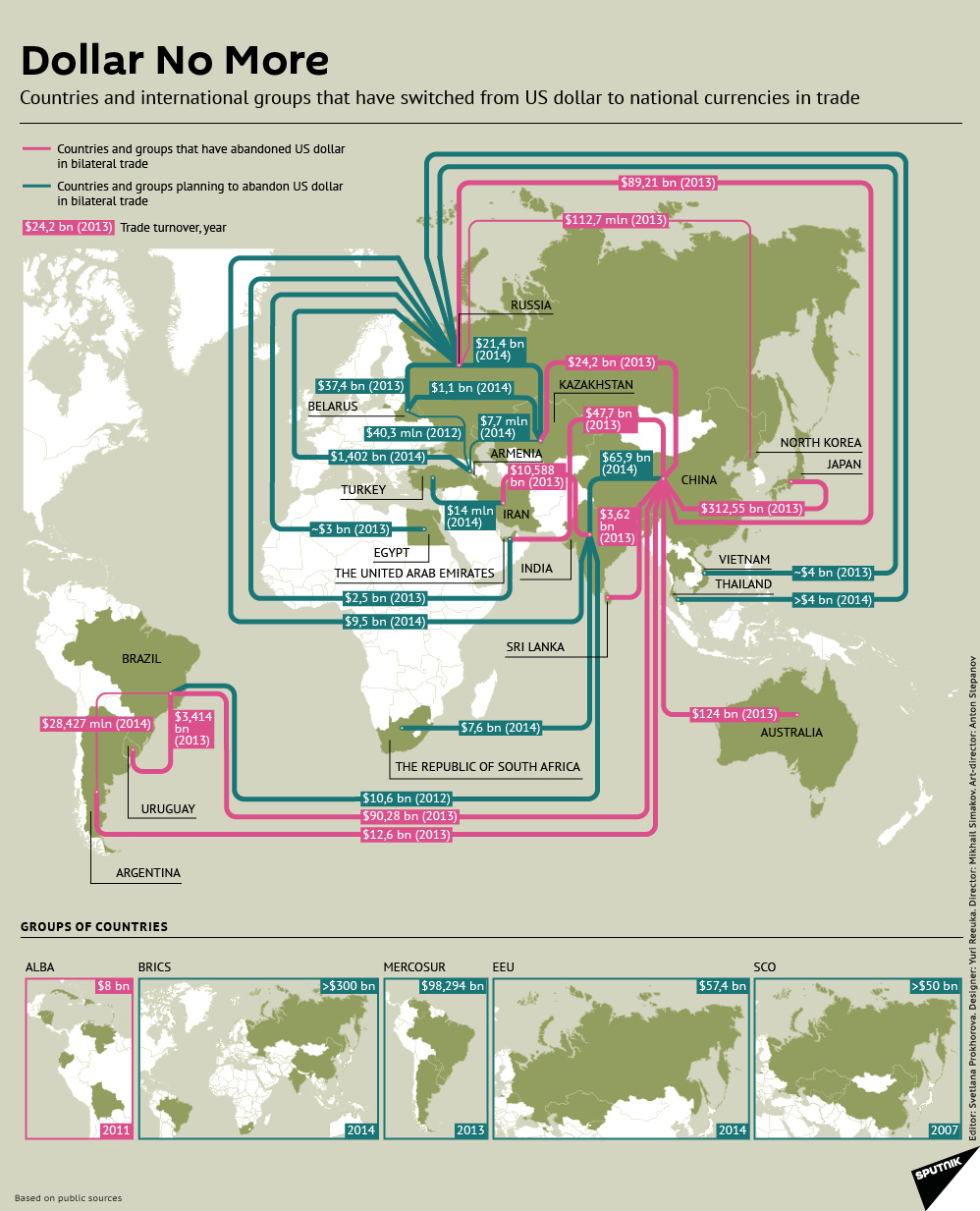

Russian news agency Sputnik has an interesting infographic showing the countries and international groups that have switched from US dollar to national currencies in trade.

In early 2014, Justin Yifu Lin, the former World Bank Chief Economist, blamed the dominance of the US dollar for global economic crises and said it should be eliminated as the world’s reserve currency. According to Lin, the solution would be to replace the national currency with a global currency.

In 2015, several countries, including Russia, China, India and Turkey, decided to ditch the US dollar in their foreign trade and instead pay for products in gold or other agreed on currencies.

To read the whole article, Dollar No More, go to the website of Sputnik.

To read the whole article, Dollar No More, go to the website of Sputnik.

Similar Posts:

- The Future of Yuan (Express Tribune)

- Russia Sanctions: What Financial Meltdown? (Sputnik/FT)

- China’s Renminbi is Rapidly Displacing the US Dollar as a Trading Currency (FT)

- Oppenheimer’s Leverenz Blames “Radical Collapse” in FX Markets for Poor Performance (WSJ)

- The Impact of Emerging Market Currencies on Corporate America’s Earnings (Forbes)

- What Makes Emerging Market Debt Tick? (CFA Institute)

- Infographic: Australian Fund Managers Biased Towards Emerging Markets (AFR)

- Emerging Market Debt: Russian Sanctions and a Possible U.S./China Trade War (Vontobel)

- The Coming Eurasian Century: Russia and China are De-Dollarizing. Is “Pipelineistan” Coming?

- Investing in Russia ADRs / Russian Stocks List

- Renminbi’s Share of Global Payments Falls (The Asset)

- Emerging Market Companies & Governments Binge on US Dollar Debt (WSJ)

- Is This Divergence an Emerging Market Warning Sign? (BCA Research)

- China’s Global Economic Footprint Via Chinese Financial Institutions (Eurasia Group)

- Flash Note: Emerging Market Currencies (Pictet Wealth Management)