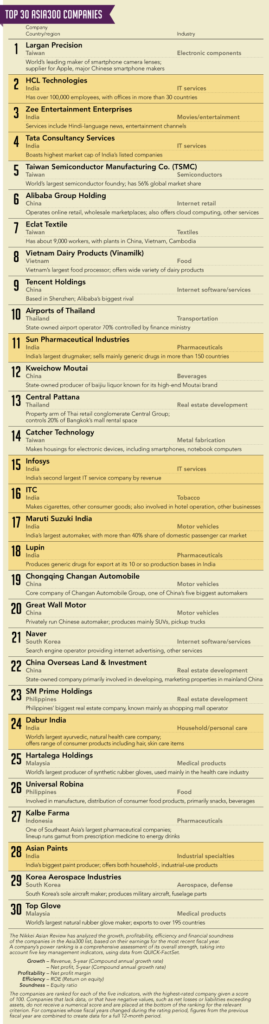

According to a Nikkei analysis of some 300 major Asian listed companies outside Japan, favorable factors at home provide Indian companies an edge while Chinese players struggle. The Asia300 list consists of a total of 327 companies in India, China, Hong Kong, South Korea, Taiwan and six Southeast Asian nations. The Nikkei ranked them based on average growth in sales and profit over the past five years, profitability, capital efficiency and financial soundness.

To read the whole article, India charges up the ranks of Asia300 companies, go to the website of the Nikkei Asian Review. In addition, check out our India ADRs list, India Closed-End Funds list and India ETFs list.

To read the whole article, India charges up the ranks of Asia300 companies, go to the website of the Nikkei Asian Review. In addition, check out our India ADRs list, India Closed-End Funds list and India ETFs list.

Similar Posts:

- Asia is Home to 50% of World’s Fastest Growing Companies (Nikkei Asian Review)

- Coronavirus Tests India’s Vaccine Makers in R&D Capability (Nikkei Asian Review)

- Southeast Asia Gains New Leverage as China and US Battle for Influence (Nikkei Asian Review)

- India to Offer More Investment Options Through ADRs (The Asset)

- Experts: Tread Carefully With Emerging Market Investments (FE Trustnet)

- China’s $5 Trillion Rout Creates Historic Gap With Indian Stocks (Bloomberg via Business Standard)

- This is the Asian Century: Seven Reasons to be Optimistic About It (Nikkei Asia)

- OMGI’s Crabb: India Consumer Stocks on “Very Stretched Multiples” (FE Trustnet)

- 5 Growth Opportunities in India (William Blair)

- CLSA Equity Strategist Says India is the Best BRICs Investment Destination (LM)

- India Ranks Highest in Latest Nielsen Consumer Confidence Survey

- China and India to Overtake U.S. Economy This Century (Bloomberg)

- moneycontrol India Stock of the Day (January 2024)

- India Economic Boom: 2031 Growth Outlook (Morgan Stanley)

- Is India’s lost generation a systemic risk? (CNBC)