Mercurity Fintech Holdings (NASDAQ: MFH) is a speculative Chinese fintech and blockchain stock. A May 16th Nikkei Asia and FT article noted the Company switched from auditor Shanghai Perfect to Onestop Assurance PAC of Singapore as the latter is registered with the Public Company Accounting Oversight Board (PCAOB) and has been inspected by the Board “on a regular basis.”

- Chinese companies switch auditors to avoid US delisting risk (FT) (Nikkei Asia version) – Firms in the US and Singapore gain business as Washington’s accountant inspections begin.

The move reduces the risk of Mercurity Fintech being thrown off American stock exchanges. However, its still not clear exactly what the Company is doing – other than trying to cash in on fintech, blockchain, and bitcoin hype.

OVERVIEW:

- Founded in 2011 and headquartered in New York, Mercurity Fintech is a fintech firm powered by blockchain. The company’s origins were as the developer of the first online collective marketplace platform in China, dubbed the “Chinese Groupon.” In 2015, MFH was successfully listed on the NASDAQ Global Market and the company’s current business evolution includes distributed computing and storage, digital payment solutions, asset management, and a continued expansion into online and traditional brokerage services.

- The company was formerly known as JMU Limited and changed its name to Mercurity Fintech Holding Inc. in April 2020.

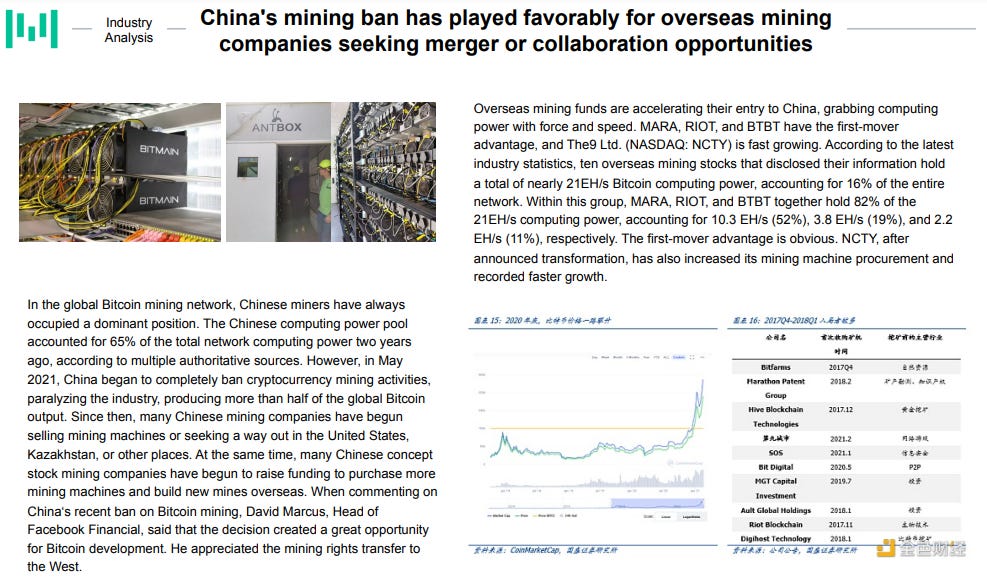

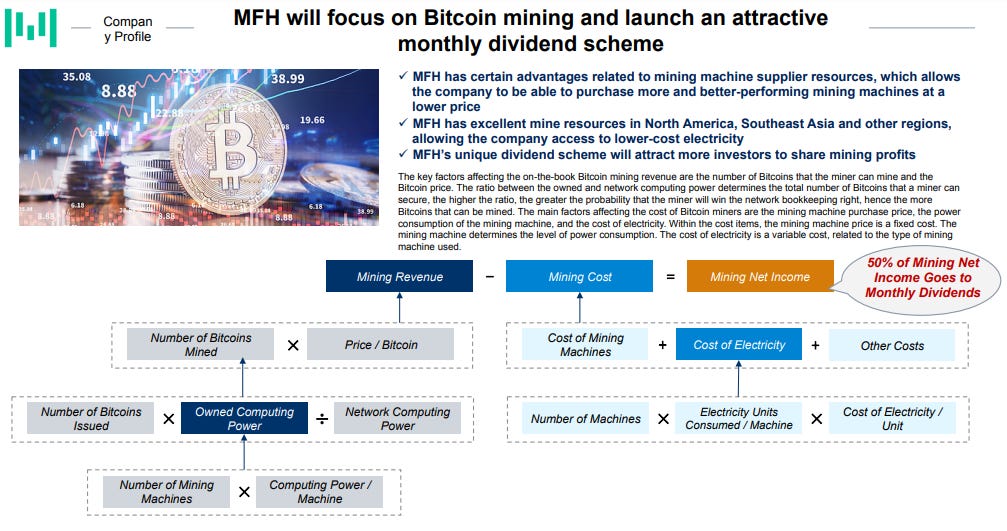

- Today, Mercurity Fintech’s primary business scope includes digital asset trading, asset digitization, cross-border remittance, and other services, providing compliant, professional, and highly efficient digital financial services to its customers. The Company recently began narrowing its focus on Bitcoin mining, digital currency investment and trading, and other related fields. This shift has enabled the company to deepen its involvement in all aspects of the blockchain industry, from production to circulation.

RECENT FINANCIALS / NEWS:

- Mercurity Fintech Holding Inc. Reports Full Fiscal Year 2022 Financial Results with Expanded Revenue Streams and Gross Profits April 2023

- GAAP revenue – MFH generated total revenue on a consolidated basis in the amounts of $863,438 for the year ended December 31, 2022, and $670,171 for the year ended December 31, 2021. The increased revenue comes from the cryptocurrency mining business and expansion of consultation services.

- GAAP operating expenses – MFH’s total operating expenses decreased significantly from $13,273,814 for the year ended December 31, 2021, to $5,368,222 for the year ended December 31, 2022. The narrowing expenses comes from the adoption of new business strategy, efficiency of the management and operation, optimizing of the compensation structure etc.

- GAAP net loss – MFH’s net loss decreased significantly from US$21,665,704 for the year ended December 31, 2021, to US$5,634,971 for the year ended December 31, 2022.

- Improved Company liquidity and funding conditions to support operations and growth. The successful completion of three rounds of financing in the fiscal year of 2022, totaling $13.15 million, demonstrated investor confidence in the Company’s prospects. These funds will be used to accelerate the Company’s growth plans and further solidify its position as a leader in the cryptocurrency mining and distributed computing space.

- Mercurity Fintech Holding Inc. Announces Co-Founding of “Fresh First, Inc.” a Digital, Same-Day, Fresh Food Delivery Service May 2023

- … announced the co-founding of “Fresh First, Inc.” a same-day meat, produce and grocery delivery service targeting urban, working Americans in higher income brackets willing to pay for fresh, healthy ingredients and convenience.

- Fresh First is a 100% digital online food delivery service founded in May 2023 and will service customers in major cities along the east coast of the United States, providing same-day delivery of locally sourced meats, vegetables, fruits, and grocery items. Fresh First intends to partner with Mercurity Fintech Holding, Inc. to create the Fresh First App to interface with customers as well as to develop the digital payment systems to process customer’s orders.

KEY RATIOS:

- P/E (Google Finance): N/A / Forward P/E (Yahoo! Finance): N/A

- Dividend Yield (Google Finance): N/A / Forward Dividend & Yield (Yahoo! Finance): N/A

1 YEAR CHART:

LONG TERM CHART:

ADDITIONAL RESOURCES:

- Website

- Investor Relations

- BITCOIN MINING To be the World’s Most Appealing ProfitSharing BTC Mining Operator 2021-2025

- Mercurity Fintech Holding Inc. Announces Co-Founding of “Fresh First, Inc.” a Digital, Same-Day, Fresh Food Delivery Service May 2023

- Mercurity Fintech Holding Inc. Reports Full Fiscal Year 2022 Financial Results with Expanded Revenue Streams and Gross Profits April 2023

- Chinese companies switch auditors to avoid US delisting risk (FT) (Nikkei Asia version) May 2023

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Similar Posts:

- Bairong Inc (HKG: 6608 / FRA: 6B5): AI/Digital Transformation Services for Chinese Banks

- China Internet Update (KraneShares)

- Alibaba Reorg (Interconnected)

- Housebound Consumers Lift Lenovo to Record Revenues & Profits (HKEXnews)

- China Definitively Reins In Jack Ma’s Ant Fintech Empire – Agreement Reached On “Restructuring” (ZeroHedge)

- Huawei Says U.S. Ban Hurting More Than Expected, to Wipe $30 Billion Off Revenue (Reuters)

- India Emerges as China’s Tech Challenger with Record Unicorn Run (Nikkei Asia)

- Will Meituan Become Hong Kong’s Tesla? (The Asset)

- Noah Holdings (NYSE: NOAH): A Chinese Wealth Management Firm Facing a “Crisis of Confidence” in the Sector

- Emerging Market Stock Pick Tear Sheets (June 1-18, 2023)

- Fangdd Network (NASDAQ: DUO): Can the Online Marketplace Ride Out the Chinese Property Downturn?

- Growing Number Of CEOs Asking About Risk Of War Between China & Taiwan (Zero Hedge)

- LG and Samsung in Full Retreat Before Chinese Flat-panel Onslaught (Nikkei Asian Review)

- Legend Biotech (NASDAQ: LEGN): The J&J Partner Recently Surged on Leaked Data About It’s Multiple Myeloma Treatment

- CMBI Research China & Hong Kong Stock Picks (March 2024)