After Sunday’s first round of voting, Colombia’s next president will be a choice between a former leftist rebel Gustavo Petro (a former mayor of the capital Bogotá as well as an ex-militant) and Rodolfo Hernández, 77-year-old populist construction magnate who the media has dubbed the country’s Trump. Mr Hernández and Mr Petro will face off in the second round on 19 June. There is an updated list of Colombian ADRs (plus other resources for investing in the country) here and ETFs here.

Meanwhile in China, rumor has it that the country is itself gripped by “discord” at the very top level, with president Xi and premier Li on opposite sides of the the “zero covid” ring. Finally, a growing number of emerging markets are carrying high repayment risk and thus have the potential to default.

Check out our emerging market ETF lists, ADR lists and closed-end fund lists (also see our site map + list update status as the lists are still being updated as of May 2022) along with our general EM investing tips / advice. All links to emerging market newspapers, investment firms, blogs and other helpful investing resources at the bottom of www.emergingmarketskeptic.com or on the menu under Resources have been update.

Subscribe Now Via Substack

Suggested Reading

$ = behind a paywall

Colombia – Hernández Surges (Latin America Risk Report Substack)

- The right-wing populist former mayor of Bucaramanga has risen in the polls and could upend the race.

China Paralyzed As Feud Erupts Between Xi And Li Over Covid Response (Zero Hedge)

- This apparent dilemma has led to paralysis within a nation normally hailed for speedy implementation of orders from above, Bloomberg reports, citing eight unnamed senior local government officials.

JPMorgan warns 10% of junk-rated emerging markets facing debt crises this year (Reuters)

- “Nearly half of the (52) country sample is classified as carrying high repayment risk in our assessment. Of these, eight are at risk of reserve depletion by the end of 2023, signalling high default risks. These are Sri Lanka, Maldives, Bahamas, Belize, Senegal, Rwanda, Grenada, and Ethiopia.”

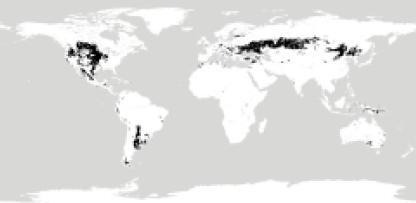

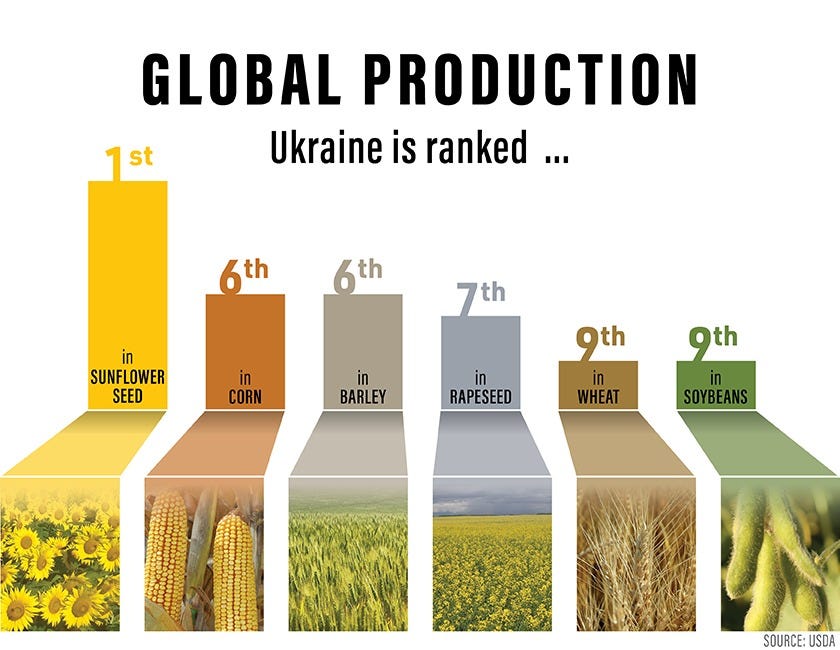

Black Gold: It’s not what you think… (The Right People Telegram Channel)

- The most fertile soils for cultivation are generally known as Mollisols, which occupy 7% of the ice-free surface of the Earth.

- MANY INTERESTING CHARTS:

Earnings Calendar

Note: Investing.com has a full calendar for most global exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

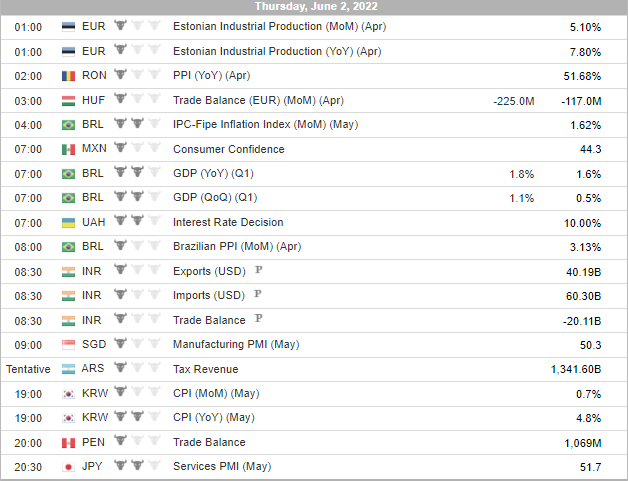

Economic Calendar

Click here for a full weekly calendar from Investing.com (my filter excludes USA, Canada, EU, Australia & NZ). Some frontier and emerging market highlights:

Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

- Colombia President 2022-05-29 Confirmed

- Senegal Senegalese National Assembly 2022-07-31 Confirmed

- Congo (Brazzaville) Congolese National Assembly 2022-07-31 Confirmed

- Kenya Kenyan Senate 2022-08-09 Confirmed

- Kenya President 2022-08-09 Confirmed

- Kenya Kenyan National Assembly 2022-08-09 Confirmed

- Latvia Latvian Parliament 2022-10-01 Confirmed

- Brazil Brazilian Federal Senate 2022-10-02 Date not confirmed

- Brazil Brazilian Chamber of Deputies 2022-10-02 Confirmed

- Brazil President 2022-10-02 Confirmed

Check out: Thoughts for Investors: Bongbong Marcos Wins the 2022 Philippines Elections in a Landslide

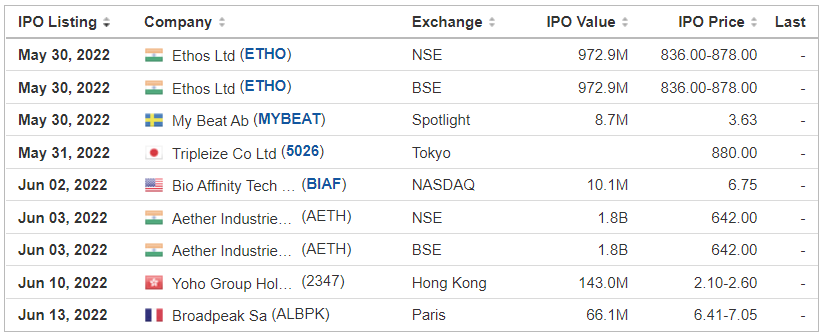

IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

- SaverOne 2014 Ltd. SVRE $13.0 mil 6/1/2022 Wednesday – NOTE: This is a NASDAQ uplisting from the Tel Aviv Stock Exchange.

- Embrace Change Acquisition Corp.EMCGU $75.0 mil 6/1/2022 Wednesday “We are a blank check company. It is our intention to pursue prospective targets that are in the technology, Internet and consumer sectors. We will look for companies with established brands, stable cash flow and readiness to access capital markets. In addition, we want to find companies that are truly technology driven and have strong industry competencies. (Incorporated in the Cayman Islands)We will not pursue a target company or a business combination with any company or business in China, Hong Kong and Macau. Our CEO Yoann Delwarde is the co-founder and CEO of Infinity Growth, a company that has helped nearly 25 companies from dozens of industries in seven countries increase their sales globally. Mr. Delwarde, who is from France, has many years of experience working in France and China.“

ETF Launches

Climate change and ESG are clearly the latest flavors of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

- 4/21/2022 – FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM – Passive, equity, ESG

- 4/6/2022 – India Internet & Ecommerce ETF INQQ – Passive, equity, thematic

- 2/17/2022 – VanEck Digital India ETF DGIN – Passive, India market, thematic

- 2/17/2022 – Goldman Sachs Access Emerging Markets USD Bond ETF GEMD – Passive, fixed income, emerging markets

- 1/27/2022 – iShares MSCI China Multisector Tech ETF TCHI – Passive, China, technology

- 1/11/2022 – Simplify Emerging Markets PLUS Downside Convexity ETF EMGD – Active, equity, options strategy

- 1/11/2022 – SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG – Passive, equity, ESG

ETF Closures/Liquidations

Frontier and emerging market highlights:

- 5/3/2022 – ProShares Short Term USD Emerging Markets Bond ETF EMSH

- 4/7/2022 – DeltaShares S&P EM 100 & Managed Risk ETF DMRE

- 3/11/2022 – Direxion Daily Russia Bull 2X Shares RUSL

- 1/27/2022 – Legg Mason Global Infrastructure ETF INFR

- 1/14/2022 – Direxion Daily Latin America Bull 2X Shares LBJ

Disclaimer: EmergingMarketSkeptic.Substack.com and EmergingMarketSkeptic.com provides useful information that should not constitute investment advice or a recommendation to invest. In addition, your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content.

Emerging Market Links + The Week Ahead (May 30, 2022) was also published on our Substack.

Emerging Markets Investing Tips + Advice

Emerging Market Skeptic (Website)

Website List Updates + Site Map

Stocktwits @EmergingMarketSkptc

Similar Posts:

- Emerging Market Links + The Week Ahead (May 16, 2022)

- Emerging Market Links + The Week Ahead (May 23, 2022)

- Emerging Market Links + The Week Ahead (June 6, 2022)

- Emerging Market Links + The Week Ahead (June 27, 2022)

- Emerging Market Links + The Week Ahead (July 18, 2022)

- Emerging Market Links + The Week Ahead (August 1, 2022)

- Emerging Market Equity Closed-End Funds List (Multiple Regions / Countries)

- Emerging Market Links + The Week Ahead (July 11, 2022)

- Emerging Market Links + The Week Ahead (June 20, 2022)

- Emerging Market Stock & Bond Closed-End Funds List (All)

- Emerging Market Links + The Week Ahead (October 10, 2022)

- Emerging Market Stock Closed-End Funds List (All)

- Emerging Market Equity & Fixed Income Closed-End Funds List (Multiple Regions / Countries)

- Emerging Market Links + The Week Ahead (September 5, 2022)

- Emerging Market Links + The Week Ahead (August 29, 2022)