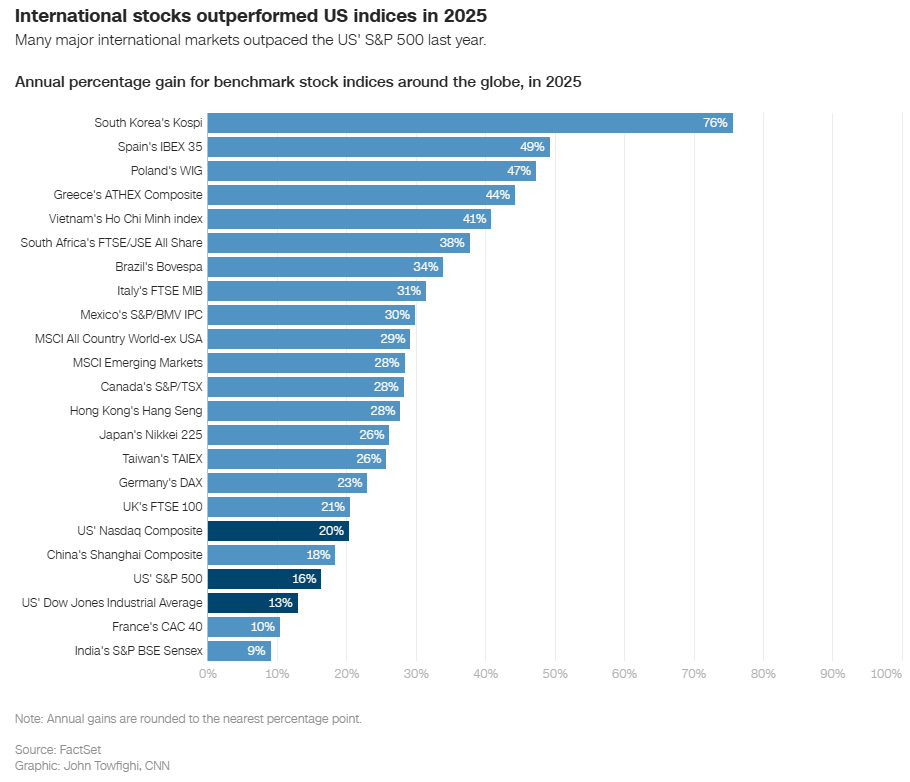

CNN has noted how the US stocks had a remarkable 2025, but international markets did much better as shown in this graphic that accompanied the article:

As a reminder, our Frontier & Emerging Market Stock Indices has 2,100+ stocks tagged to our posts plus additional stocks not tagged for a total of 3,006+ stocks to help you generate potential investment ideas depending on what your investment strategy is…

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- 🌐 EM Fund Stock Picks & Country Commentaries (January 4, 2026) Partially $

- Asia to outpace the US again in 2026, lessons from one of HK’s worse days, India’s aerospace & defense growth engines, uranium outlook, fintech’s relentless momentum, November/Q3 fund updates, etc.

- 🇨🇳 🇭🇰 China & Hong Kong Stock Picks (November-December 2025) Partially $

- 🇨🇳 China – December – JF SmartInvest Holdings Ltd, Zhongji Innolight Co Ltd, J&T Global Express, CGN Mining Co Ltd, Zoomlion Heavy Industry, Baozun, Weichai Power, Sany Heavy Industry & Meituan

- 🇨🇳 China – November – Zixin Group Holdings Ltd, Tongcheng Travel Holdings, Li Auto, Alibaba, NIO Inc, Yum China, China Sunsine Chemical Holdings, NetEase, CSPC Pharmaceutical Group, ZTO Express, Futu Holdings, Kuaishou Technology, Yangzijiang Shipbuilding Holdings, iQIYI, Xiaomi, Baidu, PDD Holdings, Trip.com, Kanzhun Ltd, Luckin Coffee, Zhejiang Leapmotor Technology Co Ltd, XPeng, Geely Automobile Holdings, Tencent, Bilibili, Sun Art Retail Group Ltd, Tencent Music Entertainment Group, Hesai Group, China Hongqiao Group, Ke Holdings, BeOne Medicines, Hua Hong Semiconductor, China Pacific Insurance, Luxshare Precision Industry, PICC Property and Casualty Co Ltd, BaTeLab Co Ltd, Haier Smart Home, BYD Electronic International Co Ltd, PetroChina, China Construction Bank, Industrial and Commercial Bank of China & China Life Insurance

- 🇭🇰 Hong Kong – DFI Retail Group Holdings, Luk Fook Holdings (International) Ltd, Far East Consortium International Ltd, CSI Properties Ltd, Vitasoy International Holdings, Tai Cheung Holdings, Hongkong Land Holdings Ltd, Link REIT, HKR International Ltd, Samsonite International SA, Galaxy Entertainment, Cathay Pacific Airways & Hong Kong Exchanges & Clearing

- CMB International Capital Corporation’s 20+ high conviction stock ideas – Geely Automobile Holdings, Zhejiang Leapmotor Technology Co Ltd, J&T Global Express, Sany Heavy Equipment International Holdings, Green Tea Group, Bosideng International Holdings, Guoquan Food Shanghai Co Ltd, Luckin Coffee, Proya Cosmetics, CR Beverage, 3SBio, China Life Insurance, Ping An Insurance, PICC Property and Casualty Co Ltd, Futu Holdings, Tencent, Alibaba, Trip.com, Greentown Service Group, Luxshare Precision Industry, Aac Technologies Holdings, BYD Electronic International Co Ltd, Horizon Robotics, OmniVision Integrated Circuits Group (Will Semiconductor Co Ltd), Zhongji Innolight Co Ltd, Shengyi Technology, BaTeLab Co Ltd, Naura Technology & Salesforce

📰🔬 Emerging Market Stock Picks / Stock Research

$ = Behind a paywall / 🗃️ = Link to an archived article (Note: Seeking Alpha earnings/conference etc. presentations are typically not paywalled) / ⛔ = Article archiving may not be working properly

🌏 Asia

🌏 Top risks and opportunities for Asian UHNWIs in 2026 (The Asset) 🗃️

- Gains to be had and dangers to heed as investing landscape shifts from macro to micro

- As we enter 2026, the landscape for Asian ultra-high-net-worth individuals ( UHNWIs ) is shifting from a macro-driven environment, focusing on global interest rates and inflation, to a more “micro” and thematic one.

- Based on the latest outlooks from major private banks and institutional research, here are the top risks and opportunities to watch in the year ahead:

🌏 2026: maybe consolidation not expansion for Asian casino sector (GGRAsia)

- For the land-based Asian casino industry, 2026 could be about future-proofing existing licences and market share via better digital engagement with customers – especially the younger ones – rather than opening fresh jurisdictions.

- So suggests Shaun McCamley, an industry expert with experience of operations in land-based, online and social gaming.

- He told GGRAsia: “For land-based casino operators, 2026 will increasingly be about integration rather than expansion.

- “The next competitive advantage will come from how effectively physical casinos link on-property play with persistent off-property engagement – before, between, and after visits.”

🌏 How cyclones and monsoon rains converged to devastate parts of Asia – visual guide (The Guardian)

- Tropical cyclones have combined with heavy monsoon rains to lay waste to swathes of Asia, killing more than 1,100 people as of Monday, with the death toll expected to rise, and leaving many more homeless.

- A confluence of three tropical weather systems – including a rare cyclonic storm that built up in the strait of Malacca – has fuelled intense wind and rainover the past week, devastating areas of Indonesia, Malaysia, Thailand and Vietnam with flooding and mudslides.

🇯🇵 Why Japanese Stocks Conquered the World in 2025 (Konichi Value)

- How Nikkei 225 beat the US, China, the UK, India and the EU.

- Ever since the Japan bubble burst of 1989, global investors spent years waiting for Japan to fail again.

- They are still waiting. The Nikkei 225 closed yesterday at 50,340, surpassing the previous peak of 38,915 set back in December 1989.

- While the S&P 500 struggled with valuation and tariff shocks, Tokyo returned over 26%. This rally was driven by a corporate governance revolution, a new political era under Prime Minister Sanae Takaichi, and a central bank that refused to kill the party.

- 2025 was the year Japan stopped apologizing for its economy and started monetizing it.

🇯🇵 3D Investment Releases a Presentation Highlighting Management Issues at SQEX Holdings and Seeks Shareholder Views (3D Investment Partners Pte Ltd)

- 3D Investment Partners Pte. Ltd. (“3D” or the “Company”), an independent investment management firm providing discretionary investment services to a fund that is a major shareholder of Square Enix Holdings Co Ltd (TYO: 9684 / FRA: EI4 / OTCMKTS: SQNXF), today released a presentation (the “Presentation”) that explains the management issues that SQEX HD has faced over many years. Taking into account the views of shareholders, we wish to engage in constructive dialogue with SQEX HD to enhance its corporate value. We therefore kindly ask all shareholders to read the Presentation and share with us your frank views regarding the management issues at SQEX HD.

- Link: https://www.3dipartners.com/wp-content/uploads/square-enix-presentation-material-en-202512.pdf

- (The slides up to slide 93 of the Presentation are the same as the material stating management issues provided to SQEX HD titled “Management Issues of Your Company as Seen from Outside.” on 29 September 2025. The slides from slide 94 onward are partial extracts of the material stating how to enhance corporate value presented to SQEX HD titled “For Creation of Dramatic corporate value of Your Company” together with the former material on the same day.)

🇯🇵 Nikkei 225 Index Rebalance Preview (Mar 2026): Potential Adds, Deletes, Capping & Other Changes (Smartkarma) $

- The review period for the Nikkei 225 (NKY INDEX) March rebalance ends in 4 weeks. Depending on the index committee discretion, there could be 1-3 changes at the rebalance.

- Advantest Corp (TYO: 6857 / FRA: VAN / VANA / OTCMKTS: ATEYY / ADTTF)‘s index weight is currently above 10% and that will result in capping. Fast Retailing Co Ltd (TYO: 9983 / FRA: FR70 / FR7 / OTCMKTS: FRCOY / FRCOF) and SoftBank Group Corp (TYO: 9984 / FRA: SFT / OTCMKTS: SFTBY / SFTBF) avoid capping for now.

- The capping for Advantest Corp (6857 JP) results in funding inflows for all the index constituents, though the impact tops out at 0.4x ADV.

🇨🇳 China / 🇭🇰 Hong Kong / 🇲🇴 Macau

🇨🇳 Year in Review: DeepSeek’s Breakout Rewrites U.S.-China AI Race (Caixin) $

- In 2025, artificial intelligence (AI) emerged as the defining technological force reshaping global life and work, and as the most consequential arena of competition between China and the U.S.

- Yet, even as the two economies have become the most active drivers of the latest AI revolution, they are no longer beneficiaries of globalization. Cooperation has given way to competition.

🇨🇳 Year in Review: Toxic Competition Drives China to Rein in Auto Price War (Caixin) $

- China’s push to rein in excessive competition in its auto market reached a climax in 2025, as policymakers moved to stamp out a relentless price war that has inflicted severe pain on carmakers, suppliers and dealerships for more than two years.

- As China’s economy shifts to new growth drivers, the auto sector faces a complex environment both at home and abroad. In March, the National Development and Reform Commission (NDRC), the country’s top economic planner, warned that disorderly competition in the domestic auto market would not only erode industry profits in the short term but also threaten to undermine innovation, product quality and corporate competitiveness in the long run.

🇨🇳 Year in Review: How Price Wars, Platform Battles and IP Booms Defined China’s 2025 (Caixin) $

- In 2025, boosting domestic consumption graduated from an industry consensus to a top-tier national strategy. Yet by the end of the year, the world’s second-largest economy presented a paradox: government stimulus flowed freely, but prices across the board continued to fall.

- In the second half of 2024, Beijing deployed 300 billion yuan ($41 billion) in special treasury bonds — colloquially known as the “national subsidy” — to support trade-ins for equipment and consumer goods. The cash injection provided a lifeline to industries plagued by overcapacity and weak domestic demand, including electric-vehicles, home appliances and consumer electronics. While the subsidies temporarily juiced demand, they could not stabilize the broader pricing landscape. As the subsidies began to taper off in the third quarter of 2025, the underlying fragility of consumer confidence reemerged.

🇨🇳 Yuan Ends Year Strong, Snapping Three-Year Losing Streak (Caixin) $

- The Chinese yuan closed out 2025 with its strongest performance in over two years, breaching the key 7-per-dollar threshold and logging a 4.2% annual gain — its first in four years.

- The onshore yuan ended the year at 6.9890 per U.S. dollar, buoyed by a softening greenback, renewed concerns over U.S. fiscal health, and unexpectedly resilient Chinese exports. The currency’s rebound marks a notable shift in sentiment after a multiyear slump fueled by China’s property market troubles and a yawning interest-rate gap with the U.S., which saw the yuan lose nearly 14% of its value from 2022 through 2024.

🇨🇳 Why China is doubling down on its export-led growth model (FT) $ 🗃️

- The country plans to reinforce its dominance of global manufacturing, despite persistent deflation at home and rising tensions abroad

🇨🇳 SMIC Buys Out Chip Unit For $5.8 Billion in Consolidation Push (Caixin) $

- Semiconductor Manufacturing International Corporation (SMIC) (HKG: 0981 / SHA: 688981 / SGX: HSMD / FRA: MKN2), China’s largest chipmaker, plans to acquire the remaining 49% stake in its Beijing subsidiary for 40.6 billion yuan ($5.8 billion) through a share issuance, consolidating control over a key production hub for mature-node chips.

- According to a filing released on Tuesday, SMIC will issue approximately 547 million new shares at 74.2 yuan each to five minority shareholders. The sellers include the China Integrated Circuit Industry Investment Fund, known as the “Big Fund,” as well as investment vehicles backed by the Beijing municipal government. The transaction values the subsidiary, Semiconductor Manufacturing North China (Beijing) Corp., or SMNC, at nearly 82.9 billion yuan, representing a premium of roughly 98% over its book value.

🇨🇳 CATL to Roll Out Sodium-Ion Batteries in 2026 to Cut Lithium Reliance (Caixin) $

- Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750) plans to mass deploy sodium-ion batteries across its product lines starting in 2026, a pivot designed to reduce reliance on lithium as pricing disputes roil the electric vehicle (EV) supply chain.

- The global battery giant confirmed the plan to Caixin on Monday following a supplier conference, positioning the lower-cost technology as a viable alternative for passenger cars, commercial vehicles, and energy storage. The move comes as surging raw material costs and contentious pricing mechanisms trigger production halts among midstream manufacturers, threatening the stability of the sector’s ecosystem.

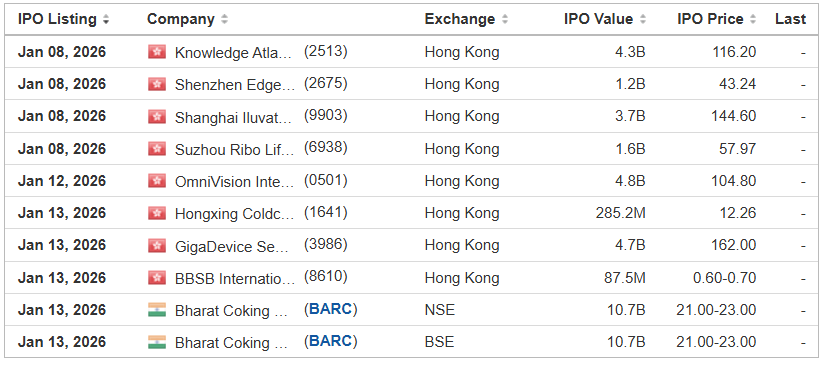

🇨🇳 GigaDevice Semiconductor Secondary Listing (Hong Kong) Preview (Douglas Research Insights) $

- GigaDevice Semiconductor Inc (SHA: 603986) is getting ready to complete its secondary listing in Hong Kong in January 2026.

- The company aims to raise up to HK$4.68 billion (US$601 million) through this secondary listing. GigaDevice Semiconductor (603986 CH) is offering 28.9 million H-shares in its Hong Kong public offering.

- GigaDevice Semiconductor is a fabless integrated circuit design house offering a diversified portfolio of semiconductor products, including specialty memory chips, micro control units (MCUs), analog chips, and sensor chips.

🇨🇳 GigaDevice Semiconductor HK Listing Valuation Analysis (Douglas Research Insights) $

- According to our valuation analysis, the implied target price of GigaDevice Semiconductor Inc (SHA: 603986) post secondary listing in Hong Kong is 230 HKD.

- This is 42% higher than the high end of the IPO price range (HKD162 per share). We have assumed a 25% discount to H shares versus the A shares.

- To value GigaDevice Semiconductor, we used four comps including Winbond Electronics Corp (TPE: 2344), Puya Semiconductor (Shanghai) Co Ltd (SHA: 688766), Ingenic Semiconductor Co Ltd (SHE: 300223), and Shenzhen Techwinsemi.

🇨🇳 OmniVision Integrated Circuits Group Secondary Listing (Hong Kong) Preview (Douglas Research Insights) $

- OmniVision Integrated Circuits Group (SHA: 603501) is getting ready to complete its secondary listing on the Hong Kong Stock Exchange and is expected to list and begin trading on 12 January 2026.

- The company aims to raise up to HK$4.8 billion ($617 million) through this offering. OmniVision (603501 CH) is a global fabless semiconductor company already listed on the Shanghai Stock Exchange.

- OmniVision is the world’s largest automotive CIS (CMOS Image Sensor) provider, with a 32.9% market share in 2024.

🇨🇳 OmniVision H Share Listing (501 HK): Valuation Insights (Smartkarma) $

- OmniVision Integrated Circuits Group (SHA: 603501), a CMOS image sensor (CIS) company, has launched an H Share listing to raise US$617 million.

- I discussed the H Share listing in OmniVision H Share Listing: The Investment Case.

- The proposed AH discount of 25.5% (based on the 30 December A Share price) is resonable, and I would participate in the H Share listing.

🇨🇳 China targets online vendors in tax crackdown (FT) $ 🗃️

- Beijing seeks to bolster revenues to compensate for slowing economic growth

🇨🇳 Temu Faces New US Lawsuit in Arizona | Import Parcels Decline Sharply Since End of ‘de Minimis’ (Smartkarma) $

[PDD Holdings (NASDAQ: PDD) or Pinduoduo]

- A new civil lawsuit filed in Arizona mainly focuses on data collection, privacy issues

- We believe US operating environment remains extremely challenging for Temu, SHEIN

- Recent media reports suggest a dramatic decline in inbound parcel volume after August

🇨🇳 Xiaomi Targets 550,000 EV Sales in 2026 (Caixin) $

- Xiaomi (HKG: 1810 / SGX: HXXD / FRA: 3CP / OTCMKTS: XIACF) is pinning higher hopes on its nascent electric vehicle (EV) business, raising its delivery target to 550,000 units in 2026 as the tech giant seeks to expand its revenue base.

- Billionaire founder Lei Jun announced the target, which is up 34% from last year’s sales of 410,000 cars, during a livestream on Saturday.

- The goal shows Xiaomi’s confidence in the continued expansion of its EV business despite fierce competition and public concerns over the safety of its assisted driving technology, which were triggered by a fatal March crash involving a Xiaomi sedan that had its autopilot system engaged.

🇨🇳 Chinese EV Exports Are Exploding, And The West Has No Way To Stop Them (Carscoops)

- Through November, Chinese electric vehicle exports rose by 29 percent globally, reaching nearly 2 million units across Asia, Europe, and emerging markets

- Chinese EV exports are booming and were up 87% last month.

- Mexico was the top export market in November with 19,344 units.

- Over 600,000 Chinese EVs have been exported to Europe in 2025.

🇨🇳 Weihai Bank gets government-led year-end capital gift, highlighting its troubles (Bamboo Works)

- The regional lender will sell new shares to a municipal investor in its hometown in Shandong province to shore up its capital cushion

- Weihai Bank Co Ltd (HKG: 9677 / FRA: 8K0) will raise about 1 billion yuan by selling new shares to an investment vehicle owned by municipal organizations in its hometown

- The move comes after the regional lender’s capital cushion weakened substantially in a slowing Chinese economy

🇨🇳 Jiumaojiu ladles up hotpot investment to boost overseas expansion (Bamboo Works)

- The restaurant operator will pay $43 million for new and existing shares of Big Way Group, boosting its stake to 49% of the North American hotpot chain

- Jiumaojiu International Holdings (HKG: 9922 / FRA: 3YU)’s investment in a North American hotpot chain will roughly double its overseas store count to around 50

- The company and its peers are increasingly looking abroad to diversify beyond a Chinese restaurant market plagued by rampant competition and growing consumer caution

🇨🇳 Turtle tempest: Can Playmates Toys fight back after losing its prize Ninjas? (Bamboo Works)

- The toymaker will end its exclusive 37-year agreement to make products based on Teenage Mutant Ninja Turtles at the end of 2026

- Playmates Toys (Playmates) (HKG: 0869 / 0635 / FRA: 45P / OTCMKTS: PMTYF / PYHOF) will soon lose its exclusive rights to Teenage Ninja Turtles toys, part of its licensed toy business that accounted for 36% of its revenue in the first half of last year

- The toymaker’s revenue plunged 58% in the first half of this year to HK$186 million, dropping the company into the red

🇨🇳 Spoiled ending for Hongjiu, as Hong Kong delists former fruit highflyer (Bamboo Works)

- With founder Deng Hongjiu in jail on suspicion of accounting fraud, the company’s worthless shares have been booted from the Hong Kong Stock Exchange

- Three years after its IPO, Chongqing Hongjiu Fruit Co Ltd (HKG: 6689) has been evicted from the Hong Kong Stock Exchange as it faces a likely restructuring and asset sales to pay off creditors

- Shares of China’s leading fruit distributor were suspended in March 2024, followed by mass management arrests on suspicion of fabricated sales

🇨🇳 Biren Tech (6082 HK) IPO: Index Inclusion Possibilities & Timeline (Smartkarma) $

- Shanghai Biren Technology Co Ltd (HKG: 6082) has raised HK$5.58bn (US$717m) in its IPO, valuing the company at HK$46.96bn (US$6.03bn). The raise size could increase if the overallotment option is exercised.

- The large allocation to cornerstone investors reduces free float market cap and could delay inclusion in global indices. Inclusion could take place in May/June or August/September.

- Shanghai Biren Technology (6082 HK) should be added to the HSCI in June and subsequently added to Southbound Stock Connect.

🇨🇳 🇭🇰 Shanghai Iluvatar CoreX Semiconductor Hong Kong IPO Preview (Douglas Research Insights) $

- Shanghai Iluvatar CoreX Semiconductor is getting ready to complete its IPO in Hong Kong on 8 January 2026.

- Iluvatar CoreX is a domestic leader in China’s general-purpose GPU sector and was the first Chinese chip designer to mass-produce both training and inference GPGPU chips using 7nm process technology.

- The company is offering 25.43 million shares at HK$144.6 per share to raise around HK$3.7 billion (US$475 million). At this IPO price, it values the company at about US$4.6 billion.

🇨🇳 🇭🇰 Zhipu AI (Knowledge Atlas Technology) Hong Kong IPO Preview (Douglas Research Insights) $

- Chinese AI firm Zhipu AI launched its share sale in Hong Kong, aiming to become the first large language model (LLM) developer to list on the exchange.

- Zhipu AI is offering over 37 million shares at an offer price of HK$116.20 each. The company aims to raise approximately HK$4.35 billion.

- Zhipu faces domestic competition from rivals like MiniMax, who are also planning a Hong Kong IPO, and global competition from firms such as OpenAI and Anthropic.

🇨🇳 🇭🇰 Zhipu AI (Knowledge Atlas Technology) Hong Kong IPO Valuation Analysis (Douglas Research Insights) $

- Our base case valuation of Zhipu AI is HK$223 per share (92% higher than the IPO price of HK$116.2).

- Given the excellent upside, we have a Positive View of this IPO. At this valuation, it represents an implied market cap of US$12.6 billion (HK$98.2 billion).

- Zhipu AI ranked first among China’s independent developers and second among all developers of general-purpose large models by revenue market share in 2024, with a share of 6.6%.

🇨🇳 🇭🇰 MiniMax Hong Kong IPO Valuation Analysis (Douglas Research Insights) $

- Our base case valuation of MiniMax is HK$301 per share (82% higher than high end of the IPO price range of HK$165).

- We believe many investors are willing to pay for the high valuations mainly due to MiniMax’s position as one of the leaders in the LLM/AGI sector in China/globally.

- We estimate MiniMax to generate revenue of US$183.9 million (up 127% YoY) in 2026 and US$356.2 million (up 94% YoY) in 2027.

🇭🇰 World-leading Hong Kong IPO market set to grow in 2026 (The Asset) 🗃️

- Falling rates, rising confidence, favourable policy to boost funds raised to HK$320 billion-HK$350 billion

- In 2025, Hong Kong reclaimed the top global position in terms of initial public offering ( IPO ) funds raised, reaching nearly HK$285.8 billion ( US$222.06 billion ), a total that has attracted worldwide market attention, underscoring Hong Kong’s leadership as an international financial centre, according to a recent report.

- In 2026, despite ongoing geopolitical uncertainties, the overall trend of falling interest rates, complemented by favourable government policies, will boost investor confidence, the report [PwC: Hong Kong IPO market to continue growth trend in 2026, expected to reach HKD320 billion to HKD350 billion by funds raised] by Big Four accounting firm PwC anticipates, making Hong Kong’s IPO market likely to continue its robust performance.

- In 2025, Hong Kong saw 119 IPOs, the report notes, marking a 68% increase from 2024, and the HK$285.8 billion raised represents a more than twofold rise ( 225% ), positioning it at the forefront globally

🇭🇰 Six IPOs in One Day Cap Hong Kong’s Return to the Top (Caixin) $

- Hong Kong is set to reclaim its position as the world’s top IPO market in 2025, with six companies listing on the same day to close out the year.

- The six debuts on Tuesday lifted Hong Kong’s total IPOs to 114 for the year, raising HK$286.3 billion ($36.7 billion), according to a Dec. 18 Deloitte report [Deloitte China releases 2025 Review and 2026 Outlook for Chinese Mainland & HK IPO markets].

- This represents a 14% increase in IPOs and a 94% jump in proceeds raised, putting the city ahead of the Nasdaq and India’s National Stock Exchange, according to the report.

🇭🇰 Hong Kong IPOs Seen Topping HK$300 Billion in 2026 on Tech Boom (Caixin) $

- Hong Kong’s IPO market is poised to raise at least HK$300 billion ($38.5 billion) in 2026, building on last year’s world-leading performance as listings reflect growing interest in artificial intelligence (AI) and biotechnology.

- Last year, Hong Kong hosted 119 new listings — up 68% from 2024 — and raised HK$285.8 billion, ranking first globally.

- Major accounting firms broadly agree on the market’s trajectory for 2026. Deloitte forecasts about 160 listings raising at least HK$300 billion, while EY, PwC and KPMG project roughly 150 to 200 IPOs with total fundraising of about HK$320 billion to HK$350 billion.

🇭🇰 HSCI Index Rebalance Preview and Stock Connect (Mar 2026): Many Changes Following Huge IPO Quarter (Smartkarma) $

- There could be 49 potential inclusions and 25 potential deletions for the Hang Seng Composite Index in March. There are more stocks that are close on market cap/liquidity.

- A lot of the potential adds are very recently listed stocks that have a limited trading history. The low free float could lead to price spikes in the stocks.

- There are stocks that have a very high percentage of holdings via Stock Connect and there could be some unwinding prior to the stocks becoming Sell-only.

🇭🇰 Alpha Technology Remains A Strong Sell (Seeking Alpha) $ 🗃️

- 🌐 Alpha Technology Group Ltd (NASDAQ: ATGL) – Cloud-based AI platforms & exclusive large language models (LLMs).

🇲🇴 Macau casino GGR to rise 11pct year-on-year in January, at least 5pct in full-year 2026: analysts (GGRAsia)

- Investment banks Deutsche Bank and JP Morgan forecast that casino gross gaming revenue (GGR) in Macau will increase by at least 5 percent in the full calendar year 2026.

- Deutsche Bank Securities Inc analyst Steve Pizzella said in a Thursday memo that Macau’s casinos would generate annual GGR of slightly more than US$32.77 billion in 2026 – the equivalent of MOP263 billion –, up by 5.8 percent year on year.

- Mr Pizzella added that mass-market GGR for the 12-month period was likely to be just under US$23.42 billion, an increase of 4.3 percent compared with calendar-year 2025.

- Deutsche Bank forecast that VIP GGR in Macao would rise by 10.0 percent, to nearly US$9.36 billion in full-year 2026.

🇲🇴 Macau 2025 GGR US$30.86bln, December up 14.8pct y-o-y (GGRAsia)

- Macau’s casino gross gaming revenue (GGR) for calendar-year 2025 reached MOP247.40 billion (US$30.86 billion), the city’s government said on Thursday, New Year’s Day.

- The full-year figure was up 9.1 percent year-on-year, according to data disclosed by Macau’s casino regulator, the Gaming Inspection and Coordination Bureau.

- It was the highest annual GGR tally since the onset of the Covid-19 pandemic in early 2020. Full-year 2019 GGR for Macau stood at just under MOP292.46 billion.

- The 2025 full-year figure was about 84.6 percent of the city’s pre-pandemic 2019 GGR.

🇲🇴 Macau sees 40.06mln visitor arrivals in 2025, new annual record (GGRAsia)

- Macau has set a record for annual visitor arrivals, recording about 40.06-million tourist entries in 2025, according to preliminary figures from the city’s Public Security Police.

- Last year’s tally surpassed the nearly 39.41-million visitor arrivals recorded in full-year 2019, the reporting period immediately preceding the Covid-19 pandemic and the previous record.

- The figure was up 14.7 percent from the approximately 34.93-million entries recorded in 2024, showed the official data.

- The police did not provide a breakdown of visitors by place of origin.

🇲🇴 Saving only L’Arc not Ponte 16 better for SJM, considering group’s resources and L’Arc’s potential: Daisy Ho (GGRAsia)

- Dropping plans to absorb Macau satellite Casino Ponte 16 and saving only the former satellite Casino L’Arc Macau and its associated hotel, “suited better” SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY), the gaming licensee for the two sites.

- So said SJM Holdings’ chairman Daisy Ho Chiu Fung, on the sidelines of a Tuesday ceremony to mark the formal takeover of the downtown L’Arc Hotel and its associated gaming operation. Ms Ho was speaking in response to a question from GGRAsia. She also mentioned the “potential” of the new core property.

- Under the terms of the transaction, SJM Holdings will pay an aggregate of HKD1.75 billion (US$224.8 million) for the acquisition of L’Arc Hotel.

- Macau casino operator MGM China Holdings Ltd (HKG: 2282 / FRA: M04 / OTCMKTS: MCHVF / MCHVY) could see a lower dividend per share for 2026 and 2027 amid a doubling of a royalty fee percentage payable to its United States-based parent MGM Resorts International. That is according to a Monday memo from brokerage Jefferies.

- Such an outcome would be in addition to a likely decline in MGM China’s 2026 and 2027 adjusted earnings before interest, taxation, depreciation, amortisation (EBITDA) and its net profit. Jefferies estimates the decline in those indicators at 6 percent and 10 percent for 2026, and 6 percent and 9 percent for 2027, “assuming all other things are equal”.

🇲🇴 SJM’s proposed U.S.-dollar notes rated ‘BB-‘ amid tough deleveraging path: Fitch (GGRAsia)

- Fitch Ratings Inc has assigned Macau casino operator SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY)’s newly-proposed U.S.-dollar, unsecured senior notes a below-investment-grade ‘BB-’ rating, with a ‘negative’ outlook for the group itself.

- The outlook reflects “heightened uncertainty” around the company’s deleveraging effort, given “weak growth” at its Cotai flagship property Grand Lisboa Palace.

- Fitch also mentioned in its rating-action commentary on Monday, “market share dilution” from the recent “closure and restructuring” of Macau satellite casinos, most of which used to rely on the SJM group’s gaming rights.

🇹🇼 Taiwan

🇹🇼 TSMC Is Relentlessly Getting Stronger, And The Market Is Mispricing It (Seeking Alpha) $ 🗃️

🇹🇼 TSMC’s Moat Is Deepening (Seeking Alpha) $ 🗃️

- 🌐 Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) – World’s largest dedicated independent (pure-play) semiconductor foundry. 🇼 🏷️

🇹🇼 Long TSMC / Short UMC: Invest in a Structural Monopoly Vs. A Crowded Recovery (Smartkarma) $

- Recent 3-month performance has been similar for Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) and United Microelectronics Corp (TPE: 2303 / NYSE: UMC) despite dramatically different fundamentals for the two companies. TSMC’s outlook is much more resilient into 2026E.

- Technology Nodes Comparison: TSMC dominates leading-edge manufacturing while UMC remains legacy-bound. TSMC higher multiples are justified and less likely to de-rate.

- TSMC ADR vs. Local Shares Consideration: Fundamentally cheaper long side of the trade? TSMC ADR likely the best Long, avoids stock market fund flow differences between US and Taiwan.

🇹🇼 Delta Electronics: Taiwan’s Power Supply Giant (Asianometry) 24:08 Minutes

- Delta Electronics (TPE: 2308) (台達電子) is a Taiwanese company in the power management and energy efficiency space. With $14 billion in sales and a $80 billion market cap, Delta is as of this writing Taiwan’s third most valuable company behind only Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) and Foxconn [Foxconn Technology Co Ltd (TPE: 2354 / OTCMKTS: FXCOF)]. The stock has skyrocketed 150% so far this year. Guess why? Hint it starts with “A” and ends with “I”. Delta’s climb to its current heights took over half a century. In this video, we talk about a quiet Taiwanese power supply giant.

🇰🇷 Korea

🇰🇷 KOSPI Size Indices: Small-To-Mid Migrations Running Up (Smartkarma) $

- The review period for the March rebalance of the KOSPI Size Indices commenced on 1 December and will end on 28 February.

- A third of the way through the averaging period, we forecast 37 migrating stocks. Among new listings, 1 stock could be added to LargeCap, 2 to MidCap, 2 to SmallCap.

- The upward migrations have outperformed the downward migrations by a lot over the last few months. The gap between the small and mid-cap migrations has continued to widen.

🇰🇷 Korean Stock Market – The Best Performing Among Major Countries Indices in 2025 (Douglas Research Insights) $

- We discuss the five most important factors driving the Korean stock market this year which was the best performing among all major country equity markets in the world in 2025.

- These five factors included the global AI boom, wars and rumors of wars, beneficiaries of MASGA, Korea Value-Up initiatives, and reduced political uncertainties with new President elected in June 2025.

- Our best bet to diversify one’s portfolio and be more cautious because staying alive will be a key in 2026 rather than FOMO, especially in 2H 2026.

🇰🇷 Woori Financial Valuation Looks Attractive To Start The New Year (Seeking Alpha) $ 🗃️

- 🇰🇷 Woori Financial Group (NYSE: WF) – Commercial bank. Range of financial services to individual, business & institutional customers. 🇼 🏷️

🇰🇷 Paradise Co reports US$52mln in Dec casino sales, annual sales up 10pct (GGRAsia)

- Paradise Co Ltd (KOSDAQ: 034230), an operator in South Korea of foreigner-only gaming venues, said its casino sales in December rose 7.6 percent year-on-year to nearly KRW75.42 billion (US$52.1 million). Judged sequentially, such sales fell 5.4 percent, the firm stated in a Monday filing to the Korea Exchange.

- Paradise Co’s table-game sales last month were KRW69.84 billion, up 5.2 percent from the prior-year period, but down 7.8 percent from November.

- Machine-game sales in December rose 49.3 percent year-on-year to nearly KRW5.58 billion. That tally was also up 40.3 percent sequentially.

- The December “table drop” – the amount paid by patrons to purchase gaming chips – amounted to KRW602.35 billion, up 11.4 percent year-on-year.

🇰🇷 GKL casino sales over US$25mln in Dec, down 6.4pct from a year earlier (GGRAsia)

- Casino sales in December at Grand Korea Leisure Co Ltd (KRX: 114090), an operator in South Korea of foreigner-only casinos, decreased by 6.4 percent from a year ago, to KRW36.30 billion (US$25.1 million), according to an update filed to the Korea Exchange on Monday.

- Judged sequentially, Grand Korea Leisure’s December casino sales were down 13.0 percent.

- In December, table-game sales were nearly KRW33.07 billion, 7.4-percent lower than a year ago, and a 13.8-percent decline month-on-month.

- Machine-game sales in December were KRW3.23 billion, an increase of 5.6 percent year-on-year, but down 4.1 percent from the prior month.

🇰🇷 UBS Says Soaring Memory Chip Prices To “Turbo-Charge” Samsung Earnings (ZeroHedge)

- For several months, we have tracked a sharp increase in DDR5 DRAM pricing, as evidenced by DRAMeXchange data, driven primarily by surging AI-related cloud computing demand and hyperscalers accelerating data center buildouts.

- On day one of the new year, Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) co-CEO Jun Young Hyun told employees in an internal memo that customers have praised the differentiated competitiveness of its next-generation high-bandwidth memory (HBM) chips, or HBM4, saying, “It’s even earning an assessment from customers that ‘Samsung is back’.” He noted that Samsung will also benefit from favorable memory market conditions this year, as demand for artificial intelligence chips has materialized much quicker than initially anticipated.

- The other week, Goldman analyst Maho Kamiya told clients that mounting concerns about soaring memory prices posed new risks for Nintendo Co Ltd (TYO: 7974 / FRA: NTO / OTCMKTS: NTDOF), which manufactures consumer electronics such as the popular Switch 2.

🇰🇷 Tender Offer of a 56.4% Stake in Echo Marketing by Bain Capital (Douglas Research Insights) $

- On 1 January 2026, it was reported that Bain Capital has launched a tender offer to acquire a 56.4% stake in Echo Marketing Co Ltd (KOSDAQ: 230360), the parent company of Andar.

- Tender offer price is 16,000 won (49.5% higher than closing price on 31 December 2025).

- After acquiring Andar in 2021, Echo Marketing transformed the company into Korea’s leading athleisure brand. It is considered a rival to global sportswear brand Lululemon Athletica Inc (NASDAQ: LULU).

🌏 SE Asia

🇸🇬 3 Reasons To Own Grab (Seeking Alpha) $ 🗃️

- 🌏 Grab Holdings Limited (NASDAQ: GRAB) – Superapp in SE Asia for mobility, deliveries, & digital financial services to millions of Southeast Asians. 🇼 🏷️

🇸🇬 BW LPG: Capitalizing On Panama Canal Disruptions (Seeking Alpha) $ 🗃️

- 🌐 BW LPG Ltd (NYSE: BWLP) – Owner & operator of LPG carriers. 🇼

🇸🇬 Can the Government’s Equity Stimulus Really Boost Dividends for Retail Investors? (The Smart Investor)

- The government’s equity stimulus may support markets, but its impact on dividends for retail investors is less clear.

- In a bold move to revitalise the Singapore equity landscape, the Singapore government has rolled out the multi-billion-dollar Equity Market Development Programme (EQDP).

- The EQDP aims to strengthen the local asset management and research ecosystem, and increase investor interest in Singapore’s equities market.

- For dividend-focused investors, the key question is whether this stimulus will translate into bigger payouts.

- In this article, we will unpack what the EQDP is all about, and how it impacts listed companies, dividend policies, and long-term investor outcomes.

- What the Equity Stimulus Is About

- How it Could Impact Corporate Dividends

- Sectors That Could Benefit Most

- The Catch: Stimulus Doesn’t Guarantee Payouts

- What This Means for Retail Investors

- Get Smart: Dividends Come From Profits, Not Policy

🇸🇬 Top 3 Blue-Chip REITs to Watch for January 2026 (The Smart Investor)

- Three blue-chip REITs enter January 2026 with pivotal earnings releases that could signal whether their turnaround strategies are gaining traction.

- From a logistics REIT showing signs of stabilisation in a challenging China market, to an industrial REIT navigating North American headwinds, to a data centre specialist riding acquisition-driven momentum, each offers distinct catalysts worth monitoring.

- Here are three blue-chip REITs that are expected to report their results this month.

- Mapletree Logistics Trust (SGX: M44U / OTCMKTS: MAPGF)

- Mapletree Logistics Trust, or MLT, owns 175 logistics properties across nine Asia Pacific markets with S$13 billion in assets under management (AUM).

- Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF)

- Mapletree Industrial Trust, or MIT, owns 136 industrial properties across Singapore, North America, and Japan, with an AUM of S$8.5 billion.

- Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF)

- Keppel DC REIT. or KDC, owns and operates 25 data centres across 10 countries in Asia Pacific and Europe, with an AUM of approximately S$5.7 billion.

- Get Smart: Different stories, common theme

🇸🇬 3 Singapore Blue Chips to Own Before the Next Earnings Season (The Smart Investor)

- These STI stalwarts are poised to outperform.

- We have curated a basket of blue chip stocks that are likely to offer stability, yet with potential upside, this coming earnings season.

- They are expected to benefit from a combination of falling interest rates, rising demand for data centres, or some attractive trait – valuation or otherwise.

- Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF)

- Keppel DC REIT owns data centres across three continents – Asia, Australia, and Europe.

- However, it generates most of its revenue from Singapore, which accounted for 72% of revenue in H1 2025.

- Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel

- Another company that is showing positive financial momentum is Singapore Telecommunications, or SingTel, Singapore’s leading telecommunications provider.

- It also owns or has significant stakes in other telcos regionally, including Australia, India, Indonesia, the Philippines, and Thailand.

- Sembcorp Industries (SGX: U96 / FRA: SBOA / OTCMKTS: SCRPF)

- The Australian connection extends to Sembcorp, another SGX-listed stock that’s worth a look. Recently, the company announced that it is purchasing Alinta Energy, a leading integrated energy company Down Under, for S$4.8 billion.

- Get Smart: Position Before Results Hit the Headlines

🇸🇬 3 Small-Cap Stocks New Investors Should Know (The Smart Investor)

- A look at three Singapore small-cap stocks and what new investors can learn from their fundamentals and recent business updates.

- SBS Transit (SGX: S61) – Singapore’s Public Transport Mainstay

- If you’ve ever tapped your EZ-Link card on the Northeast or Downtown MRT lines, you’re already familiar with SBS Transit’s business.

- In its third quarter of 2025 (3Q2025) update, the group hit a bit of a speed bump; revenue dipped 2.4% year on year (YoY) to S$386.5 million, while net profit saw a steeper 20.6% slide to S$14.5 million.

- The main culprits: the loss of the Jurong West bus package and lower fuel indexation.

- Vicom Ltd (SGX: WJP) – Leader in Vehicle Inspections

- VICOM proves that “boring” businesses can sometimes deliver the most exciting results.

- The inspection specialist knocked it out of the park in 3Q2025, with revenue jumping 36% to S$41.6 million and net profit soaring 45% to S$9.9 million.

- United Hampshire US REIT (SGX: ODBU / OTCMKTS: UNHRF) – US Necessity-Based Retail Specialist

- If you want a slice of US real estate without the headache, UHREIT is an interesting candidate.

- They own a portfolio of 20 grocery-anchored properties – the kind of “must-visit” shops that people frequent regardless of the economy.

- Get Smart: Look Beyond the Blue Chips

🇸🇬 Retire Without Worry: 3 Stocks for Steady Passive Income (The Smart Investor)

- Discover three reliable dividend-paying stocks that offer stable, long-term passive income — helping retirees build financial security without taking unnecessary risks.

- What Makes a Stock Retirement-Friendly?

- Venture Corporation (SGX: V03 / FRA: VEM / OTCMKTS: VEMLF) – Robust Balance Sheet Supports Consistent Dividends

- The company has an excellent track record of paying consistent annual dividends.

- Over the past 10 years, Venture has never failed to pay an annual dividend.

- Singapore Exchange Limited(SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY) – A Cash Flow Machine

- The only approved financial exchange for Singapore markets, Singapore Exchange or SGX, has paid an annual dividend stretching back to at least 2003.

- Rain or shine, SGX continues to generate solid cash flows through the recurring income it earns from the trading of securities and derivatives.

- Parkway Life Real Estate Investment Trust (SGX: C2PU) – Defensive Health Care

- Ending things, we suggest a defensive health care name: Parkway Life REIT or Parkway Life.

- Since its listing in 2007, Parkway Life has paid an annual dividend.

- Putting It All Together

- Get Smart: Safety and Reliability in Dividend Payments Ensure a Worry-Free Retirement

🇸🇬 3 Small Cap Stocks to Watch for January 2026 (The Smart Investor)

- 3 Singapore small caps set to win from AI, chips, and Amazon deals in 2026

- Micro-Mechanics (Holdings) Ltd (SGX: 5DD / OTCMKTS: MCRNF): Riding the Semiconductor Wave

- Micro-Mechanics kicked off its fiscal year 2026 (FY2026) on a steady note.

- Digital Core REIT(SGX: DCRU / OTCMKTS: DGTCF): Powering the AI Revolution

- Data centres remain the backbone of the digital economy, and Digital Core REIT (DCRU) is capturing this momentum.

- DCRU owns 11 freehold data centres across the United States, Canada, Germany, and Japan, with US$1.7 billion in assets under management as at 31 December 2024.

- CSE Global Ltd (SGX: 544 / FRA: XCC / OTCMKTS: CSYJY / CSYJF): Strategic Partnerships in Focus

- CSE Global continues to prove its versatility as a systems integrator across the energy, infrastructure, and data centre sectors.

- Get Smart: Finding Value in the Small-Cap Space

🇸🇬 Asia’s New Growth Frontier: 3 Stocks Tapping Into the Healthcare Boom (The Smart Investor)

- Asia has become the world’s fastest growing healthcare market, projected to reach US$5 trillion by 2030.

- The boom is underpinned by the region’s aging populations, complemented by expansion of the middle-class.

- As healthcare demand rises, healthcare providers, health-tech innovators and health-related infrastructure across Asia are poised to benefit.

- Here are three resilient companies that are tapping into Asia’s healthcare boom.

- Raffles Medical Group (SGX: BSL / FRA: 02M1 / OTCMKTS: RAFLF)

- Raffles Medical Group (RMG) is a Singapore-based integrated healthcare provider operating hospitals and clinic services across Asia.

- Abbott Laboratories (NYSE: ABT)

- Abbott Laboratories is a global healthcare company with a diverse set of products, ranging from diagnostics, medical devices, nutrition and branded generic pharmaceuticals.

- Parkway Life Real Estate Investment Trust (SGX: C2PU)

- ParkwayLife REIT or (PLife) is a Singaporean healthcare real estate investment trust (REIT) that owns three hospitals in Singapore, and multiple nursing homes in Japan and France.

🇮🇳 India / South Asia / Central Asia

🇧🇩 Bangladesh – a surprise outperformer in 2026? (Undervalued Shares)

- Judge for yourself by considering the following three ideas that provide exposure to Bangladesh.

- Idea #1: BRAC Bank (DSE: BRAC)

- A single metric illustrates why BRAC Bank (ISIN BD0138BRACB9, DSE:BRACBANK) deserves closer attention right now.

- Bangladesh has nearly caught up with India in terms of GDP per capita. Yet, when measured as a percentage of GDP, the market cap of Indian banks is 20 times higher than that of Bangladeshi banks.

- Idea #2: Beximco Pharmaceuticals (DSE: BXPH / LON: BXP / FRA: R2WA)

- Bangladeshi stocks are generally difficult to access for foreign investors. Beximco Pharmaceuticals (ISIN US088579206, UK:BXP), however, trades in the form of GDRs on the London Stock Exchange, which makes it considerably easier to invest in.

- Idea #3: AFC Asia Frontier Fund

- Long-standing Undervalued-Shares.com readers will be familiar with Thomas Hugger’s Asia Frontier Capital, particularly from earlier coverage of Iraq: in 2021, I suggested an ultra-contrarian investment in the AFC Iraq Fund. Since then, the fund has been a stellar performer, delivering returns of over 200% in US dollar terms, from a market that remains largely uncorrelated with the Western world.

🇮🇳 Infosys: Turning Bullish On 3Q Preview And AI Tailwinds (Rating Upgrade (Seeking Alpha) $ 🗃️

🇮🇳 ITC: Tobacco Volumes to Be Impacted by Increased Taxes; Uncertainty Ahead (Smartkarma) $

- India notified a new and increased excise duty on cigarettes, effective Feb 1, 2026, alongside a 40% GST regime.

- On January 1, 2026, tobacco stocks sold off sharply. ITC Ltd (NSE: ITC / BOM: 500875) fell about 9%, Godfrey Phillips India Ltd (NSE: GODFRYPHLP / BOM: 500163) around 15–17%, and VST Industries Ltd (NSE: VSTIND / BOM: 509966) about 4%.

- Total tax per cigarette rises more than expected, raising risks to volumes and accelerating illicit trade.

🇮🇳 Entero Healthcare: New Titan of Pharma Distribution (Smartkarma) $

- Entero Healthcare Solutions Ltd (NSE: ENTERO / BOM: 544122) differentiates itself through a dual-value model that combines large-scale demand fulfillment with integrated commercial solutions with a massive TAM of INR 3.3 Trillions.

- Management is aggressively targeting the high-margin MedTech segment, with revenue from this vertical expected to cross INR 1,000 crore on an annualized basis.

- Entero is becoming positive operating cash flow in H2FY26 supported by reduction Net Operating Working Capital from 69 to 60 days.

🇮🇳 JSW Steel: BPSL Deal to Provide near Term Deleveraging (Smartkarma) $

- JSW Steel Ltd (NSE: JSWSTEEL / BOM: 500228) has entered a 50:50 JV with Japan’s JFE Steel for its BPSL subsidiary, valuing the unit at an Enterprise Value (EV) of approximately Rs. 53,000 crore.

- This deal frees up Rs. 37,250 crores to pay off debt, making the company financially stronger and funding its growth to 50 MTPA.”

- Investors should view this as a valuation-unlocking event that de-risks the balance sheet while retaining 50% exposure to one of India’s most efficient steel assets.

🇮🇳 Ather Energy ~ Will The Company Be Able to Sustain 40% QoQ Growth In Q3? (Smartkarma) $

- Ather Energy Ltd (NSE: ATHERENERG / BOM: 544397) is a leading vertically integrated EV manufacturer, rapidly capturing market share through distribution expansion and the success of its affordable Rizta scooter series.

- Operational growth is driven by massive retail scaling, value engineering via the EL platform, and strategic penetration into high-potential markets like Middle India.

- We project a 21% QoQ robust 71% YoY revenue growth in Q3FY26. Although it’s crucial to know will the stock be able to maintain it’s momentum at this premium valuation.

🇮🇳 Biggest Merger in Indian QSR Industry.. (Smartkarma) $

- Devyani International (NSE: DEVYANI / BOM: 543330) and Sapphire Foods India Ltd (NSE: SAPPHIRE / BOM: 543397) will merge via share swap to form a QSR powerhouse with over 3,000 stores, creating immediate scale parity with market leader Jubilant FoodWorks.

- The combined entity projects Rs 78.3 billion in revenue and targets annualized cost synergies of up to Rs 2.25 billion through centralized procurement and streamlined overheads.

- Strategic focus lies on accelerating KFC’s expansion and revitalizing Pizza Hut, though full synergistic benefits are expected to materialize 15 to 18 months post-merger.

🇮🇳 The Post-IPO Play: Deleveraging and Diversification at Jain Resource Recycling (Smartkarma) $

- Jain Resource Recycling Ltd (NSE: JAINREC / BOM: 544537) is now aggressively pivoting toward high-margin value addition in copper and has already established itself as one of only two Indian recyclers with LME-registered lead brands.

- The strategic deployment of INR 375 crore in IPO proceeds to repay debt will slash gearing to below 0.7x, significantly boosting net margins.

- The shift from 61% import reliance to domestic scrap yard acquisitions aligns with India’s Critical Mineral Recycling Policy, effectively shortening the working capital cycle and shield from global logistics volatility.

🌍 Middle East

🇹🇷 Hepsiburada: Facing Competitors, Inflation And Currency Devaluation (Seeking Alpha) $ 🗃️

- 🇹🇷 Hepsiburada (NASDAQ: HEPS) or D-MARKET Electronic Services & Trading – eCommerce. KASPI (NASDAQ: KSPI / LON: 80TE / FRA: KKS) controlled. 🇼

🌍 Africa

🇿🇦 Anglo American: Copper Re-Rating Thesis Gathers Momentum (Seeking Alpha) $ 🗃️

- 🌐 Anglo American Plc (LON: AAL / JSE: AGL / OTCMKTS: NGLOY) – World’s largest primary producer of platinum metals (platinum, palladium, rhodium, iridium, ruthenium & osmium; base metals as in copper, nickel, cobalt sulphate, sodium sulphate & chrome; & precious metals as in gold). 🇼 🏷️

🇿🇼 Caledonia Mining: Clearing The Recent Tax Hurdle In Zimbabwe (Seeking Alpha) $ 🗃️

- 🇿🇼 Caledonia Mining Corporation Plc (NYSEAMERICAN: CMCL) – Gold production, exploration & development company.

🌎 Latin America

🌎 Latin America’s Perpetual Growth Crisis (Robin J Brooks)

- In the past decade, Latin America has massively lagged the US in per capita GDP growth

🌎 Arcos Dorados: Expanding in Brazil & Mexico with a Flexible Investment Playbook to Protect Returns and Preserve Cash Flow! (Smartkarma) $

- Arcos Dorados Holdings Inc (NYSE: ARCO), the largest independent McDonald’s franchisee in the world, posted its third quarter 2025 financial performance, showcasing several positive developments along with some areas for improvement.

- The company achieved its highest quarterly revenue of $1.2 billion, propelled by balanced U.S. dollar growth across its three divisions and a 12.7% increase in system-wide comparable sales, aligning with the inflation rate.

- Despite these positive revenue figures, the company faced ongoing challenges due in part to the volatile economic environment in some of its key markets like Brazil, where input cost pressures, particularly concerning beef prices, put a dent in profitability.

🌎 PagSeguro Digital: A 72% Banking Margin in a Tough Rate Cycle—How Is It Pulling This Off? (Smartkarma) $

- PagSeguro Digital (NYSE: PAGS) has presented its financial and operational outcomes for the third quarter of 2025 against a backdrop of macroeconomic challenges.

- These results provide a nuanced picture of the company’s ongoing strategic direction, revealing both strengths and areas for potential improvement.

- PagSeguro Digital ended the quarter with a client base of 33.7 million, marking an increase of 1.6 million year-over-year despite tougher economic conditions.

🇧🇷 Sigma Lithium After The Rally: Execution Now Matters More Than Lithium Prices (Seeking Alpha) $ 🗃️

- 🇧🇷 Sigma Lithium Corporation (CVE: SGML) – Exploration & development of lithium deposits in Brazil. 🏷️

🇧🇷 Inter & Co Vs. Nu: Which Is The Best Neobank Option For 2026? (Seeking Alpha) $ 🗃️

- 🇧🇷 Inter & Co Inc (BVMF: INBR32 / NASDAQ: INTR) – Holding company of Inter Group & indirectly holds all of Banco Inter’s shares. Inter is a Super App providing financial & digital commerce services. 🏷️

- 🌎 Nu Holdings (NYSE: NU) – Digital banking platform / fintech. 🇼

🇧🇷 PagSeguro: Undervalued Double-Digit Growth And Yield Amid Rising Global Uncertainty (Seeking Alpha) $ 🗃️

- 🇧🇷 PagSeguro Digital (NYSE: PAGS) 🇰🇾 – Financial services & digital payments. 🇼 🏷️

🇧🇷 Braskem: 3 Key Reasons To No Longer Be So Bearish (For 2026) (Rating Upgrade) (Seeking Alpha) $ 🗃️

- 🌐🅿️ Braskem SA (NYSE: BAK / BVMF: BRKM3 / BRKM5 / BRKM6) – Largest petrochemical company in Latin America. Controlled by Novonor (Odebrecht SA). 🇼 🏷️

🇨🇱 LATAM Airlines: A Golden Setup That’s Still Not Fully Priced In (Seeking Alpha) $ 🗃️

- 🌎 LATAM Airlines Group (NYSE: LTM) – Chile based. Largest airline company in Latin America. Subs. in Brazil, Colombia, Ecuador, Paraguay & Peru. 🇼

🇲🇽 The Unexpected Winner of Rising American Tariffs Is Mexico (WSJ) $ 🗃️

- Its exports to the U.S. have surged since President Trump imposed new duties on countries this year

🇵🇪 Compañía De Minas Buenaventura: A Definitive Inflection Point For 2026 (Seeking Alpha) $ 🗃️

- 🇵🇪 Compania de Minas Buenaventura SAA (NYSE: BVN) – Precious metals mining & exploration (gold, silver, copper, zinc, etc.). Energy generation & transmission services & industrial activities. 🇼

🇻🇪 Wall Street Investors Who Stuck With Venezuela Are Poised for a Payday (WSJ) $ 🗃️

- Many holding distressed Venezuelan assets hope that Maduro’s ouster signals a windfall after a long time out in the cold

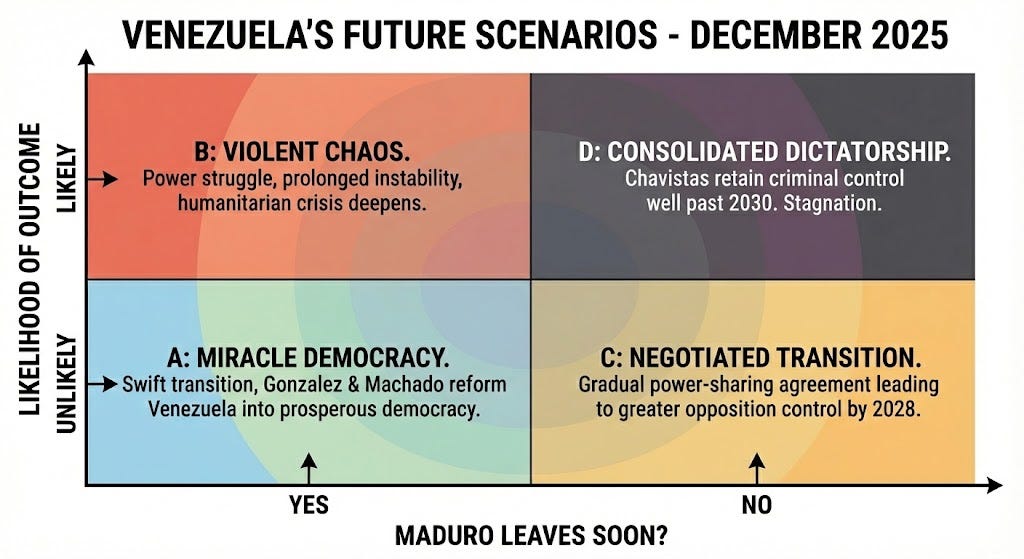

🇻🇪 Venezuela Scenarios – January 2026 / Eight initial comments on Maduro’s detention (Latin America Risk Report)

- Does US involvement keep Venezuela out of the chaos box? Or make it more likely?

🌐 Global

🌐 US stocks had a remarkable 2025. But international markets did much better (CNN)

- US stocks had a stellar 2025, but global markets stole the show.

- A major index tracking stocks outside the US, the MSCI All Country World ex-USA, gained 29.2% in 2025, handily outpacing the S&P 500’s gain of 16.39%.

- The artificial intelligence boom has benefited markets in Asia, where tech companies and chipmakers have seen surges in demand. In Europe, markets received a boost from plans for government spending on defense and improved prospects for economic growth.

- A weaker US dollar also provided a tailwind for international stocks. When the dollar weakens and other currencies strengthen, investments denominated in those currencies become more valuable when converted back into dollars.

🌐 Expect turbulent asset markets in 2026 (The Asset) 🗃️

- After three years of extraordinary returns, investors should start worrying about the inevitable crash that follows periods of sustained euphoria. But while the odds of a major market correction in the next few years appear uncomfortably high, heading for the exits now could be premature

🌐 Nebius: Ratings Upgrade; No Longer Bearish (Seeking Alpha) $ 🗃️

🌐 2026 Outlook: Why 3.1 Is A Game-Changer For Nebius (Seeking Alpha) $ 🗃️

🌐 Nebius Group: Sold Out On AI Demand, But With A 1‑Year Capex Headache (Seeking Alpha) $ 🗃️

- 🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

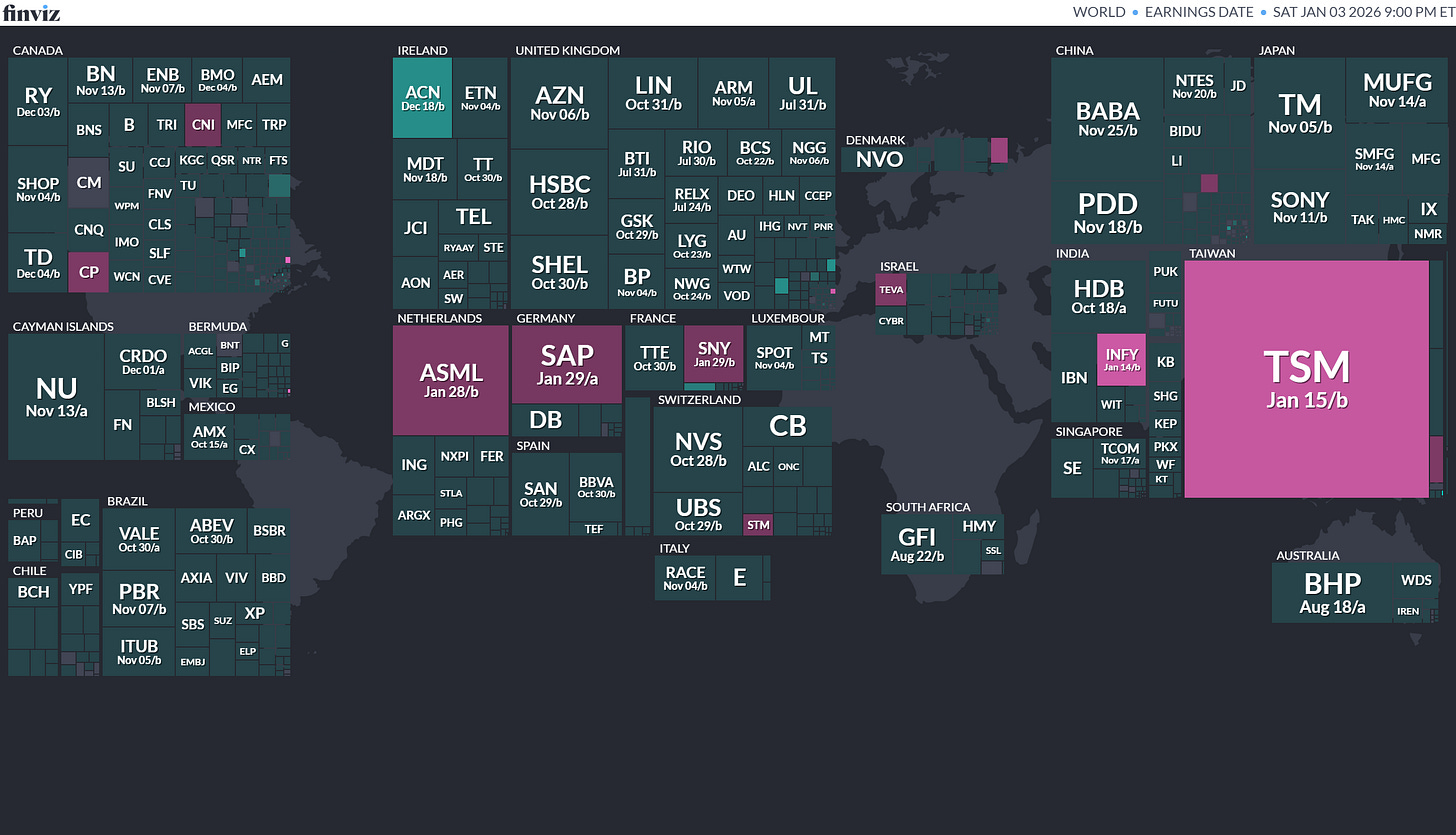

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

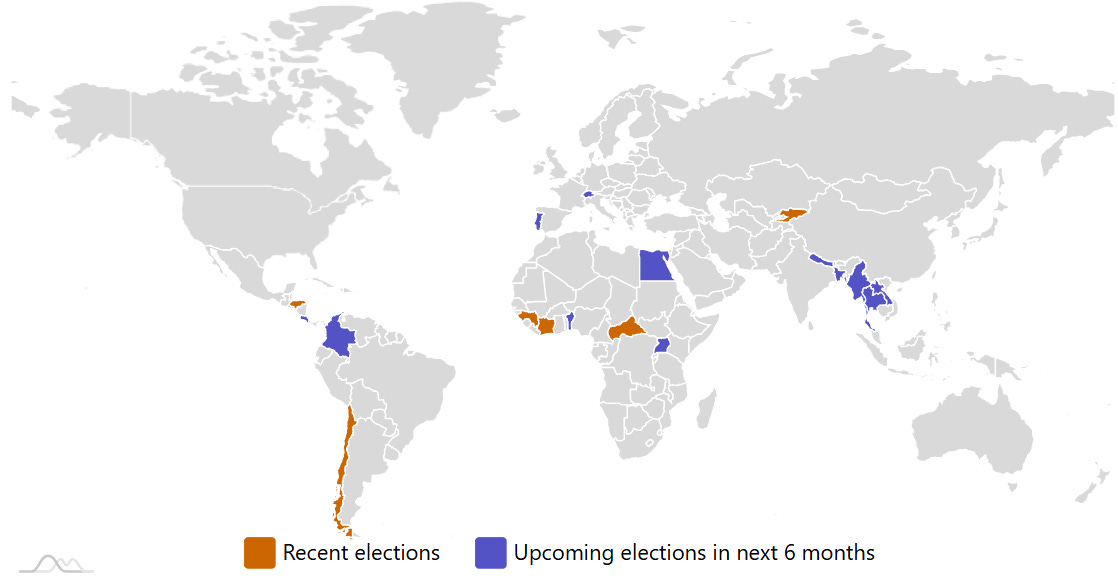

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

MyanmarMyanmar House of Representatives2025-12-28 (t) Confirmed 2020-11-08MyanmarMyanmar House of Nationalities2025-12-28 (t) Confirmed 2020-11-08- Thailand Thai House of Representatives 2026-02-08 (t) Date not confirmed 2023-05-14

- Thailand Thai House of Representatives 2026-02-08 (t) Date not confirmed 2023-05-14

- Bangladesh Bangladeshi National Parliament 2026-02-12 (d) Confirmed 2024-01-07

- Bangladesh Referendum 2026-02-12 (d) Confirmed

- Colombia Colombian Senate 2026-03-08 (d) Confirmed 2022-03-13

- Colombia Colombian House of Representatives 2026-03-08 (d) Confirmed 2022-03-13

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

[As of Monday USA time]:

AIGO Holding Ltd. AIGO Eddid Securities USA, 2.0M Shares, $4.00-6.00, $10.0 mil, 1/5/2026 Week of

(Incorporated in the Cayman Islands)

We are a consumer products provider well established in Southern Europe with global operations that extend into geographic regions including Europe, Asia, North America, Latin America, and Africa. In 2024, we generated revenue from approximately 40 countries and regions in four continents.

We primarily offer consumers lifestyle products through our various sales channels, with a particular focus on four main product categories: (i) lighting products; (ii) electrical products; (iii) household appliances; and (iv) pet products. Since 2019, we have also been developing and offering IoT-related consumer products.

We have three proprietary brands, namely, AIGOSTAR®, nobleza® and Taylor Swoden®, each of which has its distinct product lines, marketing strategies and intended consumers. As of December 31, 2024, we had a 115-member R&D team that is dedicated to research and development of new products tailored to customer needs as well as the development of our IT system. We generate recurring revenue from certain core products as well as revenue from new products we offer to the market.

We sell our products through both offline and online channels. Our offline customers are mainly business entities, including local community stores and/or high-end boutiques, shopping malls, supermarkets and distributors, who purchase products from us, either by directly placing orders with us or through our proprietary apps designed specifically for our offline customers to place orders efficiently, and on-sell them to end consumers. Our online customers are generally users who purchase products directly from us through third-party E-commerce platforms and our proprietary AigoSmart App.

Note: Net income and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: AIGO Holding Ltd. is offering 2 million shares at a price range of $4.00 to $6.00 to raise $10 million, according to its F-1 filing dated Aug. 21, 2025.)

DT House Ltd. DTDT American Trust Investment Services, 2.0M Shares, $4.00-5.00, $9.0 mil, 1/5/2026 Week of

(Incorporated in the Cayman Islands)

We are a Cayman Islands exempted company with operations conducted by our subsidiaries in the UAE and Hong Kong. DT House is the holding company of UHAD, UHHK and UFox, all being our wholly-owned subsidiaries. Our headquarters are located in the UAE, and we commenced with the establishment of UHHK in 2020. We provide corporate consultancy services encapsulating environmental, social and governance-related aspects (commonly known as “ESG”) to enterprises and corporations with the purpose of unlocking greater business resiliency and sustainable cost savings along with revenue generating opportunities. As part of our corporate consultancy services around the ESG thematic, we provide travel-related services for leisure travelers into the UAE, which includes primarily the sale of tourism attractions tickets.

Our corporate consultancy services are provided in the UAE and Hong Kong. ESG is an emerging managerial concept for enterprises and corporations. Through technology integration, our corporate consultancy services offer customized hassle-free solutions to clients, from developing the knowledge and acknowledging the importance of ESG criteria, to formulating internal ESG self-assessments and practices, identifying ESG-related risks and opportunities, implementing cost-effective ESG policies and solutions, and eventually to capitalizing on potential ESG-related market opportunities and strategies. Our clients consist of public companies in the United States and Hong Kong, as well as small and medium-sized enterprises and private corporations in the UAE, Hong Kong and southeast Asia. We leverage upon emerging technologies to drive growth, optimize operations, and create new value streams for our clients. We have our own AI driven, cloud-based software program, and will continue to develop such program so that it can interact with various databases, collect relevant data, and use the data collected to perform self-determined tasks to meet predetermined goals (commonly known as “AI Agent”), which enables clients to retrieve, analyze, compare and evaluate ESG performance of themselves, their competitors and other market participants.

In June 2024, we commenced our travel-related services by acquiring UFox. UFox is a company principally engaged in travel-related services in the UAE, with the particular emphasis of eco-friendly and sustainable travel practices. UFox maintains close business relations with various organizations in the MENA Region such as the Union of Overseas Chinese in Saudi Arabia. We believe that our travel-related services could potentially bring about a synergistic effect with our corporate consultancy services if we follow the same set of ESG principles in both segments. Our current plan is to design travel programs based on the sustainable travel concept, such as alternative transport modes with lower carbon footprints and partnering with eco-friendly hotels. Knowledge and experience gained from our design of travel programs would be useful when we develop sustainable travel policies for our corporate consultancy services clients. The cross-over between low carbon footprint travel programs and sustainability business practices would reduce the average development costs of our projects. It also broadens the scope and strengthen the quality of our consultancy in fostering responsible and impactful ESG business strategies and practices for our corporate customers. Through UFox, we started to provide travel-related services for leisure travelers in the UAE. We offer segmented travel-related services to our customers, which includes primarily the sale of tourism attractions tickets. The destinations of the travel-related services offered by us are primarily within the UAE. We offer customizable hassle-free sustainable travel experience to customers. Customers can choose to customize their own tours depending on their demands and requirements and subscribe to services on segmented basis. Currently, we only have limited business activities of travel-related services due to our short operating history of several months in this sector. The major customers of our travel-related services are two online leisure travel platforms, namely, Trip.com Group Limited (Nasdaq: TCOM) and Fliggy international platform (fliggy.com, a member of Alibaba Group (NYSE: BABA) and an online marketplace of tourism products) that connect us with independent travelers for the sales and marketing of our travel products and services. Other customers of ours include travel companies, travel agencies, tour operators, booking agents, as well as other corporations and institutes, which currently contribute an insignificant portion of our revenue from travel-related services. In the future, we hope to expand the clientele of this segment to include retail leisure travelers and clients from our corporate consultancy services, and the scope of this segment to include other types of travel-related services, such as airfreight ticketing, tour guiding, hotel booking and transportation booking, and arrangement of packaged tours.

Note: Net income and revenue are for the year that ended Sept. 30, 2024.

(Note: DT House Ltd. increased its IPO’s size to 2.0 million shares – up from 1.875 million shares initially – and kept the price range at $4.00 to $5.00 – to raise $9.0 million, according to its most recent F-1/A filing. DT House Ltd. has also named American Trust Investment Services as the sole book-runner, replacing Revere Securities. Background: DT House Ltd. filed its F-1 on March 3, 2025, and disclosed the terms for its IPO: The company is offering 1.875 million shares at a price range of $4.00 to $5.00 to raise $8.44 million, if priced at the mid-point of its range.)

Hillhouse Frontier Holdings HIFI Cathay Securities, 1.3M Shares, $4.00-6.00, $6.3 mil, 1/5/2026 Week of

(Incorporated in Nevada)

We are a luxury vehicle exporter. Through our subsidiary, Hillhouse Capital Group, we run a vehicle export business that specializes in finding premium vehicles in the U.S. and facilitating their shipment to Hong Kong to our client, who distributes the vehicles to its clients in the People’s Republic of China (PRC).

In 2024, Hillhouse Capital Group did 67 vehicle transactions, including 34 with authorized dealerships and 33 with independent dealers. We worked with 15 purchasing agents.

We specialize in exporting U.S. luxury vehicles having MSRPs of at least $80,000, targeting affluent consumers and dealers seeking premium luxury brands, such as Mercedes-Benz, BMW, Audi and Cadillac. Unlike smaller industry participants—typically family-run businesses that rely on informal sourcing networks—we operate through a structured purchasing model with authorized dealerships (i.e., purchasing from them through their designated purchasing agents) and independent dealers, ensuring a stable and scalable supply chain.

Fenglong Ma has served as our CEO and our chairman of the board since October 2022. He is a seasoned entrepreneur in international trade and automotive sales. He founded our company in October 2022, leading its strategy, operations, and entry into automotive exports. Previously, he co-founded Qingdao High-End Vehicle Trading Co., and served as general sales manager from January 2020 to September 2022. He was responsible for sales, market expansion, and supply chain management of high-end imported vehicles, establishing strong global partnerships and optimizing procurement processes. He received an associate degree in business management from Mudanjiang Forestry Vocational and Technical College. Mr. Ma is a citizen of the PRC and currently resides in the PRC.

Zheng Wen Tong has served as our chief operating officer since November 2024, overseeing vehicle procurement, logistics, and financial transactions. She has extensive experience in automotive trade and supply chain management. Before this, she was an office manager at TW&EW Service from April 2024 to October 2024 and was employed by Wave Capital Management from January 2022 to March 2024, where she oversaw administrative and supply chain operations. From January 2020 to March 2020, she served as an office manager at Luxury Unlimited Group. She received a diploma in accounting from Shanghai Business Trade College in July 1994. Ms. Tong is a citizen of the United States and currently resides in the United States.

Chihyuan Lin has served as our CFO since February 2025, overseeing financial strategy and operations. He is an experienced financial executive with expertise in strategic financial management, accounting, and SEC reporting. Before joining us, he founded Linck Consulting Inc. in September 2024 and has been serving as its CEO, providing accounting and tax consulting services. From September 2023 to September 2024, he worked as a consultant at 8020 Consulting LLC, focusing on SEC reporting and financial advisory services. Prior to that, from October 2022 to September 2023, he was the senior manager of financial reporting and technical accounting at Tattooed Chef, where he managed SEC filings, financial reporting, and statement consolidation. From October 2021 to October 2022, he held the role of senior manager of financial reporting and analysis at HF Foods Group Inc., overseeing financial reporting and compliance matters. Earlier, from February 2018 to October 2021, he served as the assistant director of finance and assistant controller at Ta Chen International Inc., specializing in operational accounting and financial statement consolidation. Mr. Lin earned a Master of Science degree in accounting from the University of Texas at Dallas on August 12, 2011, and a Master of Science degree in Finance from the University of Illinois Urbana-Champaign on May 16, 2010. Mr. Lin is a citizen of the United States and currently resides in the United States.

Note: Net income and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: Hillhouse Frontier Holdings filed its S-1 for its IPO on July 21, 2025, and disclosed the terms: 1.25 million shares at a price range of $4.00 to $6.00 to raise $6.25 million, if priced at the $5.00 mid-point of its range.)

HW Electro Co., Ltd. (NASDAQ-New Filing) HWEP American Trust Investment Services/WestPark Capital, 4.2M Shares, $4.00-4.00, $16.6 mil, 1/5/2026 Week of

We are the first company in Japan to obtain a license plate number for imported electric light commercial vehicles. We are the second company and also one of the three companies that sell electric light commercial vehicles in Japan as of the date of this prospectus. (Incorporated in Japan)

The electric light commercial vehicles we sell belong to the category of “light commercial vehicles,” which are commercial carrier vehicles with a gross vehicle weight of no more than 3,500 kilograms.

We commenced selling and delivering two models of electric light commercial vehicles, ELEMO and ELEMO-K, in Japan in April 2022 and July 2022, respectively, and have been working with Cenntro, our cooperating manufacturer, to produce them under our brand, “ELEMO,” in its factory in Hangzhou, China. ELEMO is the first electric vehicle we sell and (it) is the second electric light commercial vehicle that has ever been sold in Japan since the commencement of sales of MINICAB-MiEV in December 2011, which was the first electric light commercial vehicle produced by Mitsubishi Motors Corporation. Since June 2023, we have commenced the sales of a new model called “ELEMO-L,” a van-type electric vehicle that could be used for commercial and recreational camping purposes, which we expect may enable us to increase consumer market penetration.

Under our Exclusive Basic Transaction Agreement dated March 31, 2021 with Cenntro (the “Exclusive Basic Transaction Agreement”), Cenntro manufactures ELEMO, ELEMO-K, ELEMO-L, and other electric vehicles under the specifications designated by us in their manufacturing factories in China and delivers the electric vehicles to the ports in China designated in the individual agreement for a particular order. We arrange for the shipment from these ports to the Port of Yokohama or other designated ports in Japan. Upon arrival, we transport the vehicles to our research laboratory located in Chiba, Japan, for inspection, and then send them to our business partners’ facilities, Anest Iwata’s factory in Fukushima, Japan, and TONOX’s factories in Kanagawa, Japan. The specialists of Anest Iwata, a Tokyo Stock Exchange-listed company that specializes in industrial machinery, supplies, and components, and TONOX, a Japanese commercial vehicle manufacturer, modify the vehicles to comply with the regulations and standards for the Japanese market, install the accessories, and undertake the inspection in accordance with our instructions. After the inspection and modifications, we deliver the electric vehicles to the governmental vehicle inspection office, the National Agency for Automotive and Land Transportation Technology, for individual imported vehicle inspection, and the local land transportation office for registration. Upon completion of the individual imported vehicle inspection and registration, we conduct the final inspection in our research laboratory located in Chiba, Japan, and deliver the electric light commercial vehicles to the customers.

Since the inception of our operation, we have been leveraging the customizability and adjustability of our electric light commercial vehicles to attract corporations in different industries and local governments that have varying needs from their departments in Japan. During the fiscal years ended September 30, 2023 and 2022, we sold and delivered 52 and 16 electric light commercial vehicles to 14 and 11 customers, respectively.

Note: Net loss and revenue figures are in U.S. dollars (converted from Japanese yen) for the fiscal year that ended Sept. 30, 2024.

(Note – New IPO Plans: HW Electro Co., Ltd. filed an F-1 dated May 8, 2025 – the same date that it withdrew its previous IPO plans in a letter to the SEC. In the new IPO document – the F-1 dated May 8, 2025 – HW Electro Co., Ltd. disclosed that it is offering 4.15 million American Depositary Shares (ADS) at an assumed IPO price of $4.00 to raise $16.6 million. American Trust Investment Services and WestPark Capital are the joint book-runners.)

(Background on Previous IPO plans: Registration Withdrawn on May 8, 2025 – A.C. Sunshine and Univest Securities were the joint book-runners. Note: HW Electro Co., Ltd. filed an F-1MEF to increase its IPO’s size at pricing by 200,000 shares, according to a filing dated Jan. 24, 2025. Note: HW Electro Co., Ltd. filed an F-1/A to increase its IPO’s size to 4.0 million ADS – up from 3.75 million ADS – and increase the assumed IPO price to $4.00 – up from $3.00 – to raise $16.0 million – up from $11.25 million initially – according to an F-1/A filing dated Dec. 23, 2024. In that same filing, AC Sunshine Securities was added as the lead left joint book-runner to work with Univest Securities as the other joint book-runner, and the IPO’s proposed venue was changed to the NASDAQ from the NYSE – American Exchange, with the proposed symbol changed to “HWEP” from “HWEC”. Note: HW Electro Co., Ltd. filed its new F-1 (prospectus) on April 26, 2024, disclosing plans for its IPO and its listing of American Depositary Shares (ADS) on the NYSE – American Exchange: 3.75 million ADS at an assumed IPO price of $3.00 per ADS. Each ADS represents one ordinary share. Background: HW Electro Co., Ltd. withdrew its previous IPO plans that called for a listing on the NASDAQ with a different proposed symbol.)

K2 Capital Acquisition Corp. KIIU D. Boral Capital (ex-EF Hutton), 10.0M Shares, $10.00-10.00, $100.0 mil, 1/5/2026 Week of

(Incorporated in the Cayman Islands)

We are a newly organized blank check company – also known as a SPAC.

We intend to actively pursue opportunities in the emerging field of humanoid robotics and physical artificial intelligence (“Physical AI”), a rapidly developing sector at the intersection of advanced robotics, machine learning, sensor fusion, and biomechanical engineering. As autonomous systems become increasingly capable of interacting with the physical world in human-like ways, we believe humanoid robotics will play a transformative role across industries such as manufacturing, logistics, eldercare, domestic services, and hazardous environment operations. These systems represent a new class of intelligent machines that not only process information but also navigate and manipulate complex physical environments with dexterity and situational awareness. We believe the convergence of next-generation compute power, real-time AI, battery innovation, and mechanical design is catalyzing a step-change in capability and commercial readiness, positioning Physical AI as a foundational element of for the economy and labour force of tomorrow.