Airtel Africa (LON: AAF / FRA: 9AA / OTCMKTS: AAFRF) is a UK-based MNC providing telecommunications and mobile money services in 14 African countries. The Financial Times has recently noted how much oil prices matter to the Company’s performance (Nigeria accounts for about 40% of revenues and ebitda) as cell phone towers in Africa tend to run on diesel generators:

- Airtel Africa: weak oil creates cheap telecoms play on Nigeria (FT) (Stock price fall belies a brightening outlook)

OVERVIEW:

- Airtel Africa is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index. It is majority owned by the Indian telecommunications company Bharti Airtel (NSE: BHARTIARTL / BOM: 532454). Airtel is a global communications solutions provider with over 491 Mn customers in 17 countries across South Asia and Africa. The company ranks amongst the top three mobile operators globally and its networks cover over two billion people.

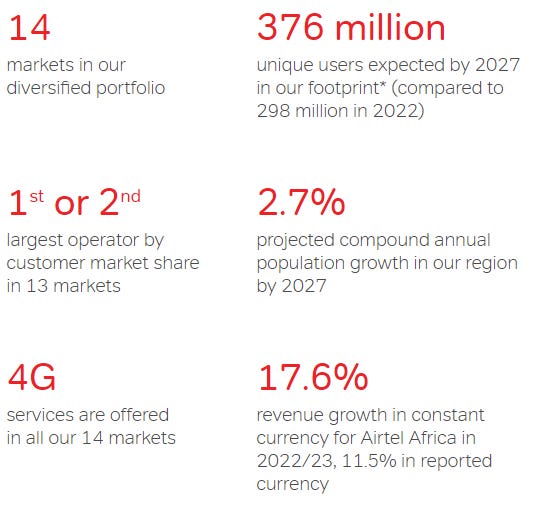

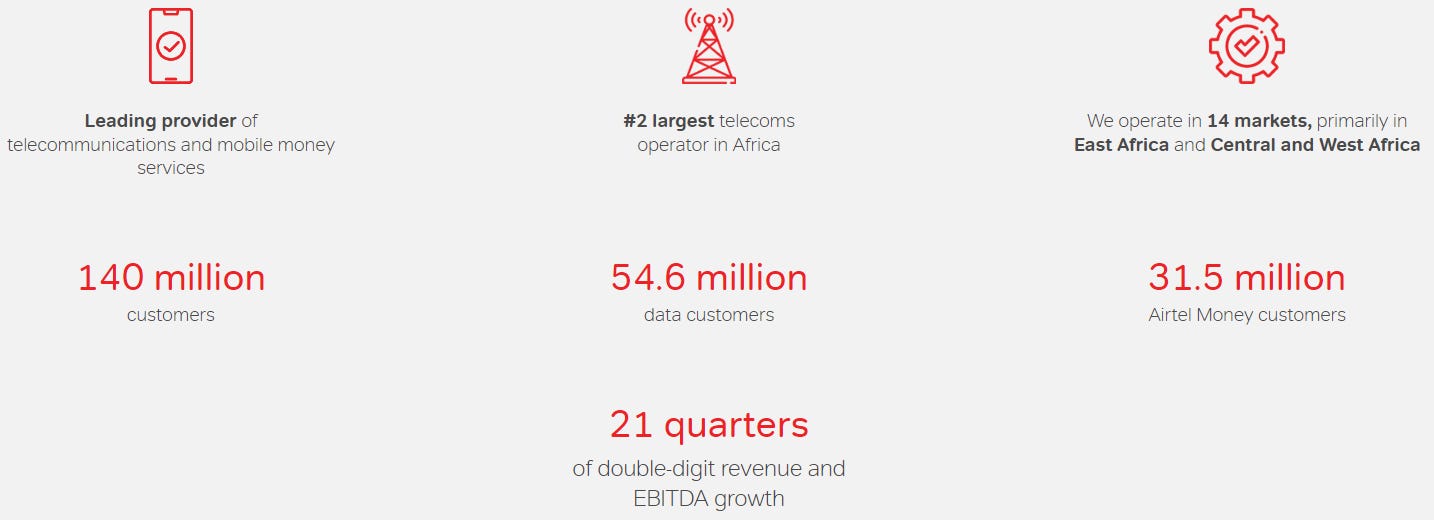

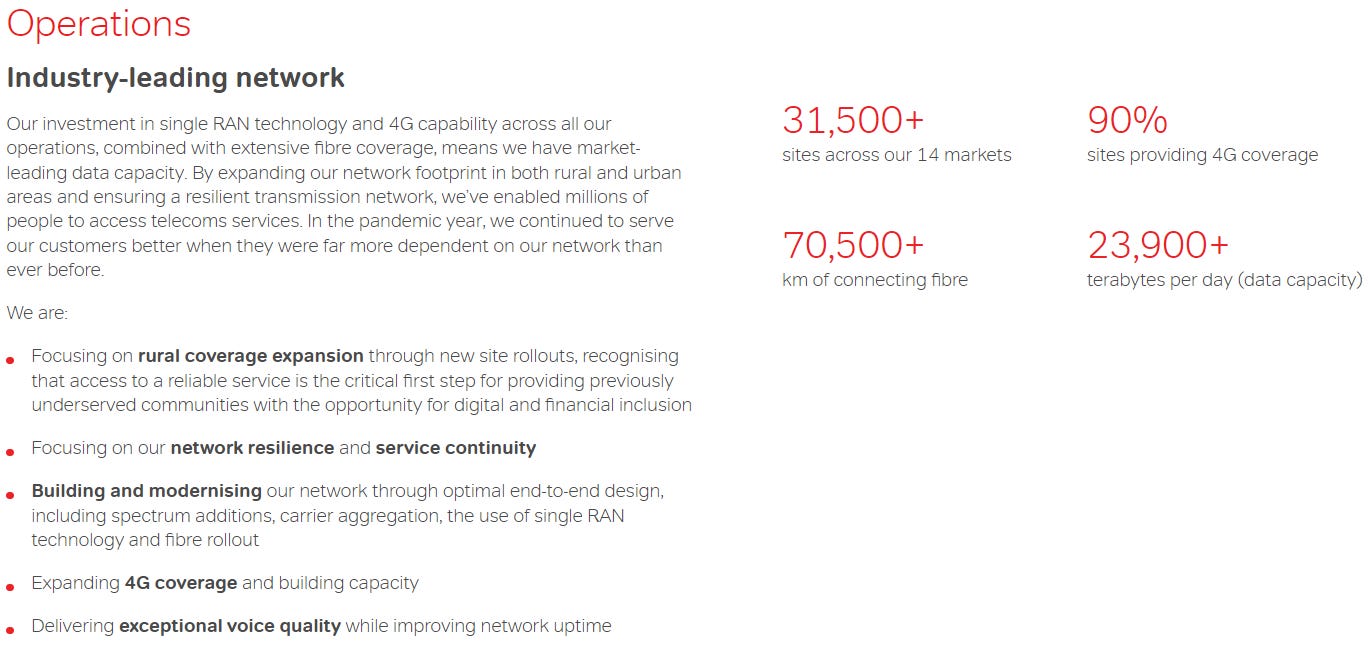

- Investor Proposition (31 March 2023 Factsheet)

- Why Airtel Africa is Worth Watching | AAF Stock Review (Youtube) 14:54 Minutes (January 2023)

- Incoming Group CEO, Airtel Africa Plc Reveals The Secret Behind The Company’s Success (Youtube) 15:31 Minutes (July 2021) (NOTE: Cannot be imbedded on third party sites)

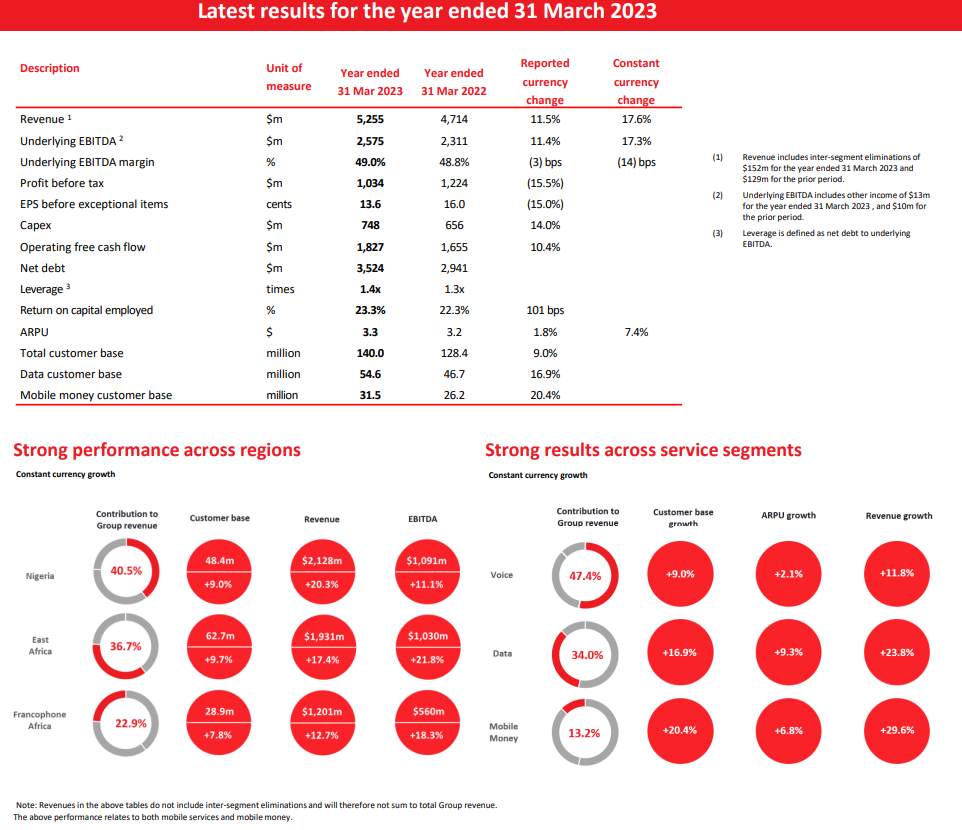

- Latest results for the year ended 31 March 2023 (31 March 2023 Factsheet)

- Press release FY 2023 (May 2023)

- Olusegun Ogunsanya, chief executive officer, on the trading update: “…Currencies across our footprint have been under pressure, and the impact from the revaluation of our foreign currency denominated liabilities provided some headwinds in the last financial year. While currency devaluation is not in our control, we have plans to continue to mitigate its impact by growing our revenues at a faster pace than devaluation, with double-digit revenue growth in reported currency delivered this year and as we continue to reduce our foreign currency exposure across our balance sheet…”

- Airtel Africa Q4FY23 net profit down 6% on-year due to higher finance (Economic Times) May 2023

- Synopsis: Bharti Airtel Africa’s Q4 net profit dipped to $227m, down 6% YoY due to high forex losses, even though revenue was up by 10% YoY. However, the company reported a 17.6% QoQ increase in net profit on strong growth in its customer base and quarterly data revenue. The number of customers increased 9%, while data customers rose nearly 17% YoY. Meanwhile, mobile money user base surged 20.4%. ARPU remained unchanged QoQ at $3.1 and went up 6.9% YoY. Airtel Africa CEO Segun Ogunsanya expects strategic focus to boost sustainable growth in the long run.

- No plan yet to expand beyond existing 14 countries, Airtel Africa CEO tells Arise News (Youtube) 9:48 Min (May 2022)

- Airtel Africa: weak oil creates cheap telecoms play on Nigeria (FT) May 2023

- Airtel Africa’s foreign exchange losses last year summed to $178mn, almost half of which came from Nigeria. The company conservatively includes these losses in its “adjusted” net income. As a result, reported earnings missed quarterly expectations.

- Falling oil prices should decrease the cost of running generators to power cell towers on Nigerian diesel, New Street analysts have noted.

- P/E (Google Finance): 8.12 / Forward P/E (Yahoo! Finance): 5.84

- Dividend Yield (Google Finance): 3.81% / Forward Dividend & Yield (Yahoo! Finance): 3.80%

1 YEAR CHART:

LONG TERM CHART:

ADDITIONAL RESOURCES:

- Website

- Investor Relations

- Wikipedia

- Investment case

- 31 March 2023 Factsheet (PDF File) 2 pages

- Press release FY 2023 (May 2023)

- Investor presentation FY 2023 (PDF File)

- Conference call transcript FY 2023 (PDF File)

- Airtel Africa Q4FY23 net profit down 6% on-year due to higher finance (Economic Times) May 2023

- Why Airtel Africa is Worth Watching | AAF Stock Review (Youtube) 14:54 Minutes (January 2023)

- No plan yet to expand beyond existing 14 countries, Airtel Africa CEO tells Arise News (Youtube) 9:48 Minutes (May 2022)

- Incoming Group CEO, Airtel Africa Plc Reveals The Secret Behind The Company’s Success (Youtube) 15:31 Minutes (July 2021)

- Airtel Africa: weak oil creates cheap telecoms play on Nigeria (FT) May 2023

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Similar Posts:

- Moody’s Downgrades Four African Nations

- Nigeria’s Forte Oil Plc and EcoBank Transnational Inc (ETI) Added to MSCI’s Frontier Market Index (AllAfrica.com)

- To Succeed in Africa, a Business Must Succeed in Nigeria (Economist)

- YPO CEO Survey: Africa CEO Confidence at 5-year Low (YPO)

- Five Emerging Markets Squeezed by Currency Pegs (Bloomberg)

- Coronation Africa Frontiers Fund Manager: Stick With MNC Subsidiaries (Citywire)

- Africa’s Smaller Stock Markets Plan to Join Forces (Yahoo! Finance)

- Africa Rising: The Hopeful Continent (Wellington Management)

- Nigeria’s Cash Problem: Multiple FX Rates, Wild Swings and Dollar Shortages (CNN Money)

- How Big is Africa’s Car Market? (African Executive)

- Opportunities in the Next “Emerging” Emerging Market of Africa (Franklin Templeton)

- Investors Exit Africa for Other Frontier Markets (WSJ)

- Mark Mobius: Nigeria is a Positive Emerging Markets Play (WSJ)

- Countdown Begins to Nigeria’s Crucial 2023 Elections (Crisis Group)

- Africa Oil Has Everything I Look For In An Oil Play (Seeking Alpha)