Our lists: India ADRs, India ETFs and India Closed-End Funds.

- Personal Care Products, Consumer Durables, Housing, Digital Infrastructure and Financial Services.

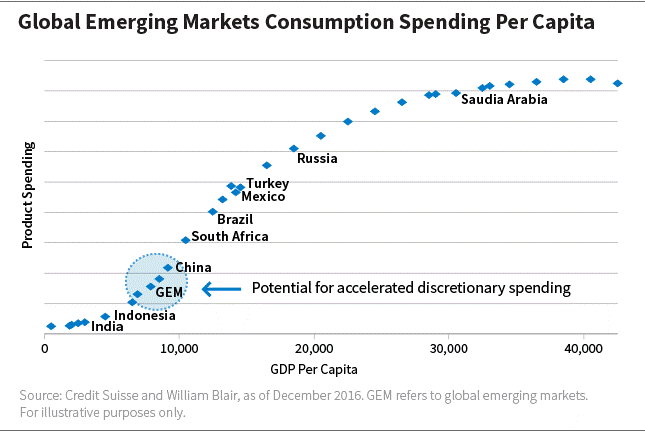

- We believe India represents an attractive market for our disciplined, bottom-up approach to seeking high-quality companies that can sustain their competitive advantage over time. In our view, India’s large, fragmented, and underpenetrated market, supported by favorable demographics and an underleveraged, growing emerging consumer class, creates a rich opportunity for growth investors. READ MORE

Similar Posts:

- OMGI’s Crabb: India Consumer Stocks on “Very Stretched Multiples” (FE Trustnet)

- China’s $5 Trillion Rout Creates Historic Gap With Indian Stocks (Bloomberg via Business Standard)

- India to Offer More Investment Options Through ADRs (The Asset)

- India Moves Up the Ranks of Asia300 Companies (Nikkei Asian Review)

- Indian Equity Outlook: From Survival to Revival (PineBridge Investments)

- India Ranks Highest in Latest Nielsen Consumer Confidence Survey

- India’s Opportunities: Impossible to Ignore (Van Eck)

- Fund Manager Interview: Aberdeen India Fund (Aberdeen)

- Global Thematics: What’s Behind India’s Growth Story? (Morgan Stanley)

- ‘Once-in-a-lifetime Opportunity’: How a Mass Lockdown at the World’s Biggest iPhone Factory is India’s Big Chance to Beat out China as Apple’s Favorite Supplier (Fortune)

- India: Underappreciated Alpha Opportunity? (Wellington Management)

- moneycontrol India Stock of the Day (December 2024)

- Emerging Markets Like India: The Next Frontier for Surgical Innovation (Cambridge Consultants)

- JPMorgan’s Mowat Talks About Iraq, EM Fund Flows and India (Economic Times)

- CLSA Equity Strategist Says India is the Best BRICs Investment Destination (LM)