As mentioned last week, I have started linking to earnings and other presentations that are usually not behind a paywall on Seeking Alpha. However, it took extra time to gather stock tickers and descriptions for stocks that had not been added to our Frontier & Emerging Market Stock Index – around 2,000+ tagged stocks plus additional stocks not tagged for a total of 2,882+ stocks.

Finally, Chilean elections last weekend will head to a runoff with right leaning candidates combined having already won a majority of the vote against a leftist/communist which should bode well for Chilean stocks moving forward. Our North & Latin America Stock Index’s 🇨🇱 Chile section has 17 stocks with more Latin American stocks having exposure to the country…

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- 🇨🇳 🇭🇰 China & Hong Kong Stock Picks (October 2025) Partially $

- China reality checks

- 🇨🇳 China – Ping An Insurance, Shenzhen Mindray Bio-Medical Electronics, BYD Company, BYD Electronic International Co Ltd, Shanghai United Imaging Healthcare, Shengyi Technolgy, Zhejiang Dingli Machinery, New Oriental Education, Anta Sports Products, WuXi AppTec, Futu Holdings, Jiangsu Hengli Hydraulic, Yangzijiang Shipbuilding Holdings, Xiaomi, Topsports, Great Wall Motor, Weibo Corp, Innovent Biologics, Meituan, Pop Mart International Group, Yancoal Australia, iQIYI, Baidu, J&T Express, JD.com, Alibaba & CGN Mining

- 🇭🇰 Hong Kong – AIA Group, WH Group Ltd, ASMPT, Budweiser Brewing Company APAC Limited, BOC Hong Kong, China Overseas Grand Oceans Group Ltd, Luk Fook Holdings (International) Ltd, Stella International Holdings Ltd, Wharf Real Estate Investment Company Ltd & Hang Lung Properties Ltd

- 20+ high conviction stock ideas: Geely Automobile Holdings, Zhejiang Leapmotor Technology Co Ltd, Zoomlion Heavy Industry, Sany Heavy Equipment International Holdings, Green Tea Group, Guoquan Food Shanghai Co Ltd, Luckin Coffee, Proya Cosmetics, CR Beverage, BeOne Medicines (BeiGene), 3SBio, Ping An Insurance, PICC Property and Casualty Co Ltd, Tencent, Alibaba, Trip.com, Greentown Service Group, Xiaomi, Aac Technologies Holdings, BYD Electronic International Co Ltd, Horizon Robotics, OmniVision Integrated Circuits Group (Will Semiconductor Co Ltd), BaTeLab, Naura Technology & Salesforce

- 🌐 EM Fund Stock Picks & Country Commentaries (November 16, 2025) Partially $

- “On the Phenomenon of Bullshit Jobs” (and applying it to AI), looking at Asian stocks beyond the AI rally, EMs move from imitators to innovators, India’s transformation, Q3/October fund updates, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = Behind a paywall / 🗃️ = Link to an archived article (Note: Seeking Alpha earnings/conference etc. presentations are typically not paywalled) / ⛔ = Article archiving may not be working properly

🇨🇳 China / 🇭🇰 Hong Kong / 🇲🇴 Macau

🇨🇳 🇯🇵 Tourism stocks plunge as Japan-China tensions soar (FT) $ 🗃️

- Tokyo dispatches envoy after Beijing warns its citizens against travel in deepening spat

- The share sell-off, which ripped through stocks in Japan’s retail and transport sectors, was fuelled by a warning from a leading economic think-tank that a sharp drop in Chinese visitors could reduce overall tourism spending by an annual ¥2.2tn ($14bn).

🇨🇳 In Depth: IPO Extortion Case Unearths Market for Burying Bad Press (Caixin) $

- In September 2023, Sichuan Kelun Pharmaceutical Co. Ltd. (002422.SZ) [🇨🇳 Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. (HKG: 6990)] filed a police report. It alleged that a slew of negative articles spreading across the internet were damaging its business reputation. The complaint, lodged in the southwestern city of Chengdu, triggered an investigation that would pull back the curtain on a shadowy, multimillion-dollar gray market operating at the intersection of media, finance, and corporate China.

- The probe led police not to a rival corporation or a powerful newsroom, but to the home of Shu Taihui, a 36-year-old in rural Jiangxi province. From there, Shu ran a cottage industry of self-operated media accounts — known in China as “self-media”— with names designed to mimic legitimate financial news outlets.

- What unfolded was a case that exposed the widespread and unspoken practice of “paid-for silence” that surrounds corporate initial public offerings. The prosecution of Shu and his accomplices has revealed a lucrative ecosystem where self-styled journalists threaten to publish negative stories about IPO-bound companies, which, fearing the derailment of their listings, pay for “cooperation agreements.” At the center of this web are financial public relations firms, hired to manage a company’s image but often found playing both sides — instigating the negative press to prove their own value and taking a cut from all parties involved.

🇨🇳 Tencent Music (TME): 3Q25, Offline Rev Up by 50%, Margin Improved for 13 Quarters (Smartkarma) $

[Tencent Music Entertainment Group (NYSE: TME)]

- Total revenue grew by 21% YoY and offline revenue grew by 50% YoY in 3Q25.

- Both ARPPU and the user base increased YoY in 3Q25.

- The margin had improved year over year for 13 quarters.

🇨🇳 Tencent Holdings Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / SGX: HTCD / OTCMKTS: TCEHY) 🇰🇾 – Technology & entertainment conglomerate & holding company. 🇼 🏷️

🇨🇳 Tencent’s Silent Encirclement (The Great Wall Street) $

- How Pony Ma’s 2022 pivot positioned Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / SGX: HTCD / OTCMKTS: TCEHY) to dominate commerce in an AI-agent world

- I’ve been thinking a lot recently about business models—AI infrastructure, e-commerce in the age of AI, social commerce, ad tech. And suddenly, the connective tissue became visible. Things are falling into place across Tencent’s ecosystem in a way I hadn’t fully grasped before. I underestimated Tencent again. I now see much more clearly where they’re heading. And when the pieces align like this, it’s scary for their competitors.

🇨🇳 JD.com, Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 JD.com (NASDAQ: JD / SGX: HJDD) – Supply chain-based technology & service provider. One of the 3 largest eCommerce platforms in China. 🇼 🏷️

🇨🇳 Bilibili Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇨🇳 Bilibili (NASDAQ: BILI) – Video sharing website (animation, comics & games) + streaming platforms serving videos on demand. 🇼 🏷️

🇨🇳 CNI Semiconductor Chips Index Rebalance Preview: One Set of Changes in December (Caixin) $

- There could be one change for the CNI Semiconductor Chips Index with VeriSilicon Microelectronics (Shanghai) Co Ltd (SHA: 688521) replacing Tianshui Huatian Technology Co Ltd (SHE: 002185).

- Passive trackers will need to buy 0.5x ADV in Verisilicon Microelectronics S (688521 CH) and sell 0.4x ADV in Tianshui Huatian Technology Co, Ltd. (002185 CH).

- There will be large selling in Cambricon Technologies Corp (SHA: 688256) due to capping while there will be smaller inflows for the other index constituents.

🇨🇳 Rebounding Vobile explores AI, in further move from content-protection roots (Bamboo Works)

- The company’s revenue rose 27% in the third quarter, as it explores new opportunities from an anticipated explosion in demand for trading services related to AI-generated video

- Vobile Group Ltd (HKG: 3738 / FRA: 6TD1 / OTCMKTS: VOBIF) posted strong third-quarter results, including 27% revenue growth and 28% growth in monthly recurring revenue

- The company has shifted its focus from video content protection to helping clients better monetize their products, with China rising to account for half of its revenue

🇨🇳 JinkoSolar Holding Co., Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 JinkoSolar Holding Co Ltd (NYSE: JKS) – Solar module manufacturer. 🇼

🇨🇳 Full Truck Alliance Co. Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇨🇳 Full Truck Alliance (NYSE: YMM) – Digital freight platform connecting shippers with truckers to facilitate shipments across distance ranges, cargo weights & types.

🇨🇳 Niu Technologies 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Niu Technologies (NASDAQ: NIU) – smart urban mobility solutions. Designs, manufactures & sells high-performance electric motorcycles, mopeds, bicycles & kick-scooters. 🇼

🇨🇳 CATL Partners With JD.com, GAC on Low-Cost EV (Caixin) $

- Chinese battery giant Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750) has partnered with JD.com (NASDAQ: JD / SGX: HJDD) and Guangzhou Automobile Group (HKG: 2238 / SHA: 601238 / FRA: 02G / OTCMKTS: GNZUF / GNZUY) to launch a low-cost electric vehicle (EV) that supports battery-swapping technology.

- The Aion UT Super went on sale Sunday, with a version that allows buyers to rent the battery costing just 49,900 yuan ($6,900) plus a monthly battery rental fee of 399 yuan.

- Under the cooperation, JD.com will serve as the online sales platform, GAC Aion will handle vehicle production and delivery, while CATL will provide the battery rental and swapping services, Caixin has learned. CATL, the world’s largest maker of power and energy storage batteries, operates battery-swapping services for commercial and passenger vehicles under the Qiji and Choco-SEB brands, respectively.

🇨🇳 XPeng: Morphing Into The Chinese Tesla (Seeking Alpha) $ 🗃️

🇨🇳 XPeng: A Cheaper Or Better Tesla (Seeking Alpha) $ 🗃️

🇨🇳 China Hongqiao (1378 HK): Index Impact of US$1.2bn Placement (Smartkarma) $

- [One of the world’s largest aluminum producer covering the entire aluminum industry chain] China Hongqiao Group (HKG: 1378 / FRA: H0Q / OTCMKTS: CHHQF / CHHQY) is looking to raise US$1.2bn via a top-up placement at an indicative price of HK$29.2/share, a 9.6% discount from the last close.

- There will be limited passive buying from global index trackers at the time of settlement of the placement shares. However, there are a couple of potential index inclusions in December.

- Then there will be more passive buying from trackers of a global index, Hang Seng Index (HSI INDEX) and Hang Seng China Enterprises Index (HSCEI INDEX) next year.

🇨🇳 China Property Slump to Drag on 2026 Growth, Citi Says (Caixin) $

- China’s property slump is expected to persist through 2026, acting as a major drag on economic growth despite fiscal stimulus, according to Citigroup’s chief China economist.

- Speaking at the group’s annual China Conference Thursday, Yu Xiangrong said he forecast China’s GDP would grow 4.7% next year, likely falling short of the government’s expected target of “around 5%.” He attributed the difficulty to a policy dilemma in the real estate sector, where Beijing is trying to stabilize the market without reinflating a bubble.

🇨🇳 KE Holdings shores up its house with share buybacks, as revenue gains fail to impress (Bamboo Works)

- China’s largest real estate brokerage has spent $2.3 billion on share repurchases in the last three years as a struggling property market weighs on its profits

- KE Holdings (NYSE: BEKE) reported its profit tumbled 36% year-on-year to 747 million yuan in the third quarter

- China’s leading property brokerage has spent $675 million on share repurchases so far this year

🇨🇳 China’s Bank Profits Stabilize as Bad Loans Climb (Caixin) $

- China’s commercial banks saw their profitability stabilize in the first three quarters after a first-half decline, even as their core profitability metric hovered at a historic low and bad loans mounted.

- Net profit for commercial banks was flat year-on-year for the first nine months of the year at 1.87 trillion yuan ($263 billion), an improvement from a 1.2% drop in the first six months, according to data released Friday by the National Financial Regulatory Administration.

🇨🇳 H World Group Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 H World Group (NASDAQ: HTHT) – Leased & owned or franchised hotel models. Chairman was a co-founder of Trip.com (NASDAQ: TCOM). 🇼 🏷️

🇨🇳 Damai rides China’s offline leisure boom to bumper profits (Bamboo Works)

- The company’s dominance in live entertainment ticketing and IP franchises has turbocharged its revenue, despite persistent consumer complaints and monopolistic behavior

- Damai Entertainment Holdings Ltd (HKG: 1060 / FRA: CBW)’s profit rose around 50% in the six months through September on the back of strong gains for its event ticketing and IP businesses

- The company’s booming live event ticketing business faces potential risks from slowing youth discretionary spending, as well as user backlash over technical glitches and scalping

🇨🇳 Nissin seeks the right flavor mix to keep noodle sales rising (Bamboo Works)

- The Japanese instant noodle giant has reported solid earnings, but the pace has slowed in mainland China, where novelty and value for money are key factors

- Nissin Foods Co Ltd (HKG: 1475 / FRA: 4NS / OTCMKTS: NSFCF) revenues for the first three quarters rose 6.99% and net profit increased 2.73% from the year-earlier period

- In mainland China, revenue rose 5.4% but the growth rate was slower than in the first half

🇨🇳 Yum China Holdings, Inc. (YUMC) Analyst/Investor Day – Slideshow (Seeking Alpha)

- 🇨🇳 YUM China (NYSE: YUMC) – China’s largest restaurant company. Exclusive right to operate & sub-license KFC, Pizza Hut & Taco Bell + owns Little Sheep & Huang Ji Huangt. Partnered with Lavazza. 🇼 🏷️

🇨🇳 Luckin Coffee Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇨🇳 Luckin Coffee (OTCMKTS: LKNCY) 🇰🇾 – Brewed drinks & pre-made food & beverage items. 🇼 🏷️

🇨🇳 Investors left crying as U.S. tariffs hit Goodbaby (Bamboo Works)

- The world’s leading producer of baby strollers and car seats is getting socked by a double whammy of U.S. tariffs and China’s baby bust

- Goodbaby International Holdings Ltd (HKG: 1086 / FRA: GBH / OTCMKTS: GBBYF) reported its revenue fell in the first nine months of the year, slipping into contraction after posting a small gain in the first half

- Gains by the baby products maker in Asia and Europe are helping to offset wobbly U.S. sales

🇨🇳 Vipshop Wants Out Of Wall Street? Inside Its Hong Kong Listing Bet (Smartkarma) $

- In a strategic move with major implications for its investor base and geographic footprint, U.S.-listed Chinese e-commerce discount retailer Vipshop Holdings (NYSE: VIPS) is reportedly exploring a secondary listing in Hong Kong.

- The decision comes amid mounting regulatory headwinds facing U.S.-listed Chinese companies, particularly around audit compliance and potential delisting threats under the Holding Foreign Companies Accountable Act (HFCAA).

- Vipshop’s management, which recently reaffirmed its long-term growth strategy anchored in high-margin apparel categories and loyalty-driven customer cohorts, is now considering Hong Kong not only as a hedge against geopolitical risk but also as a springboard to unlock capital from regional investors.

🇭🇰 IPO Boom Fizzles in Hong Kong as Hot Stocks Go Cold (Caixin) $

- A three-month rally in Hong Kong’s IPO market appears to be losing steam, after three out of four newly listed companies closed below their offer prices on Thursday.

- Among the decliners was autonomous driving startup Pony AI Inc (NASDAQ: PONY), whose shares sank 12.9% on their first day. Rival WeRide (NASDAQ: WRD) fared even worse, plunging 24.5%, while auto parts supplier Ningbo Joyson Electronic Corp (SHA: 600699 / HKG: 0699) slipped 1.8%. Only one of the four new listings ended above its IPO price.

- Investor sentiment began to shift earlier in the week. On Wednesday, electric-car maker Seres Group (SHA: 601127 / HKG: 9927) closed flat after recovering from a steep intraday decline of up to 7%. The rebound came in the final 20 minutes of trading. Still, the stock fell a cumulative 13.3% over the next two sessions.

🇭🇰 Johnson Electric Holdings Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Johnson Electric Holdings (HKG: 0179 / FRA: JOHB / OTCMKTS: JELCF / JEHLY) 🇧🇲 – Motors, solenoids, micro-switches, flexible printed circuits & micro electronics. 🇼

🇭🇰 Jinhui Shipping and Transportation Limited 2025 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Jinhui Shipping and Transportation Ltd (OSE: JINJ / FRA: J4O / OTCMKTS: JNSTF) 🇧🇲 – Supramax owners. Marine transportation services. 🇼

🇭🇰 Mandarin Oriental (MAND SP): Vote on Jardine Matheson’s Scheme Offer on 8 December (Smartkarma) $

- The vote on Mandarin Oriental (SGX: M04 / FRA: 1C4 / OTCMKTS: MAORF)’s privatisation offer from Jardine Matheson (SGX: J36 / FRA: H4W / OTCMKTS: JARLF) (US$2.75 cash + US$0.60 special dividend) is on 8 December.

- While the OCB sale completion (a scheme condition) carries timing risk, the Board continues to expect to complete the OCB sale by 31 December.

- The offer is conceivably light as Jardine’s dividends from the OCB sale comfortably cover the scheme cost. However, the offer remains reasonable on several fronts, and the vote is low-risk.

🇭🇰 Century Ent aims to expand gaming business to Vietnam (GGRAsia)

- Hong Kong-listed Century Entertainment International Holdings Ltd (HKG: 0959) says it has signed a “non-binding letter of intent” with a casino operator in Vietnam to “explore the possibility of expanding the group’s gaming operations” to that country.

- The agreement demonstrates “a parallel effort to revitalise the group’s core gaming activities following the termination of the group’s VIP room operations in Cambodia,” stated the company in a Monday filing.

- The Hong Kong-listed company started in October last year operations at two VIP rooms – under a three-year contract – in a casino at Dara Sakor, Koh Kong province, in Cambodia.

🇲🇴 Macau 2025 GGR may reach US$31bln, as 4Q growth stays strong: Jefferies (GGRAsia)

- Banking group Jefferies thinks Macau’s casino gross gaming revenue (GGR) can reach MOP246.41 billion (US$30.7 billion) for full-year 2025. It has raised its fourth-quarter growth forecast on the back of entertainment events, “incentives for players” from casinos, and the impact on Macau’s premium and VIP play, of “wealth creation” from strong regional stock market performance.

- In a Thursday memo, Jefferies said it now projects Macau’s GGR for the three months to December 31, to grow 13.3 percent year-on-year to MOP67.9 billion. Its previous forecast was 6.6 percent improvement.

- Were the full-year tally to reach MOP246.41 billion, it would be an 8.7-percent increase on 2024’s MOP226.78 billion GGR.

🇲🇴 Macau GGR at US$1.4bln in the first 16 days of November: Citigroup (GGRAsia)

- Macau’s casino gross gaming revenue (GGR) for the first 16 days of November was likely to have reached MOP11.1 billion (US$1.39 billion), or MOP671 million a day, suggested Citigroup in its latest memo on the sector, citing its industry checks.

- The institution said the second week of the month showed a “circa 6-percent moderation in GGR run-rate versus that of the first nine days of November 2025 (about MOP711 million a day)”.

- “We suspect the minor moderation in GGR is attributable to some hotel rooms being occupied by the athletes participating in the National Games, leading to a temporary small decline in average players’ length of stay (and play),” stated the institution.

🇲🇴 Melco’s Surprise Q3 Results Vindicate Lawrence Ho’s Bullish Stance (Seeking Alpha) $ 🗃️

- 🇲🇴 🇵🇭 🇨🇾 Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) – Management & development of casino gaming & entertainment resort facilities. 🇼

🇲🇴 Wynn Macau Ltd’s EBITDAR margins likely to remain stable: CreditSights (GGRAsia)

- Credit and market research provider CreditSights Inc says gross leverage at casino firm Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF) “improved thanks to better” earnings before interest, taxation, depreciation, amortisation, and rent (EBITDAR) during the period.

- The institution said in a Monday memo that it calculated the casino firm’s free cash flow to “have remained positive”.

🇲🇴 SJM notes satellite closure ‘headwinds’ as 3Q profit dips 91pct y-o-y (GGRAsia)

- Macau casino operator SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) reported a profit attributable to its owners of HKD9 million (US$1.2 million) in the three months to September 30, down 91.1 percent on the HKD101 million in the prior-year period.

- Daisy Ho Chiu Fung, chairman and executive director of SJM Holdings, was quoted as saying in a press release issued after the results: “We encountered significant headwinds in the third quarter, driven by the phased cessation of satellite casino operations and intensifying market competition.”

- The press release said the group’s third-quarter gross gaming revenue (GGR) market share decreased to 11.8 percent, down from 13.9 percent over the same period of 2024. The firm said that was driven by the “decrease in market share of satellite casinos, which dropped from 5.1 percent to 3.9 percent”.

🇹🇼 Taiwan

🇹🇼 FIT Hon Teng Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Foxconn Interconnect Technology (HKG: 6088 / FRA: 0FJ / OTCMKTS: FITGF) or FIT Hon Teng Limited – Precision components with offices & manufacturing sites in Asia, Americas & Europe. 🇼 🏷️

🇹🇼 What To Do After ChipMOS Reported Q4 Results (Seeking Alpha) $ 🗃️

- 🌐 ChipMOS Technologies (TPE: 8150 / NASDAQ: IMOS) – High-integration & high-precision integrated circuits + related assembly & testing services.

🇹🇼 ASUSTeK Computer Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 ASUSTEK Computer Inc (TPE: 2357 / OTCMKTS: ASUUY) – Computer, phone hardware & electronics manufacturer. Asus is the world’s 5th-largest personal computer vendor by unit sales. 🇼 🏷️

🇹🇼 Gogoro Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Gogoro (NASDAQ: GGR) – Battery-swapping refueling platform for urban electric two-wheel scooters, mopeds & motorcycles. 🇼

🇰🇷 Korea

🇰🇷 Clear Recent Outperformance of Korean Preferred Vs. Common Shares (Douglas Research Insights) $

- In this insight, we provide reasoning behind the clear recent outperformance of Korean preferred shares versus common shares.

- Among the 10 pairs, nine of them have preferred shares outperforming common shares in the past five days.

- One of the main reasons why the preferred shares have recently outperformed their common counterparts is because of the expectation of the higher probability of lowering tax on dividends.

🇰🇷 China Advices Its Citizens to Refrain from Traveling to Japan – Beneficial Impact on Korea Tourism (Douglas Research Insights) $

- It was reported that the Chinese government advised its citizens to refrain from traveling to Japan, which is likely to positively benefit the Korea in-bound tourism related stocks.

- If the political tensions between China and Japan are not quickly resolved but continues to last, this would have further negative impact on the Japanese consumer/tourism/leisure related companies.

- On the flip side, this could have a positive impact on the Korean consumer/tourism/leisure related companies such as Lotte Tour Development (KRX: 032350), Hotel Shilla (KRX: 008770 / 008775), and Paradise Co Ltd (KOSDAQ: 034230).

🇰🇷 Samsung’s Price Hike Says A Lot About Where Semiconductors Are Heading (Seeking Alpha) $ 🗃️

- 🌐🅿️ Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) – MNC major appliance & consumer electronics corporation. 🇼 🏷️

🇰🇷 LG Display Is Turning Its Biggest Problem Into Its Greatest Strength (Seeking Alpha) 🗃️

- 🌐 LG Display (NYSE: LPL) – Leading display company. Innovative displays & related products through differentiated technologies such as OLED & IPS. 🇼 🏷️

🇰🇷 KT Corporation 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 KT Corp (NYSE: KT / KRX: 030200 / FRA: KTC) formerly Korea Telecom – Provides integrated telecommunications & platform services in Korea & internationally. 🇼 🏷️

🇰🇷 Paradise Co 3Q profit up 70pct but EBITDA from Paradise City venture down (GGRAsia)

- Third-quarter aggregate sales at Paradise Co Ltd (KOSDAQ: 034230), an operator in South Korea of foreigner-only casinos, were nearly KRW288.25 billion (US$196.9 million), up 7.5 percent year-on-year. The group’s net profit jumped 70.0 percent from a year earlier, to KRW33.43 billion.

- Gaming sales at Paradise Co’s three wholly-controlled properties rose 18.9 percent year-on-year, to KRW100.36 billion in the three months to September 30, as per a Monday announcement. Its wholly-controlled gaming venues are at Seoul, Busan and Jeju.

🇰🇷 Paradise Co pledging shares in Paradise City venture as collateral in US$68mln loan (GGRAsia)

- Paradise Co Ltd (KOSDAQ: 034230) is to pledge some shares it holds in Paradise SegaSammy Co Ltd, the operating entity of the Paradise City integrated resort (pictured), as collateral for a KRW100 billion (US$68.2 million) loan from five South Korean banks.

- Paradise SegaSammy is Paradise Co’s venture with Japan’s SegaSammy Holdings Inc. Paradise Co holds a 55-percent stake in the joint venture.

🇰🇷 Grand Korea Leisure’s 3Q net profit up by 143pct y-o-y to US$10mln (GGRAsia)

- Grand Korea Leisure Co Ltd (KRX: 114090), an operator in South Korea of foreigner-only casinos, saw its third-quarter net profit up 142.7 percent year-on-year to nearly KRW14.67 billion (US$10.02 million), as growth in group-wide sales outpaced the increase in the cost of sales.

- Judged quarter-on-quarter, net profit was down 13.5 percent. That is according to unaudited financial results filed on Tuesday to the Korea Exchange, and the firm’s supplementary data.

- The visitor tally for Grand Korea Leisure’s three gaming properties was 788,035 in the first nine months of this year, representing a 4.9 percent growth year-on-year. About 43 percent of the group’s visitors in the period – or 336,883 individuals – were from China, a tally that declined 4.6 percent year-on-year, according to Grand Korea Leisure’s supplementary financial information.

- Visitors from Japan, which tallied 277,801 for the January to September period, tracked a year-on-year growth of nearly 16.1 percent.

🇰🇷 LG Corp: NAV Analysis Suggests a 29% Upside, Likely to Catch Up to LG Chem (Douglas Research Insights) $

- Our updated NAV valuation of LG Corp (KRX: 003550 / 003555) suggests implied market cap of 17.2 trillion won or target price of 111,605 won per share, representing 29.3% higher than current levels.

- LG Corp’s investment stakes in LG Chem (KRX: 051910 / 051915) and LG Electronics (KRX: 066570 / 066575 / FRA: LGLG / LON: 39IB) are worth 15.7 trillion won representing 119% of LG Corp’s entire market cap.

- Lower taxes on dividends could accelerate the capital allocation to companies with higher dividend yields/payouts such as LG Corp.

🇰🇷 MBK Partners: Acquires Additional 2.7% Stake in Korea Zinc – Another M&A Fight in March 2026? (Douglas Research Insights) $

- MBK Partners acquired an additional 2.7% stake in Korea Zinc (KRX: 010130) raising its total ownership to 39.7%. This is likely to fuel additional positive share price momentum on Korea Zinc.

- This is likely to rekindle a potential M&A fight for the management control of the company.

- This additional additional purchase of Korea Zinc by MBK Partners is a signal, not noise. Another M&A fight is likely in the next AGM in March 2026.

🇰🇷 Oracle Korea – Uncertainty Regarding 1.4 Trillion Won Tax Dispute + Excessive Leverage (Douglas Research Insights) $

- The Korean tax authorities have been objecting to Oracle Korea’s tax policies since 2017 and argue Oracle Korea needs to pay is about a cool 1.4 trillion won ($1 billion).

- It is estimated that about 80% of Oracle Korea’s sales are classified as sales costs such as software usage fees that are paid to Oracle’s Irish affiliated companies.

- Many investors are having increasing doubts about the sustainability of Oracle’s mammoth investments in AI and its highly leveraged balance sheet (consolidated basis).

🇰🇷 Coupang: Facing Increasing Risk of a Potential Ban on Early Dawn Deliveries – Number One Risk Factor (Douglas Research Insights) $

- Coupang, Inc. (NYSE: CPNG) faces a fast-emerging risk: a potential ban on early dawn deliveries (midnight–5 AM), driven by the powerful 1.1 million-member Korean Confederation of Trade Unions (KCTU).

- The Coupang Union and most drivers strongly oppose the ban, warning of layoffs and slower deliveries. Consumers also prefer the current system.

- If enacted, the ban could severely hurt Coupang and Korea’s economy. Probability of passage has risen sharply. I would be cautious on Coupang until this risk factor is fully resolved.

🇰🇷 ABL Bio: Equity Investment of 22 Billion Won from Eli Lilly (Douglas Research Insights) $

- On 14 November, ABL Bio (KOSDAQ: 298380) announced that it has signed an equity investment agreement with Eli Lilly & Co (LLY US) worth 22 billion won (US$15 million).

- ABL Bio will issue 175,079 new shares at 125,900 won per share (27% lower than current price). Despite the high valuation multiples, we maintain a Positive view on ABL Bio.

- Its recent major technology agreement with Eli Lilly serves as strong validation from a leading global pharmaceutical company, confirming the significant market potential of ABL’s unique platform technology.

🇰🇷 A Tender Offer of 19.9% Stake in APlus Asset Advisor by Align Partners (Douglas Research Insights) $

- Align Partners is launching a tender offer of 19.91% stake in A Plus Asset Advisor Co Ltd (KRX: 244920). Tender offer price is 8,000 won per share, which is 35.6% higher than current price.

- The tender offer period is from 18 November to 7 December. The total value of the tender offer is 36 billion won involving 4.5 million shares.

- This tender offer has a sizeable premium and likely to positively impact its share price.

🇰🇷 LivsMed IPO Valuation Analysis (Douglas Research Insights) $

- Our base case valuation of Livsmed is target price of 88,294 won per share, representing a 61% upside from the high end of the IPO price range.

- At our base case valuation, Livsmed’s market cap would be 2.3 trillion won. At this level, the probability of Livsmed being included in KOSDAQ150 index is very high in 2026.

- LivsMed is a medical device maker of advanced, articulating laparoscopic instruments that offer robotic-style dexterity and tactile feedback at a fraction of the capital cost of robotic surgical platforms.

🌏 SE Asia

🇲🇾 Genting Bhd issues US$216mln in notes amid Genting Malaysia share purchase (GGRAsia)

- Malaysian conglomerate Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF) says one of its units has issued MYR900 million (US$216.2 million) in one-year notes, with proceeds to assist “the acquisition of all remaining ordinary shares in Genting Malaysia Bhd” that it does not already hold, the parent said in a filing to Bursa Malaysia on Monday.

🇲🇾 Genting Bhd takeover bid for Genting Malaysia now mandatory, stake rises to 57pct (GGRAsia)

- Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY)’s voluntary takeover offer for its Bursa Malaysia-listed unit, global casino operator Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF), has become a mandatory offer under bourse rules. As of 5pm on Thursday, the suitor had acquired a circa 2.02-percent stake in Genting Malaysia from the open market, meaning under stock market rules that mandatory takeover is now required, to acquire the remaining shares in the subsidiary.

🇲🇾 Genting Malaysia independent advisor urges rejection of Genting Bhd takeover offer price (GGRAsia)

- The MYR2.35 (US$0.5687) per share being offered for casino group Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF)’s stock for a takeover and delisting exercise by its parent, is “not fair and not reasonable,” says an independent advisor to the target company.

- The day’s high for Genting Malaysia’s stock as of 1pm Malaysia time on Friday, was MYR2.38, a 1.28-percent premium to the offer price. That is according to Bursa Malaysia data.

- The advice from Kenanga Investment Bank Bhd was in a Thursday circular, and recommends existing shareholders “reject” the MYR2.35 offer.

🇵🇭 🇹🇭 ADB, IFC back giant Philippine and Thai IPOs (The Asset) 🗃️

- Maynilad Water Services (PSE: MYNLD)[?] and MR. D.I.Y. Holding (Thailand) PCL (BKK: MRDIYT / MRDIYT-F) are biggest local deals in 2025 but fail to impress on debut trading

- The Asian Development Bank ( ADB ) and the International Finance Corporation ( IFC ) have invested in two significant initial public offerings ( IPOs ) in the Philippines and Thailand, demonstrating their support for the development of capital markets in the region and helping attract investor interest in the transactions.

- Both multilaterals are lead cornerstone investors in the IPO of Maynilad Water Services in the Philippines, with the ADB investing US$145 million and the IFC putting US$100 million to enhance water security and improve wastewater services in Metro Manila.

🇵🇭 Ayala Corporation 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Ayala Corp (PSE: AC) – Diversified conglomerate (real estate; financial services; telecommunications; utilities, power, and transport; Manufacturing; automotive, etc). 🇼

🇵🇭 D.M. Wenceslao & Associates, Incorporated 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇵🇭 D.M. Wenceslao & Associates Inc (PSE: DMW / OTCMKTS: DMWAF) – Integrated property developer.

🇵🇭 Aboitiz Power Corporation 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇵🇭 Aboitiz Power Corp (PSE: AP / OTCMKTS: ABZPF / ABZPY) – Power generation, distribution & retail. 🇼

🇵🇭 Union Bank of the Philippines 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇵🇭 Union Bank of the Philippines (PSE: UBP) – Commercial banking products & services. 🇼

🇵🇭 Alliance Global Group, Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇵🇭 Alliance Global Group (PSE: AGI / OTCMKTS: ALGGF / ALGGY) – Holding company. F&B, real estate, tourism-entertainment/gaming, quick-service restaurant business & infrastructure development. Subs, include Megaworld Corp (PSE: MEG / OTCMKTS: MGAWY / MGAWF), Emperador Inc (PSE: EMI / SGX: EMI), Travellers International, Golden Arches Development Corp (GADC) & Infracorp. 🇼

🇵🇭 PLDT Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇵🇭 PLDT (NYSE: PHI) or Philippine Long Distance Telephone Company – Telecommunications & digital services. Controlled by First Pacific Co Ltd (HKG: 0142 / FRA: FPC / OTCMKTS: FPAFY / FPAFF). 🇼

🇵🇭 Nickel Asia Corporation 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇵🇭 Nickel Asia Corp (PSE: NIKL / OTCMKTS: NCKAF) – Largest producer of lateritic ore + renewable energy. 🇼

🇵🇭 SM Investments Corporation 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇵🇭 SM Investments Corp (PSE: SM) – Conglomerate (banking, retail, property, etc.). 🇼

🇵🇭 DMCI Holdings, Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇵🇭 DMCI Holdings (PSE: DMC / OTCMKTS: DMCHY) – 8 segments: Construction & others, coal mining, nickel mining, real estate, on-grid Power, off-grid power, water & cement manufacturing. 🇼

🇵🇭 Acen Corporation 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏👼🏻🅿️ Acen Corp (PSE: ACENA / ACENB / OTCMKTS: ACPIF) – Solar, wind, geothermal, battery storage & retail electricity supply. Subs. of Ayala Corp (PSE: AC). 🇼

🇵🇭 SM Prime Holdings, Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇵🇭 SM Prime Holdings (PSE: SMPH / OTCMKTS: SPHXF) – Integrated property developer & mall operator. 🇼

🇵🇭 Ayala Land, Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇵🇭 Ayala Land (PSE: ALI / OTCMKTS: AYAAY) – Property developer (large-scale, integrated, mixed-use estates). Subs. of conglomerate Ayala Corp (PSE: AC). 🇼

🇸🇬 Sea Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇸🇬 Sea: Pullback May Continue In The Near-Term (Rating Downgrade) (Seeking Alpha) $ 🗃️

- 🌏 Sea Limited (NYSE: SE) – 3 core businesses: Garena (global online games developer & publisher), Shopee (largest pan-regional e-commerce platform in SE Asia & Taiwan), SeaMoney (leading digital payments & financial services provider in SE Asia). 🇼 🏷️

🇸🇬 Asian Pay Television Trust 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏 Asian Pay Television Trust (SGX: S7OU / OTCMKTS: APTTF) – First listed business trust in Asia focused on pay-TV & broadband businesses. Pay-TV & broadband businesses in Taiwan, Hong Kong, Japan & Singapore. 🏷️

🇸🇬 Bitdeer Earnings: Carried By Self-Mining Amid Lofty AI Goals (Seeking Alpha) $ 🗃️

- 🌐 Bitdeer Technologies Group (NASDAQ: BTDR) – Technology company for blockchain & high-performance computing.

🇸🇬 Oversea-Chinese Banking Corporation Limited 2025 Q3 – Results – Earnings Call Presentation

- 🌏 Oversea-Chinese Banking Corp (OCBC) (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY) – One of the largest banks in SE Asia. 2nd largest banking group in Singapore. Owns Great Eastern Holdings (SGX: G07 / OTCMKTS: GEHDY). 🇼 🏷️

🇸🇬 DBS Q3 Earnings Review: As Anticipated (Seeking Alpha) $ 🗃️

- 🌏 DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) – Financial services group in Asia with a presence in 19 markets: Greater China, Southeast Asia & South Asia. 🇼 🏷️

🇸🇬 Top Stock Market Highlights of the Week: ST Engineering’s Satellite Writedown, Seatrium’s Order Wins, AMD’s AI Surge and Cisco’s Earnings Beat (The Smart Investor)

- ST Engineering’s Satellite Setback

- Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering announced a significant S$667 million non-cash impairment on its iDirect satellite communications subsidiary on 12 November 2025, reducing the unit’s carrying value to just S$170 million from S$837 million.

- Seatrium’s Order Book Momentum

- Offshore and marine engineering giant Seatrium Ltd (SGX: SE2 / FRA: S8N / OTCMKTS: SMBMF) maintained strong momentum with its net order book standing at S$16.6 billion in the third quarter of 2025.

🇸🇬 Seatrium vs YZJ: Which Stock Will Do Better in 2025/2026 (The Smart Investor)

- Seatrium Ltd (SGX: SE2 / FRA: S8N / OTCMKTS: SMBMF) and Yangzijiang Shipbuilding Holdings (SGX: BS6 / FRA: B8O / OTCMKTS: YSHLF) are two big-cap shipbuilding names that are benefiting from the secular demand for ships. However, which one can generate better returns for shareholders?

- After its mega-merger, Seatrium is still attempting to steady its footing – offering investors a potential turnaround story.

- YangZiJiang Shipbuilding, or YZJ, is already flourishing.

- Seatrium — The Rebuilding Giant

- YZJ Shipbuilding — The Steady Compounder

- The shipbuilder’s regional peers of Hanwha Ocean (KRX: 042660), HD Korea Shipbuilding & Offshore Engineering Co., Ltd. (KRX: 009540), and CSSC Offshore & Marine Engineering (Group) Company Limited (COMEC) (SHA: 600685 / HKG: 0317 / FRA: GSZ) have profit margins ranging from 1.9% to 4.9% over the same period.

- Comparing the Two: Scale vs Stability

- Industry Outlook: Winds Turning in 2025/2026

- What to Watch in 2025/2026

- What This Means for Investors

- Get Smart: Which Stock to Buy Depends on Your Risk Profile

🇸🇬 iFAST vs SGX: Which Growth Stock Could Deliver Better Returns in 2026? (The Smart Investor)

- Which growth stock stands to achieve better returns in 2026?

- iFAST Corporation Limited (SGX: AIY / FRA: 1O3 / OTCMKTS: IFSTF): Fintech Platform With Expanding Margins

- iFAST has evolved from a fund distribution platform into a digital wealth infrastructure player with strong regional presence.

- Singapore Exchange Limited(SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY): The Established Growth Compounder

- SGX remains the backbone of Singapore’s capital markets, with stable income from trading, clearing, and data businesses.

- Comparing the Two: Growth, Stability, and Valuation

- iFAST offers higher growth potential but greater volatility; SGX offers predictable cash flow and modest capital gains.

- Key Catalysts and Risks for 2026

- What Investors Should Watch

- Get Smart: Gain exposure in both counters

🇸🇬 5 Singapore Blue-Chip Stocks Trading at 52-Week Highs: Is It Time to Sell? (The Smart Investor)

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF): Banking on Record Profits

- Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY) — Tourism Tailwind at Full Throttle

- UOL Group Limited (SGX: U14 / FRA: U1O / OTCMKTS: UOLGY / UOLGF) — Property Confidence Rewarded

- Oversea-Chinese Banking Corp (OCBC) (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY) — Value Catching Up

- CapitaLand Ascendas REIT (SGX: A17U / OTCMKTS: ACDSF) — Industrial Strength Rewarded

- The Bigger Picture: What 52-Week Highs Tell Us

🇸🇬 4 Dividend-Paying Stocks to Own for the Next Decade (The Smart Investor)

- Looking for stable and consistent income from the stock market? Here are four dividend-paying stocks for the long run.

- Haw Par Corporation (SGX: H02 / OTCMKTS: HAWPF)

- Best known as the owner of Tiger Balm, Haw Par is a Singaporean manufacturing and investment company with interests in healthcare, pharmaceuticals, leisure, and property investments.

- Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering

- ST Engineering is a conglomerate with global exposure in the technology, defence, aerospace, and digital solutions industries.

- Singapore Exchange Limited(SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY)

- SGX is the only stock exchange operator in Singapore, operating equity, fixed income, currency, and commodity markets.

- United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF)

- UOB is one of three major banks in Singapore that pay a dividend, supported by stable earnings and its recent Southeast Asian expansion.

- What This Means for Investors

- Get Smart: Pick Dependable Stocks

🇸🇬 4 Blue-Chip Dividend Stocks for a Stress-Free Retirement (The Smart Investor)

- 4 blue-chip dividend stocks offer reliable dividends, strong fundamentals and lasting stability, allowing you to retire with confidence.

- Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering — Consistency Through Every Cycle

- ST Engineering, or STE, is Singapore’s prime defence contractor with commercial businesses that provide diversification, ensuring the resilience of the business.

- Singapore Exchange Limited(SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY) — A Dividend Stock Built on Stability

- Singapore Exchange, or SGX, holds a monopolistic position in Singapore’s capital markets, as the sole financial exchange operator in Singapore.

- CapitaLand Integrated Commercial Trust(SGX: C38U / OTCMKTS: CPAMF) — Blue-Chip REIT with Steady Cash Flow

- CapitaLand Integrated Commercial Trust (CICT) gives you broad exposure to a diversified portfolio of prime Singapore malls and offices.

- Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF) — Neighbourhood Retail REIT Built on Everyday Spending

- Frasers Centrepoint Trust, or FCT, owns suburban malls that people visit for everyday needs – think groceries and meals.

- Why These Blue-Chips Work Well Together

- What This Means for Investors

- Get Smart: Steady Dividends Come from Resilience

🇸🇬 Beyond Blue Chips: 3 Singapore Stocks Paying More than Your CPF (The Smart Investor)

- HRNetGroup (SGX: CHZ)

- HRnetGroup is an Asian recruitment powerhouse which operates across 18 cities with over 900 consultants, managing 20 brands including HRNetOne and RecruitFirst.

- Valuetronics Holdings (SGX: BN2 / FRA: GJ7)

- This electronics manufacturing services provider is successfully pivoting towards higher-margin opportunities in data centres and networking equipment.

- Civmec Ltd (SGX: P9D / ASX: CVL / FRA: 1CV)

- Civmec is an Australian construction and engineering specialist serving the energy, resources, infrastructure, and defence sectors from its Western Australian base.

🇸🇬 5 Singapore Blue-Chip Stocks With Dividend Hikes in 2025 (The Smart Investor)

- SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF) — Reinstating Growth and Restoring Dividends

- Air cargo handler and airline caterer SATS paused paying dividends during the pandemic.

- Singapore Exchange Limited(SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY) — A Quiet Dividend Compounder

- In 2009, SGX cut its dividend by over 30%. This was understandable, given the turmoil financial markets faced then during the Great Financial Crisis.

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) — Banking on Bigger Payouts

- DBS, the Singapore stock market’s largest company by market capitalisation, has achieved record levels of profit in recent years while maintaining capital strength, supported by both rising net interest income and fee-related income.

- Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering — Reliable Payouts From a Resilient Order Book

- ST Engineering, which is in the technology, defence, and engineering sectors, distributed S$0.08 per share in dividends to shareholders in the first half of 2025 (H1 2025), the same amount as in H1 2024. This follows an increase of 6% in the dividend per share between 2023 and 2024.

- CapitaLand Integrated Commercial Trust(SGX: C38U / OTCMKTS: CPAMF) — REIT Resilience Rewarding Investors

- CICT hiked its distribution per unit (DPU) by 3.5% to S$0.0562 in the H1 2025, supported by a 12.4% rise in distributable income to S$412 million, which in turn benefitted from a lower average cost of debt, as interest rates came down.

🇸🇬 Beyond the Blue-Chips: 3 Rising Stars That Could Enter the STI (The Smart Investor)

- 3 Singapore companies are emerging as strong STI contenders with growth, scale and resilient earnings.

- iFAST Corporation Limited (SGX: AIY / FRA: 1O3 / OTCMKTS: IFSTF)

- iFAST Corporation Limited (iFAST) operates a wealth management platform, providing a comprehensive range of investment products and services to financial advisory firms, financial institutions, banks, and sophisticated investors in Asia.

- Parkway Life Real Estate Investment Trust (SGX: C2PU)

- ParkwayLife REIT (PLife REIT) is one of Asia’s largest listed healthcare REITs, with a diversified portfolio of healthcare and healthcare-related assets across Asia-Pacific and Europe.

- Sheng Siong Group (SGX: OV8 / OTCMKTS: SHSGF)

- Sheng Siong Group Limited (Sheng Siong) operates a chain of supermarkets primarily in Singapore.

- What this means for investors

- Get Smart: Tomorrow’s Blue Chips Are Today’s Challengers

🇸🇬 4 REITs That Could Benefit From Singapore’s S$5B Equity-Market Push (The Smart Investor)

- Discover which four REITs stand to benefit from Singapore’s S$5B equity-market push that may boost REIT valuations and liquidity.

- Suntec Real Estate Investment Trust (SGX: T82U / OTCMKTS: SURVF)

- Suntec REIT owns a diversified portfolio of office and retail properties across Singapore, Australia and the UK.

- Keppel REIT (SGX: K71U / OTCMKTS: KREVF)

- Keppel REIT holds a portfolio of Grade A offices in Singapore, Australia, Japan and South Korea.

- ESR-Logos REIT (SGX: J91U / OTCMKTS: CGIUF)

- ESR-LOGOS REIT owns industrial and logistics properties across Singapore, Australia and Japan.

- CapitaLand India Trust (SGX: CY6U / OTCMKTS: ACNDF)

- CapitaLand India Trust (CLINT) offers Singaporean investors exposure to India’s IT and business park sectors, providing diversification into a high-growth office market.

- What This Means for Investors

- Get Smart: Positioning for Opportunity

🇸🇬 3 Under-the-Radar REITs That Raised Their DPU (The Smart Investor)

- Discover three under-the-radar REITs that increased their DPUs in 2025.

- United Hampshire US REIT (SGX: ODBU / OTCMKTS: UNHRF)

- United Hampshire US REIT owns 19 grocery-anchored and necessity-based retail properties plus 2 self-storage facilities across eight US states, with US$0.7 billion in assets under management (AUM).

- Elite UK REIT (SGX: MXNU)

- Elite UK REIT delivered a 9.4% increase in DPU for the first nine months of 2025 (9M2025), showcasing resilience amid active portfolio transformation.

- Prime US REIT (SGX: OXMU / OTCMKTS: KBSUF)

- Despite a challenging backdrop for US office assets, marked by higher vacancies and hybrid work trends, Prime US REIT delivered a 9.1% quarter-on-quarter increase in DPU for 2H2025, rising from US$0.0011 in 1H2024 to US$0.0012.

- Get Smart: Quiet Performers Worth a Closer Listen

🇸🇬 MIT vs MLT: Which Industrial REIT Is the Stronger Buy Right Now? (The Smart Investor)

- Mapletree Industrial Trust provides AI exposure, while Mapletree Logistics Trust offers e-commerce exposure. In a world of lower interest rates, which REIT will be a better buy now?

- Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF): Industrials + Data Centres Exposure

- MIT has a portfolio of assets that is focused on industrial properties and data centres across Singapore and North America. As of its latest update, 30 September 2025, the portfolio has a value of S$8.5 billion.

- Mapletree Logistics Trust (SGX: M44U / OTCMKTS: MAPGF): Logistics + E-commerce Exposure

- MLT has a portfolio of logistics assets in nine markets across Asia-Pacific.

- Head-to-Head Comparison

- Get Smart: Which REIT Comes Out Stronger?

🇹🇭 Home Product Center Public Company Limited (HPCRF) Presents at Opportunity Day Q3/2025 – Slideshow (Seeking Alpha)

- 🇹🇭 🇲🇾 🇻🇳 Home Product Center PCL (BKK: HMPRO / HMPRO-F / OTCMKTS: HPCRF) – Furniture & home decorations, electronic appliances & other services related to construction, renovation & home’s improvement. 🏷️

🇹🇭 PTT Exploration and Production Public Company Limited (PEXNY) Presents at Opportunity Day Q3/2025 – Slideshow (Seeking Alpha)

- 🇹🇭🏛️ PTT Exploration & Production PCL (BKK: PTTEP / PTTEP-R / SGX: TPED / OTCMKTS: PEXNY) – Petroleum exploration, development & production, renewable energy, new forms of energy & advanced technology. 🇼 🏷️

🇹🇭 PTT Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇹🇭 PTT Public Company Limited (BKK: PTT / PTT-R / FRA: NVA3 / OTCMKTS: PUTRY) – Submarine gas pipelines, LPG terminals, electricity generation, petrochemical products, oil & gas exploration/production, gasoline retailing & Café Amazon. 🇼 🏷️

🇹🇭 Bangkok Dusit Medical Services Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇹🇭 🇰🇭 Bangkok Dusit Medical Services PCL (BKK: BDMS / BDMS-R / SGX: TBDD / OTCMKTS: BDULF / BDMSF) – Largest private hospital operator in Thailand with 50+ hospitals + Cambodia. 🇼 🏷️

🇹🇭 Advanced Info Service Public Company Limited (AVIFY) Presents at Opportunity Day Q3/2025 – Slideshow (Seeking Alpha)

- 🇹🇭 Advanced Info Services PCL (BKK: ADVANC / SGX: TADD) – Operates Mobile Communication Service with 5G & 4G technology. 🇼 🏷️

🇹🇭 Land and Houses Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇹🇭 🇺🇸 Land and Houses PCL (SET: LH / LH-R / FRA: NVAH.F / LHOG.F) – Residential housing development (focused on single detached houses). 🇼 🏷️

🇹🇭 CP Axtra Public Co Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇹🇭 CP Axtra PCL (BKK: CPAXT / CPAXT.R / OTCMKTS: SMKUY / CPXTF) – Regional multi-format omnichannel retail platform. Online sales & delivery-pickup services.

🇹🇭 Krungthai Card Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇹🇭 Krungthai Card PCL (BKK: KTC / KTC-F / FRA: KRTA / OTCMKTS: KGTHY) – Credit card related business, merchant acquiring business, payment service & personal loan business.

🇹🇭 Bumrungrad Hospital Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇹🇭🅿️ Bumrungrad Hospital PCL (BKK: BH / BH-R / OTCMKTS: BUHPF) – Internationally accredited, multi-specialty hospital. One of the largest private hospitals in SE Asia. 🇼 🏷️

🇮🇳 India / South Asia / Central Asia

🇮🇳 India IPO boom faces market reckoning (The Asset) 🗃️

- Massive selloffs follow flood of listings amid retail caution and overvaluation concerns

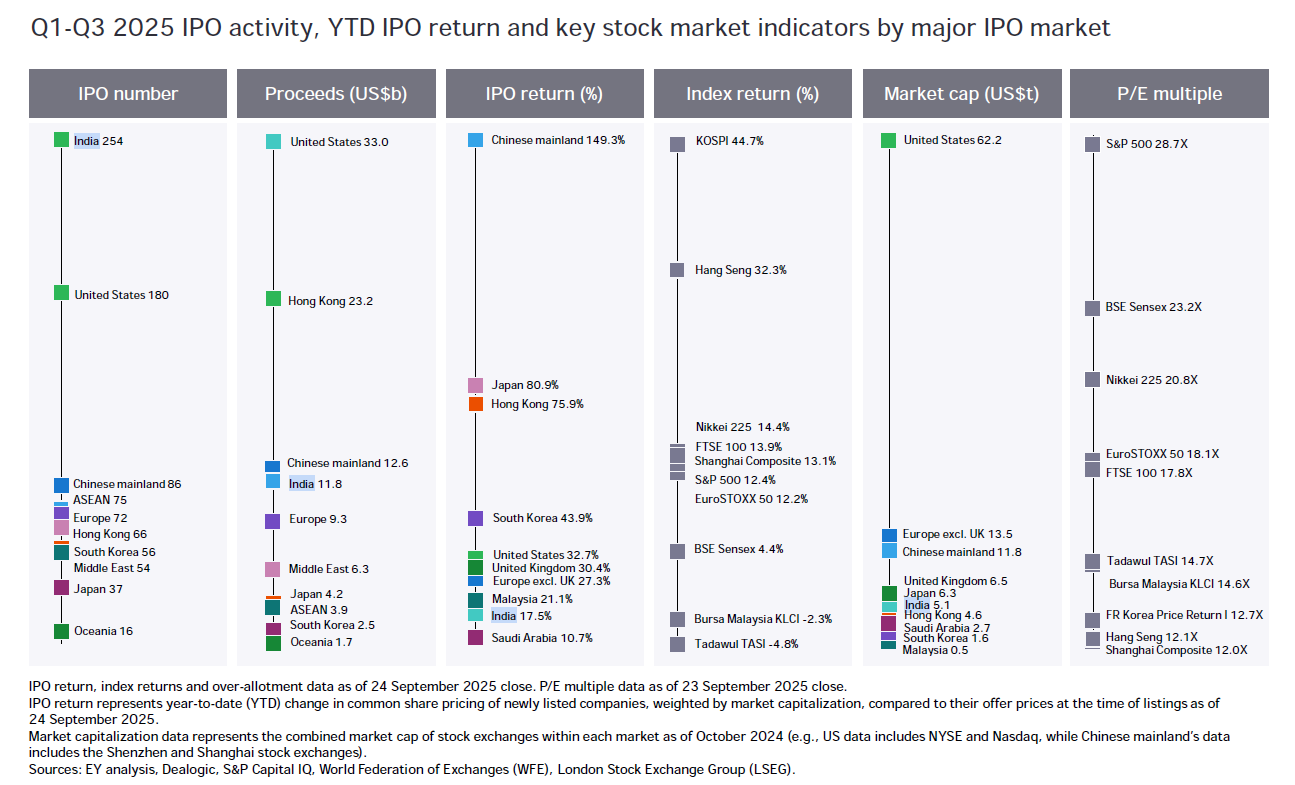

- India has emerged as the world’s hottest hub for initial public offerings ( IPOs ), leading the global charts in the sheer number of listings. In the first three quarters of 2025 alone, more than 250 companies went public – a pace that amounts to nearly one new listing every single day. Yet, despite the record-breaking momentum, the real test lies in how these newly listed stocks perform after debuting on the market, with post-listing returns challenging the early wave of investor enthusiasm.

- According to Ernst & Young ( EY ), Indian IPOs raised an impressive US$7.2 billion from 146 offerings between July and September. Over the first nine months of the year, the country accounted for 254 IPOs, approximately 30% of all global listings, leaving traditional financial powerhouses such as the United States and China trailing behind.

- Underpinned by strong valuation multiples, businesses in the fintech, manufacturing, and renewable sectors dominated the Indian IPO deals.

🇮🇳 Mahindra & Mahindra Limited (MAHMF) Shareholder/Analyst Call – Slideshow (Seeking Alpha)

- 🌐 Mahindra & Mahindra Ltd (NSE: M&M / BOM: 500520 / FRA: MOM / OTCMKTS: MAHMF) – Automotive, farm equipment, financial services, real estate, hospitality & others segments. 🇼 🏷️

🇮🇳 Yatra Online, Inc. 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Yatra Online (NASDAQ: YTRA) – Corporate travel services provider. Airline tickets, hotel & holiday packages & other services. 🇼

🇮🇳 RR Kabel Q2FY26: Strong Core, Aggressive Growth Path; Execution Key to Upside (Smartkarma) $

- R R Kabel Ltd (NSE: RRKABEL / BOM: 543981) delivered a strong Q2FY26 with 19.5% YoY revenue growth and EBITDA doubling, driven by robust volume expansion in its high-margin Cables & Wires segment.

- Solid core performance, backed by aggressive capex and margin expansion targets, positions RR Kabel as a key beneficiary of India’s accelerating infrastructure and industrial growth cycle.

- RR Kabel remains structurally well-placed for growth, though long-term margin gains depend on timely capex execution and a successful turnaround of its FMEG business.

🇮🇳 Bajaj Finance: From Credit Tightening to Digital Acceleration – A Transition Year in Motion (Smartkarma) $

- Company [Bajaj Finance Limited (NSE: BAJFINANCE / BOM: 500034)] delivered a steady Q2 FY26, with PAT growth of 23% YoY and 4% QoQ, in line with expectations. MSME stress prompted a modest downgrade in AUM guidance to 22–23%.

- The quarter reflects the company’s pivot toward quality growth, fortified by an aggressive AI transformation program (FINAI) and gold loan expansion strategy.

- While short-term credit costs weigh on margins, Bajaj Finance’s digital transformation and franchise scale position it to re-accelerate in FY27, reinforcing its premium valuation among Indian NBFCs.

🇮🇳 The Beat Ideas: Marksans Pharma – USFDA’s ‘Zero Observation’ Unlocks ₹3,000 Crore Goa Potential (Smartkarma) $

- Marksans Pharma Ltd (NSE: MARKSANS / BOM: 524404)’s new, capacity-doubling Goa facility (acquired from Teva) just received a ‘Zero 483 Observation’ clearance from the USFDA, completely de-risking its largest-ever capex.

- This facility is the engine for the company’s next growth phase. It will service a confirmed $220 million US order book and is critical to achieve INR 3,000 crore revenue.

- With the capex phase now complete and de-risked, the focus shifts to execution and the strategic deployment of its INR 711 crore cash pile, likely on a European front-end acquisition.

🇮🇳 Why Biocon’s Merger Is the Cleaner, Cheaper Path to Value Unlock?(Smartkarma) $

- Biocon Ltd (NSE: BIOCON / BOM: 532523) has confirmed its board, via a committee first formed on May 8, 2025, is formally evaluating a reverse merger of its unlisted arm, Biocon Biologics, into the parent.

- This merger is a financial de-risking move designed to immediately address $1.2 billion in acquisition debt and unlock a ‘conglomerate discount’ on the Rs.2,721 crore revenue biosimilars business.

- The move would eliminate the parent’s holding company discount, but the key hurdle is the valuation and swap ratio required to satisfy minority shareholders, chiefly Serum Institute.

🇮🇳 The Beat Ideas: DISA India – Engineering the Next Decade of Indian Foundries (Smartkarma) $

- DISA India Ltd (BOM: 500068)’s new Tumkur land acquisition marks a major capacity expansion, adding 40% footprint and enabling a new manufacturing unit by FY26.

- This expansion strengthens Disa’s ability to meet rising foundry demand, boosts export potential, and aligns with India’s manufacturing upcycle and the global China+1 shift.

- The company’s growth visibility improves meaningfully, supported by digital integration and strong balance sheet strength elevating confidence in sustained 20–25% topline growth.

🇮🇳 Shadowfax Technologies Pre-IPO Tearsheet (Smartkarma) $

- Shadowfax Technologies (1310315D IN) is looking to raise about US$225m in its upcoming India IPO. The deal will be run by Morgan Stanley, ICICI and JM Financial.

- Shadowfax Technologies is a new-age, technology-led third-party logistics (3PL) company that leverages a unified platform to facilitate digital commerce across India.

- The company provides a comprehensive suite of logistics services organised across express, hyperlocal, and other logistics segments.

🇰🇿 Joint Stock Company Kaspi.kz 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇰🇿 KASPI (NASDAQ: KSPI / LON: 80TE / FRA: KKS) – Payments Platform, Marketplace Platform & Fintech Platform. 🇼

🌍 Middle East

🇹🇷 Dogus Otomotiv Servis ve Ticaret A.S. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇹🇷 Dogus Otomotiv Servis ve Ticaret AS (IST: DOAS / OTCMKTS: DOMVF) – Importing, marketing & selling vehicles, spare parts + real estate-based assets & rights.

🇹🇷 Türkiye Halk Bankasi A.S. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 Turkiye Halk Bankasi AS (IST: HALKB) or Halkbank – Banking products & services. Third-largest bank. 🇼

🇹🇷 Ford Otomotiv Sanayi A.S. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 Ford Otomotiv Sanayi AS (IST: FROTO / FRA: FO9A / OTCMKTS: FOVSY) – Automobile manufacturer. Equally owned by Ford Motor Co (NYSE: F) & Koç Holding (IST: KCHOL). 🇼

🇹🇷 Koç Holding A.S. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Koç Holding (IST: KCHOL) – Turkey’s largest industrial & services group. 🇼

🇹🇷 BIM Birlesik Magazalar A.S. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 BIM Birlesik Magazalar AS (IST: BIMAS / OTCMKTS: BMBRF) – Supermarket/discount store operator in Turkey, Morocco & Egypt. 🇼

🇹🇷 Ülker Bisküvi Sanayi A.S. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Ulker Biskuvi Sanayi AS (IST: ULKER / FRA: A7G / OTCMKTS: UELKY) – biscuits, cookies, crackers & chocolates + other F&B products. 🇼

🇦🇪 Yalla Group Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 Yalla Group (NYSE: YALA) – Online social networking & gaming. Voice-centric group chat platform (Yalla) & casual gaming application (Yalla Ludo).

🇦🇪 Yalla sees ‘inflection point’ next year as new gaming initiative takes flight (Bamboo Works)

- After a year of preparations, the Middle Eastern social media company launched its first self-developed midcore game during the third quarter

- Yalla Group (NYSE: YALA) kept its revenue growth streak alive in the third quarter, and suggested its new gaming initiative could start contributing to its top line in the first half of 2026

- The company said its recently launched self-developed midcore game has been well received in its core Middle East market, as well as in North America and Europe

🌍 Africa

🇸🇳 Senegal’s foreign bonds plunge as government rules out restructuring (FT) $ 🗃️

- West African nation has become a test of IMF’s ability to deal with hidden debt and secure relief from creditors to support bailouts

🇿🇦 South Africa’s credit rating upgraded for first time in two decades (FT) $ 🗃️

- S&P Global Ratings raises status of the continent’s most industrialised nation to two notches below investment grade

🇿🇦 Sasol: Turning A Corner While The World Throws Curveballs (Seeking Alpha) $ 🗃️

🇿🇦 Sasol Limited (SSL) Shareholder/Analyst Call – Slideshow (Seeking Alpha)

- 🌐 Sasol (NYSE: SSL) – Global chemicals & energy company. 3 distinct market-focused businesses, namely: Chemicals, Energy & Sasol ecoFT. 🇼 🏷️

🇿🇦 Lesaka Technologies, Inc. 2026 Q1 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 Lesaka Technologies (NASDAQ: LSAK) – Full-service fintech platform (financial services & software). 🇼

🇿🇦 Gold Fields Limited (GFI) Analyst/Investor Day – Slideshow (Seeking Alpha)

🇿🇦 Gold Fields: A Miner Worth Owning, But Not Chasing Here (Seeking Alpha) $ 🗃️

- 🌐 Gold Fields (JSE: GFI / NYSE: GFI) – One of the world’s largest gold mining firms. 9 operating mines in Australia, Peru, South Africa & Ghana (including the Asanko JV) & 2 projects in Canada & Chile. 🇼 🏷️

🇿🇦 Vodacom Group Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 Vodacom Group (JSE: VOD / OTCMKTS: VODAF / VDMCY) – Telecommunications, digital and financial services. Subs. of Vodafone Group Plc (LON: VOD / NASDAQ: VOD). 🇼

🌍 Eastern Europe & Emerging Europe

🇨🇿 CEZ, a. s. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇪🇺🏛️ CEZ as (PSE: CEZ / WSE: CEZ / FRA: CEZ / OTCMKTS: CZAVF) – Generation, distribution, trading & sale of electricity & heat; trading & sale of natural gas; provision of comprehensive energy services from the new energy sector & coal mining. One of the 10 largest energy companies in Europe. 🇼 🏷️

🇬🇷 HELLENiQ ENERGY Holdings S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 HELLENiQ ENERGY Holdings SA (ASE: HEPr / FRA: HLPN / OTCMKTS: HLPMF / HLPXF) formerly Hellenic Petroleum – Liquid fuels (refineries) & chemicals, new energy & technology & innovation. 🇼

🇬🇷 Hellenic Telecommunications Organization S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 Hellenic Telecommunications Organization (ASE: OTEr / FRA: OTES / OTCMKTS: HLTOY) – Fixed-line & mobile telephony, broadband services, pay TV & integrated ICT services. 🇼

🇬🇷 National Bank of Greece S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇬🇷 National Bank of Greece SA (ASE: NBGr / FRA: NAGF / OTCMKTS: NBGIF) – Greece’s first bank. 🇼

🇭🇺 Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇭🇺 Magyar Telekom (BSE: MTEL / LON: 0NUG / FRA: MGYB / OTCMKTS: MYTAY) – One of the leading Hungarian telecommunications service provider company. It is a subs. of Deutsche Telekom. 🇼 🏷️

🇭🇺 MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság (BSE: MOL / FRA: MOGB / MOGG / OTCMKTS: MGYOY) – Leading integrated Central Eastern European oil & gas corp. Operations in 30+ countries. 🇼 🏷️

🇵🇱 KGHM Polska Miedz S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇵🇱🏛️ KGHM Polska Miedz SA (WSE: KGH / FRA: KGHA / OTCMKTS: KGHPF) – Extracting & processing of natural resources with the largest European deposits of copper ore. 🇼 🏷️

🌎 Latin America

🌎 The LATAM Bull – The World’s Most Exciting Market Is Not Where You Think (ZeroHedge) $ 🗃️

- “Many still hold the view that Argentina was the only Latin American country to undergo major political and economic shifts. However, recent developments in Bolivia, El Salvador, the highly anticipated Chilean elections, and now potential changes in Brazil suggest a broader regional transformation. In my view, Latin America is currently the most exciting region in the world for capital allocation.“ (Tavi Costa)

🌎 Globant S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Globant (NYSE: GLOB) – Luxembourg HQ’d. Argentina-founded IT & software development with a presence in 25+ countries. 🇼 🏷️

🌎 Adecoagro S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇦🇷 🇧🇷 🇺🇾 Adecoagro Sa (NYSE: AGRO) – Luxembourg HQ’s agro industrial company that produces & manufactures food & renewable energy. 3 segments: Farming; Sugar, Ethanol & Energy; & Land Transformation. 🏷️

🌎 DLocal Q3: The Market’s Concerns Are Overstated As TPV Surges (Seeking Alpha) $ 🗃️

🌎 DLocal Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Dlocal (NASDAQ: DLO) – Cross-border payment platform for global merchants to get paid & make payments in emerging markets. 🇼

🌎 Arcos Dorados: Setting The Focus On Brazil’s Recovery (Seeking Alpha) $ 🗃️

- 🌎 Arcos Dorados Holdings Inc (NYSE: ARCO) – World’s largest independent McDonald’s franchisee. Exclusive right to own, operate & grant franchises of McDonald’s restaurants in 20 Latin American & Caribbean countries & territories. 🇼 🏷️

🌎 MercadoLibre: Latin America’s Amazon Is Still In The Early Innings (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: Meltdown Almost Complete, Growth Prospects Highly Compelling (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: I’m Finally Turning Bullish (Rating Upgrade) (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: A High-Growth Compounder Dominating Latin American Commerce (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: A Solid Buying Opportunity That You Shouldn’t Miss (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: Amazon’s Aggression Proves Who Really Dominates LatAm (Seeking Alpha) $ 🗃️

- 🌎 MercadoLibre (NASDAQ: MELI) – Uruguay HQ’d. The largest online commerce & payments ecosystem in Latin America. 🇼 🏷️

🌎 Liberty Latin America Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌎 Liberty Latin America Ltd (NASDAQ: LILA / LILAK) – Communications company. 20+ countries across Latin America & Caribbean (consumer brands Flow, Liberty, Más Móvil & BTC). 🇼

🇦🇷 Bioceres Crop Solutions Corp. 2026 Q1 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇦🇷 Bioceres Crop Solutions Corp (NASDAQ: BIOX) – Fully-integrated provider of crop productivity technologies. 🏷️

🇦🇷 Cresud Sociedad Anónima, Comercial, Inmobiliaria, Financiera y Agropecuaria WT EXP 030926 2026 Q1 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇦🇷 🇧🇷 🇧🇴 🇵🇾 Cresud Sa (NASDAQ: CRESY) or Cresud Sociedad Anónima, Comercial, Inmobiliaria, Financiera y Agropecuaria – Argentine agricultural production chain + investments in Brazil [Brasilagro – Co Brasileira De Proprieda (NYSE: LND / BVMF: AGRO3)], Paraguay & Bolivia. Real estate business in Argentina through IRSA (NYSE: IRS). 🇼 🏷️

🇦🇷 Telecom Argentina: Caught Between Macro Hope And Fundamental Reality (Seeking Alpha) $ 🗃️

🇦🇷 Telecom Argentina S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇦🇷 🇵🇾 🇺🇾 Telecom Argentina SA (NYSE: TEO) – Leading telco & entertainment company + operations in Paraguay & Uruguay. 🇼 🏷️

🇦🇷 Central Puerto S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇦🇷 Central Puerto (NYSE: CEPU) – Makes investments in the national & international energy market. 🏷️

🇦🇷 Cablevisión Holding S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇦🇷 Cablevision Holding SA (BCBA: CVH / CVHD) – Development of infrastructure + convergent telecommunications services.

🇦🇷 Transportadora de Gas del Sur: Solid Q3 Operating Results Already Priced In (Seeking Alpha) $ 🗃️

- 🇦🇷 Transportadora de Gas del Sur Sa (NYSE: TGS) – Largest gas transportation company in Argentina + longest pipeline system in Latin America. 🇼 🏷️

🇧🇷 Brasil Bolsa Balcao (B3SA3 BZ) (Apeconomics) $

- Financial infrastructure monopoly trading at 13x P/E with a 7% distribution yield…

- This is the first single stock deep dive following on the back of my macro piece on Brazil and why it is the most asymmetric market in the world today. I also highlighted why the capital markets sector is the best risk/reward set-up within Brazil given the high probability rate normalization and what it means for equity flows. If you have not read the macro piece, do read it before this one!

- Brasil Bolsa Balcao (otherwise known as B3) [B3 SA – Brasil, Bolsa, Balcão (BVMF: B3SA3 / FRA: YBV0 / OTCMKTS: BOLSY)] is Brazil’s stock exchange. This is a high-quality financial infrastructure monopoly situated in a 6-year bear market where investors do not see a reason to allocate to Brazil. The drastic relative valuation gap between B3 (13.5x fwd P/E) and other global exchanges (avg. 24x fwd p/e) despite demonstrating better capital discipline suggest that the market struggles to value assets at cyclical lows. Simply put, this is a very rare instance of a monopoly with low reinvestment needs possessing share cannibal characteristics (100% capital return via buybacks/dividends), whilst trading at 13.5x P/E on cyclically depressed earnings.

🇧🇷 Syn Prop & Tech S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 SYN prop e tech SA (BVMF: SYNE3 / OTCMKTS: SYYNY) – Real estate acquisition, lease, sales, development & operation. Shopping malls & high-end corporate buildings.

🇧🇷 Grupo Casas Bahia S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 Grupo Casas Bahia SA (BVMF: BHIA3) formerly Via Varejo Sa (BVMF: VIIA3) – Omnichannel retailer with national reach, through physical stores, e-commerce (1P and marketplace) & social selling, with the Casas Bahia, Ponto & Extra.com.br brands. 🇼 🏷️

🇧🇷 Iochpe-Maxion S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Iochpe Maxion Sa (BVMF: MYPK3 / OTCMKTS: IOCJY) – World leader in the production of automotive wheels + railway wheels & a leading producer of automotive structural components in the Americas. 🇼 🏷️

🇧🇷 Cyrela Brazil Realty S.A. Empreendimentos e Participações 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 🇦🇷 🇺🇾 Cyrela Brazil Realty Sa Empreendimentos (BVMF: CYRE3 / OTCMKTS: CYRBY) – Largest homebuilder & real estate company by revenue & market value in Brazil + Argentina & Uruguay. 🇼 🏷️

🇧🇷 Light S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 Light SA (BVMF: LIGT3) – Power generation, transmission, distribution & trading concentrated in Rio de Janeiro. Subs. of Companhia Energética de Minas Gerais (CEMIG) (NYSE: CIG). 🇼 🏷️

🇧🇷 CI&T Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇧🇷 Companhia Energética de Minas Gerais – CEMIG 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷🏛️🅿️ Companhia Energética de Minas Gerais (CEMIG) (BVMF: CMIG3 / CMIG4 / NYSE: CIG) – Generation, transmission, distribution & commercialization of electric energy + distribution of natural gas. 🇼

🇧🇷 Sigma Lithium: The Winter Is Almost Over (Seeking Alpha) $ 🗃️

🇧🇷 Sigma Lithium Corporation 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 Sigma Lithium Corporation (CVE: SGML) – Exploration & development of lithium deposits in Brazil. 🏷️

🇧🇷 Inter & Co, Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 Inter & Co Inc (BVMF: INBR32 / NASDAQ: INTR) – Holding company of Inter Group & indirectly holds all of Banco Inter’s shares. Inter is a Super App providing financial & digital commerce services. 🏷️

🇧🇷 Localiza Rent a Car S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌎 Localiza Rent a Car SA (BVMF: RENT3 / OTCMKTS: LZRFY) – Largest mobility network in South America. 🇼

🇧🇷 Equatorial S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 Equatorial SA (BVMF: EQTL3 / OTCMKTS: EQUEY) – Electricity generation, distribution & transmission operations.

🇧🇷 Nu Holdings Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌎 Nu Holdings (NYSE: NU) – Digital banking platform / fintech. 🇼

🇧🇷 Braskem S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐🅿️ Braskem SA (NYSE: BAK / BVMF: BRKM3 / BRKM5 / BRKM6) – Largest petrochemical company in Latin America. Controlled by Novonor (Odebrecht SA). 🇼 🏷️

🇧🇷 Companhia de Saneamento Básico do Estado de São Paulo – SABESP 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷🏛️👼🏻 Companhia de Saneamento Básico do Estado de São Paulo – SABESP (BVMF: SBSP3) – Water & sewage service provider in São Paulo State. 🇼

🇧🇷 Ultrapar Participações S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Ultrapar Participaçoes (NYSE: UGP) – Energy & logistics infrastructure conglomerate. 🇼

🇧🇷 Petrobras: Gigantic Yield, It’s Time To Be Greedy (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras: Global Oil Giant Undervalued By The Market (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras: Record Production And Improving Oil Macro Tailwinds (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras Q3: Good Result, Old Doubts (Seeking Alpha) $ 🗃️

- 🌐🏛️ Petrobras (NYSE: PBR / PBR-A / BCBA: PBR / PETR4) or Petróleo Brasileiro SA – Explores, produces & sells oil & gas. 🇼

🇧🇷 Banco do Brasil S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐🅿️🏛️ Banco do Brasil (BVMF: BBAS3 / FRA: BZLA / OTCMKTS: BDORY) – Oldest bank in Brazil. 🇼

🇧🇷 Companhia Paranaense de Energia – COPEL 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷🅿️ Companhia Paranaense de Energia (COPEL) (BVMF: CPLE3 / CPLE5 / CPLE6 / NYSE: ELP / ELPC) – Generation, transformation, distribution, & sale of electricity. Concessions in the states of Paraná & Santa Catarina. 🇼

🇧🇷 B3 S.A. – Brasil, Bolsa, Balcão 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 B3 SA – Brasil, Bolsa, Balcão (BVMF: B3SA3 / FRA: YBV0 / OTCMKTS: BOLSY) – São Paulo Stock Exchange (Bovespa), Brazilian Mercantile & Futures Exchange (BM&F) & CETIP. 🇼

🇧🇷 Afya Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 Afya (NASDAQ: AFYA) – Bertelsmann backed medical education & digital health services group in Brazil. Delivering an end-to-end physician-centric ecosystem. 🏷️

🇧🇷 Embraer: The Aerospace Comeback Story That Just Keeps Flying Higher (Seeking Alpha) $ 🗃️

- 🌐 Embraer SA (BVMF: EMBR3 / NYSE: ERJ) – The 3rd largest producer of civil aircraft after Boeing & Airbus & the leading provider of regional jets worldwide. 🇼 🏷️

🇧🇷 Suzano: Price Increases Possible With Domestic Chinese Demand For Pulp (Seeking Alpha) $ 🗃️

🇧🇷 Itau Unibanco: Near Fair Value But Brazil Provides Solid Fair Equity Returns (Seeking Alpha) $ 🗃️

- 🌐 Itau Unibanco (NYSE: ITUB / BVMF: ITUB3 / ITUB4) – Largest banking institution in Brazil + Latin America. 🇼 🏷️

🇨🇱 Trump-Style Conservative Favored Against Communist Candidate As Chile Enters Presidential Run-Off (ZeroHedge)

- The consensus out of a closely watched presidential race in Chile is that the Right is rising and holds the upper hand, after a Sunday vote produced no clear winner between Jeannette Jara of the Communist Party, and José Antonio Kast, an ultraconservative lawyer who has expressed admiration for Donald Trump.

- A run-off is now scheduled for December 14. Sunday’s election, in which neither secured the necessary majority to be declared winner, saw the left-wing Jara finish slightly ahead in the initial round.

- However, Kast is favored in the run-off election given that the vote on the right was divided among several candidates, while Jara was the only one on the far Left. But now the lone contender representing the Right, Kast is expected to sweep up these additional votes in December.

🇨🇱 Compania Cervecerias Unidas Lost The Argentina Tailwind, All Eyes On Chile’s Election (Seeking Alpha) $ 🗃️

🇨🇱 Compañía Cervecerías Unidas S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌎 Compañía Cervecerías Unidas Sa (NYSE: CCU) – Multi-category beverage company with operations in Chile, Argentina, Bolivia, Colombia, Paraguay & Uruguay. 🇼 🏷️

🇨🇱 Sociedad Quimica y Minera de Chile: Taking Advantage Of Share Price Uptick To Sell My Position (Downgrade) (Seeking Alpha) $ 🗃️

- 🌐 Sociedad Química y Minera de Chile (NYSE: SQM) – Lithium, potassium nitrate, iodine & thermo-solar salts. 🇼

🇨🇱 Banco Itaú Chile 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌎 Banco Itaú Chile (SSE: ITAUCL) – Universal bank. Subs. of Itau Unibanco (NYSE: ITUB / BVMF: ITUB3 / ITUB4). 🇼

🇨🇴 Grupo Aval Acciones y Valores S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)