China-USA based Legend Biotech (NASDAQ: LEGN) is a developer of commercial-stage biotech medicines partnered with J&J. A May 16th Nikkei Asia and FT article noted the Company had told them how concerns about the Holding Foreign Companies Accountable Act (HFCAA) had prompted them to shift its auditing work from Ernst & Young Hua Ming in Shanghai to an E&Y office in New Jersey in 2022. Tina Carter, corporate communications lead at Legend Biotech, was quoted as saying:

“When this law went into effect, we began to transition [from] a China-based accounting company to a PCAOB-registered accounting company based in the U.S… That process is now complete.”

- Chinese companies switch auditors to avoid US delisting risk (FT) (Nikkei Asia version) – Firms in the US and Singapore gain business as Washington’s accountant inspections begin.

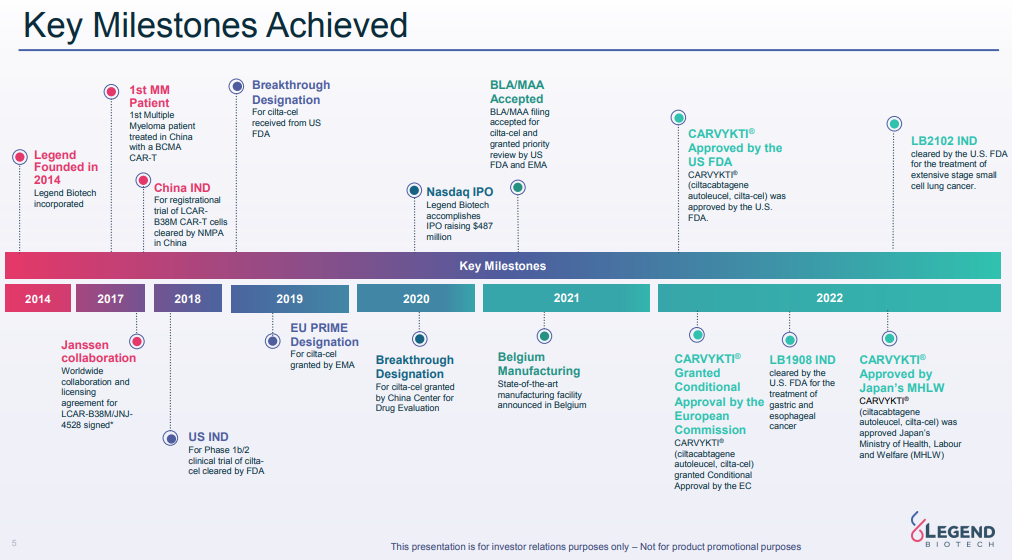

Shares also recently surged on leaked data suggesting infusion of Legend and J&J’s CAR-T therapy Carvykti slashed the risk of tumor progression or death by a whopping 74% compared with the standard of care in patients with multiple myeloma.

OVERVIEW:

- Legend Biotech is a subsidiary of Genscript Biotech Corporation (HKG: 1548 / FRA: G51 / OTCMKTS: GNNSF).

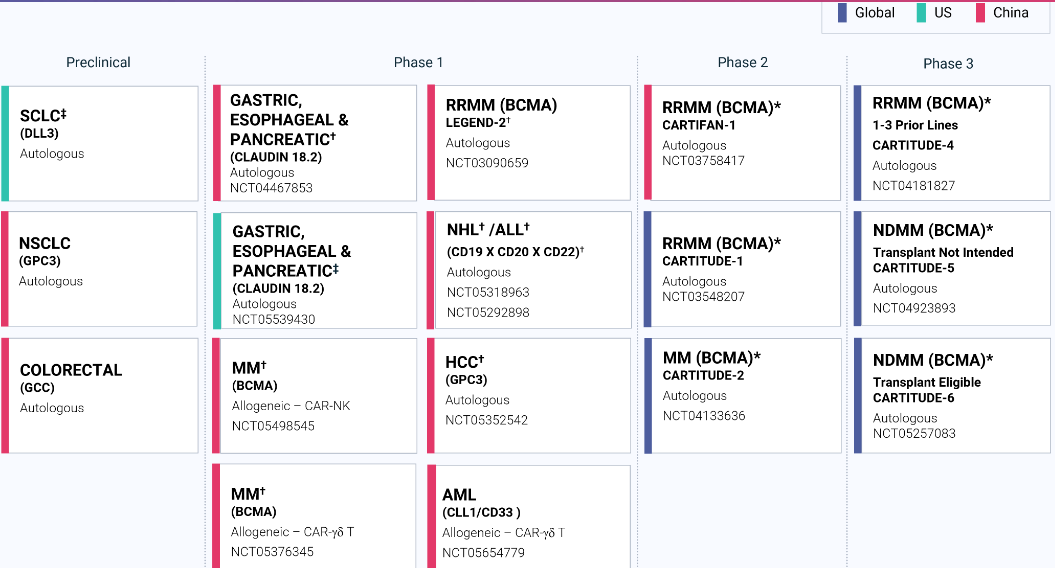

- Headquartered in Somerset, New Jersey, Legend Biotech is developing advanced cell therapies across a diverse array of technology platforms, including autologous and allogenic chimeric antigen receptor T-cell and natural killer (NK) cell-based immunotherapy.

- Specifically, Legend Biotech is currently discovering and developing a broad portfolio of cell therapies to help strengthen patients’ immune systems and fight disease. The Company explores several innovative and evolving technologies to treat hematologic malignancies and solid tumors: autologous chimeric antigen receptor T-cell therapy (CAR-T), allogeneic non-gene-editing CAR-T, natural killer (NK) cells and CAR-γδ T cells.

RECENT FINANCIALS / NEWS:

- Legend Biotech Reports First Quarter 2023 Results and Recent Highlights May 2023

- $350 million in gross proceeds raised in a registered direct offering

- $212 million in gross proceeds raised from private placements

- Gross proceeds of $200 million received from the exercise of warrant issued in May 2021

- Total revenue for the three months ended March 31, 2023 was $36.3 million compared to $50.0 million for the three months ended March 31, 2022. Collaboration revenue recognized in the first quarter of 2023 was from CARVYKTI® sales primarily in the U.S. License revenue recognized in first quarter of 2022 was due to the achievement of commercial milestone for FDA approval in the U.S. in connection with the license and collaboration agreement (the “Janssen Agreement”) with Janssen Biotech, Inc. (“Janssen”).

- Collaboration cost of revenue for the three months ended March 31, 2023 was $35.6 million. Legend Biotech did not have any collaboration cost of revenue in the three months ended March 31, 2022. The $35.6 million is a combination of Legend’s portion of collaboration cost of sales in connection with collaboration revenue under the Janssen Agreement along with expenditures to support the manufacturing capacity expansion which cannot be capitalized.

- For the three months ended March 31, 2023, net loss was $112.1 million, or $0.34 per share, compared to a net loss of $32.3 million, or $0.10 per share, for the three months ended March 31, 2022.

- As of March 31, 2023, prior to giving effect to the registered direct offering, private placements or warrant exercise noted above, Legend Biotech had approximately $854 million of cash and cash equivalents, time deposits, and short-term investments.

- Ying Huang, Chief Executive Officer of Legend Biotech: “We are extremely pleased to announce that we have recently raised $762 million in funding. With this substantial capital infusion, we are poised to embark on a critical chapter in our company’s growth to advance CARVYKTI® toward its full potential, and we look forward to presenting the latest data from our CARTITUDE clinical development programs at ASCO and EHA this June.”

- Leaked abstract shows massive benefit for J&J, Legend’s Carvykti (Fierce Pharma) April 2023

- The much-anticipated CAR-T showdown between Bristol Myers Squibb and the alliance of Johnson & Johnson and Legend Biotech in the early treatment of multiple myeloma has arrived sooner than expected—courtesy of a data leak.

- One infusion of J&J and Legend’s CAR-T therapy Carvykti slashed the risk of tumor progression or death by a whopping 74% compared with standard of care in patients with multiple myeloma who had previously tried one to three lines of therapy, according to an apparently leaked abstract Fierce Pharma has obtained.

- Meanwhile, J&J and Legend just recruited another cell therapy veteran, Novartis, to help manufacture Carvykti for clinical trials outside of China. However, given the tech transfer and the requirement for FDA approval of the new manufacturing site, Phipps thinks the deal could take several years to fully affect supply

- Legend Biotech: Leaked EHA Abstract Shows Outstanding CARTITUDE-4 Results (Seeking Alpha) April 2023

- Shares of Legend Biotech rose after a leaked EHA abstract showed a robust treatment effect of Carvykti in the CARTITUDE-4.

- The hazard ratio of 0.26 was much better than my expectations of a ratio of at least below 0.50 and possibly/likely below 0.40.

- Importantly, there were no new safety signals, and the majority of relevant adverse events were grade 1 and 2.

- Partner J&J reported $72 million in Carvykti net sales in the first quarter in what is still a supply-constrained launch.

- CARTITUDE-4 results put Carvykti in an excellent position to capture significant market share in the earlier lines of multiple myeloma.

KEY RATIOS:

- P/E (Google Finance): N/A / Forward P/E (Yahoo! Finance): N/A

- Dividend Yield (Google Finance): N/A / Forward Dividend & Yield (Yahoo! Finance): N/A

1 YEAR CHART:

LONG TERM CHART:

ADDITIONAL RESOURCES:

- Website

- Investor Relations

- Wikipedia (GenScript Biotech)

- Legend Biotech Reports First Quarter 2023 Results and Recent Highlights May 2023

- Chinese companies switch auditors to avoid US delisting risk (FT) (Nikkei Asia version) May 2023

- Leaked abstract shows massive benefit for J&J, Legend’s Carvykti (Fierce Pharma) April 2023

- Legend Biotech: Leaked EHA Abstract Shows Outstanding CARTITUDE-4 Results (Seeking Alpha) April 2023

- Corporate Presentation – January 2023 (PDF File)

- Legend Biotech Corporation Announces Pricing of Public Offering December 2021

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Similar Posts:

- China Internet Update (KraneShares)

- Fangdd Network (NASDAQ: DUO): Can the Online Marketplace Ride Out the Chinese Property Downturn?

- TOP Financial Group (NASDAQ: TOP): Hong Kong’s Latest Crazy Meme Stock

- ACM Research (NASDAQ: ACMR): Successfully Straddling the US-China Chip Conflict (So Far…)

- Shanghai Milkground Food Tech (SHA: 600882): A Cheese Darkhorse Hit by Peak Cheese Lollipop as Chinese Consumers Tighten Belts

- Mercurity Fintech Holdings (NASDAQ: MFH): Speculative Chinese Fintech, Blockchain and Bitcoin Stock

- DouYu Ends First Day at Its Offer Price in $775 Million IPO (Bloomberg)

- Huawei Says U.S. Ban Hurting More Than Expected, to Wipe $30 Billion Off Revenue (Reuters)

- ZJLD Group (HKG: 6979): IPO of the First Baijiu Maker to List Outside of China Flops

- Noah Holdings (NYSE: NOAH): A Chinese Wealth Management Firm Facing a “Crisis of Confidence” in the Sector

- Housebound Consumers Lift Lenovo to Record Revenues & Profits (HKEXnews)

- China Internet Flash Report: 2015 & Beyond + an Overview of 2014 Results (KraneShares)

- Wynn Palace Will Outperform Other Macau Casino Developments (Fitch)

- Emerging Market Stock Pick Tear Sheets (June 1-18, 2023)

- After Jack: Alibaba Searches for New Growth in the Post-Ma Era (Nikkei Asian Review)