Two interesting articles about how China has a much bigger problem that goes beyond the problems people normally write about (e.g. real estate, debt, demographics and the Taiwan issue). According to the economic theory of the “unholy trinity” or “impossible trinity,” countries can have a fixed exchange rate, free capital flow, or sovereign monetary policy, but must choose only two of three. Attempting all three will eventually cause “humiliation.”

Meanwhile, India is trying to get its act together to attract more investment (and factories relocating from China) with a plan to offer investors and companies a one-stop solution for design of projects, seamless approvals and easier estimation of costs.

Finally and despite the recent market turmoil, several new emerging market ETFs have launched – albeit most tend to be ESG focused (see the list at the bottom of this post).

Subscribe Now Via Substack

Suggested Reading

$ = behind a paywall

Prepare For Capital Controls – The Third Horseman Of The Unholy Trinity’s Apocalypse (FortuneAndFreedom.com)

- According to an economic theory called the Unholy Trinity, governments can only ever have two of the following three things: pegged exchange rates, independent monetary policy and free capital flows.The reason why this is so is quite complicated. But the point is that they must choose two of the three, making the third a pressure valve for the problems created by their attempts to control the other two.Of course, governments occasionally try to have all three. But it always ends in humiliation. It’s only a question of when.

The Biggest Problem China Faces Isn’t Real Estate (The Epoch Times via Zero Hedge)

NOTE: I realize The Epoch Times is very anti-CCP, but this short piece is also worth reading.

- Sovereign currency policy faces the intractable dilemma of what economists call the “impossible trinity.” Countries can have a fixed exchange rate, free capital flow, or sovereign monetary policy but must choose only two of three. Economics textbooks give clean and clear definitions of each. Still, in reality, China tried to manipulate each and come out worse due to its attempts to manipulate the laws of economics.Chinese Communist Party (CCP) technocrats attempted to create a system where they could enjoy the best of the three options and leave behind the worst parts. China implemented a quasi-fixed exchange rate, which is effectively a U.S. dollar index, with tightly controlled capital flows, and a semi-sovereign monetary policy.

Emerging markets debt: Value trap or unfairly tarnished? (Janus Henderson Investors)

- High energy prices, dollar strength, and rising financing costs have brewed sovereign default concerns, reflected in wider spreads. Portfolio Managers Bent Lystbaek, Jacob Ellinge Nielsen, Thomas Haugaard and Sorin Pirău, CFA, consider the divergence in emerging markets.

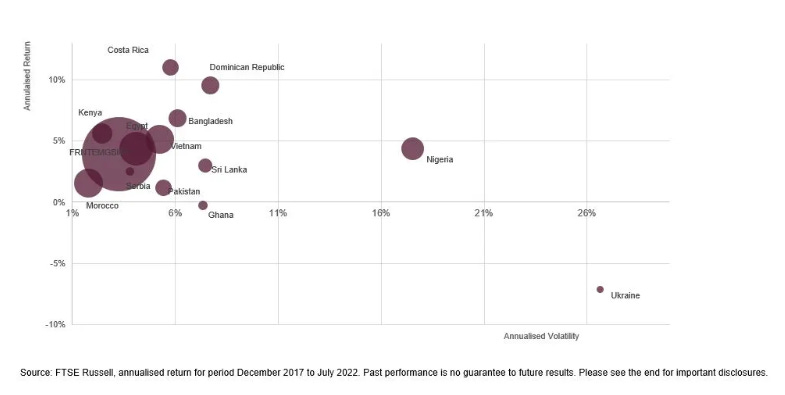

The new Frontier in fixed income: short-term, diversified exposure to emerging market bonds (FTSE Russell)

- In the current market backdrop of inflation and rising interest rates, as well as geopolitical uncertainties, investment in frontier EM local currency markets has some unexpected advantages. Traditionally, the term structure for a frontier EM market has been shorter than in developed markets because frontier markets tend to have shorter maturities and investors access a combination of bonds, treasury-bill, and local FX to add exposures.

India Has a $1.2 Trillion Plan to Snatch Factories From China (Bloomberg via Money Control)

- In India, half of all infrastructure projects are delayed, and one in four run over their estimated budget.

- Under a 100-trillion-rupee ($1.2 trillion) mega project called PM Gati Shakti — Hindi for strength of speed — Modi’s administration is creating a digital platform that combines 16 ministries. The portal will offer investors and companies a one-stop solution for design of projects, seamless approvals and easier estimation of costs.

Analysis: Chile’s sliding peso reflects tough battle vs rampaging dollar (Reuters)

- Chile, the world’s top producer of copper and the No. 2 for electric vehicle battery metal lithium, is also grappling with annual inflation at some 14%, weakening copper prices and a predicted recession, compounding the hit from the strong dollar.

- Currency strategist Juan Prada at Barclays said the tightening of global financial conditions was ramping up pressure on some regional markets particularly susceptible to external global economic impacts. “We have identified Chile and Colombia as vulnerable, and COP (Colombian peso) and CLP (Chilean peso) have underperformed LatAm peers” since the U.S. Federal Open Market Committee meeting in September, he said.

Brazil: a nation divided | FT Film

NOTE: This short 25 minute film from the Financial Times is the closest thing to an objective overview you can expect from English language media concerning the Brazil elections.

FT Brazil bureau chief Bryan Harris travels the nation to look at the enormous economic and social challenges facing the next president. He meets wealthy farmers, truckers, evangelicals and those facing food insecurity.

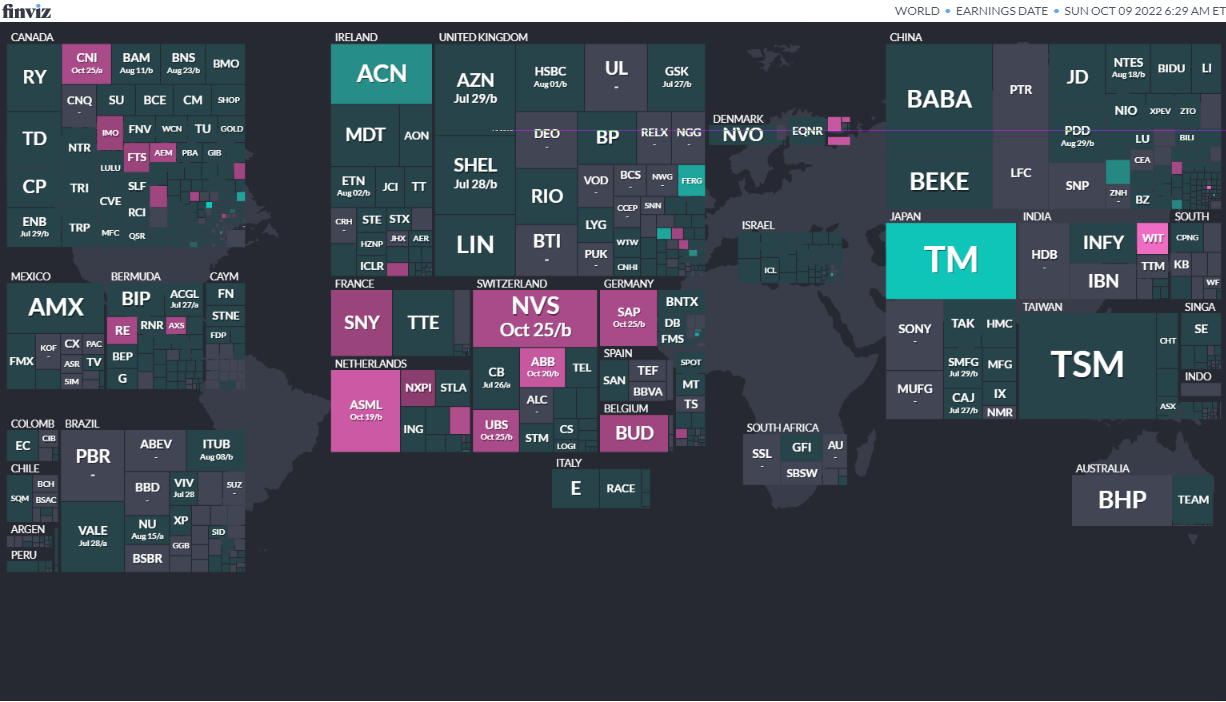

Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

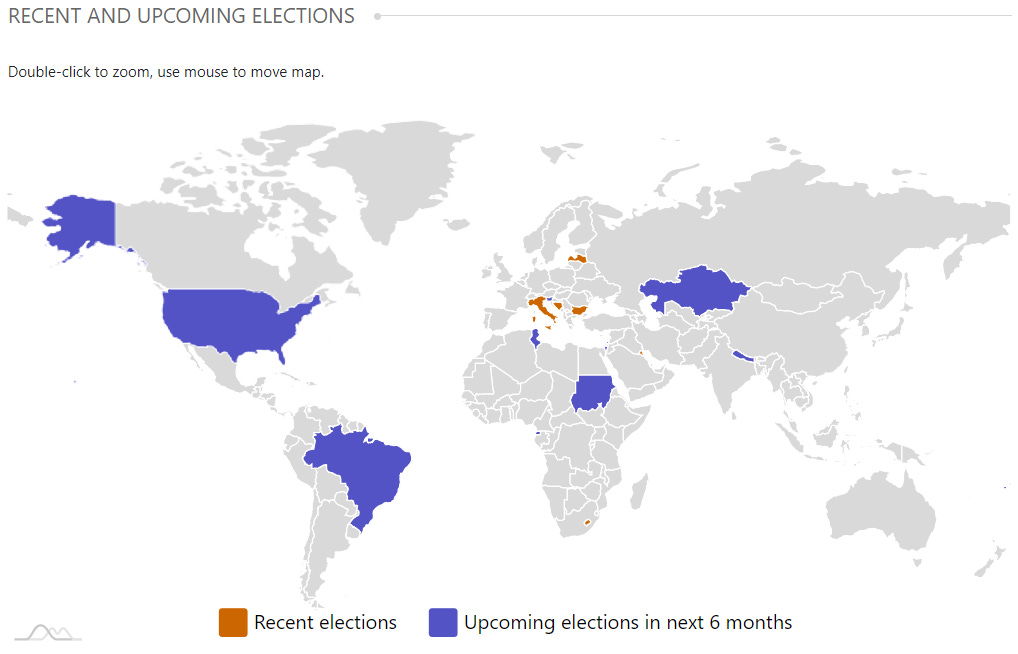

Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

BrazilPresidentOct 2, 2022 (d) Confirmed Oct 30, 2022BrazilBrazilian Federal SenateOct 2, 2022 (t) Confirmed Oct 7, 2018BrazilBrazilian Chamber of DeputiesOct 2, 2022 (d) Confirmed Oct 7, 2018- Vanuatu Ni-Vanuatu Parliament Oct 13, 2022 (d) Snap Mar 19, 2020

- Brazil President Oct 30 2022 (d) Second Round if needed

- Israel Israeli Knesset Nov 1 2022 (d) Snap Mar 23, 2021

- Bahrain Bahraini Council of Representatives Nov 12, 2022 (d) Confirmed Dec 1, 2018

- Equatorial Guinea President Nov 20, 2022 (d) Snap Apr 24, 2016

- Equatorial Guinea Equatorial Guinean Senate Nov 20, 2022 (d) Confirmed Nov 20, 2022

- Equatorial Guinea Equatorial Guinean Chamber of Deputies Nov 20, 2022 (d) Confirmed Nov 20, 2022

- Nepal House of Representatives of Nepal Nov 20, 2022 (d) Confirmed May 13, 2022

- Kazakhstan President Nov 20, 2022 (d) Snap Apr 26, 2015

- Fiji Fijian House of Representatives Nov 30, 2022 (d) Date not confirmed

- Tunisia Tunisian Assembly of People’s Representatives Dec 17, 2022 (d) Confirmed Oct 6, 2019

IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

ETF Launches

Climate change and ESG are clearly the latest flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

- 9/22/2022 – WisdomTree Emerging Markets ex-China Fund XC – Passive, equity, emerging markets

- 9/15/2022 – KraneShares S&P Pan Asia Dividend Aristocrats Index ETF KDIV – Passive, equity, Asia, dividend strategy

- 9/15/2022 – OneAscent Emerging Markets ETF OAEM – Active, Equity, emerging markets, ESG

- 9/9/2022 – Emerge EMPWR Sustainable Select Growth Equity ETF EMGC – Active, equity, emerging markets

- 9/9/2022 – Emerge EMPWR Unified Sustainable Equity ETF EMPW – Active, equity, emerging markets

- 9/8/2022 – Emerge EMPWR Sustainable Emerging Markets Equity ETF EMCH – Active, equity, emerging markets, ESG

- 7/14/2022 – Matthews China Active ETF MCH – Active, equity, China

- 7/14/2022 – Matthews Emerging Markets Equity Active ETF MEM – Active, equity, emerging markets

- 7/14/2022 – Matthews Asia Innovators Active ETF MINV – Active, equity, Asia

- 6/30/2022 – BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF XEMD – Passive, fixed income, emerging markets

- 5/2/2022 – AXS Short CSI China Internet ETF SWEB – Active, inverse, thematic

- 4/27/2022 – Dimensional Emerging Markets High Profitability ETF DEHP – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Core Equity 2 ETF DFEM – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Value ETF DFEV – Active, equity, emerging markets

- 4/27/2022 – iShares Emergent Food and AgTech Multisector ETF IVEG – Passive, equity, thematic [Mostly developed markets]

- 4/21/2022 – FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM – Passive, equity, ESG

- 4/6/2022 – India Internet & Ecommerce ETF INQQ – Passive, equity, thematic

- 2/17/2022 – VanEck Digital India ETF DGIN – Passive, India market, thematic

- 2/17/2022 – Goldman Sachs Access Emerging Markets USD Bond ETF GEMD – Passive, fixed income, emerging markets

- 1/27/2022 – iShares MSCI China Multisector Tech ETF TCHI – Passive, China, technology

- 1/11/2022 – Simplify Emerging Markets PLUS Downside Convexity ETF EMGD – Active, equity, options strategy

- 1/11/2022 – SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG – Passive, equity, ESG

ETF Closures/Liquidations

Frontier and emerging market highlights:

- 8/22/2022 – iShares MSCI Argentina and Global Exposure ETF AGT

- 8/22/2022 – iShares MSCI Colombia ETFI COL

- 6/10/2022 – Infusive Compounding Global Equities ETF JOYY

- 5/3/2022 – ProShares Short Term USD Emerging Markets Bond ETF EMSH

- 4/7/2022 – DeltaShares S&P EM 100 & Managed Risk ETF DMRE

- 3/11/2022 – Direxion Daily Russia Bull 2X Shares RUSL

- 1/27/2022 – Legg Mason Global Infrastructure ETF INFR

- 1/14/2022 – Direxion Daily Latin America Bull 2X Shares LBJ

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as some ETF lists are still being updated as of Summer 2022).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer: EmergingMarketSkeptic.Substack.com and EmergingMarketSkeptic.com provides useful information that should not constitute investment advice or a recommendation to invest. In addition, your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content.

Emerging Market Links + The Week Ahead (October 10, 2022) was also published on our Substack.

Emerging Markets Investing Tips + Advice

Emerging Market Skeptic (Website)

Website List Updates + Site Map

Stocktwits @EmergingMarketSkptc

Similar Posts:

- Emerging Market Links + The Week Ahead (May 30, 2022)

- Emerging Market Links + The Week Ahead (November 21, 2022)

- Emerging Market Links + The Week Ahead (June 6, 2022)

- Emerging Market Links + The Week Ahead (June 27, 2022)

- Emerging Market Links + The Week Ahead (May 16, 2022)

- Emerging Market Links + The Week Ahead (November 14, 2022)

- Emerging Market Links + The Week Ahead (August 1, 2022)

- Emerging Market Links + The Week Ahead (October 24, 2022)

- Emerging Market Links + The Week Ahead (October 17, 2022)

- Emerging Market Links + The Week Ahead (October 31, 2022)

- Emerging Market Links + The Week Ahead (November 7, 2022)

- Emerging Market Links + The Week Ahead (August 15, 2022)

- Emerging Market Links + The Week Ahead (July 18, 2022)

- Emerging Market Links + The Week Ahead (August 8, 2022)

- Emerging Market Links + The Week Ahead (October 3, 2022)