- As the Chinese market continues growing, investors with broad EM exposure have been left with a 33% position in a market that has an incredible amount of both headwinds and tailwinds, making it complicated to implement their specific asset allocation views.

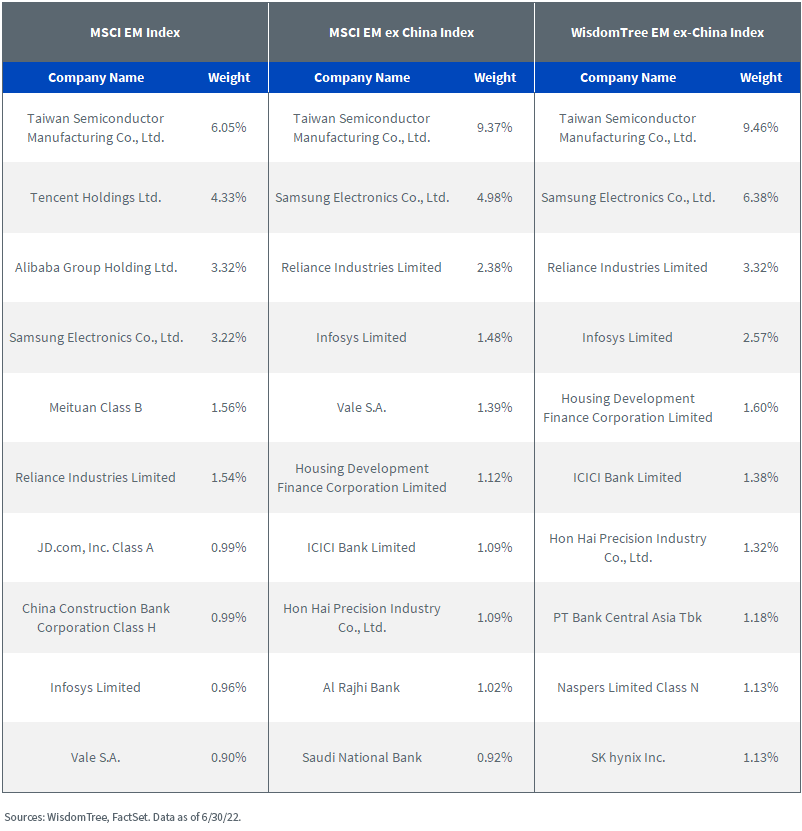

- WisdomTree is launching XC – the WisdomTree Emerging Markets ex-China Fund – which will track the WisdomTree Emerging Markets ex-China Index, which rebalances on an annual basis and provides investors with exposure to non-state-owned companies (non-SOEs) in emerging market countries excluding China.

- Excluding China from a broad EM universe has considerable consequences in terms of fundamentals, sector and country exposures. READ MORE

Similar Posts:

- Is Your Emerging Market Strategy Overexposed to These 3 Factors? (KraneShares)

- BNP Paribas’ Chi Lo: Patient Investors Should Build Up China Exposure Now (CMN)

- Renminbi’s Share of Global Payments Falls (The Asset)

- It’s Time for Investors to Reevaluate Their China Exposures (Investments & Wealth Monitor)

- China’s Year of the Dog Bounds Into View (Allianz Global Investors)

- Macro Tailwinds That Could Propel China’s Internet Sector (KraneShares)

- Pinduoduo Research Report (Hayden Capital)

- Shift Your Emerging Market Consumer Exposure from MNCs to Local Stocks (FE Trustnet)

- Chinese Stocks: Cheap Long-term Play or Value Trap? (FE Trustnet)

- The Great Chinese Exodus (WSJ)

- F/X Exposure Hit APAC Corporates (Asset Benchmark Research)

- The Long View: China is Too Big to Fail (Fidante Partners)

- Changes to the Emerging Markets Club: China (A Shares), Argentina and Saudi Arabia (Franklin Templeton)

- Emerging Market Funds Hammer Developed Market Funds in July (Interactive Investor)

- Uncommon Yields: How China is a Rare Bright Spot in a World Deprived of Yield (KraneShares)