Chinese New Year started in Asia on Saturday with Chap Goh Mei set to fall on Saturday February 24th this year – meaning the next two weeks should not be too eventful in much of East and SE Asia:

In Malaysia, its a three day weekend with packed malls and a few weeks of mall entertainment like acrobatic lion dances which are always amazing to watch – this one was from this afternoon:

On a fun financial note, Hong Kong based CLSA has been doing their Feng Shui Index 2024 report for a couple of decades with sector, property, Chinese zodiac sign (mine is predicted to have a mediocre year… 🫣🫣🫣) and celebrity (including Taylor Swift 🙄, Jerome Powell, etc.) predictions:

For what its worth, the Feng Shui Index predicts things will be looking up some time later this year for the Hang Seng Index, but not for all sectors…

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- 🇮🇳 moneycontrol India Stock of the Day (January 2024) Partially $

- Craftsman Automation, Asian Paints, Persistent Systems, Tata Consumer Products, INOX India Ltd, Aarti Industries, Sky Gold Ltd, GAIL, Transport Corporation of India, SBI Life Insurance, Prince Pipes and Fittings Ltd, Data Patterns (India) Ltd, Varun Beverages, Bosch Ltd, Syngene International, DCB Bank, Dhanuka Agritech, Trent Ltd, Manappuram Finance Ltd & Home First Finance

- 🌐 EM Fund Stock Picks & Country Commentaries (February 11, 2024) $

- “This NVIDIA is killing me [coz I follow the benchmarks…],” funds take notice of India’s high valuations, Nu Holdings report, Tata Motors, Georgia Capital Plc, EZCORP Inc, Gruma, Melco Resorts, etc.

- [Note: I have also added some additional international focused funds that can have emerging market stocks as their holdings, but may not have monthly factsheets or only do quarterly letters, etc. that then get posted on Seeking Alpha, Reddit, etc.]

📰🔬 Emerging Market Stock Picks / Stock Research

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 BYD vs Tesla: The Battle for the EV Market (The Asset)

- Racing to capture market share and increase sales [BYD Company (HKG: 1211 / SHE: 002594 / OTCMKTS: BYDDY / BYDDF)]

🇨🇳 Alibaba International records solid growth led by AliExpress (Bamboo Works)

- The international e-commerce arm of Alibaba Group (NYSE: BABA) posted 44% revenue growth in its latest quarter, led by major contributions from its AliExpress B2C global marketplace

- Alibaba International recorded strong revenue growth in the three months to December, its sixth consecutive quarterly increase since Alibaba partner Jiang Fan took the helm in 2022

- The company will further invest in its AliExpress “Choice” program, which has shown strong results in boosting customer acquisition and retention

🇨🇳 China Semi Foundry: Fierce Competition & Sluggish Rebound In Year Of The Dragon (Smartkarma) $

- Both Semiconductor Manufacturing International Corporation (SMIC) (SHA: 688981 / HKG: 0981 / FRA: MKN2) & Hua Hong Semiconductor (HKG: 1347 / FRA: 1HH / OTCMKTS: HHUSF) reported Q423 earnings in line with expectations and both guided Q124 flat to slightly down. SMIC expects FY24 mid single digit growth YoY.

- The downturn has exposed inherent weakness in China’s Semi Foundry segment relative to peers as exemplified by the significant GM disparity

- China’s two leading semi foundries have ~80% domestic dependence. Right now, that’s a headwind

🇨🇳 Yum China expands footprint in lower-tier cities to drive growth amid growing consumer caution (Bamboo Works)

- The operator of KFC and Pizza Hut restaurants in China posted 21% revenue growth last year, led by aggressive new store opening and price widening campaigns to capture new customers

- YUM China (NYSE: YUMC)’s revenue grew 21% in both the fourth quarter and for all of 2023, as it opened a record of nearly 1,700 new stores last year

- The master franchisee for KFC and Pizza Hut restaurants in China had 14,644 stores at the end of last year, and reiterated its plan to raise that to 20,000 by 2026

🇨🇳 EDU/TAL: China Tutoring – Here Comes The Policy Tailwind (Smartkarma) $

- Today, after Hong Kong market close, the Ministry of Education issued a new draft regulation on K12 tutoring.

- I have written before on New Oriental Education (NYSE: EDU) and China Beststudy Education Group (HKG: 3978) that there is now a equilibrium reached between all parties on tutoring in China.

- The new draft regulation basically puts it into concrete policy, which should alleviate investor concern on the sector.

🇨🇳 Growth-hungry Fanhua finds a potential benefactor in Singaporean investor (Bamboo Works)

- The insurance broker has struck a deal to receive up to $1 billion in new investment for itself and recently acquired wealth manager unit Puyi (NASDAQ: PUYI)

- Singapore-based White Group has agreed to invest as much as $500 million each in Fanhua (NASDAQ: FANH) and its Puyi wealth management unit

- The deal is the latest in a series engineered by Fanhua as it seeks to accelerate its faltering growth

🇨🇳 China Renaissance Edges Closer to Trading Resumption Under New Chairman (Bamboo Works)

- Xie Yijing will take over as the troubled investment bank’s head, as missing former chairman and CEO Bao Fan steps down ‘for health reasons and to spend more time with his family’

- China Renaissance Holdings (HKG: 1911 / FRA: 6RN / OTCMKTS: CSCHF)’s shares could resume trading as early as March, after it named a new chairman to replace co-founder Bao Fan, who has been missing for a year

- The company’s stock could fall 50% or more when trading resumes, reflecting not only concerns about Bao’s departure but also plunging business for Chinese investment banks

🇭🇰 L’Occitane (973 HK): Blackstone Pondering an Offer (Smartkarma) $

- Bloomberg reports that L’Occitane International (HKG: 0973 / FRA: COC / OTCMKTS: LCCTF) draws takeover interest from Blackstone (NYSE: BX), which is considering partnering with Chairman and largest shareholder Reinold Geiger.

- Blackstone needs an attractive takeover premium due to the presence of significant disinterested shareholders (Mr. Geiger and Acatis KVG).

- Shareholders will be wary of the latest rumour due to Mr Geiger’s aborted offer on 4 September 2023. Nevertheless, the valuation is undemanding compared to peer multiples.

🇭🇰 Cathay Pacific – Strong Pax Momentum Suggests 2024 Can Outperform Expectations (Smartkarma) $

- Cathay Pacific Airways Limited (HKG: 0293 / OTCMKTS: CPCAY)‘s strong end to 2023 has been well flagged but we think expectations are too low for 2024.

- ANA Holdings (TYO: 9202 / FRA: ANCA / LON: 0Q09 / OTCMKTS: ALNPY / ALNPF), Japan Airlines (TYO: 9201 / FRA: JAL / OTCMKTS: JPNRF) and Korean Air (KRX: 003490) have each seen unit pax revenue momentum accelerate into calendar 4Q23 which bodes well for 2024 prospects, particularly as manpower challenges slow capacity restoration.

- Our 2024 EBITDAR is 5% ahead of consensus while we are 11% ahead at the net income level.

🇭🇰 HK 第5部分; 7%+ dividend yield portfolio (Jam_invest’s Newsletter)

- On January 12th, 2024, I started writing about absurdly cheap Hong Kong stocks. Today, I reveal my initial HK portfolio, generating a 7%+ dividend yield.

- Analogue Holdings Ltd (HKG: 1977) is a reknowned holding of famous HK stock investor David Webb. The stock is current trading at HKD 1. That price is currently more than covered by Analogue’s financial assets value, especially when including market value – as opposed to book value – for the 15.83% interest in Nanjing Canatal Data-Centre Environmental Tech Co., Ltd (SHA: 603912). On normalized earnings, Analogue probably trades around 5-6x P/E and a high-single-digit if not low-double-digit (hsd-ldd) % dividend yield, given the 50% or better dividend payout ratio.

- Analogue is an electrical and mechanical (E&M) engineering services company. It makes and installs equipment

🇭🇰 Hong Kong Life Insurer AIA Group: Value Trap After Regulations Erode China Market Economics (Seeking Alpha) $

- AIA Group (HKG: 1299 / FRA: 7A2 / OTCMKTS: AAIGF) is a mix of mature and growing insurance markets, making it suitable for conservative investors.

- The company’s growth trajectory has stalled due to COVID-related challenges, including a decrease in the number of insurance agents.

- Concerns over Chinese customer preferences, China’s macro weakness, and regulatory changes pose challenges for AIA and its peers.

🇭🇰 TOP Financial: A Meme Trade, Time To Take Some Profit (Rating Downgrade) (Seeking Alpha) $

- TOP Financial Group (NASDAQ: TOP), a Hong Kong-based online brokerage firm, has been given a “Sell” rating due to its status as a meme stock.

- Investors are warned to be cautious as the stock is prone to speculative activity and may not be suitable for long-term investment.

- The company’s financial numbers and business expansion strategy are unconvincing, leading to doubts about its growth potential.

🇲🇴 Wynn’s Macau 4Q GGR outpaces despite competition: JPM + A Macau dividend depends on capital outlook: Wynn CEO + Wynn Macau Ltd 4Q EBITDAR up, revenue tops US$910mln (GGRAsia)

- Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF) Ltd outperformed the rest of the Macau casino market in the fourth quarter in terms of sequential growth in gross gaming revenue, according to a Thursday note from JP Morgan Securities (Asia Pacific) Ltd.

- It followed the results issued on Wednesday by the United States-based parent Wynn Resorts Ltd (NASDAQ: WYNN) for the three months to December 31.

- The quarterly numbers were “very respectable considering the ramp in new supplies by the peers” of the company, said the brokerage.

🇹🇼 3022:TW Industrial PC Manufacturer with 36% Margin and 4.4% dividend yield trading for <5.5 EV/EBIT (One foot hurdle)

- IEI Integration (TPE: 3022) is a manufacturer in industrial PCs and related products (embedded systems, motherboards, controllers, network equipment…etc). Industrial PCs is a growing industry with robust scale and strong companies. Founded in 1997, IEI Integration has been profitable in 26 consecutive years. Paying dividend 21 years straight. Trading is available on Interactive Brokers and English filings are available.

- IEI Integration is solid, profitable company that occupies a niche. Solid shareholder returns. Daily volume should make it actionable for many investors. It appears that IEI at this price is safe and inexpensive. If the goal is to merely beat the cost of capital in Taiwan(2~3%) it can probably deliver.

🇹🇼 Himax Technologies: Leading Player In Automotive Display, Notable Inventory Improvement, Initiate With ‘Buy’ (Seeking Alpha) $

- Himax Technologies (NASDAQ: HIMX) is the leader in the automotive display market, holding approximately 40% of the global market share.

- Their automotive display business is expected to experience high growth due to increasing sales of electric and hydrogen fuel cell vehicles and the rising trend of software applications in vehicles.

- Himax’s recent financial results showed a decline in revenue and profits, but their automotive business continues to show strong growth momentum.

🇹🇼 United Microelectronics: Not Enough Incentive To Warrant Added Risk (Seeking Alpha) $

- The stock has dropped after the latest report from United Microelectronics Corp (NYSE: UMC / TPE: 2303), which came in mixed, especially as it relates to the outlook for FY2024.

- UMC was less optimistic about the outlook than others, which is noteworthy in light of all the fab capacity being added everywhere.

- The charts seem to have a few things to say, which could provide clues as to how shareholders should position themselves at this time.

- Holding on to UMC is still worth pursuing, especially with a generous dividend in store, but to be a buyer is likely not a wise move.

🇰🇷 Kangwon Land 4Q profit US$59mln, rev down 13pct q-o-q (GGRAsia)

- Kangwon Land (KRX: 035250), operator of Kangwon Land, a South Korean resort with the only casino in the country allowed to accept local players, saw fourth-quarter net income attributable to owners of the company increase 5.2 percent quarter-on-quarter. [See our tear sheet: Kangwon Land (KRX: 035250): Shares Are Still Down Despite a Mass Gaming Revenue Recovery]

- The volume of visits to the Kangwon Land casino in the quarter to December 31 was 569,957, a 11.3-percent decrease from the preceding quarter. The great majority of the visits were by South Koreans.

- For full-year 2023, Kangwon Land Inc’s net income attributable to its owners stood at KRW345.15 billion, up 198.5 percent from 2022, on sales that grew by 9.3 percent year-on-year, to just under KRW1.39 trillion.

🇰🇷 SK Innovation: Announces Share Cancellation of Nearly 4.92 Million Shares (Smartkarma) $

- On 5 February, SK Innovation (KRX: 096770) announced a large-scale shares cancellation of 4.92 million shares, representing 4.9% of outstanding shares.

- This is the first ever large scale shares cancellation for SK Innovation since it was first established in 2011.

- All in all, despite the company’s disappointing results in 2023, the large scale share cancellation should help to support SK Innovation’s share price in the coming weeks.

🇵🇭 PLDT Inc. Struggling To Get Traction (Seeking Alpha) $

- Inflation in the Philippines has improved significantly, which is positive for PLDT (NYSE: PHI)‘s profitability.

- The company is struggling with declining volumes and stagnant average revenue per user (ARPU), impacting its core business.

- My updated DCF, taking into account the ongoing struggles in the core business and possible scenarios for new business growth, sets a price target of $17—a 27% downside from current.

- The dividend is also at a high risk of being cut.

🇸🇬 Keppel Ltd Chalks Up a Record-High Profit of S$4.1 Billion and Increases Dividends to S$0.34: 5 Highlights from the Asset Manager’s 2023 Earnings (The Smart Investor)

- The blue-chip asset manager is going from strength to strength as it pushes on with its asset-light strategy.

- Here are five salient highlights from Keppel Corp (SGX: BN4 / FRA: KEP1 / OTCMKTS: KPELY / KPELF)’s latest earnings report.

- A blowout set of earnings

- All three segments were profitable

- Growing its base of recurring income

- Building its infrastructure platform to grow FUM

- Surpassed its monetisation target

🇸🇬 DBS Reports Record 2023 Profit, Ups Quarterly Dividend to S$0.54 and Proposes a Bonus Issue: 5 Highlights from the Bank’s Latest Earnings (The Smart Investor)

- Singapore’s largest bank [DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF)] is returning more capital to shareholders through a dividend increase and bonus issue.

- Here are five highlights from the bank’s latest earnings report.

- A record net profit

- A slight decline in NIM with flat loan book

- Healthy growth in fee income

- Corporate social responsibility and accountability for digital disruptions

- An increase in dividends along with a bonus issue

🇸🇬 CICT Reports a 1.7% Increase in DPU for 2023: 5 Highlights from the Retail and Commercial REIT’s Latest Earnings (The Smart Investor)

- The diversified REIT [CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF)] announced a robust set of earnings and has more asset enhancement initiatives planned for its portfolio.

- Here are five highlights from the diversified REIT’s latest earnings that investors should pay attention to.

- A solid financial report accompanied by a higher portfolio valuation

- Resilient operating metrics with a diversified tenant base

- An improvement in debt metrics

- Healthy leasing activity and retention rates

- More AEIs planned

🇹🇭 Asian Dividend Gems: Regional Container Line (RCL) (Asian Dividend Stocks) $

- Regional Container Line (BKK: RCL / RCL-F) is the largest container shipping company in Thailand. It has attractive valuations, strong balance sheet, and has a major tailwind of higher global shipping freight rates.

- RCL’s dividend yield averaged 9.6% from 2019 to 2022. The biggest factor driving higher shipping freight rates in 2024 has been the Suez crisis resulting from Houthi drone attacks.

🇮🇳 MakeMyTrip: Sales Growth Remains Impressive, But Watching Customer Inducement Costs (Seeking Alpha) $

- Makemytrip (NASDAQ: MMYT) has the potential for further growth going forward.

- Q3 2024 earnings showed impressive revenue growth and a rise in overall revenue on a year-on-year basis.

- Gross bookings are up, and liquidity remains strong, but the rising P/E ratio indicates that price is outpacing earnings growth.

- I will be monitoring customer inducement growth across the Hotels and Packages segment more closely heading into the next quarter.

🇦🇪 Yalla Group: High Uncertainty Despite Strong Balance Sheet (Seeking Alpha) $

- Yalla Group (NYSE: YALA) aspired to be the “Clubhouse of MENA”. It operates the voice-based group chat platform Yalla and the gaming app Yalla Ludo.

- YALA’s share price has been trading sideways since its peak in February 2021. Balance sheet and profitability are strong, but overall growth prospects are unclear.

- Heightened competition, past red flags, and elevated risk profile due to the gaming business making YALA too risky despite my 15% upside projection, in my view.

🇿🇦 Ex-Invesco fund manager acquires stake in diversified South African industrial group (Capital Markets Africa)

- A former Invesco portfolio manager has acquired a beneficial interest in Argent Industrial (JSE: ART / OTCMKTS: AILTF), a JSE-listed South African steel manufacturer and trader. According to a SENS update from the Johannesburg Stock Exchange, Jason Holzer now owns 5.09% of Argent Industrial’s total issued ordinary share capital.

- Argent Industrial, the holding company, sells and trades manufactured steel and steel-related products such as metal gates, railings, and shutters. It owns over 20 vertically-integrated subsidiaries in South Africa, the UK, and the US while it sends exports to over 35 countries globally. The Argent group of companies also includes a number of jet refuelling and fuel storage businesses.

🌍 Listed African banks: Results this week (Capital Markets Africa)

Note: I think this piece was only emailed.

- EGYPT – Commercial International Bank, Egypt (COMI: EGX), expected to report its 2023 Full-Year results.

- NIGERIA – Infinity Trust Mortgage Bank Plc (INFINITY: NSE), expected to report its 2023 Full-Year results.

- ZAMBIA – Zambia National Commercial Bank Plc (ZANACO: LUSE), expected to report its 2023 Full-Year results.

- CÔTE D’IVOIRE – Société Générale Côte d’Ivoire (SGBC: BVRM), expected to report its Q4 2023 results.

🇧🇷 BB Seguridade: Q4 Earnings, Slowdown Ahead, Still An Attractive Income Stock (Seeking Alpha) $

- BB Seguridade (BVMF: BBSE3 / OTCMKTS: BBSEY) [holds equity investments in insurance, pension plans, premium bonds and dental care plan companies, as well as in the brokerage business] showed robust profit growth in Q4 2023 despite modest guidance, reflecting potential interest rate declines in Brazil.

- Key performance drivers include Brazil’s interest rate environment, economic growth, and inflation, supporting strong profitability and dividend payouts.

- Despite the projected slowdown, BB Seguridade remains attractive, maintaining its status as a robust income stock with generous dividends, expected to range from 80% to 90% payout.

- Valuation analysis suggests BB Seguridade’s stock may be undervalued, presenting significant upside potential for investors.

🇧🇷 StoneCo: I Was Wrong About This High-Growth Brazilian Fintech Leader (Rating Upgrade) (Seeking Alpha) $

- StoneCo Ltd (NASDAQ: STNE) stock has significantly outperformed the S&P 500 since my November update, prompting a reassessment of its bullish momentum.

- The inflation dynamics in Brazil have provided more clarity for investors, benefiting battered growth plays like STNE.

- StoneCo’s B2B fintech business model and growth prospects make it an attractive investment despite competitive risks and potential interest rate cuts.

- I gleaned that bullish sentiments on STNE have remained solid, suggesting investors are holding on to their positions confidently.

- Despite the possibility of a welcomed pullback, I explain why I was wrong about my caution in STNE.

🇧🇷 Banco Bradesco: Q4 Earnings, Ugly With Prolonged Recovery Ahead (Seeking Alpha) $

- Banco Bradesco (NYSE: BBD) reported poor Q4 results, with a significant decline in net income and a contraction in client margin.

- The bank acknowledged the need for structural changes and presented a strategic plan to restore profitability.

- Despite the discouraging results, there is optimism that the worst is behind Bradesco, but caution is advised during the strategic restructuring process.

- Bradesco’s current trading below 1x its P/B ratio reflects market pessimism, exacerbated by shares trading below $3.

🇧🇷 Itaú Unibanco’s Q4 Earnings: Consistent Quarter And Constructive Guidance (Seeking Alpha) $

- Itaú Unibanco (NYSE: ITUB)‘s Q4 earnings showcased consistent net profit growth, robust ROE, and controlled delinquencies, although loan portfolio growth remained a challenge.

- The bank announced an extraordinary dividend, raising the payout to 60%, with indications of maintaining this ratio until 2024.

- Guidance for 2024 includes anticipated improvements in credit costs and profitability, supporting expectations of higher dividends and continued growth.

- Itaú Unibanco maintains a premium valuation compared to peers, justified by its leading position in efficiency, loan portfolio size, low delinquency rates, and strong capital resilience.

🇧🇷 Natura: Strategic Confusion And Subpar Execution (Smartkarma) $

- The beauty industry is experiencing significant growth and has strong demand resiliency and pricing power.

- Natura & Co Holding (NYSE: NTCO) has repositioned itself in the masstige/low prestige segment, but lost strategic drive.

- Natura’s strategic direction and integration of Avon have been challenging, making it a less favorable investment option.

🇧🇷 GOL – Ramifications of GOL’s Chapter 11 Filing (Smartkarma) $

- Gol Linhas Aereas Inteligentes Sa (NYSE: GOL / BVMF: GOLL4) recently filed for CH11 bankruptcy protection as it was due to run out of readily available cash in mid-February. We assess the ramifications.

- We highlight that GOL may need to reduce aircraft ownership/financing costs by a third to achieve PBT margins of 5%+; difficult in a strong aircraft leasing market.

- We see the risk GOL loses scale. However, long-term, an increasingly competitive GOL is good for its parent Abra Group, and sister company Avianca.

🇧🇷 Gerdau: Infrastructure Spending Could Fuel Growth In Face Of Cheap Chinese Steel (Seeking Alpha) $

- Metalurgica Gerdau SA Preference Shares (BVMF: GOAU4 / GOAU3) faces short-term challenges due to cheap Chinese steel exports but should benefit from significant infrastructure spending in the US and Brazil.

- GGB has significant exposure to the US market, which accounts for more than half its gross profits and should offset the impacts of Chinese steel exported to Brazil.

- Gerdau has a strong balance sheet and is well-capitalized to ride out these challenges and then benefit from the increased government spending in its key markets.

🇨🇱 Compania Cervecerias Unidas: Strong Company Suffering From External Headwinds (Seeking Alpha) $

- Compañía Cervecerías Unidas Sa (NYSE: CCU) is a Chilean beverage company with a strong market position in Chile and other South American countries.

- CCU’s financial performance has been impacted by external factors, but it is working towards reaching pre-COVID profitability levels.

- The stock could potentially trade 25% higher if external headwinds normalize.

🇨🇱 Embotelladora Andina: A Value Proposition (Seeking Alpha) $

- Embotelladora Andina Sa (NYSE: AKO.A / AKO.B) distributes Coca-Cola trademark beverages in South American countries. It is a market leader with a dominant position in the countries it operates in.

- The company has a high dividend yield of 6.68% and is rated favorably by credit agencies.

- AKO.A pays a safe and sustainable dividend every year.

- It is considered cheap and offers a potential 75% upside from the current price of $11.64.

- There are headwinds, but the company has weathered the worst in the past 20 years, remained profitable, and continued to pay dividends regardless.

🇨🇴 🇨🇦 Parex Resources – All weather oil stock with a great track record and a strong yield (Calvin’s thoughts) $

- A recent sell off represents a rare opportunity to own Parex Resources (TSE: PXT / FRA: QPX / OTCMKTS: PARXF) at very high capital yields

- It’s not often you get the chance to buy a world class compounder with a superbly clean balance sheet at under 4x earnings and a 14% 2024 capital yield at $75/bbl, with an estimated 17% annual average capital yield over the next 3 years. Due to a recent sell off, that’s exactly what we’ve got in Parex Resources, a Canada listed, Colombian operated E&P that as of today has a $1.7B USD market cap.

🇲🇽 Aeromexico – International Strength Accelerating Progress but Delta JCA Termination a Speed Bump (Smartkarma) $

- We raise our forecasts to reflect the strength of International revenue at Grupo Aeroméxico (BMV: AEROMEX.MX) – we expect it to beat 2023 EBITDAR targets by 26%

- Aeromexico has been outperforming domestic competitors Volaris (NYSE: VLRS), Viva Aerobus due to international unit revenue gains – their forced capacity cuts due to GTF issues should help Aeromexico manage 2024 margins

- Fitting with the global theme of consolidation difficulties, the US has ruled the Delta/Aeromexico JV must terminate – this could be a double digit % risk to PBT

🇵🇦 Copa Holdings – A Slow-Growth Year in 2024 – Impressive Gain on Pre-Pandemic Economics Sustainable? (Smartkarma) $

- Copa Holdings (NYSE: CPA)’s 2023 EBITDAR of $1,117m was achieved while growing unit revenues, while capacity expanded 13% with a 17% unit fuel cost tailwind. Not an easy feat.

- In 2024, we expect only 5% EBITDAR growth on 10% capacity growth as unit revenues decline (following the emergence of this theme in 2H23) and EBITDAR-level unit costs grow.

- We model Copa’s EBITDAR/ASM premium to 2019 down to a still-impressive 35% in 2024 but new route selection and efficiency will need to be strong to sustain these economics.

📰🔬 Further Suggested Reading

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 China to export deflation to the world as economy stumbles (FT) $ 🗃️

- Prices of products shipped overseas have been falling at the fastest rate since 2008 crisis

🇨🇳 China’s consumers tighten belts even as prices fall (FT) $ 🗃️

- Shoppers hold back as gloom persists about world’s second-largest economy

🇨🇳 The risks of US-China decoupling (FT) $ 🗃️

- High-end semiconductors is an area where US companies remain dominant, but the evidence is pointing towards Chinese acceleration

🇨🇳 China’s software service providers bet on AI amid funding chill (Caixin) $

- The Chinese software service industry is heading into a capital winter as the buzz of the late 2010s and flood of investment have yet to generate any headline-grabbing success stories. But as downtrodden investors pull back from much of the sector, one niche is still attracting capital: software as a service (SaaS) combined with artificial intelligence (AI).

- Embedding software tools with AI technology is allowing some firms to offer better standardized products and cut back on development costs, potentially serving as a last resort for startups trying to secure backing from the sector’s core venture capital (VC) funds.

🇨🇳 China’s software service providers cut costs, prices as investors pull back (Caixin) $

- China’s cloud software vendors are feeling the brunt of the sharpest drop in venture capital (VC) investment in the sector in a decade, with many rushing to cut prices or costs to tide them over.

- The country’s current 13 software as a service (SaaS) unicorns — startups valued at more than $1 billion — raised just 495 million yuan ($69 million) from investors last year, the lowest amount since 2014, according to ITjuzi, a domestic provider of data on tech companies and investments, based on announced deals. The amount pales in comparison to the peak of 9.3 billion yuan they raised in 2021, when the Covid pandemic boosted demand for digital services.

🇨🇳 Are Chinese stocks a value trade or a value trap? (FT) $ 🗃️

- When an asset is declared ‘uninvestable’ it is often time to buy

🇨🇳 Chinese stock brokerages reports strong 2023 profits despite market slump (Caixin) $

- Despite China’s stock market rout, most of the listed stock brokerages reported increased earnings last year, boosted by investment gains and growth in investment banking business.

- Among the 21 listed brokerages that have posted results or estimates for 2023, 17 companies said their profits increased from the previous year.

🇨🇳 China’s star fund manager under investigation, sources say (Caixin) $ & Star Chinese fund manager Wang Yawei no longer involved in daily management of Qianhe Capital (SCMP)

- Wang Yawei, one of China’s most prominent fund managers and founder of Qianhe Capital Management Co. Ltd., is facing investigation for violations including insider trading, sources with knowledge told Caixin.

- Wang has stepped back from Qianhe’s daily operations due to personal reasons, the private fund manager said in a Saturday statement. Without elaboration, Qianhe said its management team will ensure normal operations of the firm, and it has ample liquidity. The company has almost completed a redemption of funds, it said.

🇭🇰 Hong Kong’s death has been exaggerated (Asian Century Stocks)

Table of contents

1. The opportunity set

2. Timeline of the current bear market

3. Hong Kong remains the centre of Asia

4. Hong Kong’s economy is recovering

5. Potential risks for Hong Kong

6. Hong Kong domestic small caps remain cheap

7. Ten highlighted stocks

8. Conclusion🇨🇳🌏 Profit-flush China pharma firms cast eyes south (The Asset)

- In 2023, a total of 35 biomedical companies terminated their initial public offerings on China’s stock exchanges, reflecting various challenges within the domestic market, among them, intensive competition, poor business performance, uncertain prospects, high customer concentration and soaring costs.

- Southeast Asia – with approximately 680 million people, equivalent to half of China’s population, and a 7% ageing population – presents a substantial market opportunity. The current development of the Southeast Asian pharmaceutical market is often likened to that of China’s in the early 2000s, suggesting a market size of at least US$200 billion.

- In addition to construction, the wider Southeast Asian population tends to favour affordable generic drugs over expensive innovative medications, posing another significant challenge for pharmaceutical firms aiming to make inroads in the region.

🇹🇼 Taiwan set to allow active ETFs into booming retail market (FT) $ 🗃️

- Exchanged traded fund assets under management soared more than 60% last year

🌏 Asian investors return to fixed income funds (The Asset) 🗃️

- Equity allocations see modest gains, passive funds back in fashion, while ESG strategies suffer setback

🌐 Global fintech investment drops to six-year low (The Asset) 🗃️

- Asia-Pacific hit hard, while payments, proptech, ESG defy trend in challenging year

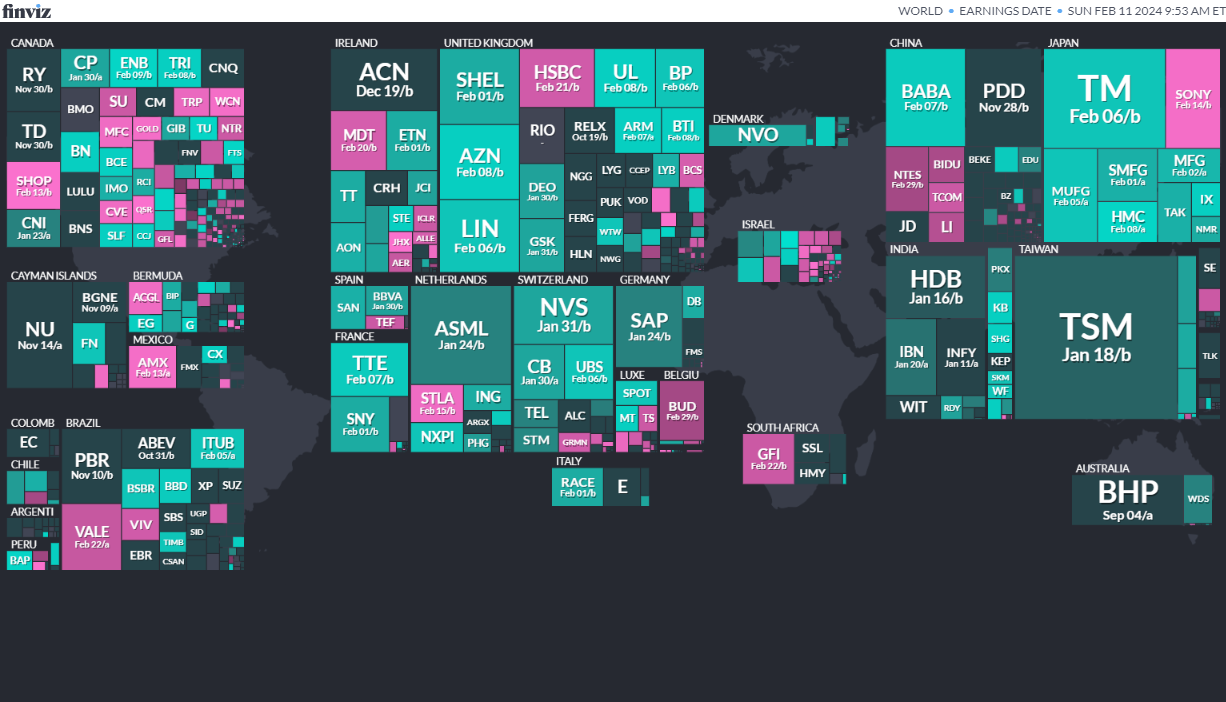

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

PakistanPakistani National AssemblyFeb 8, 2024 (d) Confirmed Jul 25, 2018- Indonesia Indonesian Regional Representative Council Feb 14, 2024 (t) Confirmed Apr 17, 2019

- Indonesia Indonesian Presidency Feb 14, 2024 (t) Confirmed Apr 17, 2019

- Indonesia Indonesian House of Representatives Feb 14, 2024 (t) Confirmed Apr 17, 2019

- Russian Federation Russian Presidency Mar 17, 2024 (t) Confirmed Mar 18, 2018

- South Korea South Korean National Assembly Apr 10, 2024 (d) Confirmed Apr 15, 2020

- India Indian People’s Assembly Apr 30, 2024 (t) Date not confirmed Apr 11, 2019

- Panama Panamanian National Assembly May 5, 2024 (t) Confirmed May 5, 2019

- Panama Panamanian Presidency May 5, 2024 (t) Confirmed May 5, 2019

- Venezuela Venezuela Presidency May 31, 2024 (t) Date not confirmed

- Mexico Mexican Senate Jun 2, 2024 (t) Date not confirmed Jul 1, 2018

- Mexico Mexican Chamber of Deputies Jun 2, 2024 (t) Date not confirmed Jun 6, 2021

- Mexico Mexican Presidency Jun 2, 2024 (t) Date not confirmed Jul 1, 2018

- Mongolia Mongolian State Great Hural Jun 28, 2024 (t) Tentative Jun 24, 2020

- Croatia Croatian Assembly Jun 30, 2024 (t) Date not confirmed Jul 5, 2020

- South Africa South African National Assembly Jun 30, 2024 (t) Date not confirmed May 8, 2019

- Sri Lanka Sri Lankan Presidency Sep 30, 2024 (t) Date not confirmed

- Czech Republic Czech Senate Sep 30, 2024 (t) Date not confirmed Sep 23, 2022

- Georgia Georgian Parliament Oct 26, 2024 (d) Confirmed Oct 31, 2020

- Uruguay Uruguayan Presidency Oct 27, 2024 (t) Date not confirmed

- Uruguay Uruguayan Chamber of Representatives Oct 27, 2024 (t) Date not confirmed

- Uruguay Uruguayan Chamber of Senators Oct 27, 2024 (t) Date not confirmed

- Georgia Georgian Presidency Nov 30, 2024 (t) Date not confirmed Nov 28, 2018

- Romania Romanian Presidency Nov 30, 2024 (t) Date not confirmed Nov 24, 2019

- Romania Romanian Chamber of Deputies Nov 30, 2024 (t) Date not confirmed Dec 6, 2020

- Romania Romanian Senate Nov 30, 2024 (t) Date not confirmed

- Namibia Namibian Presidency Nov 30, 2024 (t) Date not confirmed Nov 27, 2019

- Namibia Namibian National Assembly Nov 30, 2024 (t) Date not confirmed Nov 27, 2019

- Uzbekistan Uzbekistani Legislative Chamber Dec 31, 2024 (t) Tentative Dec 22, 2019

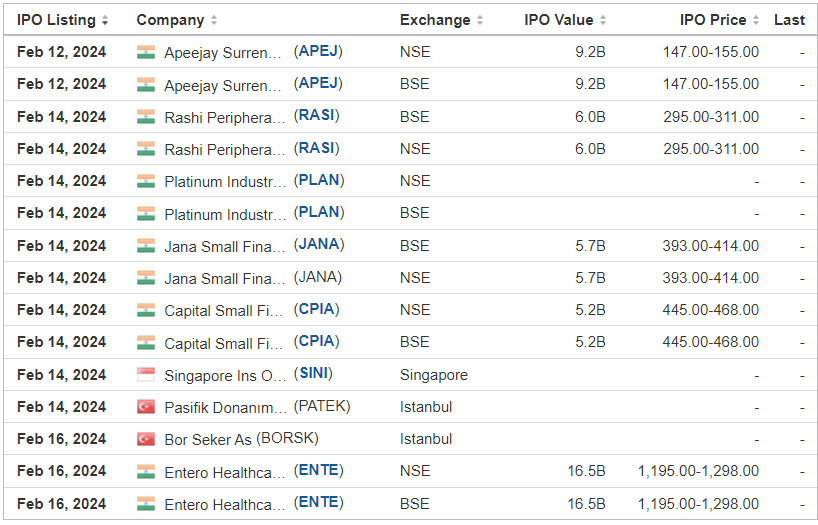

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

BioLingus (Cayman) Ltd. SUBL, Univest Securities, 0.4M Shares, $20.00-20.00, $7.2 mil, 2/12/2024 Week of

We are an exempted company with limited liability incorporated under the laws of the Cayman Islands, whose principal place of business is in Switzerland. As a holding company with no operations, we conduct all of our operations through our subsidiaries in Switzerland and to a lesser extent, Hong Kong SAR (“HK SAR”), the People’s Republic of China (“PRC”) and Australia. (Incorporated in the Cayman Islands)

We are a biotechnology company spearheading the development of oral (specifically, sublingual) delivery of peptides and proteins.

Many of the more effective drugs to treat diabetes and obesity are “biologics”, the vast majority of which currently have to be injected. For example, although insulin was discovered almost 100 years ago, there has, to date, not been any commercially viable solution to administer insulin without the need for injection.

Consistent with this, the delivery of peptides or proteins, such as insulin, in a non-invasive way (i.e. without needles or injections) is a very challenging endeavor from a scientific and technical perspective.

Since our inception, we have focused on developing an alternative approach, known as sublingual delivery. The sublingual area lies under the tongue and is lined by a thin layer of cells which has a rich supply of blood vessels. Sublingual delivery has been successfully used commercially for many years to deliver a variety of so-called small molecule drugs, such as glyceryl trinitrate and ondansetron, which can readily penetrate this layer of cells to rapidly enter the blood stream. We hypothesized that we could similarly exploit the unique nature of the sublingual area to effectively deliver peptides and proteins, and this subsequently became the focus of our research. The main peptide used to improve the technology was exenatide, which was the first commercial glucagon-like peptide (GLP-1) receptor protein product and is routinely used to treat type 2 diabetes.

During our first series of studies with exenatide, the sublingual dose required was almost 200 times the injectable dose to achieve a similar effect. After 2 to 3 years of extensive development, we were able to reduce this ratio to 5 to 10, and we now have a “platform” of formulations (the “BioLingus Platform”) and expertise on how formulations should be designed for better performance.

During the course of our research and testing of various peptides and proteins across several different disease indications, it has become clear to us that there are two areas for our technology with significant commercial potential: (1) Metabolic disease, in particular, diabetes and obesity and related metabolic disorders such as NASH (nonalcoholic steatohepatitis) and (2) Immunology (mainly allergy and auto-immune disorders)

Our lead product candidate, Liraglutide Sublingual, being evaluated in a Phase Ib and Phase IIa together. The phase Ib/IIa is a “dose-finding study”: the goal is – as the name says – to find an optimal dose range in humans; this is a relatively short study, which lasts 6-9 months. The trial begun in late April 2023, when the first patient was successfully enrolled and dosed, and is taking place at the Clinical Trials Centre of the Chinese University of Hong Kong. In total, 15 patients will be enrolled in the trial, which is being conducted as a single ascending dose study of sublingual liraglutide in patients with type 2 diabetes, with the main endpoints related to safety, tolerability and preliminary efficacy. As of May 29, 2023, 1 of 15 patients had been enrolled.

*Note: Net loss is for the fiscal year that ended April 30, 2023. The company has no product revenues.

(Note: BioLingus filed an F-1/A dated Nov. 9, 2023, in which it cut its IPO’s size to 360,000 shares – down sharply from 3.0 million shares initially – and raised its assumed IPO price to $20.00 – up from its initial price range of $15.00 to $16.00 – to raise $7.2 million. Background: BioLingus filed its F-1 on June 30, 2023, and disclosed terms for its IPO: 3.0 million shares at $15.00 to $16.00 to raise $47.0 million.)

Neo-Concept International Group Holdings Limited NCI, Revere Securities, 2.3M Shares, $4.00-5.00, $10.4 mil, 2/12/2024 Week of

We are a holding company, incorporated in the Cayman Islands. We conduct our business through our operating subsidiaries in Hong Kong and the U.K.

NCI is a one-stop apparel solution services provider. We offer a full suite of services in the apparel supply chain, including market trend analysis, product design and development, raw material sourcing, production and quality control, and logistics management serving customers located in the European and North American markets through Neo-Concept HK.

(Note: Neo-Concept International Group Holdings Limited increased its IPO’s size to 2.32 million shares – up from 2.0 million shares originally – and kept the price range at $4.00 to $5.00 – to raise $10.44 million, according to an F-1/! filing dated Jan. 17, 2024. Background: Neo-Concept International Group Holdings Limited disclosed terms for its IPO in an F-1/A filed Nov. 1, 2023: 2.0 million shares at $4.00 to $5.00 to raise $9.0 million.)

Wetouch Technology WETH, WestPark Capital/Craft Capital/R.F. Lafferty & Co./ Orientert., 4.0M Shares, $5.00-7.00, $24.0 mil, 2/15/2024 Thursday

(Note: This is NOT an IPO. This is a NASDAQ uplisting from the OTCQB market.)

WeTouch Technology makes and sells large-format touchscreens used in the financial, automotive, POS (point-of-sale), gaming, lottery, medical and other specialized industries. The company sells its touchscreens in the People’s Republic of China and internationally. (Incorporated in Nevada)

**Note: Net income and revenue figures are in U.S. dollars for the 12 months that ended Sept. 30, 2023.

(WeTouch Technology filed an S-1/A dated Nov. 17, 2023, in which it cut the price of its NASDAQ uplisting to a range of $5.00 to $7.00 – down from an assumed public offering price of US$11.20 – and kept the number of shares at 4.0 million – to raise $24.0 million. In that Nov. 17, 2023, filing with the SEC, WeTouch Technology updated its financial statements for the nine-month period through Sept. 30, 2023. Background: WeTouch Technology disclosed terms for its NASDAQ uplisting/public offering in an S-1/A filing dated Sept. 22, 2023: 4.0 million ordinary shares at an assumed public offering price of US$11.20 to raise $44.8 million. A 1-for-20 reverse stock split became effective on Sept. 12, 2023, according to the prospectus.)

(Background: WeTouch Technology resurrected its plans for a public offering/NASDAQ uplisting in an S-1 filing dated March 21, 2023. In a letter dated March 8, 2023, the SEC deemed that Wetouch Technology’s previous IPO was abandoned; that previous IPO filing began with an S-1 in September 2021.)

Ryde Group Ltd. RYDE, Maxim Group, 3.0M Shares, $4.00-5.00, $13.5 mil, 2/20/2024 Week of

We are a Singapore-based ride-hailing app. (Incorporated in the Cayman Islands)

Our vision is to become a “Super mobility app” where multiple mobility tools can be accessed and function seamlessly out of a single app, offering ultimate convenience and reliability for our customers. We currently operate in Singapore, with our core businesses in the following segments: (i) mobility, where we provide on-demand and scheduled carpooling and ride-hailing services, matching riders to our driver partners; and (ii) quick commerce, where we provide on-demand, scheduled, and multi-stop parcel delivery services.

Our mobility business segment includes carpooling and ride-hailing.

Carpooling refers to services that connect riders with driver partners who provide rides in a variety of vehicles, such as cars of different seating capacities. Carpooling is about sharing rides and is provided via our RydePOOL service in our mobile app. We launched carpooling through our RydePOOL service in Singapore. RydePOOL allows real-time, on-demand bookings as well as advance bookings via our Schedule Pickup function, and only allows seating capacity for one rider per request, while riders may have to share their ride with other riders.

Ride-hailing refers to services that connect riders with private-hire or taxi drivers, with the rider having the option to choose the type of ride from a variety of vehicles, such as cars of different seating capacities and make. We started off with only carpooling services, but ride-hailing services was a natural adjacency for us as we have the technology and the platform to enable it. Our ride-hailing services allow riders to determine the number of seats they require for the trip, and offers real-time, on-demand bookings as well as advance bookings and multi-stop options. We started to grow our offerings in this space and currently have the following different service offerings: RydeX, RydeXL, RydeLUXE, RydeFLASH, RydePET, RydeHIRE, and RydeTAXI services.

Quick Commerce is a package delivery booking service, which enables driver partners to accept bookings for package delivery services through our driver partner app. Our partners that fulfill deliveries range from driver partners, to motorcyclists and walkers as well. Consumers can arrange for instant deliveries and cater for different package sizes. E-commerce businesses, Food and Beverage businesses and social sellers can utilise our last mile delivery services to their customers as an option as well. We provide our quick commerce service through our RydeSEND offering, which comprises of real-time on-demand, scheduled, and multi-stop parcel delivery services.

Acquisition of Meili

On February 20, 2023, we completed the purchase of Meili Technologies Pte. Ltd. (“Meili”), a last-mile on-demand logistics service provider in Singapore, where we purchased the entire issued and paid-up share capital of Meili for a purchase consideration of S$450,000 which shall be satisfied through the issuance of exchangeable notes to the shareholders of Meili in an amount equal to the proportion of the purchase consideration (“Meili Acquisition”). The Meili Acquisition enables us to expand our business into the quick commerce industry, thereby increasing our revenue streams, acquire a new consumer and driver partner’s base as well as improve our operational efficiency. By leveraging on the existing technology and operational infrastructure of Meili, our operational costs have reduced. We believe that the Meili Acquisition helps us to stay competitive in the quick commerce market and potentially grow our business.

*Note: Net loss and revenue figures are in U.S. dollars for the 12 months that ended June 30, 2023.

(Note: Ryde Group Ltd. increased the size of its micro-cap IPO in an F-1/A filing dated Jan. 18, 2024, to 3.0 million shares – up from 2.25 million shares originally – and kept the price range the same at $4.00 to $5.00 to raise $13.5 million. Background: Ryde Group Ltd. disclosed terms for its IPO in an F-1/A filing dated Oct. 2, 2023: 2.25 million Class A ordinary shares at a price range of $4.00 to $5.00 to raise $10.13 million. Background: Ryde Group Ltd. filed its F-1 on Aug. 31, 2023, without disclosing terms for its IPO. The company submitted confidential IPO documents to the SEC in May 2023.)

CDT Environmental Technology Investment Holdings Limited CDTG, WestPark Capital, 2.0M Shares, $4.00-5.00, $9.0 mil, 2/26/2024 Week of

We are a waste treatment company that generates revenue through design, development, manufacture, sales, installation, operation and maintenance of sewage treatment systems and by providing sewage treatment services. We primarily engage in two business lines: sewage treatment systems and sewage treatment services in both urban and rural areas. Sewage treatment systems are sometimes also referred to herein as rural sewage treatment, and sewage treatment services are sometimes also referred to herein as septic tank treatment.

For sewage treatment systems, we sell complete sewage treatment systems, construct rural sewage treatment plants, install the systems, and provide on-going operation and maintenance services for such systems and plants in China for municipalities and enterprise clients. We provide decentralized rural sewage treatment services with our integrated and proprietary system using our advanced quick separation technology. Our quick separation technology uses a biochemical process for economically and sufficiently treating rural sewage. In addition, our integrated equipment generally has a lifespan of over 10 years without replacement of the core components. Due to our quick separation technology and our technological expertise and experience, our integrated rural sewage treatment system produces a high quality of outflowing water, with high degrees of automation, efficient construction and start up, and low operational costs. In addition, our equipment is typically able to process abrupt increases of sewage inflows and high contamination. Our integrated equipment consists of a compact structure and is buried underground in order to minimize changes to the surrounding environment.

**Note: Net income and revenue figures are in U.S. dollars for the 12 months that ended June 30, 2023.

(Note: CDT Environmental Technology Investment Holding Limited updated its financial statements for the six-month period that ended June 30, 2023, in an F-1/A filing dated Nov. 20, 2023.)

(Note: CDT Environmental Technology Investment Holding Limited cut its IPO’s size by about 35 percent to 2.0 million shares – down from 3.07 million shares – and increased the price to a range of $4.00 to $5.00 – up from an assumed IPO price of $4.00 – to raise $9.0 million, according to an F-1/A filing dated March 27, 2023. CDT Environmental Technology Investment Holdings Limited updated its financial statements in an F-1/A dated Feb. 24, 2023. The company changed its sole book-runner to WestPark Capital from ViewTrade Securities in an F-1/A filing in June 2021. The F-1 was filed on Jan. 15, 2021. The company submitted confidential IPO documents to the SEC on Nov. 15, 2019.)

Intelligent Group Limited INTJ, WestPark Capital, 2.0M Shares, $4.00-5.00, $9.0 mil, 3/4/2024 Week of

(Incorporated in the British Virgin Islands)

We are a professional services provider in Hong Kong that engages in the business of providing Financial PR services. Our Financial PR services include arranging press conferences and interviews, participating in the preparation of news releases and shareholders’ meetings, monitoring news publications, identifying shareholders, targeting potential investors, organizing corporate events, and implementing crisis management policies and procedures.

We aim to build an effective channel for the exchange of information between the public, investors and our clients. We provide information about our clients to the public and investors in a manner designed to enable them to understand our clients’ operations more easily. We also provide training to our clients so as to allow them to understand public relations tactics and practice. The objective is to create a positive market image of our clients to the public.

Our Industry

Hong Kong, which occupies a unique geographic position, continues to achieve remarkable expansion in its role as a regional financial leader. As one of the financial centers in the Asia-Pacific region, Hong Kong attracts a number of public relations firms to provide services in Hong Kong, mainly in Financial PR, corporate public relations and consumer marketing services. According to the website of the HK Stock Exchange — Annual Market Statistics (As of December 30, 2022) (source: https://www.hkex.com.hk/-/media/HKEX-Market/Market-Data/Statistics/Consolidated-Reports/Annual-Market-Statistics/e_2022-Market-Statistics.pdf and https://www.hkex.com.hk/-/media/HKEX-Market/Market-Data/Statistics/Consolidated-Reports/Annual-Market-Statistics/2021-Market-Statistics_e.pdf), Hong Kong has ranked number four and four in the world in 2021 and 2022, respectively, in terms of the amount of funds raised through IPOs. According to the market statistics published by the HK Stock Exchange, the total funds raised through IPOs on the HK Stock Exchange in 2021 and 2022 were approximately HK$328.9 billion and HK$99.1 billion, respectively. The total post-IPO funds raised by listed companies on the HK Stock Exchange in 2022 amounted to HK$147.3 billion and, together with funds raised by IPOs, the total funds raised on the Main Board (“Main Board”) and GEM Board of the Hong Kong Stock Exchange, amounted to approximately HK$251.9 billion. Despite the decrease in the total funds raised in 2022 due to the impact of resurgences of the COVID-19 outbreak, the capital market and fund-raising activities are expected to rebound in 2023.The demand for Financial PR services is expected to correlatively rebound.

Competitive Strengths

We believe the following competitive strengths differentiate us from our competitors:

• We provide comprehensive Financial PR services to our clients;

• We provide extensive coverage in media monitoring and promotion services for our clients;

• We have a strong client base; and

• We have experienced and competent management and professional staff.

Our Strategy

We intend to pursue the following strategies to further expand our business:

• Further strengthening our Financial PR business in Hong Kong;

• Expanding our market presence in other international capital markets, in particular the U.S.; and

• Enhancing the automation and establishment of our virtual Financial PR services.

(Intelligent Group Limited filed an F-1/A dated Nov. 21, 2023. The terms of its IPO: 2 million ordinary shares at $4.00 to $5.00 to raise $9.0 million. )

🏁 Emerging Market ETF Launches

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

- 11/07/2023 – Global X MSCI Emerging Markets Covered Call ETF EMCC – Equity, leverage

- 11/07/2023 – Avantis Emerging Markets Small Cap Equity ETF AVEE – Active, equity, small caps

- 09/22/2023 – Matthews Asia Dividend Active ETF ADVE – Active, equity, Asia

- 09/22/2023 – Matthews Pacific Tiger Active ETF ASIA – Active, equity, Asia

- 09/22/2023 – Matthews Emerging Markets Sustainable Future Active ETF EMSF – Active, equity, ESG

- 09/22/2023 – Matthews India Active ETF INDE – Active, equity, India

- 09/22/2023 – Matthews Japan Active ETF JPAN – Active, equity, Japan

- 09/22/2023 – Matthews Asia Dividend Active ETF ADVE – Active, equity, Asia

- 08/25/2023 – KraneShares Dynamic Emerging Markets Strategy ETF KEM – Active, equity, emerging markets

- 08/18/2023 – Global X India Active ETF NDIA – Active, equity, India

- 08/18/2023 – Global X Brazil Active ETF BRAZ – Active, equity, Brazil

- 07/17/2023 – Matthews Korea Active ETF MKOR – Active, equity, South Korea

- 05/18/2023 – Putnam Emerging Markets ex-China ETF PEMX – Active, value, growth stocks

- 05/11/2023 – JPMorgan BetaBuilders Emerging Markets Equity ETF BBEM – Passive, large + midcap stocks

- 03/16/2023 – JPMorgan Active China ETF JCHI – Active, equity, China

- 03/03/2023 – First Trust Bloomberg Emerging Market Democracies ETF EMDM – Principles-based

- 1/31/2023 – Strive Emerging Markets Ex-China ETF STX – Passive, equity, emerging markets

- 1/20/2023 – Putnam PanAgora ESG Emerging Markets Equity ETF PPEM – Active, equity, ESG, emerging markets

- 1/12/2023 – KraneShares China Internet and Covered Call Strategy ETF KLIP – Active, equity, China, options overlay, thematic

- 1/11/2023 – Matthews Emerging Markets ex China Active ETF MEMX – Active, equity, emerging markets

- 12/13/2022 – GraniteShares 1.75x Long BABA Daily ETF BABX – Active, equity, leveraged, single stock

- 12/13/2022 – Virtus Stone Harbor Emerging Markets High Yield Bond ETF VEMY – Active, fixed income, junk bond, emerging markets

- 9/22/2022 – WisdomTree Emerging Markets ex-China Fund XC – Passive, equity, emerging markets

- 9/15/2022 – KraneShares S&P Pan Asia Dividend Aristocrats Index ETF KDIV – Passive, equity, Asia, dividend strategy

- 9/15/2022 – OneAscent Emerging Markets ETF OAEM – Active, Equity, emerging markets, ESG

- 9/9/2022 – Emerge EMPWR Sustainable Select Growth Equity ETF EMGC – Active, equity, emerging markets

- 9/9/2022 – Emerge EMPWR Unified Sustainable Equity ETF EMPW – Active, equity, emerging markets

- 9/8/2022 – Emerge EMPWR Sustainable Emerging Markets Equity ETF EMCH – Active, equity, emerging markets, ESG

- 7/14/2022 – Matthews China Active ETF MCH – Active, equity, China

- 7/14/2022 – Matthews Emerging Markets Equity Active ETF MEM – Active, equity, emerging markets

- 7/14/2022 – Matthews Asia Innovators Active ETF MINV – Active, equity, Asia

- 6/30/2022 – BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF XEMD – Passive, fixed income, emerging markets

- 5/2/2022 – AXS Short CSI China Internet ETF SWEB – Active, inverse, thematic

- 4/27/2022 – Dimensional Emerging Markets High Profitability ETF DEHP – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Core Equity 2 ETF DFEM – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Value ETF DFEV – Active, equity, emerging markets

- 4/27/2022 – iShares Emergent Food and AgTech Multisector ETF IVEG – Passive, equity, thematic [Mostly developed markets]

- 4/21/2022 – FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM – Passive, equity, ESG

- 4/6/2022 – India Internet & Ecommerce ETF INQQ – Passive, equity, thematic

- 2/17/2022 – VanEck Digital India ETF DGIN – Passive, India market, thematic

- 2/17/2022 – Goldman Sachs Access Emerging Markets USD Bond ETF GEMD – Passive, fixed income, emerging markets

- 1/27/2022 – iShares MSCI China Multisector Tech ETF TCHI – Passive, China, technology

- 1/11/2022 – Simplify Emerging Markets PLUS Downside Convexity ETF EMGD – Active, equity, options strategy

- 1/11/2022 – SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG – Passive, equity, ESG

🚽 Emerging Market ETF Closures/Liquidations

Frontier and emerging market highlights:

- 11/11/2023 – Global X China Innovation ETF – KEJI

- 11/11/2023 – Global X Emerging Markets Internet & E-commerce ETF – EWEB

- 11/09/2023 – Franklin FTSE South Africa ETF – FLZA

- 10/27/2023 – Simplify Emerging Markets Equity PLUS Downside Convexity – EMGD

- 10/20/2023 – WisdomTree India ex-State-Owned Enterprises Fund – IXSE

- 10/20/2023 – WisdomTree Chinese Yuan Strategy Fund – CYB

- 10/20/2023 – Loncar China BioPharma ETF – CHNA

- 10/18/2023 – KraneShares Emerging Markets Healthcare Index ETF – KMED

- 10/18/2023 – KraneShares MSCI China ESG Leaders Index ETF – KSEG

- 10/18/2023 – KraneShares CICC China Leaders 100 Index ETF – KFYP

- 10/16/2023 – Strategy Shares Halt Climate Change ETF – NZRO

- 09/20/2023 – VanEck China Growth Leaders ETF – GLCN

- 08/28/2023 – Asian Growth Cubs ETF – CUBS

- 08/01/2023 – VanEck Russia ETF – RSX

- 07/07/2023 – Emerge EMPWR Sustainable Emerging Markets Equity ETF – EMCH

- 06/23/2023 – Invesco PureBeta FTSE Emerging Markets ETF – PBEE

- 06/16/2023 – AXS Short China Internet ETF – SWEB

- 04/11/2023 – SPDR Bloomberg SASB Emerging Markets ESG Select ETF – REMG

- 3/30/2023 – Invesco BLDRS Emerging Markets 50 ADR Index Fund – ADRE

- 3/30/2023 – Invesco BulletShares 2023 USD Emerging Markets Debt ETF – BSCE

- 3/30/2023 – Invesco BulletShares 2024 USD Emerging Markets Debt ETF – BSDE

- 3/30/2023 – Invesco RAFI Strategic Emerging Markets ETF – ISEM

- 2/17/2023 – Direxion Daily CSI 300 China A Share Bear 1X Shares – CHAD

- 1/13/2023 – First Trust Chindia ETF – FNI

- 12/28/2022 – Franklin FTSE Russia ETF – FLRU

- 12/22/2022 – VictoryShares Emerging Market High Div Volatility Wtd ETF CEY

- 8/22/2022 – iShares MSCI Argentina and Global Exposure ETF AGT

- 8/22/2022 – iShares MSCI Colombia ETFI COL

- 6/10/2022 – Infusive Compounding Global Equities ETF JOYY

- 5/3/2022 – ProShares Short Term USD Emerging Markets Bond ETF EMSH

- 4/7/2022 – DeltaShares S&P EM 100 & Managed Risk ETF DMRE

- 3/11/2022 – Direxion Daily Russia Bull 2X Shares RUSL

- 1/27/2022 – Legg Mason Global Infrastructure ETF INFR

- 1/14/2022 – Direxion Daily Latin America Bull 2X Shares LBJ

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (February 12, 2024) was also published on our Substack.

Emerging Markets Investing Tips + Advice

Emerging Market Skeptic (Website)

Website List Updates + Site Map

Stocktwits @EmergingMarketSkptc

Similar Posts:

- Emerging Market Links + The Week Ahead (February 20, 2023)

- TOP Financial Group (NASDAQ: TOP): Hong Kong’s Latest Crazy Meme Stock

- Emerging Market Links + The Week Ahead (January 16, 2023)

- Emerging Market Links + The Week Ahead (February 13, 2023)

- Emerging Market Links + The Week Ahead (January 23, 2023)

- China Internet Update (KraneShares)

- Emerging Market Links + The Week Ahead (May 29, 2023)

- Vietnamese Verses Chinese Retail Investors (AFC)

- Emerging Market Links + The Week Ahead (August 1, 2022)

- Emerging Market Links + The Week Ahead (October 10, 2022)

- Emerging Market Links + The Week Ahead (September 19, 2022)

- Yale University Added $100M to the Vanguard FTSE Emerging Markets ETF (VWO) in 1Q2014 (P&I)

- Emerging Market Links + The Week Ahead (February 27, 2023)

- Emerging Market Links + The Week Ahead (September 12, 2022)

- Emerging Market Links + The Week Ahead (February 6, 2023)