Mexico based Alsea SAB de CV (BMV: ALSEA / FRA: 4FU / OTCMKTS: ALSSF) is the leading restaurant operator in Latin America and Spain of global brands in the quick service, coffee shop (Starbucks), casual and family dining segments. The Company’s Starbucks outlets reported a significant 36% growth in same-store sales for Q1 2023 while the Quick Service Restaurant (QSR) segment experienced a robust 19% growth.

The stock is also a holding of The Mexico Fund, Inc (NYSE: MXF).

OVERVIEW:

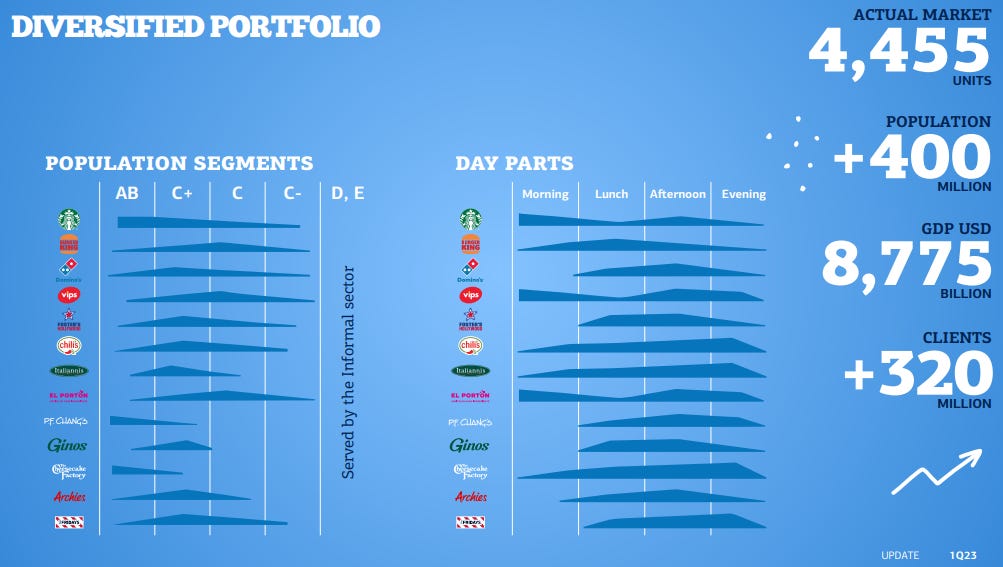

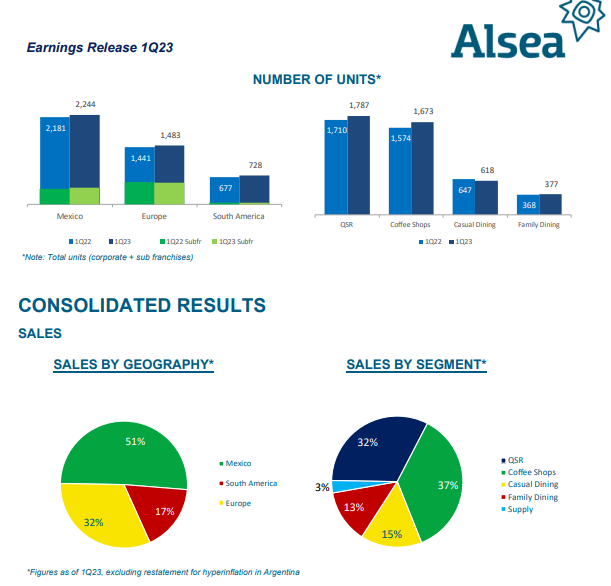

- Alsea has a diversified portfolio, with brands such as Domino’s Pizza, Starbucks, Burger King, Chili’s, P. F. Chang’s, Italianni’s, The Cheesecake Factory, Vips, Vips Smart, El Portón, Archies, Foster’s Hollywood, Gino’s, TGI Fridays, Foster’s Hollywood Street, Ole Mole and Corazón. The company operates more than 4,000 units in Mexico, Spain, Argentina, Colombia, Chile, France, Portugal, Netherlands, Belgium, Luxembourg and Uruguay.

- Alsea’s business model includes support for its brands through a Shared Services Center that provides all the Administrative and Development Processes, as well as the Supply Chain.

- Alsea Day 2023 (YouTube) 2:55 Hours (Alsea) April 2023

RECENT FINANCIALS / NEWS:

- Alsea Earnings Release 2023 1Q

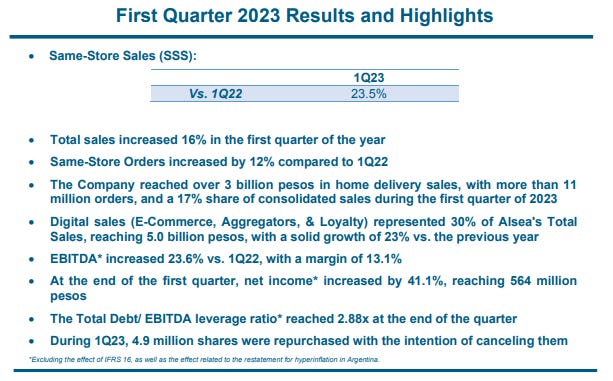

- Armando Torrado, Chief Executive Officer of Alsea, commented: “…..I am pleased to share our strong results for the first quarter of 2023. Total sales in the period increased by 16% year over year to 17.5 billion pesos, demonstrating significant growth in all our regions. Additionally, EBITDA for the quarter (Pre-IFRS 16) increased by 23.6% year over year, to 2.3 billion pesos.

- These positive results reflect the robust demand for our brands and the Company’s operational excellence. Furthermore, even though our in-restaurant sales are increasing, our delivery sales during the quarter accounted for 17% of the overall sales, in line with the previous quarter.

- With respect to our expansion strategy, in the quarter we added 20 new corporate restaurants and 8 franchises, primarily Starbucks and Domino’s Pizza. We carefully assess each new potential opening to capitalize on market opportunities throughout our regions, while always prioritizing profitability.

- Regarding our brands, Starbucks reported a significant 36% growth in same-store sales in the quarter, and I’m pleased to share that Alsea recently signed an agreement with Starbucks to open its first store in Paraguay. The Quick Service Restaurant (QSR) segment experienced a robust 19% growth, while the Casual Dining Segment saw a 17% increase compared to the same quarter of last year.

- On March 30, 2023, we held our investor day “Alsea Day” in New York City, providing an excellent space to interact with our investors, discuss strategic initiatives, and share our 2023 guidance. In our presentation, we shared that we’re reducing our team member turnover rate and utilizing Artificial Intelligence technology solutions for team member recruitment. Related to supply chain, we are boosting efficiency and reducing costs through technological advancements in trucking, manufacturing more of our ingredients in house, and strategic hedging contracts. Regarding digital initiatives, our customers with loyalty accounts spend more per transaction, visit us more frequently, and leave us with valuable data to learn how to serve them better. In line with the digital transformation strategy, we are making progress with the roll out of the Domino’s CLOUD E-Commerce Platform in Mexico and Colombia, as well as the pilot of Stars for Everyone (SFE) in Mexico, which will enable us to continue expanding and refining our brands’ digital programs.

- In terms of our 2023 guidance, we anticipate opening between 250 and 290 new stores, while projecting a 14% to 17% growth in same-store sales, with revenues exceeding 13%. Additionally, we expect pre-IFRS 16 EBITDA to grow by more than 15% and post-IFRS 16 EBITDA to increase by more than 10%….”

- Mexico’s Alsea seeking to open 300 new Starbucks stores in Europe by 2028 (World Coffee Portal) April 2023

- The quick-service hospitality group, which licenses Starbucks stores across 11 markets, will invest $304m to support group expansion in 2023 with a focus on growing the Seattle-based coffee chain in Europe.

KEY RATIOS:

- P/E (Google Finance): 28.59 / Forward P/E (Yahoo! Finance): 19.72

- Dividend Yield (Google Finance): N/A / Forward Dividend & Yield (Yahoo! Finance): N/A

1 YEAR CHART:

LONG TERM CHART:

ADDITIONAL RESOURCES:

- Website

- Investor Relations

- Wikipedia

- Asea Day 2023 – Presentation

- Alsea Day 2023 (YouTube) 2:55 Hours (Alsea) April 2023

- Alsea Earnings Release 2023 1Q

- Mexico’s Alsea seeking to open 300 new Starbucks stores in Europe by 2028 (World Coffee Portal) April 2023

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Similar Posts:

- Mexico Closed End Fund Stock Picks (Early 2023)

- Betterware de Mexico (NASDAQ: BWMX): Mexico’s Direct Selling Powerhouse With Big Expansion Plans

- Emerging Market Stock Pick Tear Sheets (July 1-15, 2023)

- Vista Energy (NYSE: VIST): Has the Largest Shale Oil and Gas Play Under Development Outside North America

- Quálitas Controladora (BMV: Q): A Potential NAFTA and Mexico Nearshoring Play

- Back to “Old School” Emerging Markets: Mexico (Wellington Management)

- Vesta (BMV: VESTA / NYSE: VTMX): The Mexico Nearshoring Industrial Real Estate Stock Continues to Rise

- The Mexican Peso as a US Election Barometer (Bloomberg)

- Hungary, Poland, Mexico and South Korea Poised to Handle a Pull Back in US Monetary Stimulus (WealthManagement.com)

- Mexico’s $100-Billion Auto Parts Industry is Reinventing Itself for the EV era (Rest of World)

- Mexico Analysis: Tequila Surprise? (LGIM)

- Latin America: Will Politics Overshadow GDP Growth? (Invesco)

- Emerging Market CDS Volume Up 46% in 2014 (EMTA)

- Mexico’s Economic Reforms Take Hold (CSMonitor)

- The Brazilian Real and the Mexican Peso Have Climbed Against the Dollar as it Steamrolls Rival Currencies This Year — But Economic and Political Risks Could Eat Into Their Gains (Markets Insider)