube) 12:06 Minutes (March 2023)

- As Oil Giants Retreat Globally, Smaller Players Rush In (WSJ) May 2023

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Similar Posts:

- How Food Inflation is Swallowing Latin America’s Dietary Staples (Financial Times)

- Chinese Wages Now Higher Than in Brazil, Argentina and Mexico (Global Insolvency)

- Pricey Tortillas: LatAm’s Poor Struggle to Afford Staples (AP)

- Latin America’s Pink Wave Faces Investor Skepticism (The Emerging Markets Investor)

- Argentina: Where Growth & Stock Market Returns Diverge (Mobius Blog)

- Is There Progress Fighting Latin American Corruption? (Economist)

- S&W’s McGrath: Emerging Markets Are at the Perfect Entry Point (FE Trustnet)

- Which Emerging Markets Have the Most Leveraged Stocks? (Bloomberg)

- The Flawed Global X MSCI Argentina ETF’s Holdings (September 2023)

- Betterware de Mexico (NASDAQ: BWMX): Mexico’s Direct Selling Powerhouse With Big Expansion Plans

- Latin America Slow Descent into Interventionism (Daniel Lacalle)

- Argentine Central Bank’s Sudden Dollar Shortage Sparks Fears Of Mass Corporate Credit Crisis (Zero Hedge)

- What it Looks Like When a Country Doesn’t Trust its Banks (VOX)

- Alsea (BMV: ALSEA / FRA: 4FU / OTCMKTS: ALSSF): Seeing Robust Starbucks and QSR Growth

- Trying to Make Sense of Argentina’s Debt Mess (BA Herald)