Banco Santander-Chile (NYSE: BSAC), part of the Santander group and majority controlled by Santander Spain, is the largest bank in Chile by loans and the second largest by deposits. The bank just reported earnings on Friday. However, some of the funds (who own its shares) we cover in our Tuesday posts have mixed views about Chile in the wake of recent political turmoil, outflows from pension funds during COVID (which might lower future consumption), and the recent lithium nationalization announcements.

OVERVIEW:

- Market position:Q1 2023 Management Commentary

- “Más Lucas, 100% digital savings and sight accountThe first initiative presented was “Más Lucas”, the first 100% digital on-boarding interest-bearing sight and savings account for the mass market. This product will not charge maintenance or transaction fees. In this way, “Más Lucas” responds to Santander’s commitment to financial inclusion, by granting people access to new financial products.” Santander announces strategic projects for 2023 as part of the new Chile First program: “Más Lucas”, a digital zero-cost interest bearing sight and savings account and the new Work/Café Expresso transaction centers

- CHILE FIRST – Santander 2023 Strategic projects (April 2023) (Youtube) 44 Min w/ English subtitles (Details new initiatives like the above one…)

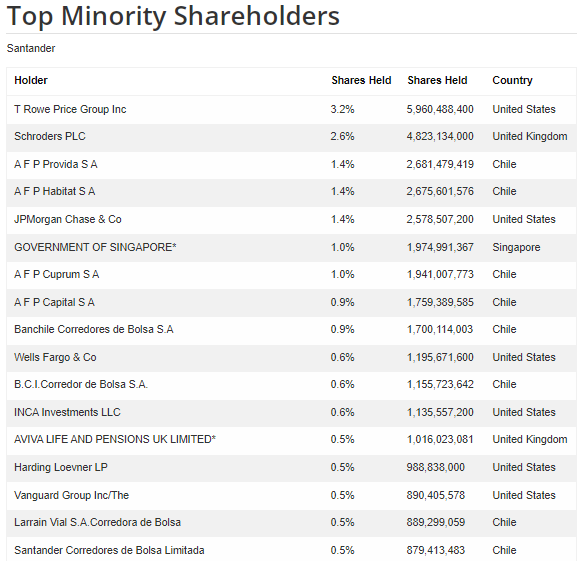

- Shareholders:

- “Net income attributable to shareholders in 3M23 decreased 42.4% YoY, (Ch$0.72 per share and US$ 0.36 per ADR) with the Bank’s ROAE in 3M22 reaching 13.3%. Compared to 4Q22, net income attributable to shareholders in 1Q23 increased 33.3% YoY, (Ch$0.72 per share and US$ 0.36 per ADR) with the Bank’s ROAE improving from 10.1% in 4Q22 to 13.3% in the quarter. Our business segments continue to grow solidly with our corporate activities affected by the impact of higher interest rates on our cost of funding and the carry of lower rate interest earning assets. Fees continue to grow strongly while costs have remained controlled.” Q1 2023 Management Commentary

- Guidance:1Q 2023 Earnings Webcast

- “Banco Santander Chile is one of the companies with the highest risk classifications in Latin America with an A2 rating from Moody’s, A- from Standard and Poor’s, A+ from Japan Credit Rating Agency, AA- from HR Ratings, and A from KBRA.”

- International Ratings:RatingsRatings

- Chile Update/Outlook:1Q 2023 Earnings Webcast1Q 2023 Earnings Webcast

- P/E (Finviz): 8.97 / P/E (Yahoo! Finance): 9.16

- Dividend Yield (Finviz): 6.53% / Forward Dividend & Yield (Yahoo! Finance): 6.53%

1 YEAR CHART:

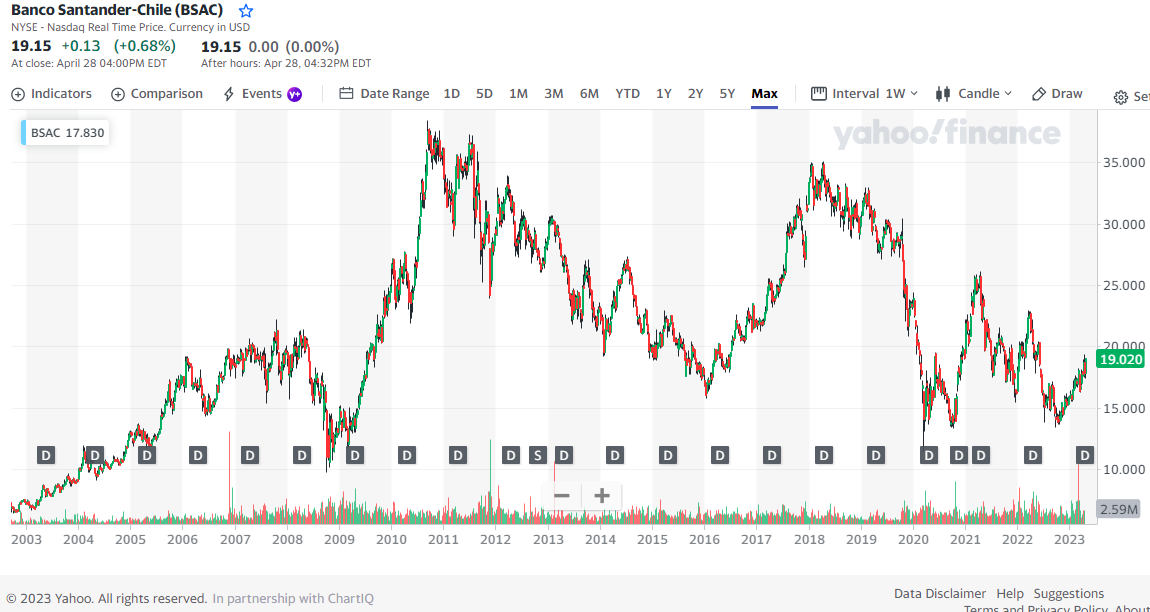

LONG TERM CHART:

ADDITIONAL RESOURCES:

- Website

- Investor Relations

- 1Q 2023 Earnings Webcast (April 28, 2023)

- Q1 2023 Management Commentary

- Banco Santander-Chile (BSAC) Q1 2023 Earnings Call Transcript (Seeking Alpha)

- CHILE FIRST – Santander 2023 Strategic projects (April 2023) (Youtube) 44 Min w/ English subtitles

- Santander announces strategic projects for 2023 as part of the new Chile First program: “Más Lucas”, a digital zero-cost interest bearing sight and savings account and the new Work/Café Expresso transaction centers March 2023

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Similar Posts:

- Chile Has Outperformed Other Emerging Markets and the S&P 500 This Year. Here’s How (CNBC)

- Volatility Storm Adds to Pain for Chile’s Battered Markets (Bloomberg via Yahoo)

- Copper Mining Opportunities in Peru and Chile (Mobius Blog)

- Chile’s Draft Constitution is Seriously Flawed (FT)

- Latin American Stocks to Consider (Aberdeen)

- AmCham Chile’s President Talks Up “Consensus,” “Shared Goals,” “Internal Dialog…”

- Analysis: Chile’s Sliding Peso Reflects Tough Battle vs Rampaging Dollar (Reuters)

- Pricey Tortillas: LatAm’s Poor Struggle to Afford Staples (AP)

- Dreaming of Salvador Allende (and 35% Corp Tax Rates) in Chile (WSJ)

- Chile Argues It Can Bring Change Without Scaring Investors (Bloomberg)

- Latin America Slow Descent into Interventionism (Daniel Lacalle)

- Emerging-Market Capital Outflow Risk Rises With US Dollar (Bloomberg)

- Copper ETFs Rally on Economic Recovery, Chile Supply Concerns (NASDAQ)

- The S&P Indices Versus Active (SPIVA) Latin America Scorecard (S&P Dow Jones Indices)

- Mercado Libre CFO Talks E-commerce Markets, Fintech Services, Crypto, Outlook (Yahoo! Finance)