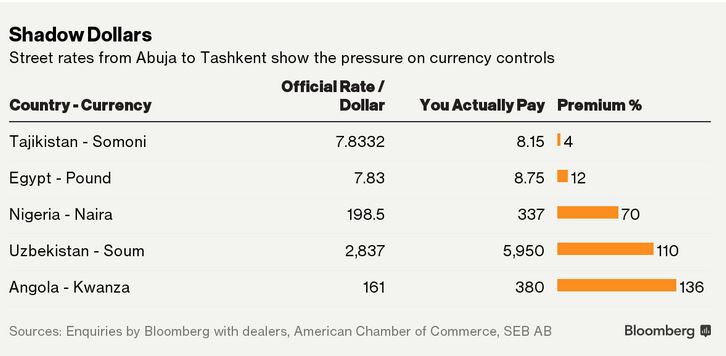

According to a Bloomberg survey, individuals and businesses in five nations across central Asia, the Middle East and Africa are paying anywhere from 4% to 136% more than official exchange rates to get their hands on dollars. In the four months that followed China’s devaluation of the yuan in August, Bloomberg also noted that Kazakhstan, Argentina and Azerbaijan abandoned control of their exchange rates to boost competitiveness and avoid draining reserves. In countries like Tajikistan, Egypt, Nigeria, Uzbekistan and Angola thriving unregulated trading may be forcing central banks to reassess currency policy.

To read the whole article, Five Countries Being Squeezed by Currency Pegs, go to the website of Bloomberg.

Similar Posts:

- Africa’s Consumer Market Potential: Trends, Drivers, Opportunities and Strategies (Brookings Institution)

- Russia is Winning Battle to Control the World’s Wheat (The Times)

- Moody’s Downgrades Four African Nations

- What’s Ahead for the MENA Region? (Franklin Templeton)

- Africa Rising: The Hopeful Continent (Wellington Management)

- MENA Market Outlook: Managing the Economic Fallout (Franklin Templeton)

- Africa’s Oil & Gas Scene After the Boom: What Lies Ahead (Oxford Energy Forum)

- The “Next Eleven” and the World Economy (The Asset)

- Frontier Markets Post-pandemic (Capital Group)

- 3 Emerging Market Risks Companies Should Watch for in 2018 (Harvard Business Review)

- How MSCI’s Removal of Qatar & UAE Impacts the Frontier Markets Landscape (MM)

- Egypt Insight: Four Tailwinds for Economic Growth in 2018 (Bloomberg Economic Insights)

- New Fragile Five Facing a Forex Crisis: Argentina, Brazil, South Africa, Ukraine & Venezuela (Institutional Investor)

- How Big is Africa’s Car Market? (African Executive)

- Nielsen Global Survey of Consumer Confidence for Q1 2015