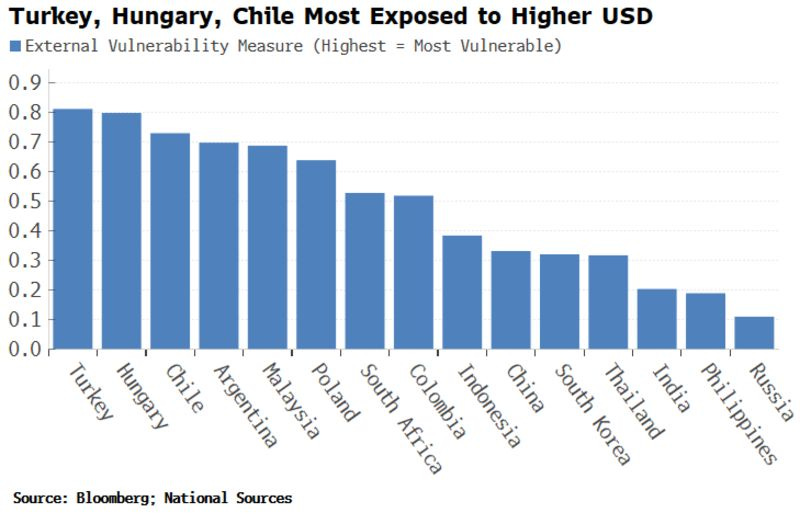

- I created an External Vulnerability Measure based on the IMF’s reserve adequacy score. This version has three inputs: reserve adequacy with respect to exports, short-term debt (the latter is the Greenspan-Guidotti ratio), and the current account.

- The measure has Turkey, Chile, Hungary and Argentina as the most vulnerable to capital outflow. READ MORE

Similar Posts:

- Which Emerging Markets Have the Most Leveraged Stocks? (Bloomberg)

- S&W’s McGrath: Emerging Markets Are at the Perfect Entry Point (FE Trustnet)

- The 15 Most Miserable Emerging Market Economies (Bloomberg)

- Emerging Market Companies & Governments Binge on US Dollar Debt (WSJ)

- Key Findings: Credit Suisse Emerging Markets Consumer Survey

- How ECB QE Could Impact Emerging Markets (FT)

- New Fragile Five Facing a Forex Crisis: Argentina, Brazil, South Africa, Ukraine & Venezuela (Institutional Investor)

- Emerging Market Debt: Looking Towards ‘Beaten Up’ Opportunities (GAM)

- What Risks Do Emerging Markets Pose to US Economy? (Bloomberg)

- Mark Mobius Answers Readers’ Questions (Mobius Blog)

- Psigma’s Gregory: Avoid Economies With Current Account Deficits (FE Trustnet)

- Mexico and Colombia Join ‘Fragile Five’ Emerging Markets (FT)

- Election Results in Some Fragile Five Emerging Markets Calm Investors (Reuters)

- Emerging Market Acronyms Like “Fragile Five” are Misleading and Unhelpful (SCMP)

- Emerging Market CDS Volume Up 46% in 2014 (EMTA)