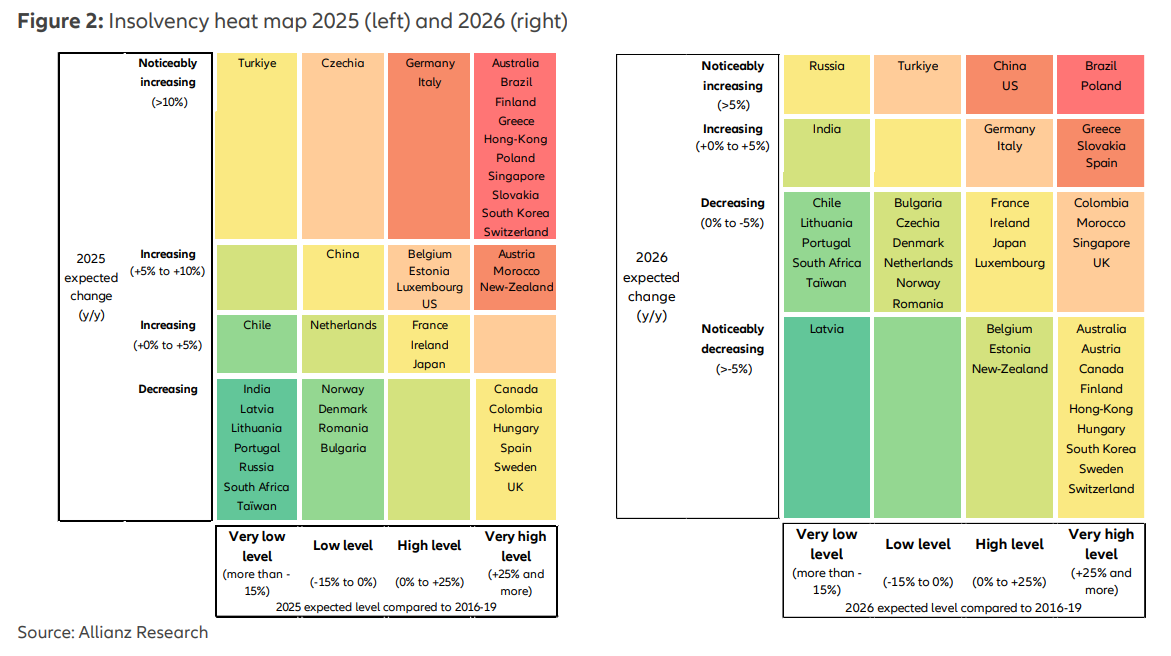

The Asset has noted a recent report pointing a surge and ebb in bankruptcies depending on the jurisdiction:

🌏 HK, Singapore lead Asia in bankruptcy surge as tariffs bite (The Asset) 🗃️

Hong Kong and Singapore registered the biggest increases in insolvency cases in Asia this year, as the impact of US tariffs weighed heavily on the two export-oriented economies, a new report reveals.

Bankruptcy filings rose 33% in Hong Kong and 22% in Singapore, Allianz says in its Global Insolvency Outlook report. On the other hand, Taiwan, whose semiconductor exports are currently not covered by US punitive duties, saw a 24% decline in insolvency cases. India, another high-growth economy in Asia, posted a 27% plunge in the number of companies going bust, the biggest drop worldwide.

Here is a heatmap from the actual report (page 5):

Allianz expects global business insolvencies to rise by +6% in 2025, and again by +5% in 2026, before a modest decline by –1% in 2027. 2026 will mark five consecutive years of increases to reach a record high number of bankruptcies – +24% above pre-pandemic average…

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- EM Fund Stock Picks & Country Commentaries (November 2, 2025) Partially $

- China corporate governance reforms, ASEAN’s tariff advantage, Jardine Matheson, Shell plc, Remgro, Reinet, Booking Holdings, frontier markets stocks/bonds portfolio role, Sept/Q3 fund updates, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = Behind a paywall / 🗃️ = Link to an archived article / ⛔ = Article archiving may not be working properly

🌏 Asia

🌏 HK, Singapore lead Asia in bankruptcy surge as tariffs bite (The Asset) 🗃️

- Trade hurdles, weak economic growth, limited access to funds add to insolvency pressure, recovery unlikely before 2027

- Hong Kong and Singapore registered the biggest increases in insolvency cases in Asia this year, as the impact of US tariffs weighed heavily on the two export-oriented economies, a new report reveals.

- Bankruptcy filings rose 33% in Hong Kong and 22% in Singapore, Allianz says in its Global Insolvency Outlook report. On the other hand, Taiwan, whose semiconductor exports are currently not covered by US punitive duties, saw a 24% decline in insolvency cases. India, another high-growth economy in Asia, posted a 27% plunge in the number of companies going bust, the biggest drop worldwide.

🌏 Asia’s Economic Growth Is Weathering Tariffs and Uncertainty (IMF Blog)

- The region has proved unexpectedly resilient, aided by a front-loading of exports, technology investment, and policy support. To sustain strong and durable growth, it must now rebalance more toward domestic demand and deepen regional integration.

🌏 Bright prospects for Asia equities amid global shifts (The Asset) 🗃️

- Despite ongoing shifts in financial markets, supply chains, and geopolitics worldwide, Asia equities offer bright prospects amid the weakening US dollar, the region’s technological dominance, China’s AI surge, and India’s structural growth.

- These factors are reshaping investment opportunities in late 2025 and into 2026, according to Anuj Arora, head of emerging markets and Asia-Pacific equities, and Alexander Treves, Asia head of investment specialists for Asia-Pacific, emerging markets and Asia-Pacific equities, J.P. Morgan Asset Management.

- In a compelling discussion at the 2025 Asia Media Summit in Seoul, Arora and Treves outline an optimistic outlook for Asia-Pacific markets. They note that despite geopolitical tensions and the recent tariff headlines, Asia’s economic fundamentals remain robust, with markets – particularly Korea, Taiwan, and India – shrugging off the noise to hit multi-year highs.

🌏 Yet another US pivot to Asia (Murray Hunter)

- What we learnt from Trump’s recent Asian tour

🇨🇳 China / 🇭🇰 Hong Kong / 🇲🇴 Macau

🇨🇳 Analysis: China Tries to Lift Factory Prices, but Demand Is Still Missing (Caixin) $

- China appears to be engineering a floor under producer prices through administrative pressure, as a narrower September decline hints at early effects, but without stronger demand, any gains may remain fragile.

- The producer price index fell 2.3% year-on-year last month, its mildest drop in seven months. The improvement chiefly came from heavy industry.

- In July, Beijing called for curbing “low-price, disorderly” competition and promoting the exit of outdated capacity. Markets have interpreted this as a signal of tighter discipline in sectors prone to price undercutting.

🇨🇳 Didi: A Great Business That Still Leaves Me Uneasy (The Great Wall Street) $

- Strong fundamentals, lingering doubts.

- Let’s start with a confession: I can’t imagine my life without DiDi Global (OTCMKTS: DIDIY). I love their service. They’re the very reason I sold my car, and I’m not thinking for a minute about buying another one. I like the business too, I like the whole setup with trading over the counter and having the option of being relisted in Hong Kong. I’m the second-highest tier user, and everyone on my company’s staff uses their service.

- But a couple of weeks ago, I had a conversation with DiDi’s investor relations team that left me feeling… let’s say uneasy. The kind of uneasy you get when someone you trust tells you not to worry about something that absolutely deserves worrying about.

- To be clear, Didi’s investor relations team was fully professional and genuinely helpful — which, in fairness, isn’t something one can take for granted when dealing with Chinese companies. My concern isn’t with the IR team itself, but with what was actually said.

- I’ve been mulling this over ever since, but because DiDi updates are among the most requested from readers, and because some news I read a few days ago finally convinced me to put this in writing, here we are.

🇨🇳 Pet tech boom lifts Dogness revenue, but investors aren’t biting (Bamboo Works)

- The pet pioneer’s business is getting a lift from products like smart collars and intelligent feeders, even as its core leash business is in the doghouse

- Dogness International Corp (NASDAQ: DOGZ) reported its revenue rose 39.5% in its fiscal year through June to $20.7 million, while its loss narrowed by 15.8% to $5.1 million

- The pet product seller’s shares have fallen by three quarters since the beginning of the year, despite strong growth for smart products in its latest fiscal year

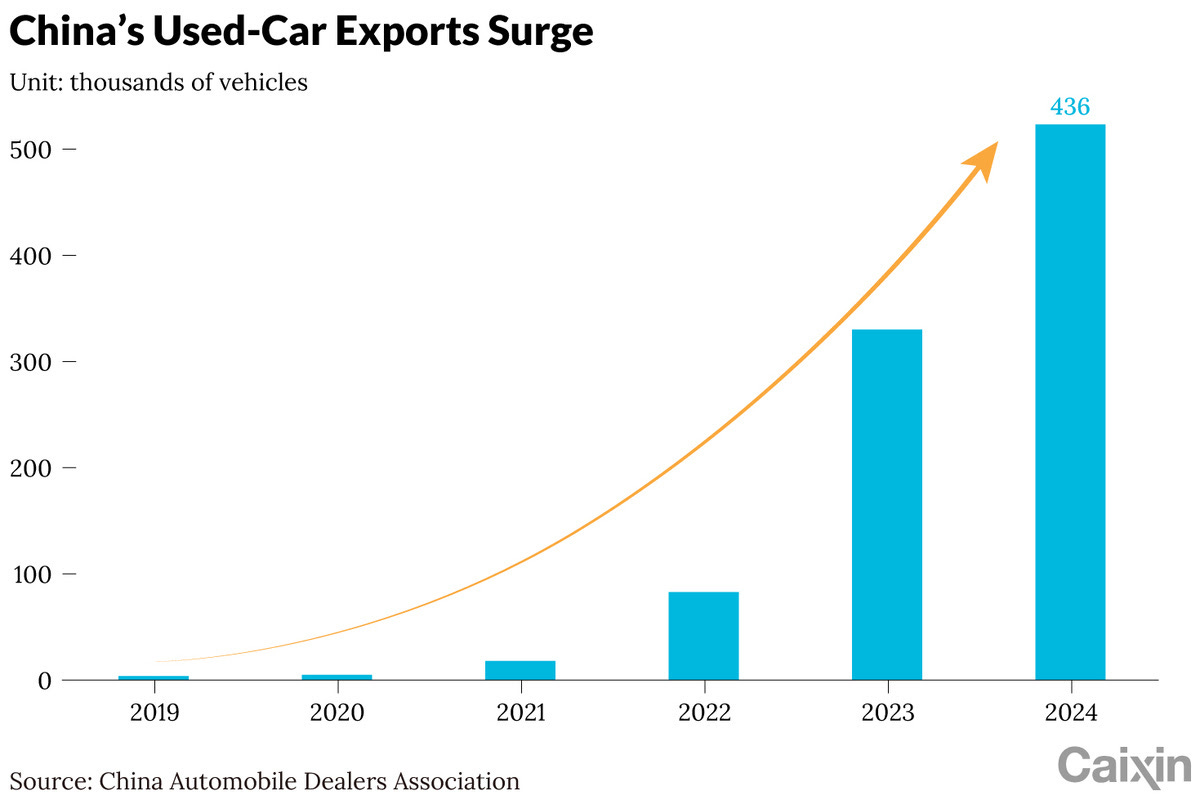

🇨🇳 In Depth: China’s Growing Trade of Unused ‘Used’ Cars Threatens Automakers’ Global Expansion (Caixin) $

- At a glance, selling more cars overseas seems like the obvious solution for a Chinese automaker squeezed between government incentives to boost sales and production, and a cutthroat domestic market locked in an ongoing price war.

- The problem is that formally exporting new cars from China is a complicated, expensive undertaking. It requires dealerships to be open, logistics chains to be established and after-sales services to be guaranteed, all of which drive up the cost of selling the vehicles abroad. China’s government also imposes strict requirements on new car exports — only a car’s manufacturer or authorized exporters can obtain a license to do so.

- In 2021, however, some of China’s more eagle-eyed companies spotted a loophole in the rules. What if they sold their new vehicles as if they were second-hand cars?

🇨🇳 Chery (9973 HK): 3Q25, Revenue Growth Plunged to Single Digit (Smartkarma) $

- Chery Automobile Co Ltd (HKG: 9973)’s revenue growth rate plunged below 5% YoY in 3Q25 from 28% YoY in 2Q25.

- Chery’s domestic retail sales volume began to decline in September 2025.

- The company is still the number five largest car maker in China.

🇨🇳 BYD (1211 HK): 3Q25, No Surprise, Revenue Down for First Time (Smartkarma) $

- It is no surprise that BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF)’s revenue decreased YoY in 3Q25 according to our previous sales volume note.

- The quarter-over-quarter margin improvement is not about seasonality, but about a sign of the margin recovery in 2026.

- We believe the stock has a downside of 25% for 2026.

🇨🇳 How a high-end Chinese electric-car maker lost its charge (FT) $ 🗃️

🇨🇳 Xiaomi, EV Rivals Offer Tax Subsidies Ahead of China’s 2026 Incentive Cut (Caixin) $

- Xiaomi (HKG: 1810 / SGX: HXXD / FRA: 3CP / OTCMKTS: XIACF) and several other Chinese electric vehicle makers are offering purchase-tax subsidies to cushion the impact of reduced government incentives set to take effect in 2026.

- On Friday, Xiaomi announced a limited-time subsidy program for buyers who place orders before Nov. 30, offering up to 15,000 yuan ($2,100) to cover the difference in vehicle purchase tax if their cars are delivered after year-end. The offer applies to all three of Xiaomi’s current models.

🇨🇳 Everdisplay’s cash hunger in focus with new Hong Kong IPO application (Bamboo Works)

- The maker of AMOLED displays has renewed its filing to list in Hong Kong, following its application’s approval earlier this month by China’s securities regulator

- Everdisplay Optronics Shanghai Co Ltd (SHA: 688538) is seeking funds from a Hong Kong IPO as it prepares to make the transition to flexible AMOLED displays

- The company has posted steady revenue growth in the last three years, but is also losing big money as its production costs exceed revenue

🇨🇳 Seres Group Hong Kong IPO Preview (Douglas Research Insights) $

- Seres Group (SHA: 601127) is getting ready to complete its IPO on the Hong Kong exchange in the coming weeks that could raise about US$1.7 billion.

- At the high end of the IPO price range of HK$131.50 per share, Seres would have a market capitalization of nearly HK$215 billion (about $27.6 billion).

- Seres Group is one of the largest new-energy vehicle makers in China. There are 22 cornerstone investors that have committed to purchase approximately 49% of the offer.

🇨🇳 Seres Group Valuation Analysis (Douglas Research Insights) $

- Our base case valuation of Seres Group (SHA: 601127) is target price of 189.9 CNY which represents a 17% upside from current levels over a 6-12 month period.

- Our target P/S multiple of 1.4x is 50% premium to the average valuation multiple of the comps in 2026.

- We used a premium valuation multiple for Seres Group due the company’s higher sales growth, EBITDA margins, and ROE.

🇨🇳 Seres (9927 HK): Index Inclusion Timeline for a Max Offering of US$2.2bn; Big Discount to A-Shares (Smartkarma) $

- Seres Group (SHA: 601127) could raise up to HK$17.4bn (US$2.24bn) in its H-share listing if the Offer Size Adjustment Option and the Overallotment Option are both exercised.

- There is a big allocation to cornerstone investors that is locked up for 6 months. That eliminates the already small possibility of Fast Entry inclusion to global indexes.

- Seres (9927 HK) should be added to Southbound Stock Connect from the open of trading on 1 December following the end of the Price Stabilisation period.

🇨🇳 Pony.AI Hong Kong IPO Preview (Douglas Research Insights) $

- Pony AI Inc (NASDAQ: PONY) is getting ready to complete its IPO in Hong Kong in the coming weeks. Pony.ai is one of the leading autonomous driving companies in China.

- Pony.ai plans to sell 41.96 million Class A shares under its global offering in Hong Kong, including 4.2 million shares for Hong Kong retail investors.

- The maximum offer price of the Hong Kong IPO is HK$180 (US$23) per share, which could value the company at more than US$10 billion.

🇨🇳 China’s Biggest Bank ICBC to Absorb Troubled Lender in State Rescue (Caixin) $

- Industrial and Commercial Bank of China (SHA: 601398 / HKG: 1398 / FRA: ICK / OTCMKTS: IDCBY / IDCBF) has received regulatory approval to acquire the business of the troubled Bank of Jinzhou (HKG: 0416 / FRA: 2JI), marking a decisive step in a state-led bailout of the regional lender.

- China’s largest state-owned bank by assets will take over the assets, liabilities, operations, branches and staff of the Liaoning-based city commercial bank, according to a recent announcement on Bank of Jinzhou’s website. Under the acquisition agreement, ICBC will continue to serve Bank of Jinzhou’s customers.

🇨🇳 Citic Securities in equity sweet spot as investors flock to Chinese stocks (Bamboo Works)

- China’s largest brokerage reported big jumps in its revenue and profit during the third quarter amid a bull run in Chinese stocks and a wave of Hong Kong IPOs

- CITIC Securities Co Ltd (SHA: 600030 / HKG: 6030 / OTCMKTS: CIIHY / CIIHF)’ net profit jumped 52% year-on-year in the third quarter as its revenue grew at a similar pace

- A Chinese stock rally fueled the company’s big increase in fee income from brokerage services, while a resurgence of IPOs drove up its investment banking revenues

🇨🇳 So big but so what? Innovent’s license deal fails to excite investors (Bamboo Works)

- The Chinese biotech is selling some cancer drug rights to a Japanese pharma giant for up to $11.4 billion, pocketing a big downpayment, so why did its stock price fall?

- Innovent Biologics (HKG: 1801 / FRA: 6IB / OTCMKTS: IVBXF / IVBIY) and its partner Takeda Pharmaceutical Co Ltd (NYSE: TAK) will share global development costs for the main oncology drug covered by the deal

- Innovent will also partner in efforts to commercialize the drug in the United States, becoming only the second Chinese biotech to participate directly in U.S. sales of new drugs

🇨🇳 Fuyao Glass looks to new era as its founder bows out (Bamboo Works)

FuYao Glass Industry Group (SHA: 600660 / HKG: 3606 / FRA: 4FG)

- The son of celebrated entrepreneur Cao Dewang has formally taken the helm at the automotive glass giant, just as the firm unveiled upbeat quarterly earnings

- The company logged double-digit growth in revenue and profit, and its operating cash flow surged, but its shares slipped

- In a long-anticipated handover, Cao Hui moved up from the position of vice chairman after a long career in the business founded by his father

🇨🇳 Brand expansion deflates Topsports’ top, bottom lines (Bamboo Works)

- The former top China distributor for Nike and Adidas is betting on a “running + community” concept to penetrate the performance sports market with a new self-developed brand

- Topsports (HKG: 6110 / OTCMKTS: TPSRF)’ revenue fell 5.8% to 12.3 billion yuan in the first half of its fiscal year through August, while its gross profit margin held steady at 41%

- The athletic footwear seller, which recently launched its self-developed ektos lifestyle brand, has over 800 accounts with 89.1 million members on social media platforms

🇨🇳 New Oriental turns in mixed report card of rising revenue, falling profits (Bamboo Works)

- The education services provider’s latest quarterly report reflected its largely steady but unspectacular performance

- New Oriental Education (NYSE: EDU) reported revenue for its fiscal quarter through August reached $1.52 billion, up 6% year-on-year

- The education services provider’s revenue for its fiscal year through May is expected to reach up to $5.4 billion

🇨🇳 Pop Mart International: Increasing Concerns About Resale Price Declines (Douglas Research Insights) $

- Pop Mart International Group (HKG: 9992 / FRA: 735 / OTCMKTS: PMRTY / POPMF)’s share price is down 33% from its peak levels in late August 2025. Going forward, we expect further downside risk on Pop Mart.

- We highlight the growing concerns about the declining resale values of Labubu. After reaching their peak prices in this summer, the resale prices of Labubu dolls have continued to drop.

- Its share price declining below the critical HK$250 support on big volumes suggest negative technicals on this stock.

🇨🇳 Andre Juice’s growth stalls after bumper period (Bamboo Works)

- China’s leading maker of apple juice concentrate reported its revenue contracted in the third quarter, ending a period of strong gains in the previous year and a half

- Yantai North Andre Juice Co Ltd (SHA: 605198 / HKG: 2218 / FRA: YNA1 / OTCMKTS: YNAJF)’s revenue fell 5% in the third quarter, reversing a 50% gain in the first half of the year and a 62% rise in 2024

- The company’s Hong Kong and Shanghai listed shares look overvalued, following a 70% rally this year

🇨🇳 Sichuan Teway spices up Hong Kong’s hot IPO market (Bamboo Works)

- The maker of ready-to-cook and hotpot pre-mixed seasonings has filed to list in Hong Kong, positioning itself as a consolidator in China’s huge seasonings market

- Sichuan Teway Food Group Co Ltd (SHA: 603317) has filed for a Hong Kong IPO, focused on the business of pre-mixed seasonings that are popular with today’s younger Chinese

- The company’s revenue grew about 15% annually between 2022 and 2024, but contracted in the first half of this year, as it blamed the timing of the Lunar New Year holiday

🇭🇰 ANE (9956 HK): Consortium’s Attractive Preconditional Offer (Smartkarma) $

- [Investment holding company operates an express freight network in the less-than-truckload (LTL) market in China] ANE (Cayman) Inc (HKG: 9956) has disclosed a preconditional scheme privatisation offer from a consortium. The offer is cash (HK$12.18) or scrip (One TopCo Class A Share per scheme share).

- The precondition relates to SAMR approval. The scheme vote is low risk, as the offer is attractive relative to historical ranges and peer multiples.

- The offer price is final. Mr Wang Yongjun, the former chairman, holds a blocking stake but should be supportive. Timing is the key risk.

🇭🇰 HUTCHMED (China) Limited (HCM) Discusses Antibody Targeted Therapy Conjugates Platform and Lead Candidate HMPL-A251 in R&D Update – Slideshow (Seeking Alpha) $ 🗃️

- 🌐 Hutchmed (NASDAQ: HCM) – Commercial-stage biopharmaceutical company. Global development of targeted therapies & immunotherapies for the treatment of cancer & immunological diseases. CK Hutchison Holdings (HKG: 0001 / FRA: 2CKA / OTCMKTS: CKHUY / CKHUF) controlled.🏷️

🇭🇰 Silicon Motion Technology Corporation 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌐 Silicon Motion Technology Corporation (NASDAQ: SIMO) – Designs, develops, & markets NAND flash controllers for solid-state storage devices. 🇼

🇭🇰 Futu Holdings: Focus On Q3 Preview And Policy Headwinds (Seeking Alpha) $ 🗃️

- 🌏 Futu Holdings Ltd (NASDAQ: FUTU) – Digitized brokerage & wealth management platform in China, Hong Kong, USA, etc.

🇲🇴 Macau GGR hit US$3.01bln in October, best monthly figure since Oct 2019 (GGRAsia)

- Macau saw monthly gross gaming revenue (GGR) rise 15.9 percent year-on-year in October, to a new post-pandemic record of nearly MOP24.09 billion (US$3.01 billion).

- Judged month-on-month, it was up 31.7 percent.

- It beat the previous post-pandemic record set in August, of nearly MOP22.16 billion, which had topped January 2020’s MOP22.13 billion, the latter achieved just before the onset of the Covid-19 pandemic.

- Observers would need to refer back to the end of 2019 for a higher monthly GGR figure than this October’s.

- This month’s tally is the best since October 2019’s MOP26.44 billion.

🇲🇴 MGM China 3Q year-on-year revenue jump of 17pct, EBITDA up 20pct (GGRAsia)

- Macau casino operator MGM China Holdings Ltd (HKG: 2282 / FRA: M04 / OTCMKTS: MCHVF / MCHVY) posted net revenue of approximately HKD8.51 billion (US$1.10 billion) for the third quarter of 2025, up by 17.4 percent year-on-year.

- Adjusted earnings before interest, taxation, depreciation and amortisation (EBITDA) were HKD2.37 billion, an increase of 19.6 percent over the same period one year earlier.

- Both figures were “record highs for a third quarter,” said the firm in a press release issued on Thursday. It followed an MGM China filing to the Hong Kong Stock Exchange featuring a set of selected unaudited financial data for the three months ended September 30, 2025.

🇹🇼 Taiwan

🇹🇼 TSMC: You’re Buying At Peak Valuation (Seeking Alpha) $ 🗃️

🇹🇼 TSMC Stock And The AI Bubble: 40%+ AI Accelerator Growth Fuels Valuation Debate (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: The Purest AI Play In The Semiconductor World (Seeking Alpha) $ 🗃️

- 🌐 Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) – World’s largest dedicated independent (pure-play) semiconductor foundry. 🇼 🏷️

🇹🇼 Taiwan Semiconductor (TSMC) Is Going BIG: Advanced Nodes Set to Dominate the AI Boom! (Smartkarma) $

- Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) reported a robust performance for the third quarter of 2025, reflecting its strong position in the global semiconductor industry.

- The company achieved a 10.1% sequential increase in U.S. dollar revenue, reaching $33.1 billion, marginally surpassing its guidance.

- This growth was primarily driven by the increased demand for advanced process technologies, with 3nm technology contributing 23% of wafer revenue.

🇹🇼 TSMC’s Incredible 2nm Curvy Masks (Asianometry)

- All indications point to Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM)’s N2 process node being a beautiful one. TSMC recently discussed their 2nm process node at IEDM 2024, calling it the “world’s most advanced logic technology”. N2’s headlining feature is of course the Gate-All-Around transistor. Its first major transistor transition in nearly 15 years. But there is another new technology being inserted into the node: The Curvilinear mask, or masks with curved lines. TSMC’s first node with curvy masks. Curves. Big whoop, right? It matters because these masks unlock the power of GPUs for semiconductor manufacturing. In this video, TSMC’s curvy masks for its 2nm node.

🇹🇼 ChipMOS Technologies: Is In The Process Of Breaking Free Of Its Shackles (Seeking Alpha) $⛔🗃️

- 🌐 ChipMOS Technologies (TPE: 8150 / NASDAQ: IMOS) – High-integration & high-precision integrated circuits + related assembly & testing services.

🇹🇼 ASE Technology Holding Co., Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌐 ASE Technology Holding (NYSE: ASX) – Independent semiconductor manufacturing services in assembly, test, materials & design manufacturing. 🇼 🏷️

🇹🇼 United Microelectronics Corporation 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌐 United Microelectronics Corp (TPE: 2303 / NYSE: UMC) – Global semiconductor foundry. 🇼 🏷️

🇹🇼 Powertech Technology Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌐 Powertech Technology Inc (TPE: 6239 / OTCMKTS: PWOGF) – World’s leading OSAT. Memory packaging & testing solution provider. Chip bumping, chip probing, IC assembly, final testing, burn in & system level assembly. 🇼 🏷️

🇰🇷 Korea

🇰🇷 As Kangwon Land marks 25 years of its locals-casino monopoly, the case grows for ending its exclusive rights: experts (GGRAsia)

- The locals-play monopoly enjoyed in South Korea by the casino at the Kangwon Land (KRX: 035250) complex since the facility (pictured) opened in October 2000, has so far been affirmed by the national authorities on a rolling basis. But the question of ending its locals-play monopoly is likely to be raised in any meaningful discussion of the future for the South Korean casino industry.

- That is according to several experts on the industry, in comments to GGRAsia.

- A possibility would be for foreigner-only casinos in that country – there are 17 currently – to be allowed to apply for some form of conditional licence to serve local players, said one of the commentators.

- Kangwon Land, run by Kangwon Land Inc, opened at the start of the century, under the mandate of the “Special Act on the Assistance to the Development of Abandoned Mine Areas,” enacted in 1995. The measure was renewed in 2009, forward-dated for a 10-year period up to 2025. In 2021 the act was renewed in advance, to cover a 20-year period from 2025 to 2045.

🇰🇷 Kangwon Land Inc is latest S.Korea casino operator eyeing power of AI as business booster (GGRAsia)

- Kangwon Land (KRX: 035250) is the latest casino operator in South Korea to announce plans to invest in AI. In September, Grand Korea Leisure Co Ltd (KRX: 114090), which runs foreigner-only casinos in South Korea, said it was establishing an “AI innovation team”, with the goal of integrating AI into casino operations and customer services.

🇰🇷 K-Beauty’s Viral Rise in the U.S. Market (NIQ)

- In partnership with Spate, NIQ explores how Korean beauty brands have strategically leveraged TikTok Shop to achieve explosive growth in the U.S. market. With a focus on viral content, influencer partnerships, and innovative product formats, K-Beauty has become a dominant force in the beauty category, reaching $2B in U.S. sales.

🇰🇷 KB Financial Group Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌏 KB Financial Group (NYSE: KB) – Financial holding company. Banking, credit card, financial investment, insurance business etc. 🇼 🏷️

🇰🇷 SK Telecom Co., Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇰🇷 SK Telecom (NYSE: SKM / KRX: 017670 / FRA: KMBA) – Wireless telecommunication services in Korea. 3 segments: Cellular Services, Fixed-Line Telecommunications Services & Other Businesses. 🇼 🏷️

🇰🇷 Samsung Electronics Co., Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌐🅿️ Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) – MNC major appliance & consumer electronics corporation. 🇼 🏷️

🇰🇷 Samsung Electronics: Block Deal Sale of 1.8 Trillion Won for Inheritance Tax Payment by Lee Family (Douglas Research Insights) $

- It was announced today that Samsung’s Lee family members are selling about 1.8 trillion won worth of Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) through an after-hours block trade.

- The purpose of the block trade is for the Lee family members to pay for inheritance taxes and repay stock-backed loans.

- The block trade selling level is between 102,200 won and 104,100 won, representing a discount of 0% to 1.8% compared to the closing price of the day.

🇰🇷 Woori Financial Group Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇰🇷 Woori Financial Group (NYSE: WF) – Commercial bank. Range of financial services to individual, business & institutional customers. 🇼 🏷️

🇰🇷 Shinhan Financial Group Co., Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌐 Shinhan Financial Group (NYSE: SHG / KRX: 055550) – 6 segments: Banking, Credit Card, Securities, Life Insurance, Credit & Others. Merchant bank with 200 global channels & 15 subs.. 🇼 🏷️

🇰🇷 SK Square: Selling Its Stake in 11st to SK Planet (Douglas Research Insights) $

- On 29 October, SK Square (KRX: 402340) announced that it is selling its stake in 11st to SK Planet. This is likely to have a slightly negative impact on SK Square.

- Given SK Planet’s limited financial resources, it is likely that SK Square will provide funding to SK Planet through a capital increase.

- However, the biggest factor driving SK Square’s share price right now is the continued surge in SK Hynix (KRX: 000660)’s share price.

🇰🇷 SK D&D: Delisting Tender Offer by Hahn & Co Fails – What’s Next? (Douglas Research Insights) $

- SK D&D Co Ltd (KRX: 210980) announced the results of the delisting tender offer by Hahn & Co. SK &D mentioned that the subscription reached only 40% of the planned tender offer amount.

- Post failed tender offer for SK D&D by Hahn & Co, we expect this to have a positive impact on SK D&D’s share price.

- The major reason for this is that there are still many investors that believe that SK D&D’s shares are significantly undervalued at P/B of only 0.4x.

🇰🇷 LG Chem: Considering Higher Dividend Payout Using Sale Proceeds from LGES (Douglas Research Insights) $

- LG Chem (KRX: 051910 / 051915) – Parent of LG Energy Solution (KRX: 373220) is considering on paying higher dividends using sale proceeds from LG Energy Solution (KRX: 373220).

- This breaks the company’s principle of using only ordinary income from operating activities as a source for dividends.

- If indeed LG Chem goes ahead with this plan, this would be as a result of heightened demands from major activist investors including Palliser Capital.

🇰🇷 POSCO: Signs a Strategic Partnership with Cleveland-Cliffs (Douglas Research Insights) $

- POSCO [POSCO Holdings (NYSE: PKX) / Posco International Corp (KRX: 047050)] has signed a strategic partnership with Cleveland-Cliffs Inc (NYSE: CLF). POSCO is likely to invest more than 1 trillion won to purchase at least a 10% stake in Cleveland-Cliffs by early 2026.

- Overall, we believe that a potential US$700 million investment in Cleveland-Cliffs for about 10% stake in the company could have a positive impact on POSCO.

🇰🇷 Korea Small Cap Gem #48: Daewon Sanup (Douglas Research Insights) $

- Daewon Sanup Co Ltd (KOSDAQ: 005710)’s net cash as percentage of market cap is 171%. This is one of the highest net cash/market cap ratios in the Korean stock market.

- Daewon Sanup is one of the largest Korean automobile seat manufacturers. It is also one of the beneficiaries of the reduction in US auto tariffs to 15% (from 25% previously).

- The company is trading at dirt cheap valuations. It is trading at P/E of 2.3x and P/B of 0.4x based on LTM financials.

🌏 SE Asia

🇮🇩 PT Bank Danamon Indonesia Tbk 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇮🇩 Bank Danamon Indonesia Tbk PT (IDX: BDMN / FRA: HX9) – Banking services for retail, SMEs & corporate customers. Retail & Wholesale segments. 🇼

🇮🇩 PT Bank Rakyat Indonesia (Persero) Tbk 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇮🇩🏛️ Bank Rakyat Indonesia Tbk PT (IDX: BBRI / FRA: BYRA / OTCMKTS: BKRKF / BKRKY) – One of the largest state-owned banks in Indonesia. 🇼 🏷️

🇮🇩 PT Indosat Ooredoo Hutchison Tbk 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇮🇩 PT Indosat Ooredoo Hutchison Tbk (IDX: ISAT / FRA: IDO1 / OTCMKTS: PTITF) – Wireless services for mobile phones + broadband internet lines for homes. 🇼 🏷️

🇮🇩 PT Bank Mandiri (Persero) Tbk 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

🇲🇾 Genting Malaysia ‘virtually assured’ of winning downstate NY casino licence: Maybank (GGRAsia)

- Casino group Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF) is “virtually assured” of winning a downstate New York casino licence in the United States, suggested Maybank Investment Bank Bhd in a Tuesday note.

- “We believe that all three remaining bidders, including Genting Malaysia’s Resorts World New York City, are virtually assured of a licence each,” wrote analyst Samuel Yin Shao Yang, referring to a bidding contest where the results are expected in December.

- The latter Genting property in Queens, New York City, is currently an electronic gaming venue. It would be upgraded and expanded as a full-scale casino resort (pictured in a rendering) in a move the Genting group has previously said would be a US$5.6-billion project.

- Casino group Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF) says its Resorts World New York City (RWNYC) complex could provide US$2.5 billion over the coming four years to New York state’s Metropolitan Transportation Authority (MTA) if Genting is awarded a downstate New York casino licence this year.

- “This is achievable because RWNYC could begin operations as early as March 2026 if it is selected by the New York Gaming Facility Location Board by December 1, 2025, and the licence is issued by the Gaming Commission by December 31, 2025, consistent with the dates the Board has indicated,” stated the group in a Friday press release.

- The RWNYC property (pictured) in Queens, New York City, is currently an electronic gaming venue. It would be upgraded and expanded as a full-scale casino resort, in a move the Genting group has previously said would be a US$5.6-billion project.

🇵🇭 Bloomberry to sell its loss-making South Korean casino operation (GGRAsia)

- Philippine casino operator Bloomberry Resorts Corp (PSE: BLOOM / OTCMKTS: BLBRF) announced on Monday plans to sell its Jeju Sun hotel casino operation on South Korea’s holiday island of Jeju.

- The firm said in a filing to the Philippine Stock Exchange that its South Korean indirect subsidiary, Golden & Luxury Co Ltd, had signed a share purchase agreement under which it would spin off – via “demerger” – the Jeju casino business into a separate new company.

- It added that the new company would then be sold to an entity called Gangwon Blue Mountain Co Ltd.

- No further details were included in the release about the buyer, except that it had made a “down payment of KRW500.0 million [US$348,820]” related to the deal.

🇵🇭 Maybank starts DigiPlus stock coverage with upbeat view on firm’s EBITDA growth up to 2028 (GGRAsia)

- DigiPlus Interactive (PSE: PLUS), an online gambling and bingo operator in the Philippines, could see an 18-percent compound annual growth rate (CAGR) in its earnings before interest, taxation, depreciation and amortisation (EBITDA) during the fiscal years 2025 to 2028.

- That is according to a Wednesday memo from Maybank Securities Inc, initiating coverage of the gaming group’s Manila-listed stock.

- Analyst Raffy Mendoza said that the 18 percent CAGR in EBITDA would be “driven by top-line growth as we expect monthly active users and ARPU [average revenue per user] to recover; and EBITDA margin of 19.6 percent”.

- Active users and average revenue had seen depressed levels this year, associated with scrutiny of, and tightening contros on, Phillippines domestic online gambling, he observed.

🇵🇭 Belle Corp’s Jan–Sept gaming revenue from City of Dreams Manila down 12pct year-on-year (GGRAsia)

- Belle Corp (PSE: BEL)’s gaming revenue derived from its share of the casino business at City of Dreams Manila fell 12.1 percent year-on-year in the nine months to September 30, reaching PHP1.32 billion (US$22.4 million), the company said in a filing on Thursday to the Philippine Stock Exchange.

- Belle is entitled to a share of revenues or earnings from gaming operations at City of Dreams Manila (pictured in a file photo), in the Philippine capital, through an operating agreement between Belle’s subsidiary Premium Leisure Corp and a unit of the casino group Melco Resorts & Entertainment Ltd.

- Belle said its revenues from leasing City of Dreams Manila to the Melco Resorts group stood at PHP1.76 billion for the January to September 2025 period, up 1.3 percent from a year earlier.

- Belle’s aggregate net income for the nine months to September 30 was PHP1.32 billion, representing a year-on-year decline of 13.6 percent.

- In February, Melco Resorts said it was considering “strategic alternatives” regarding its role in City of Dreams Manila. Lawrence Ho Yau Lung, the company’s chairman and chief executive, said such a move was aligned with the group’s aim of adopting an “asset-light” investment strategy.

🇵🇭 Manila Electric Company 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇵🇭 Manila Electric Company (PSE: MER) or Meralco – Largest private sector electric distribution utility company in the Philippines. Subs. of First Pacific Co Ltd (HKG: 0142 / FRA: FPC / OTCMKTS: FPAFY / FPAFF). 🇼

🇸🇬 Get Smart: Who’s Carrying the STI Higher? (Hint: Not the Banks) (The Smart Investor)

- Singapore’s Straits Times Index (SGX: STI) has a weight problem: three banks control half the index, but growth may have to come from somewhere else.

- Let me explain the STI’s weight problem.

- This isn’t really an index of 30 equal companies.

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF), Oversea-Chinese Banking Corp (OCBC) (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY), and United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF) control over 50% of the index weight.

- Toss in Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel at 7.5%, and the quartet dominate nearly 60% of the index.

- Real estate, which includes real estate investment trusts (REITs) and property developers, contribute 16.7% of the index, but are positioned to do the heavy lifting.

- Don’t overlook Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY) and Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering, which account for 3.4% and 3.2% of the STI respectively.

🇸🇬 Singapore investors, firms desire greater transparency (The Asset) 🗃️

- Improvement in company disclosures on strategy, risk backed by six in 10

- Singapore investors and corporations share a desire for greater transparency, with six in 10 of them believing there is room for improvement in company disclosures on strategy and risk, according to a recent report.

- While more than 80% of Singapore Exchange ( SGX )-listed companies engage with significant investors at least quarterly, only 18% of investors rate such disclosures as “very transparent”, finds the research report by Stewardship Asia Centre ( SAC )’s Stewarding Value: Unlocking Market Potential Through Engagement research report, which concludes that quality engagement – not quantity – is what builds trust, attracts capital and supports sustainable valuations.

- The report, which draws on surveys and interviews with over 250 corporate leaders and institutional investors, explores how engagement quality shapes trust, valuation and long-term company performance and highlights five major findings.

🇸🇬 CapitaLand Integrated Commercial Trust 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌍🌏 CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF) – First REIT listed in Singapore & largest proxy for Singapore commercial real estate. Germany + Australia properties. 🇼 🏷️

🇸🇬 CapitaLand China Trust 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇨🇳 CapitaLand China Trust (SGX: AU8U / OTCMKTS: CLDHF) – Singapore’s largest China-focused REIT. Retail, office & industrial (business parks, logistics facilities, data centres and integrated developments). 🇼 🏷️

🇸🇬 Keppel Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌐 Keppel Ltd (SGX: BN4 / FRA: KEP / KEP1 /OTCMKTS: KPELY / KPELF) – Property, infrastructure & asset management businesses. 🇼 🏷️

🇸🇬 Mapletree Industrial Trust 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇯🇵 🇸🇬 Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF) – Primarily for industrial purposes in Singapore + data centres worldwide. Singapore & Japan. 🇼 🏷️

🇸🇬 Wave Life Sciences Ltd. (WVE) Spotlight on RNA Editing and RNAi: Pipeline and Clinical Advances in Oligonucleotide Therapeutics – Slideshow (Seeking Alpha) $ 🗃️

- 🌐 Wave Life Sciences Ltd (NASDAQ: WVE) – Clinical-stage biotech RNA medicines platform.

🇸🇬 China Yuchai International: Seems To Have Found The Growth Catalyst Needed (Seeking Alpha) $ 🗃️

- 🌏 China Yuchai International Limited (NYSE: CYD) 🇧🇲 – Diesel & natural gas engines for trucks, buses & passenger vehicles, marine, industrial, construction, agriculture & generator set applications. Subs. of Singapore-based Hong Leong Asia Ltd (SGX: H22 / FRA: HOM). 🇼

🇸🇬 Grab Holdings: Sustained Growth And Expansion Justify Optimistic Valuation (Seeking Alpha) $ 🗃️

🇸🇬 Grab Holdings’ Robotaxi Moment Is Here – Premium Valuations Trigger Risks (Seeking Alpha) $ 🗃️

- 🌏 Grab Holdings Limited (NASDAQ: GRAB) – Superapp in SE Asia for mobility, deliveries, & digital financial services to millions of Southeast Asians. 🇼 🏷️

🇸🇬 Can Shopee parent really become a trillion-dollar company? (Momentum Works)

- Last week, Bloomberg reported a memo from Sea Group founder Forrest Li, in which he “sees path to US$1 trillion market cap with help of AI”.

- The memo, written to mark the 8th anniversary of the Shopee parent’s IPO, quickly caught media attention – and for good reason. Only 11 companies in the world have ever crossed the trillion-dollar threshold, and none of them are from Southeast Asia.

- We ran quick polls across Momentum Works channels to see how people felt about Sea’s trillion-dollar ambition.

- On LinkedIn, optimism prevailed – nearly half (46%) said “Dream big, it might happen.”

- In our private chat groups, the mood was very different: 65% said “unrealistic — market is small,” and not a single person voted for “dream big.”

- Meanwhile, on WeChat (where almost 1,000 people voted and we could offer more nuanced options), sentiment was mixed: 24% said “unrealistic,” but 21% chose “It has to – I’m a shareholder.”

🇸🇬 4 Singapore Companies Report Earnings: Here are the Key Takeaways (The Smart Investor)

- CapitaLand China Trust: Soft Pricing Power

- CapitaLand China Trust (SGX: AU8U / OTCMKTS: CLDHF), or CLCT, offers a glimpse into the state of China’s property scene.

- CDL Hospitality Trusts: A Challenging Hospitality Environment

- CDL Hospitality Trusts (SGX: J85 / OTCMKTS: CDHSF), or CDL, reported a third-quarter (3Q2025) operational update that highlights softness in the hospitality industry.

- Wilmar International: Excellent Operating Quarter Soured by a One-Time Legal Payment

- Keppel Limited: Firing on All Cylinders

🇸🇬 Office REITs in 2025: Poised for Recovery? (The Smart Investor)

- With lower interest rates, are office REITs now worth buying?

- Singapore office REITs include familiar names such as CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF), Keppel REIT (SGX: K71U / OTCMKTS: KREVF), Suntec Real Estate Investment Trust (SGX: T82U / OTCMKTS: SURVF), OUE Real Estate Investment Trust (SGX: TS0U / OTCMKTS: OUECF), and Mapletree Pan Asia Commercial Trust (SGX: N2IU / OTCMKTS: MPCMF) or MPACT.

- In their latest half-year update, these REITs shared that most of their Singapore offices had an occupancy rate of between 94.5% and 99.0%.

- Why 2025 Could Offer Opportunities

- Why Risks Remain

- What Investors Should Focus On

- What This Means for Investors

- Get Smart: Location, Leverage, and Local

🇸🇬 3 Singapore REITs That Just Reported: Mapletree Industrial Trust, Starhill Global REIT, and Keppel REIT Ltd (The Smart Investor)

- Here’s a closer look at how these Singapore-listed REITs performed in their latest reporting periods.

- Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF): Strategic Repositioning Amid Revenue Pressures

- Starhill Global Real Estate Investment Trust (SGX: P40U / OTCMKTS: SGLMF): Steady Performance in Challenging Environment

- Keppel REIT (SGX: K71U / OTCMKTS: KREVF): Strong Leasing Momentum Drives Double-Digit Rental Reversions

🇸🇬 3 REITs With the Strongest Balance Sheets and Steady Payout (The Smart Investor)

- In this article, we highlight three Real Estate Investment Trusts (REITs) that reward shareholders with consistent distributions while maintaining fortress-like balance sheets.

- Parkway Life REIT: Defensive REIT Providing Healthcare Exposure

- One of Singapore’s most defensive REITs, Parkway Life Real Estate Investment Trust (SGX: C2PU), or Parkway, stands out with its portfolio of healthcare assets and long-term master leases.

- Keppel DC REIT: Best-In-Class Data Centre REIT

- Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF), or Keppel, is a pure-play data centre REIT whose operating performance is inflecting due to strong digitalisation and AI demand trends.

- Capitaland Integrated Commercial Trust: Singapore’s Largest REIT

- CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF), CICT, offers investors a diversified exposure to some of Singapore’s best properties across retail, office, and integrated development segments.

🇸🇬 3 Blue-Chip Singapore REITs Report Earnings: What You Need to Know (The Smart Investor)

- As earnings season unfolds, it is clear that Singapore’s REITs continue to diverge in performance.

- CapitaLand Integrated Commercial Trust: Slow and Steady

- CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF), or CICT, turned in a resilient report card for its third quarter (3Q2025).

- Mapletree Logistics Trust: A Mixed Bag

- Mapletree Logistics Trust (SGX: M44U / OTCMKTS: MAPGF), or MLT, reported mixed earnings, dragged down by foreign exchange impact and divestments, for the second quarter of the fiscal year ending 31 March 2026 (2QFY25/26).

- Keppel Infrastructure Trust: Divestment Fuels Strong Distributable Income

- Keppel Infrastructure Trust (SGX: A7RU / OTCMKTS: KPLIF), or Keppel, posted strong financials for its nine-month update (9M2025), on the back of robust operations in its Distribution and Storage segment.

🇸🇬 Is Parkway Life REIT The Safest Dividend Play in Singapore? (The Smart Investor)

- Focusing on the defensive healthcare sector has made Parkway Life Real Estate Investment Trust (SGX: C2PU) a dependable choice for those looking for safe growth.

- But is Parkway Life REIT truly the safest dividend play in Singapore?

- Established in 2007, Parkway Life REIT owns a portfolio of hospitals in Singapore, as well as nursing homes and healthcare facilities in Japan, France, and Malaysia.

- As of 30 June 2025, its AUM was S$2.46 billion.

- Parkway Life also has one of the longest master lease structures in Singapore REITs, with strong anchor tenants from the healthcare sector.

- As of 24 October 2025, Parkway Life REIT is trading at S$4.18 per unit, remaining fairly stable since 2021.

🇸🇬 3 REITs With A Track Record of Growing Payouts (The Smart Investor)

- 3 top Singapore REITs that continue to reward investors with rising distributions.

- Parkway Life Real Estate Investment Trust (SGX: C2PU)

- With a focus on core healthcare infrastructure. supported by current demographic trends, the REIT’s portfolio comprises three hospitals in Singapore, 60 nursing homes in Japan and 11 nursing homes in France.

- CapitaLand Integrated Commercial Trust(SGX: C38U / OTCMKTS: CPAMF)

- With an impressive portfolio of Grade A office space in the Central Business District and popular shopping malls, CapitaLand Integrated Commercial Trust, or CICT, has the benefit of its scale, diversified tenant pool, and market leadership.

- Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF)

- Mapletree Industrial Trust (MIT) is an industrial and data centre REIT with assets in Singapore and North America, a potential growth play on the digital economy.

🇸🇬 Beyond Blue Chips: 3 Small Cap Stocks Paying Dividends in November 2025 (The Smart Investor)

- 3 Singapore small cap dividend stocks showing quiet resilience this November.

- What unites them isn’t dividend generosity, but dividend persistence.

- In an era where many small-caps have suspended payouts entirely, these companies are determined to keep their dividend-paying status alive, even if the amounts tell stories of caution, constraint, or conservation.

- Isoteam Ltd (SGX: 5WF): 14 November 2025

- The building maintenance specialist’s FY2025 results reveal the strain: revenue fell 8.4% to S$119.2 million, net profit dropped 21.2% to S$5.1 million, and crucially, free cash flow turned negative at S$0.2 million versus positive S$5.2 million a year ago.

- Micro-Mechanics (Holdings) Ltd (SGX: 5DD / OTCMKTS: MCRNF): 18 November 2025

- The semiconductor tools supplier with five manufacturing facilities across Asia and the USA delivers its S$0.06 per share dividend for FY2025 on 18 November, unchanged from a year ago.

- Tai Sin Electric Ltd (SGX: 500): 28 November 2025

- The Singapore-based electrical cable manufacturer delivered impressive FY2025 results with revenue jumping 20% YoY to S$480.7 million, and net profit attributable to shareholders soaring 78% to S$26.0 million.

- Get Smart: Beyond Size, Toward Staying Power

🇸🇬 These Singapore Small-Caps Are Sitting on Cash—And Paying It Out (The Smart Investor)

- Strong balance sheets, steady dividends. See how Singapore small-caps are turning cash reserves into reliable shareholder rewards.

- Boustead Singapore (SGX: F9D / OTCMKTS: BSTGF)

- Boustead Singapore proves that cash is king.

- The multi-industry conglomerate sits on a fortress balance sheet with S$326.0 million in net cash, representing nearly 35% of its market capitalisation.

- Pan-United Corporation Ltd (SGX: P52)

- Pan-United Corporation sits at the foundation of Singapore’s construction boom, with the cash to prove it.

- UMS Integration Ltd (SGX: 558 / OTCMKTS: UMSSF)

- UMS Integration shows that semiconductor suppliers can be both growth-oriented and shareholder-friendly.

- Get Smart: Strength Behind the Payouts

🇸🇬 4 Dividend-Paying Stocks to Own for the Next Decade (The Smart Investor)

- Looking for stable and consistent income from the stock market? Here are four long-term picks with high dividend yields.

- Haw Par Corporation (SGX: H02 / OTCMKTS: HAWPF)

- Haw Par is a Singaporean manufacturing and investment company which deals in healthcare, pharmaceuticals, leisure products, and property.

- Best known as the owner of Tiger Balm, the company is a steady dividend payer with strong cash reserves and recurring dividend income from its stakes in United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF) and UOL Group Limited (SGX: U14 / FRA: U1O / OTCMKTS: UOLGY / UOLGF).

- Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering

- ST Engineering is a conglomerate with global exposure in the technology, defense, aerospace, and digital solutions industries.

- Singapore Exchange Limited(SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY)

- SGX is the only stock exchange operator in Singapore, operating equity, fixed income, currency, and commodity markets.

- United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF)

- UOB is one of three major banks in Singapore which pay a dividend, supported by stable earnings and its recent Southeast Asian expansion.

🇸🇬 Telcos in Transition: Can Singtel and StarHub Deliver Growth Beyond 5G? (The Smart Investor)

- Singapore telecom companies such as Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel and StarHub (SGX: CC3 / FRA: RYTB / OTCMKTS: SRHBY / SRHBF) have long been heralded as defensive stalwarts, prized for their steady dividends.

- With the 5G rollouts maturing, investors may have the following question: Will these telecom businesses revert to a low-growth cycle, or can they find new growth opportunities?

- The Telco Business Model in Transition

- Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel

- The local telco also has a strong regional presence in neighbouring Asian countries through its subsidiaries such as Airtel and Telkomsel.

- Singtel has been growing its exposure to data centres, ICT services, and digital infrastructure.

- StarHub

- Key Challenges Ahead

- What This Means for Investors

- Get Smart: Core Business Provides Stable Dividends, with New Growth Initiatives

🇹🇭 Thai PM vows a no-casino policy during talks with China’s Xi Jinping (GGRAsia)

- Thailand’s prime minister Anutin Charnvirakul has reaffirmed his anti-gambling stance, telling on Thursday China’s President Xi Jinping that the Thai government will not pursue casinos as an economic driver. His comments were made at a bilateral meeting during the APEC Economic Leaders’ gathering in South Korea last week.

🇹🇭 The Siam Cement Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇹🇭 Siam Cement PCL (BKK: SCC / SGX: TSCD) – Cement-Building Materials Business, Chemicals Business, Packaging Business & Investment Business. 🇼 🏷️

🇻🇳 Ho Chi Minh City races to become global financial hub (The Asset) 🗃️

- Linkages with London and New York aim to attract capital flows from world’s top financial institutions

- Under the city’s master plan, the HCMC International Financial Centre will span approximately 898 hectares, covering the Thu Thiem Peninsula, Ben Thanh Ward, and part of Saigon Ward – considered the “heart” of the city.

- At its 9.2-hectare core, the city plans to construct 11 high-rise towers, including a landmark building symbolizing HCMC’s ambition to join the global financial map.

🇮🇳 India / South Asia / Central Asia

🇮🇳 NIFTY Bank Index: Methodology Changes to Result in Big Flows (Smartkarma) $

- In May, SEBI recommended changes to the minimum number of constituents for non-benchmark indices and the capping for those indices. Then came the market consultation in August.

- SEBI has now confirmed the changes along with the timeline for capping changes to the largest stocks in the index.

- The changes could commence in December and continue till March. The adds will take place in December and weight changes for the largest stocks will take place in 4 tranches.

🇮🇳 GAIL (India) Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇮🇳🏛️ GAIL (NSE: GAIL / BOM: 532155) formerly Gas Authority of India Ltd – Diversified interests across the natural gas value chain of trading, transmission, LPG production & transmission, LNG re-gasification, petrochemicals, city gas, E&P, etc. 🇼🏷️

🇮🇳 MakeMyTrip: Business Fundamentals Keep Getting Structurally Better (Seeking Alpha) $ 🗃️

- 🇮🇳 Makemytrip (NASDAQ: MMYT) – Online travel services. 🇼

🇮🇳 Dr. Reddy’s: Underappreciated Future Amid Exaggerated Headwinds (Seeking Alpha) $ 🗃️

- 🌐 Dr. Reddy’s Laboratories Limited (NYSE: RDY) – Manufactures & markets a wide range of pharmaceuticals. 🇼

🇮🇳 Larsen & Toubro Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇮🇳 Larsen & Toubro (L&T) (NSE: LT / BOM: 500510) – Engineering, procurement & construction projects (EPC). 🇼

🇮🇳 Eternal: Blinkit Leads Scale-Up as Inventory Model Lifts Margins (Smartkarma) $

- Eternal Ltd (NSE: ETERNAL / BOM: 543320) [Formerly Zomato Limited (NSE: ZOMATO / BSE: ZOMATO)]’s Q2FY26 revenue surged 183% YoY to INR 135B, driven by Blinkit’s shift to an owned-inventory quick commerce model, a major operational transformation.

- The new model boosts revenue and gross margins but pressures profits amid higher marketing costs, dark store expansion, and increased working capital needs.

- Eternal is prioritizing scale over near-term profits, investing heavily to strengthen its long-term leadership in Q-commerce and digital retail.

🇮🇳 Cipla-Eli Lilly Deal: Strategic Masterstroke or Margin Mirage? (Smartkarma) $

- CIPLA Ltd (NSE: CIPLA / BOM: 500087) signed an exclusive distribution and promotion agreement with Eli Lilly on 23 October 2025 to market tirzepatide under the brand name Yurpeak in India.

- The deal positions Cipla as a first mover in India’s nascent GLP-1 obesity care segment, projected to grow 40x by 2030.

- Financially modest but strategically transformative, the deal anchors Cipla’s entry into obesity therapeutics and sets the stage for a broader GLP-1 platform spanning branded and generic drugs.

🇮🇳 Dollar Industries’ Big Reshuffle: Why It Matters? (Smartkarma) $

- Dollar Industries Ltd (NSE: DOLLAR / BOM: 541403) has announced a Composite Scheme of Arrangement, merging eight promoter group companies and demerging one hosiery business undertaking into the listed entity.

- The scheme fundamentally restructures DIL, consolidating brand ownership, key manufacturing assets, and operational real estate, directly addressing long-standing concerns regarding related-party transactions and corporate complexity.

- While execution risks persist, the strategic clarity and governance enhancement resulting from this vertical integration could serve as a powerful catalyst, potentially driving a valuation re-rating.

🇮🇳 The Beat Ideas: Wendt India – The Silent Force Behind India’s Precision Manufacturing Revolution (Smartkarma) $

- Wendt (India) Limited (NSE: WENDT / BOM: 505412) completed a transformative acquisition of global “Wendt” brand IP, while Wendt GmbH (3M) initiated exit from the JV, consolidating CUMI and public ownership.

- Autonomous brand/IP rights unshackle Wendt from legacy risk while maintaining technical lead. A diversified, high technology industrial revenue stream, debt-free balance sheet, and high cash conversion reinforce the investment case.

- Wendt India is among the highest quality plays in Indian manufacturing: sticky client relationships, sectoral diversity, and recurring cash flows balance mid-term volatility in autos/steel.

🇮🇳 Lenskart IPO: Fashioning Vision or Pricing Perfection? (Smartkarma) $

- [Technology-driven eyewear] Lenskart Solutions’s upcoming IPO marks India’s first major consumer-tech listing, positioning the eyewear disruptor as a vertically integrated D2C brand with around 75% share in organized retail and strong international traction.

- While Lenskart’s 75% revenue surge and 275% EBITDA jump over two years highlight its operational strength, but the proposed valuation (70x EV/EBITDA) far exceeds global peers raises serious concerns.

- Lenskart’s vertically integrated model, data-led omnichannel scale, and strong international playbook offer structural advantages. But the IPO’s frothy valuation and pre-IPO promoter stake sales warrant a cautious stance for investors.

🇮🇳 Lenskart IPO: Earliest Index Inclusion in June (Smartkarma) $

- [Technology-driven eyewear] Lenskart Solutions (0370405Z IN) is looking to list on the exchanges by selling 181.05m shares via a primary and secondary offering to raise US$829m at a valuation of US$7.95bn.

- The price band has been set at INR 382-402/share, and the issue is likely to price at the top end of the range.

- The stock will not get Fast Entry to global indices. Inclusion at regular rebalances will commence in June 2026 but flow will be small given the low float.

🇮🇳 Lenskart Solutions IPO- Covered-Up Deal? (Smartkarma) $

- [Technology-driven eyewear] Lenskart Solutions (0370405Z IN) much-awaited IPO, comprising a fresh issue of INR 21.5 bn and offer for sale of 127.5 mn shares, is set to open for subscription this week.

- We also find it surprising to note that the company purchased Dealskart, a profitable company with EBITDA of INR 2.33 bn for an insignificant sum of INR 20 mn.

- Company was able to report in FY25 is mainly on account of “Other Income” by accounting for gains from lower deferred consideration to boost its Profitability.

🇬🇪 Georgia Capital PLC 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇬🇪 Georgia Capital Plc (LON: CGEO / FRA: 2IX / OTCMKTS: GRGCF) – Investing in & developing businesses in Georgia.

🌍 Middle East

🇹🇷 Arçelik Anonim Sirketi 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌍 Arçelik AS (IST: ARCLK / OTCMKTS: ACKAY) – Household appliances producer. Third largest white goods player in Europe. 🇼

🇹🇷 Turkiye Garanti Bankasi A.S. ADR 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌍 Turkiye Garanti Bankasi AS (IST: GARAN / / OTCMKTS: TKGBY / TKGBF / TKGZY) or Garanti BBVA – Turkey’s second-largest private bank. Subs. of Banco Bilbao Vizcaya Argentaria S.A. (NYSE: BBVA). 🇼

🌍 Africa

🌍 Stockpickers: Airtel Africa, C&C Group, Ultimate Products (FT) $ 🗃️

- Our experts discuss which companies to buy, sell or hold this week

- Scale matters for telecoms companies. Competitive pricing and heavy spending on network infrastructure means tight margins, and London’s big three telecoms companies, BT, Vodafone Group Plc (LON: VOD / NASDAQ: VOD) and Airtel Africa (LON: AAF / FRA: 9AA / OTCMKTS: AAFRF), all face the same pressure to build vast customer bases.

🌍 Africa takes lead in emerging market rally as ‘real’ assets attract investors (FT) $ 🗃️

- Record metals prices, a weak dollar and painful reforms are paying off for the continent’s markets

- South African, Nigerian, Kenyan and Moroccan stocks have returned at least 40 per cent this year in US dollar terms, ahead of a 31 per cent dollar gain for an MSCI emerging-market share gauge that is itself the strongest since 2017.

🌍 Airtel Africa Plc 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌍 Airtel Africa (LON: AAF / FRA: 9AA / OTCMKTS: AAFRF) – UK-based MNC providing telecommunications & mobile money services in 14 African countries. 🇼 🏷️

🇿🇦 Datatec Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌐 Datatec Ltd (JSE: DTC / FRA: DTT / OTCMKTS: DTTLF) – ICT solutions & services group. 🇼

🇿🇦 Wall Street’s Gold Price Forecasts Enable DRDGold To Invest Ambitiously In Gold Projects (Rating Upgrade) (Seeking Alpha) 🗃️

- 🇿🇦 DRD Gold (JSE: DRD / NYSE: DRD) – Gold mining company involved in the surface gold tailings retreatment business in South Africa. Exploration, extraction, processing & smelting activities. Sibanye Stillwater Ltd (JSE: SSW / NYSE: SBSW) controlled. 🇼 🏷️

🇿🇦 Pick n Pay Stores Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌍 Pick ‘n Pay (JSE: PIK / FRA: PIK) – Leading South African retailer. Stores in South Africa, Namibia, Botswana, Zambia, Swaziland & Lesotho + owns a 49% share of Zimbabwean chain TM Supermarkets. 🇼 🏷️

🌍 Eastern Europe & Emerging Europe

🇬🇷 Eurobank Ergasias Services and Holdings S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌍 Eurobank Ergasias Services (ASE: EURBr / FRA: EFGD / EFGA / OTCMKTS: EGFEY) – Holding company owning 100% of the Eurobank SA shares. 🇼

🇵🇱 mBank S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇵🇱 mBank SA (WSE: MBK / FRA: BRU / OTCMKTS: MBAKF) – First Internet bank in Poland. Retail, corporate & investment banking + other financial services. 🇼 🏷️

🇵🇱 KRUK Spólka Akcyjna 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

🇵🇱 Alior Bank S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇵🇱 Alior Bank (WSE: ALR / FRA: A6O) – Universal bank. A subs. of insurance company PZU (WSE: PZU / FRA: 7PZ / FRA: 7PZ0). 🇼 🏷️

🇵🇱 Santander Bank Polska S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇵🇱 Santander Bank Polska SA (WSE: SPL / FRA: BZI) – One of the largest financial groups & the largest private bank in Poland. 🇼 🏷️

🌎 Latin America

🌎 MercadoLibre, Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

🌎 MercadoLibre: Latin America’s Digital Empire Deserves A Premium (Seeking Alpha) $ 🗃️

- 🌎 MercadoLibre (NASDAQ: MELI) – Uruguay HQ’d. The largest online commerce & payments ecosystem in Latin America. 🇼 🏷️

🌎 Ternium S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌎 Ternium S.A. (NYSE: TX) 🇱🇺 – Manufactures & processes steel products (including for oil & gas) with 18 production centers in Argentina, Brazil, Colombia, United States, Guatemala & Mexico. Subs. of Argentine-Italian conglomerate Techint. 🇼 🏷️

🇦🇷 Argentine bonds and currency surge after victory for Javier Milei’s party (FT) $ 🗃️

- Investors bet that electoral endorsement will keep president’s market-friendly reforms on track

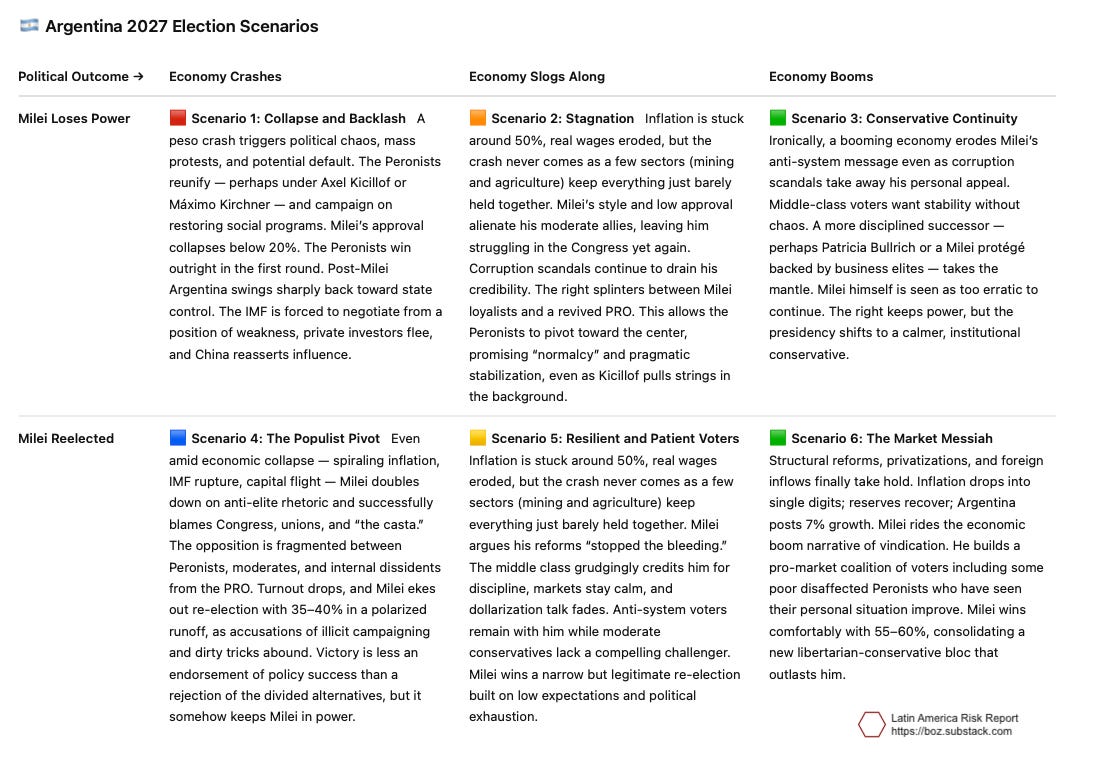

🇦🇷 Argentina 2027 Election Scenarios – October 2025 (Latin America Risk Report)

- Milei won the midterms. Can he win reelection?

- With the midterm election over, let’s jump to the question of 2027. What are the odds of Milei’s reelection? Before I can figure that out, I need to think through the scenarios. The key factors for Milei’s potential reelection, in descending order, are:

- Argentina’s economy

- Argentina’s economy

- Milei’s corruption scandals and behavior

- The Peronists’ cohesion and reputation

- Milei’s coalition

- Given that the top two most important factors are Argentina’s economy, I built a 3×2 matrix that considers three potential futures for Argentina’s economy and assesses a scenario in which Milei is reelected or not in each.

🇦🇷 Loma Negra: Strategic Sale And Election Results In Argentina Renew The Bullish Case (Seeking Alpha) $ 🗃️

- 🇦🇷 Loma Negra Compañía Industrial Argentina Sociedad Anónima (NYSE: LOMA) – Production & commercialization of cement in Argentina. 🇼 🏷️

🇦🇷 Banco BBVA Argentina: Rapid Loan Growth To Power Shares Higher (Seeking Alpha) $ 🗃️

🇦🇷 Banco BBVA Argentina: Breathing Fresh Air After Milei’s Midterm Victory (Seeking Alpha) $ 🗃️

- 🇦🇷 Bbva Argentina (NYSE: BBAR) – Subs. of Banco Bilbao Vizcaya Argentaria S.A. (NYSE: BBVA). Retail & corporate banking to a broad customer base, including individuals, SMEs & large companies. 🇼 🏷️

🇦🇷 Argentina’s Financial Rebirth – Banco Macro Leads The Post-Election Rally (Seeking Alpha) $ 🗃️

- 🇦🇷 Banco Macro Sa (NYSE: BMA) – A universal bank providing a wide range of financial services with focus in low & mid-income individuals & SMEs. 🇼 🏷️

🇦🇷 Grupo Supervielle: Not The Best Macro Play, But ‘A Rising Tide Lifts All Boats’ (Seeking Alpha) $ 🗃️

- 🇦🇷 Grupo Supervielle SA (NYSE: SUPV) – Provides a range of financial & non-financial services. 🏷️

🇦🇷 Milei’s Mid-Term Victory Sparks An Argentina Relief Rally: What It Means For YPF (Seeking Alpha) $ 🗃️

- 🇦🇷 🏛️ Ypf Sa (NYSE: YPF) – Vertically integrated, majority state-owned Argentine energy company. Oil & gas exploration & production + transportation, refining & marketing of gas & petroleum products. 🇼 🏷️

🇧🇲 The Bank of N.T. Butterfield & Son Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌐 Bank of NT Butterfield & Son Ltd (NYSE: NTB) – Specialized offshore financial services & wealth management. 🇼

🇧🇷 Are We $BAK? Event-Driven Bet with 300-500% Upside Potential (TheOldEconomy Substack) $

- Chemical Industry M&A is Revving Up

- A few years ago, I discovered Braskem SA (NYSE: BAK / BVMF: BRKM3 / BRKM5 / BRKM6). At the time, the lore was that the company would face imminent bankruptcy due to unbearable liabilities (financial and legal). Furthermore, the chemical industry was perceived—and I believe it still is—as completely redundant.

- A perfect setup for bottom fishing.

- Then, news came. In November 2023, Abu Dhabi National Oil Company (ADNOC) approached Braskem. ADNOC offered 10.5 billion BRL, or BRL 37.29 per share, for Novonor’s stake in Braskem. This is a premium of almost 100% over Braskem’s closing price on November 15, 2023, of BRL 17.68. The ADNOC offer was good enough for me to take the plunge. In other words, to buy some Braskem shares as an event-driven bet on a successful deal with ADNOC.

- However, in May 2024, ADNOC abandoned its plans. This event was the signal to close the trade. In conclusion, I realized a tiny <10 bps loss on that trade, and Braskem moved from the portfolio to the watchlist.

- Recent developments in Brazil and the chemical industry have made Braskem interesting again. Moreover, Braskem’s price action is, to say the least, tempting. This is a three-monthly chart:

🇧🇷 Vale S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

🇧🇷 Vale: Another LATAM Giant With Good Prospects (Seeking Alpha) $ 🗃️

- 🌐 Vale (NYSE: VALE) – Iron Solutions & Energy Transition Materials segments. Produces & sells iron ore, iron ore pellets, nickel, copper etc + related logistic service. 🇼 🏷️

🇧🇷 Telefônica Brasil S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇧🇷 Telefônica Brasil S.A. (NYSE: VIV) – Fixed line, mobile, data, pay TV, IT, etc. services. Subs. of Telefonica SA (NYSE: TEF). 🇼

🇧🇷 Ambev S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌎 Ambev (NYSE: ABEV) – Brazilian brewing company now merged into Anheuser-Busch Inbev SA (NYSE: BUD). 🇼

🇧🇷 Hypera S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇧🇷 Hypera SA (BVMF: HYPE3 / OTCMKTS: HYPMY) – Pharmaceuticals, consumer healthcare, cosmetics & biotechnology products. 🇼

🇧🇷 Nu Holdings: U.S. Banking License, Favorable FX, All-Time Highs (Seeking Alpha) $ 🗃️

- 🌎 Nu Holdings (NYSE: NU) – Digital banking platform / fintech. 🇼

🇧🇷 Banco Santander (Brasil) S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇧🇷🅿️ Banco Santander Brasil (NYSE: BSBR / BVMF: SANB3 / SANB4 / SANB11) – Various banking products & services to individuals, SMEs & corporate customers. Part of Spain based Santander Group. 🇼

🇧🇷 Sigma Lithium: Building Value While The Market Looks Away (Seeking Alpha) $ 🗃️

- 🇧🇷 Sigma Lithium Corporation (CVE: SGML) – Exploration & development of lithium deposits in Brazil. 🏷️

🇲🇽 Vista Energy: Q3 Confirms Production Momentum, Stronger Than Expected 2025 On Deck (Seeking Alpha) $ 🗃️

🇲🇽 Vista Energy: Building A Major At A Minor Valuation (Seeking Alpha) $ 🗃️

🇲🇽 Vista Energy: Remains A Key Pick, Strong Buy Reiterated (Seeking Alpha) $ 🗃️

- 🇦🇷 🇲🇽 Vista Energy (NYSE: VIST / FRA: 1CIA / BMV: VISTAA)’s – Mexico HQ’d. Main asset in Argentina is the largest shale oil & shale gas play under development outside North America. 🏷️

🇲🇽 Regional S.A.B. de C.V. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇲🇽 Regional SAB (BMV: RA / OTCMKTS: RGNLF) aka Banco Regional de Monterrey S.A. or BanRegio – Focused on serving the financial needs of SMEs. 🇼 🏷️

🇲🇽 Grupo México, S.A.B. de C.V. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌎 Grupo Mexico (BMV: GMEXICOB / FRA: 4GE / OTCMKTS: GMBXF) – Mining, Transportation, Infrastructure & Fundacion Grupo Mexico. ASARCO (American Smelting & Refining Company) + Southern Copper (NYSE: SCCO). 🇼 🏷️

🇲🇽 Wal-Mart De Mexico S.A.B. de C.V. ADR 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️ (1)

🇲🇽 Wal-Mart De Mexico S.A.B. de C.V. ADR 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️ (2)

🇲🇽 Wal-Mart De Mexico: Multi-Format Approach And Leadership Continuity Support Resilient Performance (Seeking Alpha) $ 🗃️

- 🇲🇽 Wal-Mart de Mexico SAB de CV (BMV: WALMEX) – Discount warehouses & stores, hypermarkets, supermarkets & membership self-service wholesale stores. 🇼 🏷️

🇲🇽 Alsea, S.A.B. de C.V. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌎 🇪🇸 Alsea SAB de CV (BMV: ALSEA / FRA: 4FU / OTCMKTS: ALSSF) – Leading restaurant operator in Latin America & Spain of global brands. 🇼 🏷️

🇲🇽 Orbia Advance Corporation, S.A.B. de C.V. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇲🇽 Orbia Advance Corporation SAB de CV (BMV: ORBIA / FRA: 4FZ / OTCMKTS: MXCHF) – Polymer Solutions (Vestolit & Alphagary), Building & Infrastructure (Wavin), Precision Agriculture (Netafim), Connectivity Solutions (Dura-Line) & Fluorinated Solutions (Koura) sectors. 🇼 🏷️

🇲🇽 Becle, S.A.B. de C.V. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🇲🇽 Becle SAB de CV (Cuervo) (BMV: CUERVO / FRA: 6BE / OTCMKTS: BCCLF) – World’s largest and oldest tequila manufacturer – Jose Cuervo. 🇼 🏷️

🇲🇽 Grupo Bimbo, S.A.B. de C.V. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌐 Grupo Bimbo SAB de CV (BMV: BIMBOA / FRA: 4GM / OTCMKTS: GRBMF / BMBOY) – Largest baking company in the world & a relevant participant in snacks. 🇼 🏷️

🇲🇽 CEMEX, S.A.B. de C.V. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

🇵🇦 Bladex Remains Attractive Given Record-Low Spreads (Seeking Alpha) $ 🗃️

🇵🇦 Banco Latinoamericano de Comercio Exterior, S. A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) 🗃️

- 🌎 Banco Latinoamericano (NYSE: BLX) or the Foreign Trade Bank of Latin America or Bladex – Founding shareholders were the Central Banks & government entities of 23 countries in the region. Specialized in addressing trade finance needs. 🇼 🏷️

🇵🇪 Cementos Pacasmayo’s 2 Engines Are Thrusting At Least Into H1 2026, And The Price Remains Attractive (Seeking Alpha) $ 🗃️

🇵🇪 Cementos Pacasmayo S.A.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) ⛔🗃️

- 🇵🇪 Cementos Pacasmayo (NYSE: CPAC) – Produces, distributes & sells cement & cement-related materials. 🇼

🌐 Global

🌐 Nebius Stock Powers Up Ahead Of Key Q3 Test (Seeking Alpha) $ 🗃️

🌐 Nebius Group: AI Infrastructure Powerhouse With Significant Upside Ahead (Seeking Alpha) $ 🗃️

🌐 Nebius Enters Q3 With Momentum (Seeking Alpha) $ 🗃️

🌐 Nebius: Irrational Exuberance Should Alarm You (Seeking Alpha) $ 🗃️

- 🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

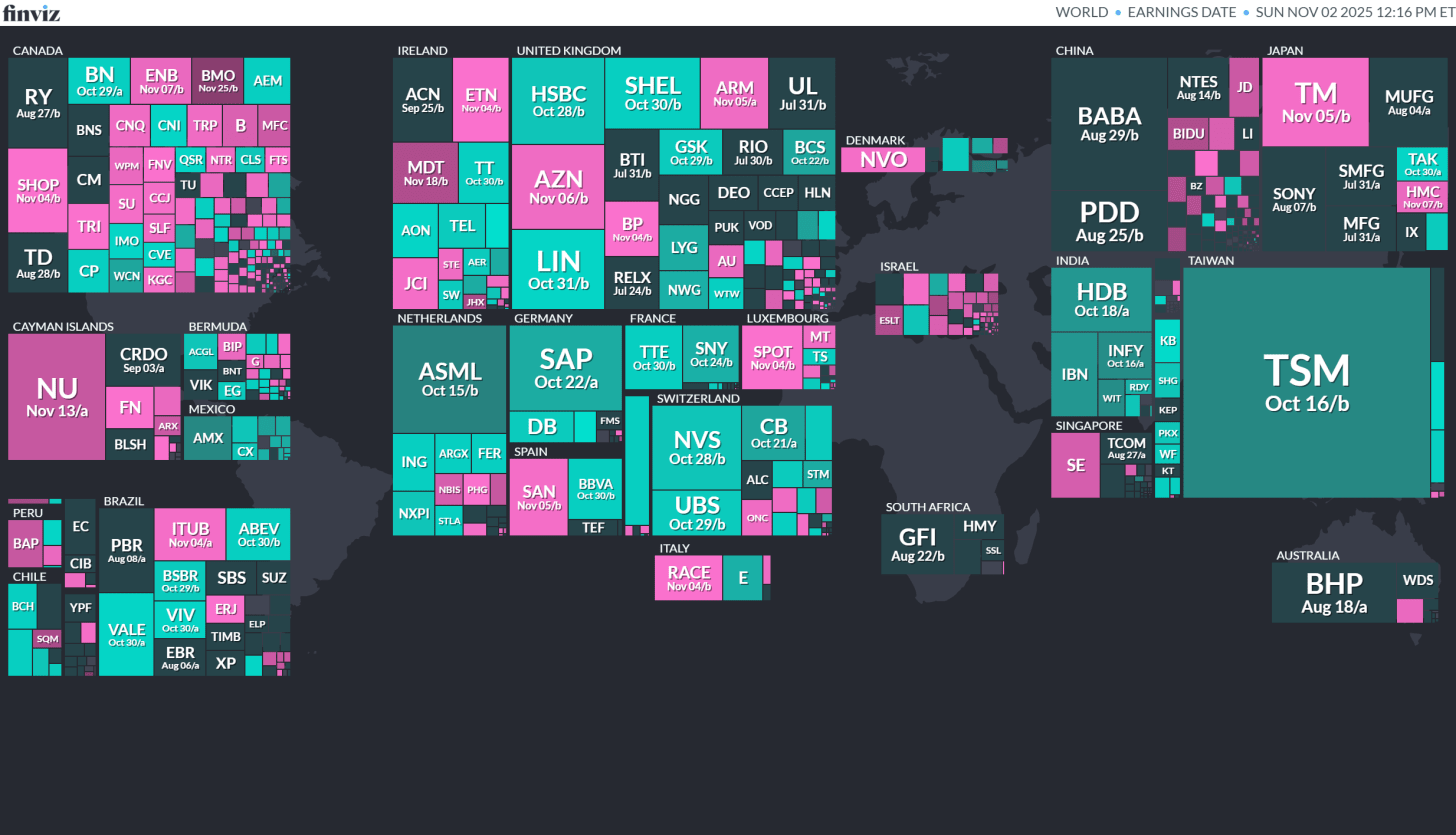

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

- Egypt Egyptian House of Representatives 2025-11-10 (d) Confirmed 2020-10-24

- Iraq Iraqi Council of Representatives 2025-11-11 (d) Confirmed 2021-10-10

- Chile Chilean Chamber of Deputies 2025-11-16 (d) Confirmed 2021-11-21

- Chile Chilean Presidency 2025-11-16 (d) Confirmed 2021-12-19

- Chile Chilean Senate 2025-11-16 (d) Confirmed 2021-11-21

- Hong Kong Hong Kong Legislative Council 2025-12-07 (d) Confirmed 2021-09-05

- Côte d’Ivoire Ivorian Presidency 2025-10-25 (d) Confirmed 2020-10-31

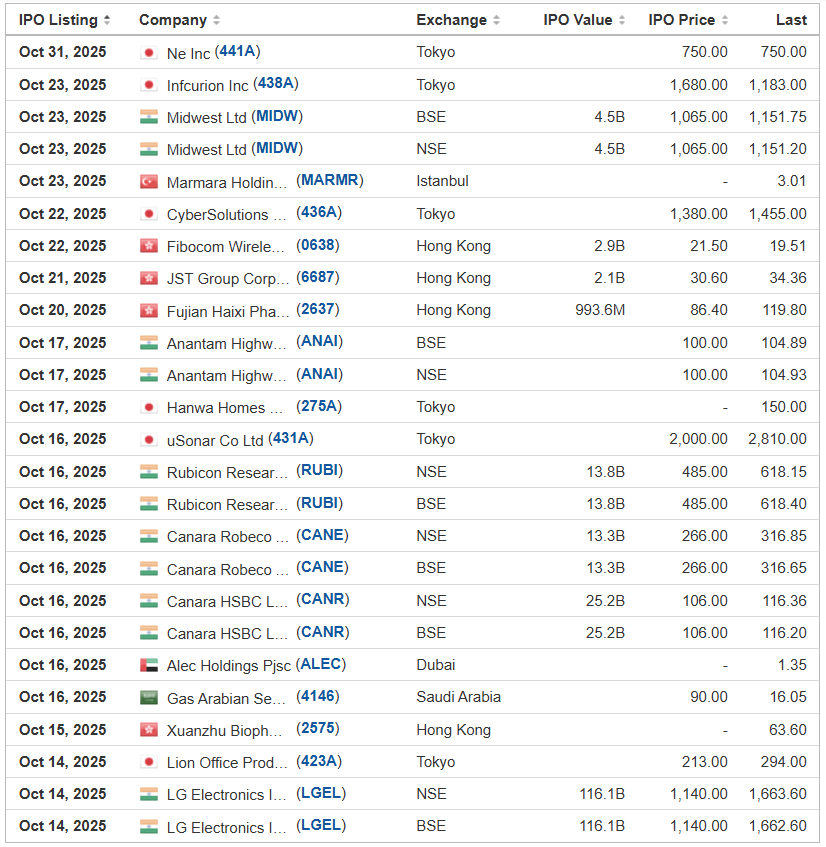

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Grupo Aeromexico AERO Barclays/ Morgan Stanley/ J.P. Morgan/ Evercore ISI/ Apollo Global Securities, 11.7M Shares, $18.00-20.00, $222.8 mil, 11/6/2025 Thursday

We are uniquely positioned as the only full service carrier, or FSC, based in Mexico and the only airline that provides long-haul, wide-body service connecting Mexico with the rest of the world.(Incorporated in the United Mexican States)

We are uniquely positioned as the only full service carrier, or FSC, based in Mexico and the only airline that provides long-haul, wide-body service connecting Mexico with the rest of the world. We offer a premium experience to both international and domestic destinations. As of June 30, 2025, we served every major city in Mexico and 52 international cities in 22 countries across multiple continents: North America, South America, Europe and Asia. We maintain the most attractive route network in Mexico, and we are the leading airline at MEX, the largest airport in Mexico, which is capacity constrained, and accounted for 36.3% of total passengers flying within, to and from Mexico in the twelve-month period ended June 30, 2025, according to the AFAC. We also have a strong presence in Mexico’s other large business markets, including Guadalajara and Monterrey, where we provide global connectivity by offering long-haul intercontinental flights. In addition, we have a large footprint in high-demand leisure markets, such as Cancún and Puerto Vallarta. We are the only Mexican airline that is a member of one of the three global airline alliances through our membership in SkyTeam, a global network of 18 international carriers, which we co-founded with Delta more than 25 years ago.

In 2022, as a result of the economic downturn caused by the COVID-19 pandemic, we completed a reorganization process. We believe we are positioned for significant and profitable growth through our reduced cost structure following our Chapter 11 restructuring and the upgauging of our fleet to larger, more efficient aircraft. In the years following our restructuring, we intend to invest to expand our fleet and improve the product and customer experience for our passengers. These investments will allow us to maintain the highest service standard as the only FSC based in Mexico, as well as our position as Mexico’s airline of choice. We are well-positioned for strength, as we operate in one of the largest and highest-growth aviation markets, according to the World Bank, and our CASK is significantly lower than that of U.S. legacy carriers and major European international FSCs. The Mexican airline competitive landscape has materially changed since the start of the COVID-19 pandemic. We believe the combination of air travel market size and growth in Mexico has created one of the best air travel market environments in the world.