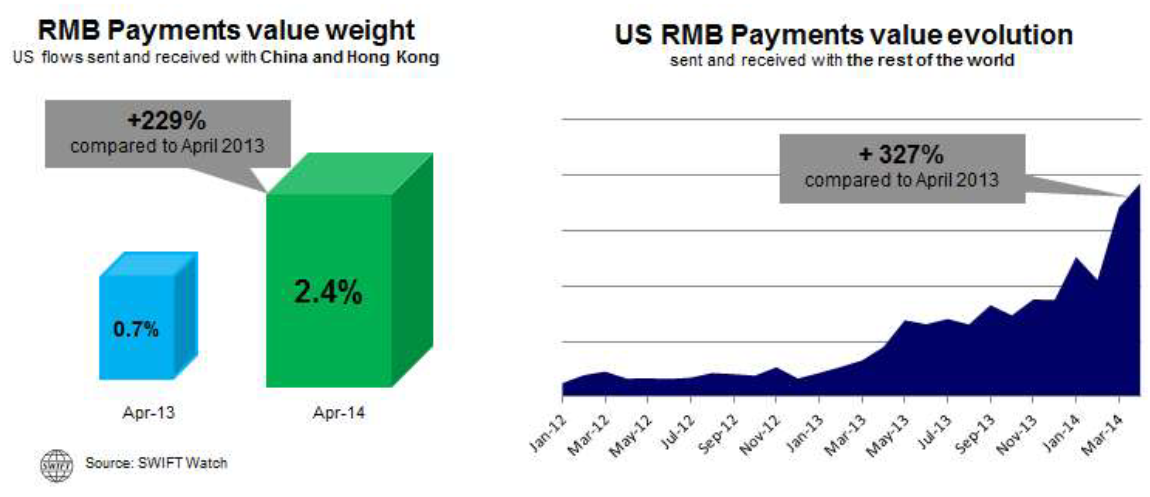

The Financial Times’ beyondbrics blog has noted that the value of renminbi payments between the US and the rest of the world rose by 327% in April this year from the same month a year ago as more US corporations switched to using the Chinese currency to pay for imports from China:

And while just 2.4% of payments between the US and China/Hong Kong were settled in renminbi in April of this year, up from 0.7% in April 2013, Debra Lodge, a managing director at HSBC in New York, was quoted as saying:

“By the end of 2015, we think that 30 per cent of (China’s) global trade will be settled in renminbi, up from 13 to 15 per cent now. I think over the next two years we are going to see a much greater uptake from small and medium enterprises in China using renminbi (for trade with the US).”

Although the shift is being driven in part by commercial considerations, it also carries a strategic resonance because Beijing was frustrated in 2008 and 2009 as it watched the value of its vast US treasury holdings plunge along with the dollar’s value.

To read the whole article, Renminbi use surges in home of US dollar, go to the website of the Financial Times.

Similar Posts:

- Renminbi’s Share of Global Payments Falls (The Asset)

- The Renminbi’s Creeping Internationalisation (BNP Paribas)

- Korea & Taiwan Use Renminbi for Majority of Payments with China & Hong Kong (The Asset)

- Emerging Market Risk Ranking: Most Vulnerable to the Strongest (FT)

- Some Key Points: The Renminbi & China Commercial Paper Market (KraneShares)

- The Coming Eurasian Century: Russia and China are De-Dollarizing. Is “Pipelineistan” Coming?

- China’s Economy Will Not Overtake the US Until 2060, If Ever (Financial Times)

- Why a Financial Crisis is NOT Brewing in China (Institutional Investor)

- Emerging Market Monitor: Hit by the Trump Trade (Pictet Asset Management)

- What’s Really Driving China’s Currency Stability (KraneShares)

- ZJLD Group (HKG: 6979): IPO of the First Baijiu Maker to List Outside of China Flops

- Are There Greater Opportunities In Asia’s Frontier Markets Than in China? (FT)

- The Future of the RMB: Special Focus (Euromoney)

- Singapore’s Sovereign Wealth Fund to Increase Investment in China (FT)

- Unlike Emerging Markets, Frontier Markets Are a Less Volatile Haven (FT)