In the wake of the Russia-Ukraine conflict, more and more corporate executives and the media are starting to examine what a China-Taiwan conflict might mean for their businesses and the overall economy. However, China is increasingly grappling with banking and real estate problems as homebuyers start to refuse to pay their mortgages on unfinished housing projects.

Meanwhile, there are growing troubles in Latin America, particularly with the usual suspect Argentina and now in Colombia (in the wake of a Leftist winning elections).

Check out our emerging market ETF lists, ADR lists and closed-end fund lists (also see our site map + list update status as the lists are still being updated as of Summer 2022) along with our general EM investing tips / advice. All links to emerging market newspapers, investment firms, blogs and other helpful investing resources at the bottom of www.emergingmarketskeptic.com or on the menu under Resources have been updated.

Subscribe Now Via Substack

Suggested Reading

$ = behind a paywall

Growing Number Of CEOs Asking About Risk Of War Between China & Taiwan (Zero Hedge)

Executives seek briefings on Taiwan war risk (Financial Times) $ (Non-Paywalled)

- “Firms want to know how to perceive situational risks and they want to know what key elements they should be tracking on an ongoing basis,” said Tong, a former veteran Asia diplomat. Tong added that the clients requesting briefings ranged from technology and financial groups to pharmaceutical makers and consumer goods manufacturers.

Economic Chaos of a Taiwan War Would Go Well Past Semiconductors (Bloomberg) $ (Non-Paywalled)

- According to a RAND Corporation study, a war lasting one year would slash America’s gross domestic product by a painful 5% to 10%. But it would gut China’s gross domestic product by an excruciating 25% to 35%. And lest Americans console themselves that China would get the worst of it, the entire world would suffer as the war ripped apart critical technological supply chains.

- Over 90% of the world’s most advanced semiconductors are manufactured in Taiwan.

China On Verge Of Violent Debt Jubilee As “Disgruntled” Homebuyers Refuse To Pay Their Mortgages (Zero Hedge)

- First, it was the violent outcry against mandatory covid vaccines that put an end to Beijing’s desire to forcibly innoculate all Beijing residents in just 48 hours – a feat not all of America’s armed militias have been able to achieve, and now it’s a grassroots push for what appears to be a debt jubillee as millions of homeowners suddenly stop paying their mortgages, a shocking move that has sent shockwaves across China’s capital markets and has sparked panic within China’s political leadership circles.

- As Bloomberg reports overnight, a rapidly increasing number of “disgruntled Chinese homebuyers” are refusing to pay mortgages for unfinished construction projects, exacerbating the country’s real estate woes and stoking fears that the crisis will spread to the wider financial system as countless mortgages default.

Putin and Xi’s Bet on the Global South (WSJ)

- As their relations with the West deteriorate, Russia and China are seeking to rewire global power flows in ways that will work to their advantage for years to come.

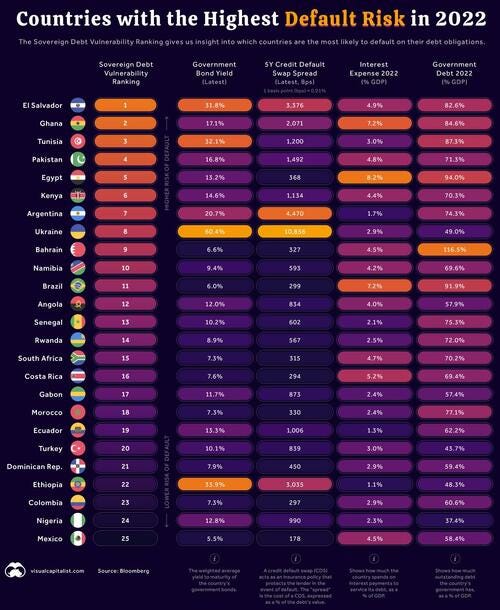

These Are The Countries With The Highest Default Risk (Zero Hedge)

Why Argentina’s Export Boom Is Falling Short (Americas Quarterly)

- Government policy, macroeconomic trouble and political crisis are holding the country back.

Colombians look to Miami as Gustavo Petro’s election sparks capital flight fears (Financial Times) $ (Non-Paywalled)

Rappi mafia: How a delivery startup took over Colombia’s tech scene (Rest of the World)

The timeline as of mid-2022 (Latin America Risk Report)

- A likely recession and a debt crisis will build on coronavirus and supply chain challenges.

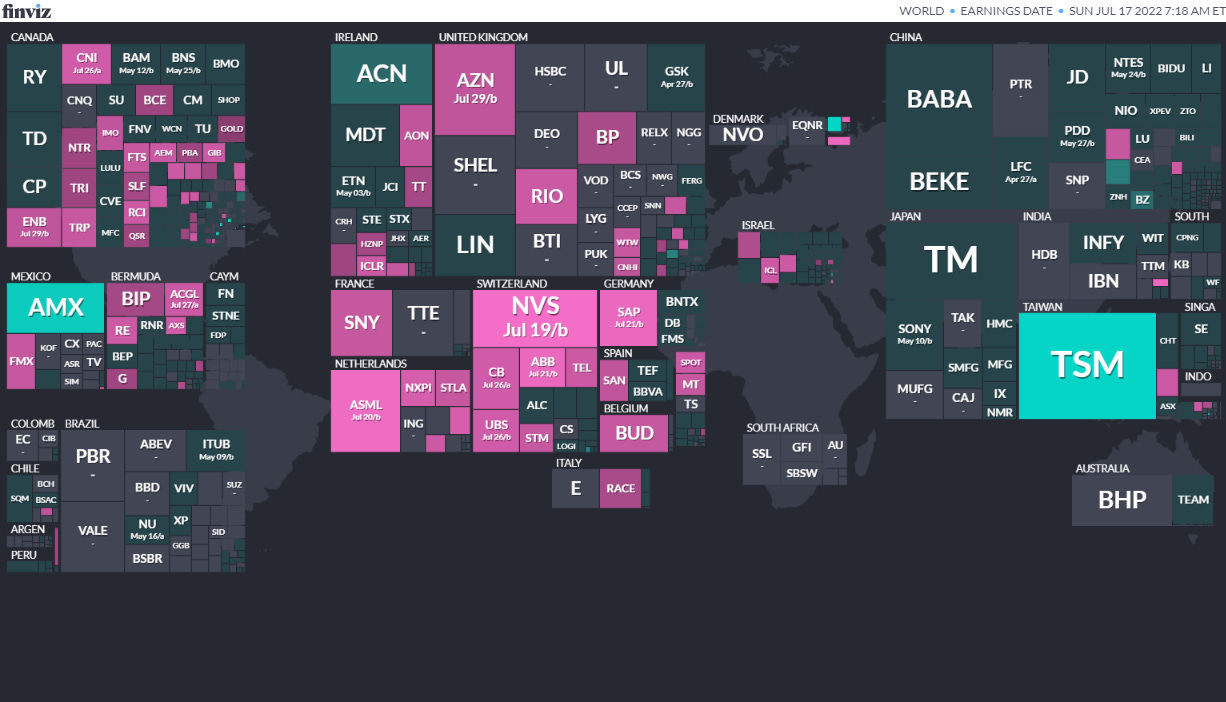

Earnings Calendar

Note: Investing.com has a full calendar for most global exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

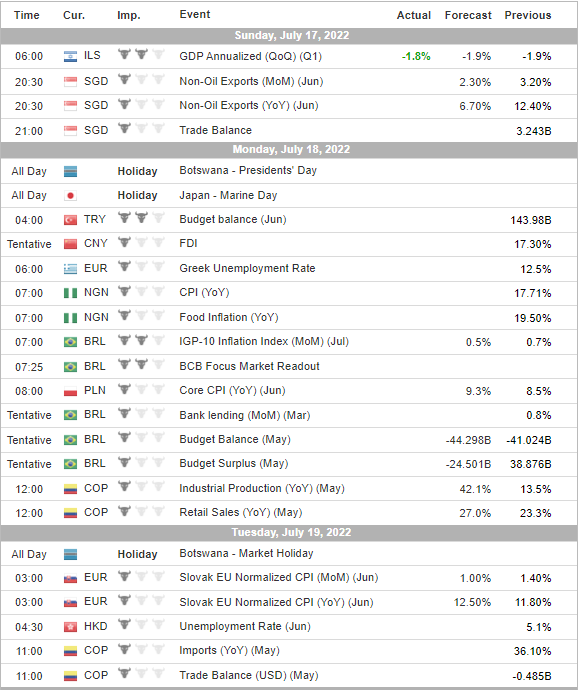

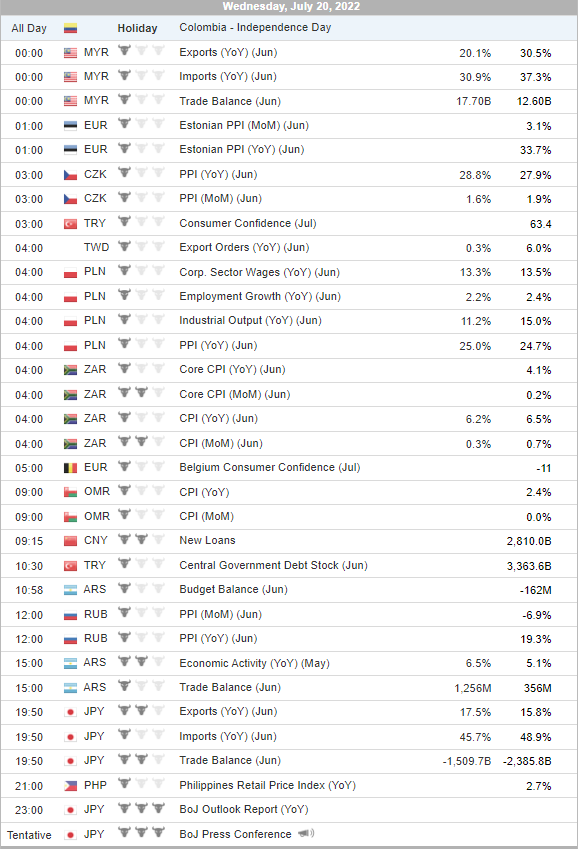

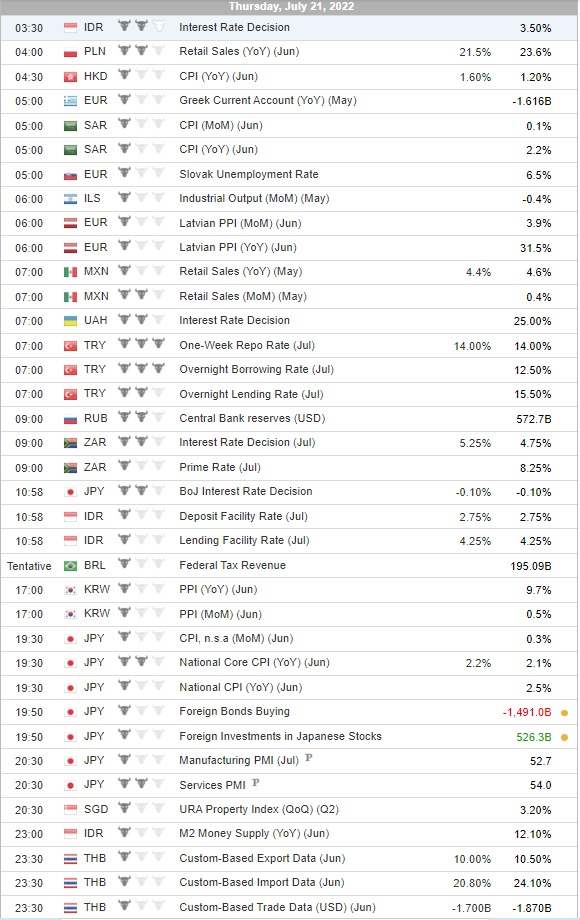

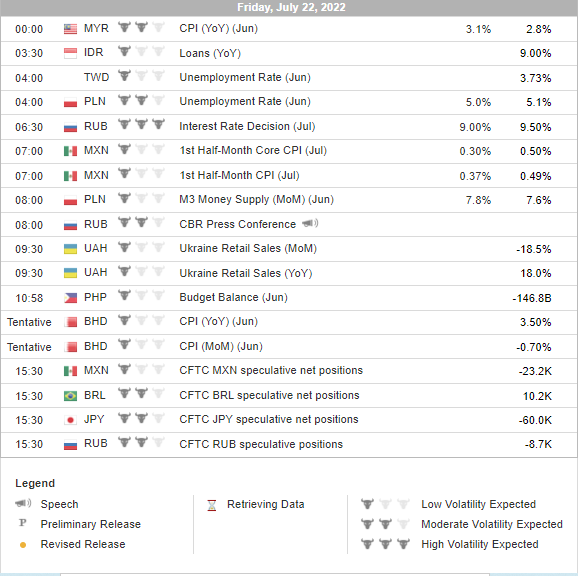

Economic Calendar

Click here for a full weekly calendar from Investing.com (my filter excludes USA, Canada, EU, Australia & NZ). Some frontier and emerging market highlights:

Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

- Papua New Guinea National Parliament of Papua New Guinea Jul 9, 2022 (d) Date not confirmed Jun 24, 2017

- Tunisia Referendum Jul 25, 2022 (t) Confirmed Oct 24, 1999

- Senegal Senegalese National Assembly Jul 31, 2022 (d) Confirmed Jul 2, 2017

- Congo (Brazzaville) Congolese National Assembly Jul 10, 2022 (d) Confirmed Jul 16, 2017

- Angola Angolan National Assembly Aug 3, 2022 (t) Tentative Aug 23, 2017

- Kenya President Aug 9, 2022 (d) Confirmed Dec 27, 2007

- Kenya Kenyan National Assembly Aug 9, 2022 (t) Confirmed Aug 8, 2017

- Kenya Kenyan Senate Aug 9, 2022 (t) Confirmed Aug 8, 2017

- Brazil President Oct 2, 2022 (d) Confirmed Oct 30, 2022

- Brazil Brazilian Federal Senate Oct 2, 2022 (t) Confirmed Oct 7, 2018

- Brazil Brazilian Chamber of Deputies Oct 2, 2022 (d) Confirmed Oct 7, 2018

- Bosnia and Herzegovina Bosnia and Herzegovina House of Representatives Oct 2, 2022 (d)

- Bosnia and Herzegovina Chairman of the Presidency Oct 2, 2022 (d)

Check out: Thoughts for Investors: Bongbong Marcos Wins the 2022 Philippines Elections in a Landslide

IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Jianzhi Education Technology Group Company Ltd. JZ 5.0M Shares, $5.00-6.00, $25.0 mil, Week of 7/18/2022

- Since being established, we, together with the VIEs, have been committed to developing educational content to fulfill the massive demand for high quality professional development training resources in China. (Incorporated in the Cayman Islands)

Virax Biolabs Group Limited VRAX, 1.4M shares, $5.00, $6.8 mil, Week of 7/21/2022

- We are a holding company incorporated as an exempted company under the laws of the Cayman Islands. As a holding company with no material operations of our own, we conduct our substantial operations in the United Kingdom and Hong Kong with operating subsidiaries in Singapore, China and the British Virgin Islands. We have been operating since 2013.

- We are a global innovative biotechnology group that primarily engages in sales, distribution and marketing of diagnostic test kits and med-tech and Personal Protective Equipment (“PPE”) products for the prevention, detection, diagnosis and risk management of viral diseases with a particular interest in the field of immunology. Our mission is to minimize the risks of viruses throughout the world via our product offerings.

- We intend to apply for an aggregate of four (4) patents in 2022. For one of the pending patents, we are in the process of acquiring it, and we expect to close the acquisition in 2022. Further, we are developing a T-Cell IVD test kit under the Virax Immune brand for COVID-19 initially, which we subsequently intend to adapt for immunological profiling against multiple viral threats. We are also building a proprietary mobile application for Virax Immune, using an in-house code, that will present an individual’s immunological profiling data and provide advice on the user’s immune system. Based on our management team’s analysis, we expect to file a patent for the Virax Immune Cell diagnostic test kit and a copyright for the Virax Immune app in 2022.

ETF Launches

Climate change and ESG are clearly the latest flavors of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

- 4/21/2022 – FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM – Passive, equity, ESG

- 4/6/2022 – India Internet & Ecommerce ETF INQQ – Passive, equity, thematic

- 2/17/2022 – VanEck Digital India ETF DGIN – Passive, India market, thematic

- 2/17/2022 – Goldman Sachs Access Emerging Markets USD Bond ETF GEMD – Passive, fixed income, emerging markets

- 1/27/2022 – iShares MSCI China Multisector Tech ETF TCHI – Passive, China, technology

- 1/11/2022 – Simplify Emerging Markets PLUS Downside Convexity ETF EMGD – Active, equity, options strategy

- 1/11/2022 – SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG – Passive, equity, ESG

ETF Closures/Liquidations

Frontier and emerging market highlights:

- 6/10/2022 – Infusive Compounding Global Equities ETF JOYY

- 5/3/2022 – ProShares Short Term USD Emerging Markets Bond ETF EMSH

- 4/7/2022 – DeltaShares S&P EM 100 & Managed Risk ETF DMRE

- 3/11/2022 – Direxion Daily Russia Bull 2X Shares RUSL

- 1/27/2022 – Legg Mason Global Infrastructure ETF INFR

- 1/14/2022 – Direxion Daily Latin America Bull 2X Shares LBJ

Disclaimer: EmergingMarketSkeptic.Substack.com and EmergingMarketSkeptic.com provides useful information that should not constitute investment advice or a recommendation to invest. In addition, your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content.

Emerging Market Links + The Week Ahead (July 18, 2022) was also published on our Substack.

Emerging Markets Investing Tips + Advice

Emerging Market Skeptic (Website)

Website List Updates + Site Map

Stocktwits @EmergingMarketSkptc

Similar Posts:

- Emerging Market Links + The Week Ahead (July 11, 2022)

- Emerging Market Links + The Week Ahead (July 4, 2022)

- Emerging Market Links + The Week Ahead (June 6, 2022)

- Emerging Market Links + The Week Ahead (May 30, 2022)

- Emerging Market Links + The Week Ahead (June 27, 2022)

- Emerging Market Links + The Week Ahead (August 1, 2022)

- Emerging Market Links + The Week Ahead (May 16, 2022)

- Emerging Market Links + The Week Ahead (June 20, 2022)

- Emerging Market Links + The Week Ahead (August 8, 2022)

- Emerging Market Links + The Week Ahead (May 23, 2022)

- Emerging Market Links + The Week Ahead (July 25, 2022)

- Emerging Market Links + The Week Ahead (October 10, 2022)

- Emerging Market Links + The Week Ahead (August 29, 2022)

- Emerging Market Links + The Week Ahead (January 23, 2023)

- Emerging Market Links + The Week Ahead (September 5, 2022)