After Sri Lanka, more emerging markets are getting ready to fall like dominos with (nuclear armed) Pakistan possibly up next. While this is not the first time emerging markets have faced sovereign debt defaults, this time is different. The problem now (according to investor Jay Newman) is that the size, scope and terms of China’s BRI deals are state secrets. This makes it nearly impossible to do a proper debt restructurings.

Meanwhile, the war in the Ukraine and sanctions against Russia means many emerging markets dependent on wheat from those two countries are facing starvation. However, Russia appears to be winning the wheat war and has time to shift energy exports away from Europe to Asia…

Check out our emerging market ETF lists, ADR lists and closed-end fund lists (also see our site map + list update status as the lists are still being updated as of May 2022) along with our general EM investing tips / advice. All links to emerging market newspapers, investment firms, blogs and other helpful investing resources at the bottom of www.emergingmarketskeptic.com or on the menu under Resources have been update.

Subscribe Now Via Substack

Suggested Reading

$ = behind a paywall

There will be a wave of emerging-market defaults, says the investor who seized one of Argentina’s ships (MarketWatch)

- Jay Newman: “We are on the brink of an epidemic of emerging market defaults, the scale and scope of which will rival the debt crisis of the 1980s,” he wrote in an op-ed in the Financial Times. [Click here for a non paywalled article)

- “When Sri Lanka, predictably, found itself unable to satisfy the debt, China sprang the trap, insisting on repayment, offering to exchange debt for further concessions and vast tracts of land, and offering additional cash to help tide the political class over.”

Just say no – China has sprung a debt trap on many developing countries(Financial Times) $ [Click here for a non paywalled article)

- According to JPMorgan, Sri Lanka, the Maldives, the Bahamas, Belize, Senegal, Rwanda, Grenada, and Ethiopia are all “at risk of reserve depletion” — aka the cash drawer is empty. Let’s not leave out Lebanon, Egypt, Pakistan, Russia, the inevitable renegotiation of Ukrainian debt, or, for that matter, the 27 countries with bonds that yield more than 10 per cent — always a sign of trouble…

- Unless a debtor demonstrates a willingness and capacity for reinvention, and unless all creditors — including China and the IFIs — agree to disclose the entirety of their claims and agree to negotiate a resolution on commercial terms, any restructuring will fail.

Pakistan On The Verge Of Inflationary Collapse – Pleads For Larger IMF Bailout (Zero Hedge)

40,000 Factories At Risk Of Closing In Pakistan’s Commercial Capital Amid Fuel Crisis (Zero Hedge)

- Pakistan is also a nuclear power — political elites may stoke a conflict with neighboring India to distract public anger from domestic financial pain.

Is Pakistan About to Pop? (Petition Substack)

- China made extraordinary efforts to shore up funds for Sri Lanka by way of “covert imperialism” in order to take power away from India and put it into its own hands.

- We are now seeing the same happening in Pakistan, except that here, China will almost certainly have more influence than India if it wants, because India and Pakistan aren’t exactly homies.

Turkey’s inflation soars to 73%, a 23-year high, as food and energy costs skyrocket (CNBC)

- Turkey’s inflation for the month of May rose by an eye-watering 73.5% year on year, its highest in 23 years, as the country grapples with soaring food (food prices in the country of 84 million rose 91.6% year on year) and energy costs.

Russia is winning battle to control the world’s wheat (The Times)

- The two countries share many of the same export partners, located for the most part in north Africa and the Middle East. Faced with the possibility of food shortages, many are turning to Russia to make up the shortfall.

Africans ‘victims’ of the Ukraine war, AU head tells Putin (DW)

- More than 44% of wheat consumed in countries on the continent comes from Russia and Ukraine, according to UN figures. Wheat prices have soared around 45% as a result of the supply disruption, according to the African Development Bank.

EU Slowly Weening Off Russian Crude Gives Moscow Time To Divert Flows To Asia (Zero Hedge)

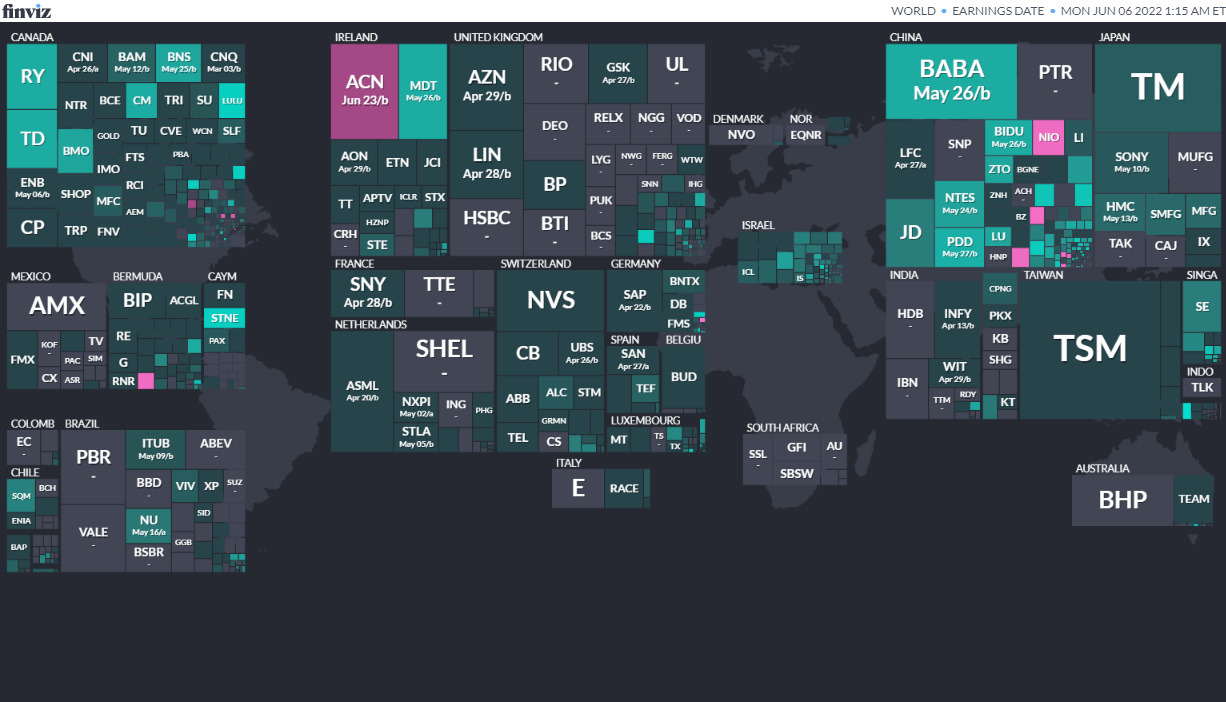

Earnings Calendar

Note: Investing.com has a full calendar for most global exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

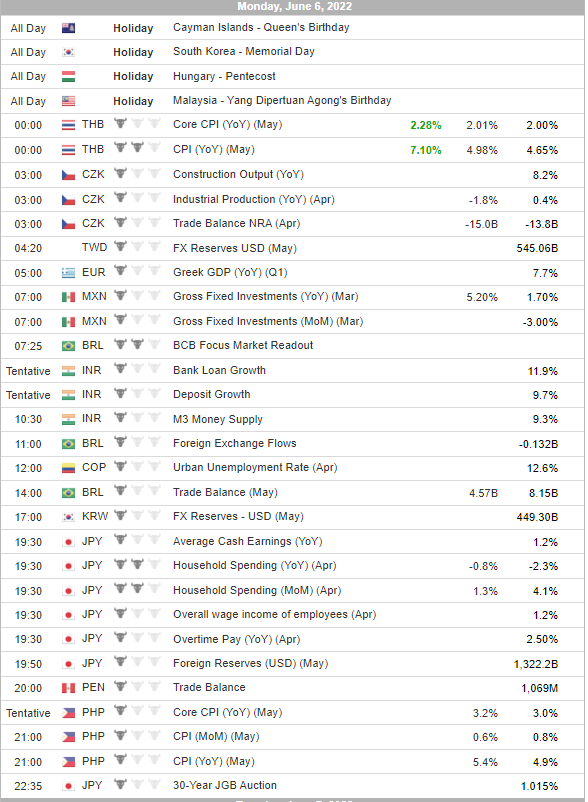

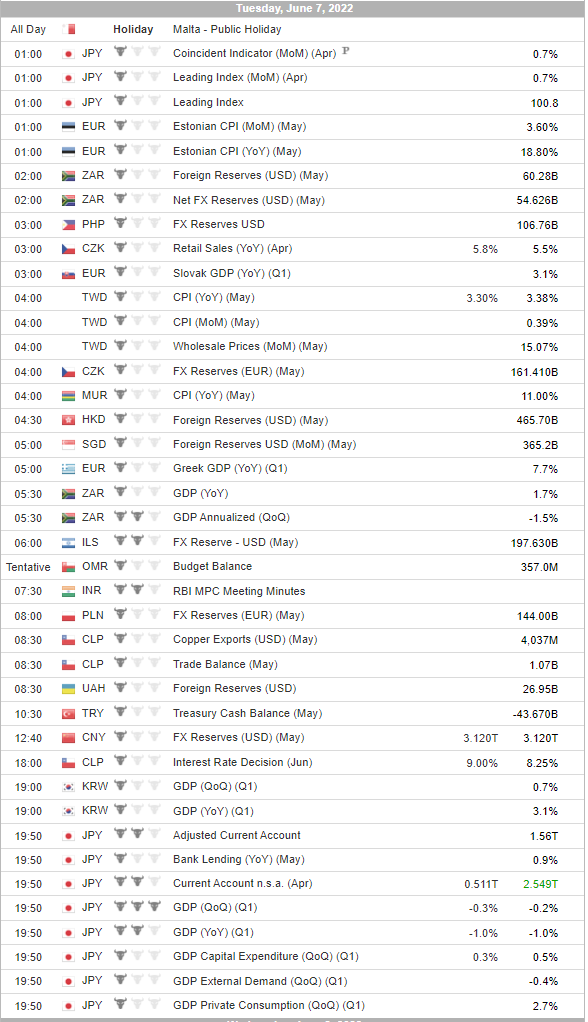

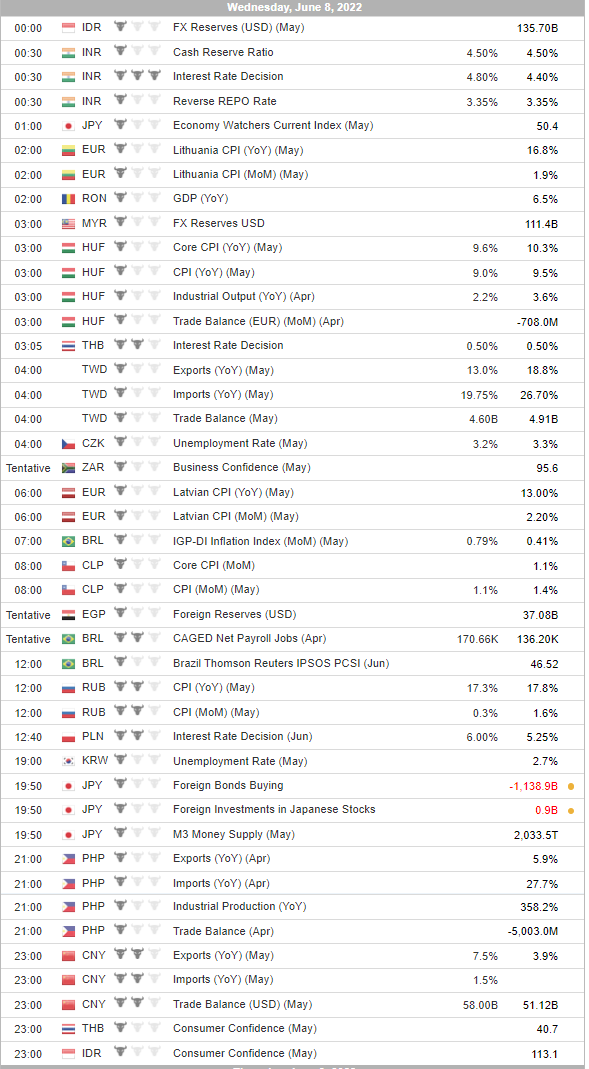

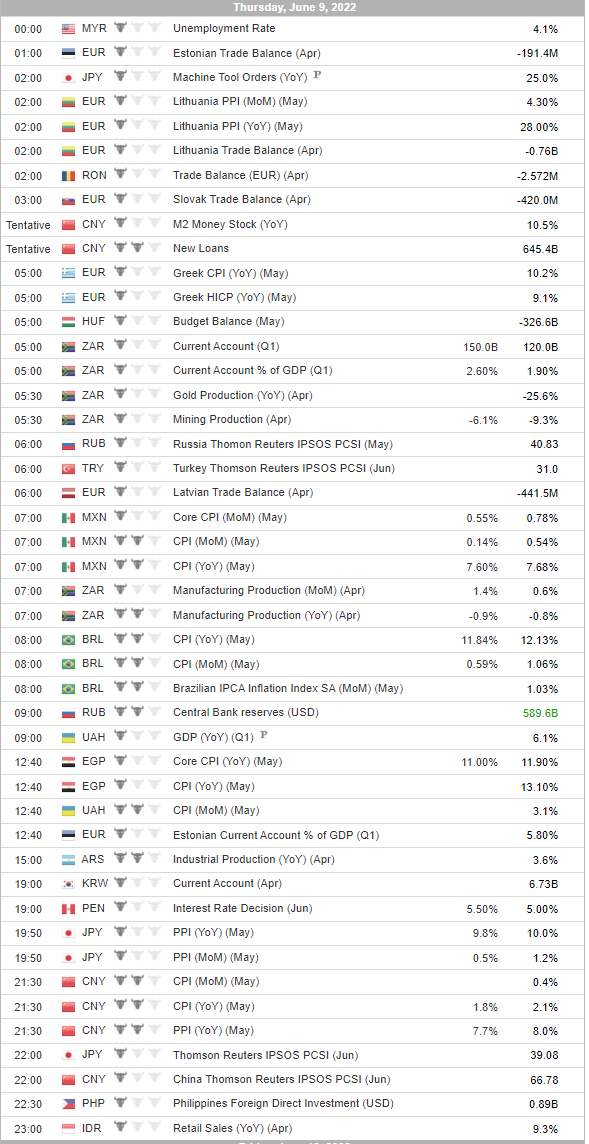

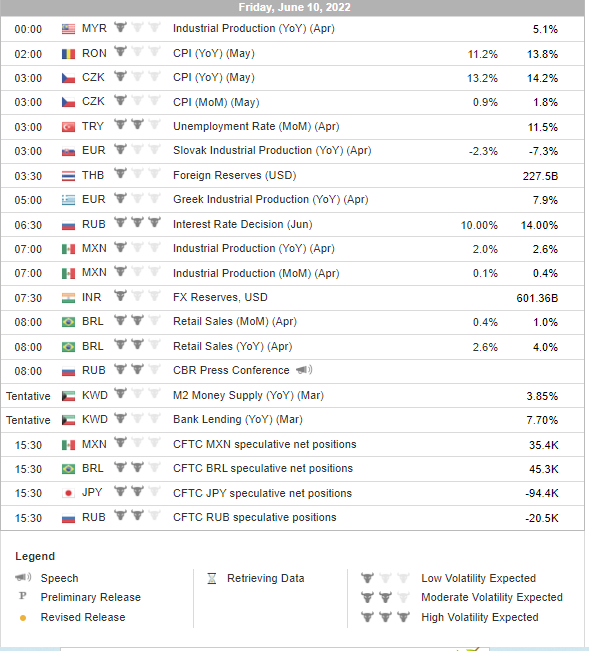

Economic Calendar

Click here for a full weekly calendar from Investing.com (my filter excludes USA, Canada, EU, Australia & NZ). Some frontier and emerging market highlights:

Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

- Colombia President Jun 19, 2022 (d) Second Round if needed Jun 17, 2018

- Grenada Grenadian House of Representatives Jun 23, 2022 (t) Snap Mar 13, 2018

- Grenada Grenadian Senate Jun 23, 2022 (t) Snap Jul 8, 2008

- Papua New Guinea National Parliament of Papua New Guinea Jul 9, 2022 (d) Date not confirmed Jun 24, 2017

- Tunisia Referendum Jul 25, 2022 (t) Confirmed Oct 24, 1999

- Senegal Senegalese National Assembly Jul 31, 2022 (d) Confirmed Jul 2, 2017

- Congo (Brazzaville) Congolese National Assembly Jul 10, 2022 (d) Confirmed Jul 16, 2017

- Angola Angolan National Assembly Aug 3, 2022 (t) Tentative Aug 23, 2017

- Kenya President Aug 9, 2022 (d) Confirmed Dec 27, 2007

- Kenya Kenyan National Assembly Aug 9, 2022 (t) Confirmed Aug 8, 2017

- Kenya Kenyan Senate Aug 9, 2022 (t) Confirmed Aug 8, 2017

- Brazil President Oct 2, 2022 (d) Confirmed Oct 30, 2022

- Brazil Brazilian Federal Senate Oct 2, 2022 (t) Confirmed Oct 7, 2018

- Brazil Brazilian Chamber of Deputies Oct 2, 2022 (d) Confirmed Oct 7, 2018

Check out: Thoughts for Investors: Bongbong Marcos Wins the 2022 Philippines Elections in a Landslide

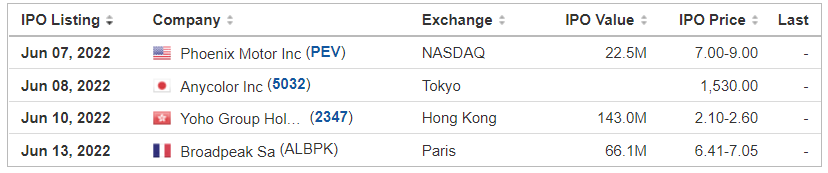

IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

ETF Launches

Climate change and ESG are clearly the latest flavors of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

- 4/21/2022 – FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM – Passive, equity, ESG

- 4/6/2022 – India Internet & Ecommerce ETF INQQ – Passive, equity, thematic

- 2/17/2022 – VanEck Digital India ETF DGIN – Passive, India market, thematic

- 2/17/2022 – Goldman Sachs Access Emerging Markets USD Bond ETF GEMD – Passive, fixed income, emerging markets

- 1/27/2022 – iShares MSCI China Multisector Tech ETF TCHI – Passive, China, technology

- 1/11/2022 – Simplify Emerging Markets PLUS Downside Convexity ETF EMGD – Active, equity, options strategy

- 1/11/2022 – SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG – Passive, equity, ESG

ETF Closures/Liquidations

Frontier and emerging market highlights:

- 6/10/2022 – Infusive Compounding Global Equities ETF JOYY

- 5/3/2022 – ProShares Short Term USD Emerging Markets Bond ETF EMSH

- 4/7/2022 – DeltaShares S&P EM 100 & Managed Risk ETF DMRE

- 3/11/2022 – Direxion Daily Russia Bull 2X Shares RUSL

- 1/27/2022 – Legg Mason Global Infrastructure ETF INFR

- 1/14/2022 – Direxion Daily Latin America Bull 2X Shares LBJ

Disclaimer: EmergingMarketSkeptic.Substack.com and EmergingMarketSkeptic.com provides useful information that should not constitute investment advice or a recommendation to invest. In addition, your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content.

Emerging Market Links + The Week Ahead (June 6, 2022) was also published on our Substack.

Emerging Markets Investing Tips + Advice

Emerging Market Skeptic (Website)

Website List Updates + Site Map

Stocktwits @EmergingMarketSkptc

Similar Posts:

- Emerging Market Links + The Week Ahead (June 27, 2022)

- Emerging Market Links + The Week Ahead (May 30, 2022)

- Russia Now Demands Rubles For Grain As World’s Largest Wheat Exporter (Zero Hedge)

- Emerging Market Links + The Week Ahead (May 16, 2022)

- Emerging Market Links + The Week Ahead (July 4, 2022)

- Emerging Market Links + The Week Ahead (July 18, 2022)

- Emerging Market Links + The Week Ahead (August 1, 2022)

- Emerging Market Links + The Week Ahead (June 20, 2022)

- Emerging Market Links + The Week Ahead (May 23, 2022)

- Emerging Market Links + The Week Ahead (July 25, 2022)

- Emerging Market Links + The Week Ahead (September 5, 2022)

- Emerging Market Links + The Week Ahead (June 13, 2022)

- Emerging Market Links + The Week Ahead (July 11, 2022)

- Investing in South Asia ETFs / South Asia ETF Lists

- Emerging Market Links + The Week Ahead (August 8, 2022)