Oversea-Chinese Banking Corp (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY) is one of the largest banks in SE Asia and has consistently ranked highly as one of the “safest banks in the world.” The Financial Times recently noted how Singapore’s big banks have been breaking earnings record after record as Hong Kong wanes and money continues to flow to the city-state:

- Singapore: foreign billionaires drive record profits for banks (FT) (New money inflows should benefit wealth management services which sprawl from banks into niche funds and family offices)

OVERVIEW:

- OCBC Bank is the second-largest banking group in Singapore by total assets and among the top players in bancassurance sales, home loans, unit trust distribution, personal credit, small and medium-sized enterprises market and the Singapore dollar capital market.

- OCBC Bank was born out of the Great Depression through the consolidation of three banks in 1932 — Chinese Commercial Bank (incorporated in 1912), Ho Hong Bank (incorporated in 1917) and the Oversea-Chinese Bank Limited (incorporated in 1919)

- Highlights from Wind behind the Sails (Youtube) 3:43 Minutes

- Lim Kay Tong takes us through some of the highlights from OCBC Bank’s 85-year history that have been chronicled in the book, Wind behind the Sails.

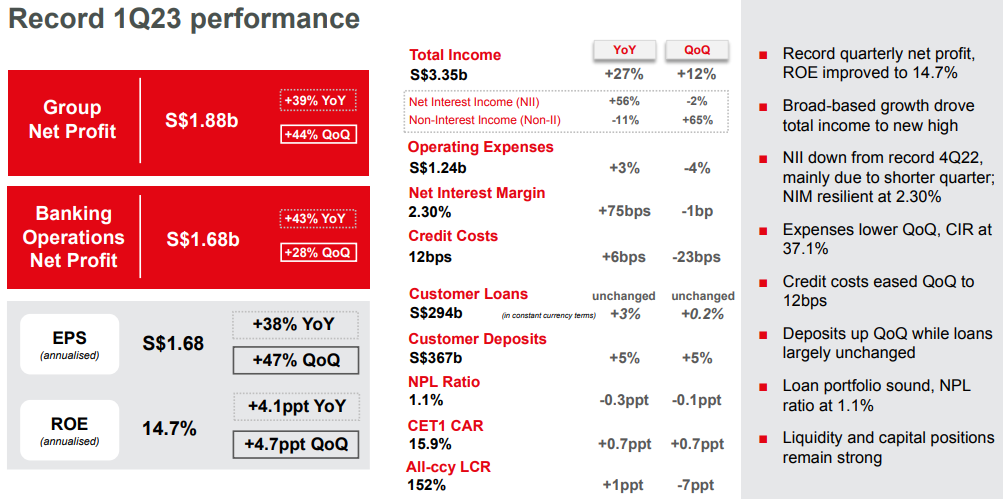

- OCBC Group First Quarter 2023 Net Profit Up 39% from the Previous Year to a Record S$1.88 billion (Press Release) May 2023 (PDF File)

- Message from Group CEO, Helen Wong: “We are pleased to achieve a record quarter on the back of a strong operating performance. Total income reached a new high and expenses were well controlled, while we maintained prudent levels of allowances. Our loan portfolio was resilient and our wealth management business continued to attract net new money inflows. These reflected the strength of our diversified franchise and contributed to a strong uplift in our return on equity…”

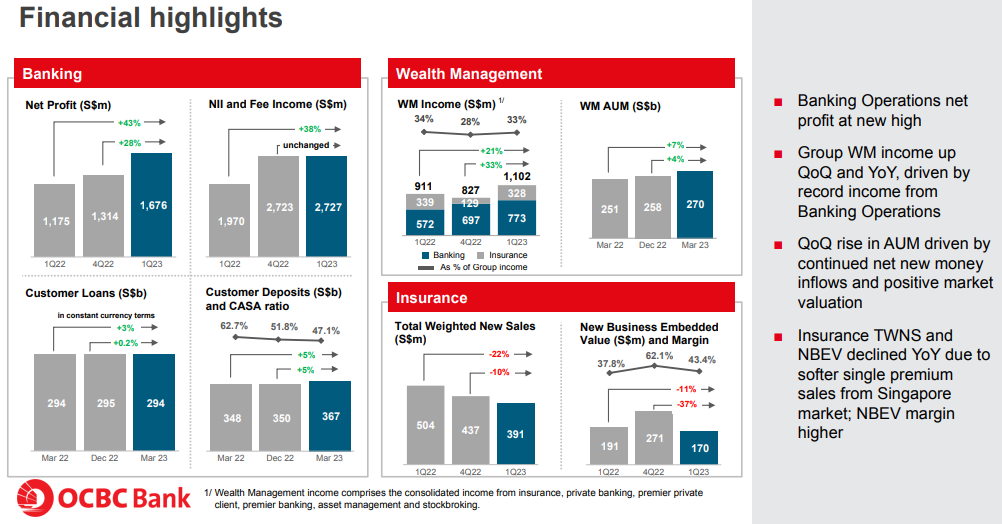

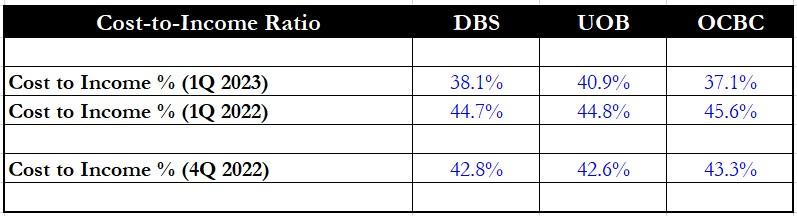

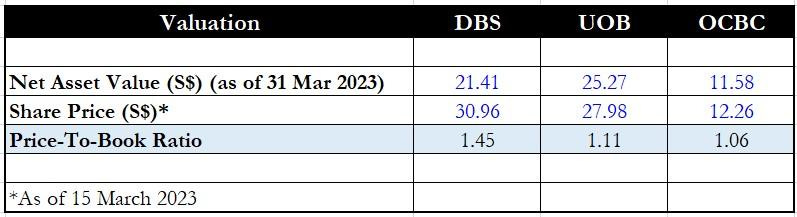

- DBS, OCBC and UOB All Reported Record Earnings: Which Bank Qualifies as the Best Pick? (The Smart Investor) May 2023

- We size up the trio of local banks after their recent earnings period to tease out which qualifies as the best investment.

- NOTE: They discuss 6 criteria in detail. OCBC was on top for the following two:

- Singapore: foreign billionaires drive record profits for banks (FT) May 2023

- Local lenders already trade above tangible book value. They have scope to go higher, given Singapore’s financial momentum.

- Softer OCBC Wealth Fees As Investors Cut Risk (WealthBriefingAsia) Feb 2023

- OCBC, the parent of Bank of Singapore, last week reported that net fee income fell 18 per cent year-on-year in 2022 to S$1.85 billion ($1.96 billion), with softer wealth management fees taking a toll as clients shifted to lower-risk investments amidst difficult markets.

- However, the market turmoil of last year had a positive effect on net trading income because clients transacted more business. Fee income rose 9 per cent to S$34 million…

- P/E (Google Finance): 9.58 / Forward P/E (Yahoo! Finance): 8.07

- Dividend Yield (Google Finance): 5.61% / Forward Dividend & Yield (Yahoo! Finance): 6.53%

1 YEAR CHART:

LONG TERM CHART:

ADDITIONAL RESOURCES:

- Website

- Investor Relations

- Wikipedia

- Highlights from Wind behind the Sails (Youtube) 3:43 Minutes

- World’s Safest Banks 2022 (Global Finance) November 2022

- OCBC Group First Quarter 2023 Net Profit Up 39% from the Previous Year to a Record S$1.88 billion (Press Release) May 2023 (PDF File)

- 1Q23 Highlights (PDF File)

- DBS, OCBC and UOB All Reported Record Earnings: Which Bank Qualifies as the Best Pick? (The Smart Investor) May 2023

- 1Q23 Highlights (PDF File)

- Singapore: foreign billionaires drive record profits for banks (FT) May 2023

- Softer OCBC Wealth Fees As Investors Cut Risk (WealthBriefingAsia) Feb 2023

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Similar Posts:

- United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF): Betting on ASEAN Growth With 2M New Citibank Clients

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF): Record Earnings But Profit Margins From Higher Rates Have Peaked

- Singapore Banks: Breaking Out (Smart Karma)

- High-Yield Singapore Banks & REITs (Mid-2024)

- The One Country With “Significant Real Income Growth” (Channel NewsAsia)

- Asian Banks Are Nibbling the Lunches of Global Banks (CCTV)

- The Singapore Story: Not a Sure Thing for Investors?

- Singapore Stocks: The Edge Billion Dollar Club 2023 Award Winners

- Why China’s ‘Crazy’ Mega-rich Are Moving Their Wealth, and Partying, to Singapore (SCMP)

- Morningstar Hong Kong & Singapore Stock of the Week (Q2 2023)

- Luckin Coffee is Launching in Singapore, Will it Do Well? (Momentum Asia)

- Covid-weary Chinese Millionaires Eye Singapore Amid ‘Chaos and Unpredictability’ at Home (SCMP)

- Singapore’s Sovereign Wealth Fund to Increase Investment in China (FT)

- Are Asian Households Over Their Head in Consumer Debt? (CNBC)

- Asia: The Multi-Asset Class Opportunity Set – With Partners Capital & Singapore Management University (Money Maze Podcast)