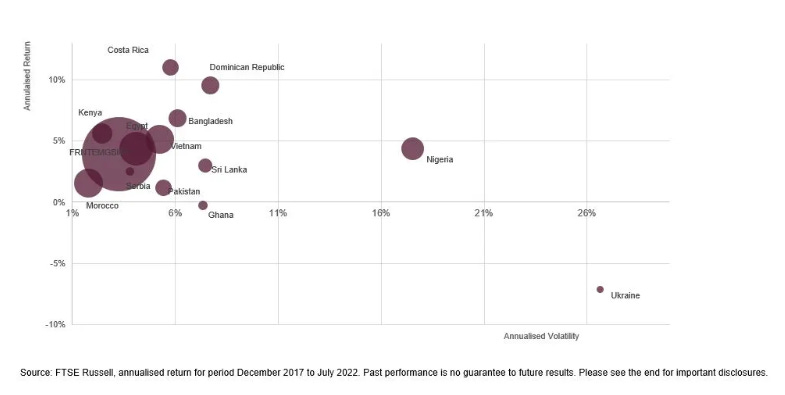

In the current market backdrop of inflation and rising interest rates, as well as geopolitical uncertainties, investment in frontier EM local currency markets has some unexpected advantages. Traditionally, the term structure for a frontier EM market has been shorter than in developed markets because frontier markets tend to have shorter maturities and investors access a combination of bonds, treasury-bill, and local FX to add exposures. READ MORE

Similar Posts:

- Emerging Markets in a World of Higher Long-Term U.S. Inflation (PGIM Fixed Income)

- The Brazilian Real and the Mexican Peso Have Climbed Against the Dollar as it Steamrolls Rival Currencies This Year — But Economic and Political Risks Could Eat Into Their Gains (Markets Insider)

- AFC Asia Frontier Fund – Review 2022 and Outlook 2023 (AFC Asia Frontier Fund)

- Are Investors Ignoring Growing Warning Signs for Emerging Market Debt? (RBA)

- Is Turkey Really Out of The Woods? (Amundi AM)

- Emerging Market Links + The Week Ahead (October 10, 2022)

- Asia Equities: Three Trends Driving Investor Optimism (PineBridge Investments)

- Emerging Market Opportunities Can Still Be Found (T. Rowe Price)

- Frontier Markets (Meketa Investment Group)

- Latin America Faces a Third Shock as Global Financial Conditions Tighten (IMF)

- 3 Successful Frontier Market Investing Strategies (DraculaCapital.com)

- Stars Align for Emerging Market Opportunities (The Asset)

- Middle Eastern Resilience: Improving Economic Activity and Defensive Characteristics (Franklin Templeton)

- Frontier Markets: Attractive Valuations with Limited Correlation (Mobius Blog)

- Emerging Market Economies: A Brighter Outlook for 2019? (Hermes)