Last week, there was an interesting Tweet from a pro-China Twitter account:

Even IF you believe all of these various PMI numbers are accurate, none of them are particularly great – except for this one:

Meanwhile, its been reported that China tech has skipped the traditional seasonal hiring rush amid weak export demand (as in weak Western economies) and shifting supply chains.

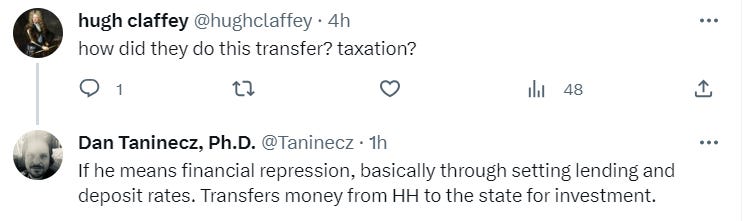

Chinese banks are also slashing interest rates on deposits as the government appears to be trying “financial repression” once again to cover (or “transfer…”) bad debts and fund more (bad…) investments. This post has some tweets explaining what is happening – none of which sounds good:

They’ve never “magically disappeared” bad debt. Once before, in the 2000s, they transferred it to the household sector, causing such a decline in the consumption share of GDP that it set off much of the subsequent surge in non-productive investment.

Finally, we have a number of stock picks or writeups. Today is Labor Day in the USA (the end of summer and children should all be settled back in school) and we just had Merdeka Day (parade…) plus Hungry Ghost Festival in Malaysia (with another Chinese temple festival coming this week on my street). Hopefully, there will be more fund letters and stock write-ups as we enter autumn – always an interesting time of the year for the stock market (October: The Month of Market Crashes?).

Subscribe Now Via Substack

Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- Rondure New World + Overseas Fund EM Stock Holdings (Mid-2023)

- A closer look at almost 100 individual emerging market stock holdings of the Rondure New World Fund (MUTF: RNWOX / RNWIX) and the Rondure Overseas Fund (MUTF: ROSOX / ROSIX) covering the following countries:

- Africa: South Africa

- Asia – East Asia: China, Korea & Taiwan

- Asia – SE Asia: Indonesia, Malaysia, Philippines, Thailand & Vietnam

- Asia – South Asia: India

- Asia – Middle East: Qatar

- Eastern Europe & Emerging Europe: Greece & Poland

- Latin America: Argentina, Brazil, Colombia, Mexico & Uruguay

- A closer look at almost 100 individual emerging market stock holdings of the Rondure New World Fund (MUTF: RNWOX / RNWIX) and the Rondure Overseas Fund (MUTF: ROSOX / ROSIX) covering the following countries:

Emerging Market Stock Picks / Stock Research

$ = behind a paywall

Pinduoduo has enough $$$ to fund Temu’s Southeast Asia expansion, and more (Momentum Works)

- Investors responded positively, sending the share prices up by almost 20% in the two trading days after the release.

- Looks like a short squeeze – as we knew many hedge funds were shorting PDD because of the current economic situation in China as well as its aggressive cash burn with Temu.

- Revenue & profit growth of PDD is very positive;

- PDD Holdings (NASDAQ: PDD) spent $850m more on sales & marketing this quarter – probably mostly on Temu;

- PDD reduced general and administrative expenses by 29% QoQ, even as revenue grew by 39% QoQ – suggesting it it run even more efficiently;

- With a quarterly net income of US$1.8b, PDD can perfectly afford the burn by Temu. They are not overstretching;

- Whether Temu will be successful, however, depends on other factors. An observation by a friend in May seems to have suggested something.

Pinduoduo (PDD US): Don’t Fight with PDD (Smart Karma) $

- PDD Holdings (NASDAQ: PDD) reported blowout 2Q results with bottom line beating consensus by 40% thanks to stronger domestic marketplaces business, narrower losses incurred by TEMU and higher other income.

- 2Q results cleared much of our concern around PDD’s bottom line growth and we now see 2Q as the low point of earnings growth in FY23.

- We believe the company will report $9 billion net profit for FY23 and expect rounds of earnings revision by the street will further lift share price. US $120 price target.

Dada Nexus rides to profits, but tamps down high expectations (Bamboo Works)

- The provider of intracity delivery services recorded its first-ever profit on a non-GAAP basis in the second quarter, as its revenue grew 23%

- Dada Nexus (NASDAQ: DADA)recorded its first ever non-GAAP profit in the second quarter, but continued to lose money on a net and operating basis

- The company could benefit from its strong focus on grocery delivery as Chinese consumers eat more at home in the current environment of economic uncertainty

[Xiaomi(1810 HK, SELL, TP HK$8.2) Update]: Huawei’s Impact on Xiaomi Will Be Meaningful in 2024 (Smart Karma) $

- Users are enthusiastic about the return of 5G Huawei smartphones, and thus we expect sales volume of Huawei devices to improve.

- If the combined share of Huawei+ Honor can reach 30/32% we estimate Xiaomi’s (HKG: 1810 / FRA: 3CP / OTCMKTS: XIACF) current 12.5% share of the China smartphone market could decline 0.8/1.3ppts, respectively.

- We maintain Xiaomi’s SELL and HK$ 8.2 TP, implying 26x FY23 PE. The increase in CY23 EPS reflects lowered OPEX, improved gross margin due to the impact of IC oversupply.

Home sweet home: SharkNinja (NYSE: SN), a global household appliance leader (Alex’s Investment Memo)

- SharkNinja (NYSE: SN) is a leading small household appliance company in US and Europe. It is a recently spin-off from JS Global Lifestyle (HKG: 1691 / FRA: 3JS / OTCMKTS: JGLCF) on Jul 31st. The stock is traded at an absurdly low 12.8x LTM PE partly because of market’s unfamiliarity to it (so far I don’t find any sellside coverages), and partly due to market’s concern to its corporate governance (it’s a Cayman incorporated company with a Chinese businessman owning 57% of the equity). However, as a follower of the whole spin-off process and who has access to the Chairman, I’m pretty sure it is a very good business with great corporate governance:

RLX holds breath as illegal vaping slows its rebound (Bamboo Works)

- China’s vaping giant has been slow to bounce back from an industry crackdown due to competition from makers of illegal rival products

- RLX Technology’s (NYSE: RLX) revenue plunged 83% in the second quarter year-on-year, but was up from the previous quarter as it adjusts to a new regulatory framework launched last fall

- Despite complying with the new framework, China’s leading maker of vaping devices continues to face challenges from illegal rival products

Mengniu Dairy (2319 HK): Solid Value Play (Smart Karma) $

China Mengniu Dairy Co (HKG: 2319 / FRA: EZQ / OTCMKTS: CIADY / CIADF) is a good pick for those seeking value in the China consumer sector.

The company currently trades at 15x 2024E PE, compared to over 20x forward PE in the last 5 years, as the industry growth stagnated.

We can still expect above 10% net profit growth over the next three years, with the company looking to return more cash to shareholders.

Greentown China (3900 HK): Disciplined Market Share Gainer Amid Chaos (Smart Karma) $

- Greentown China (HKG: 3900 / FRA: G7C / OTCMKTS: GTWCF) is a high quality China property developer that is unfairly suppressed given the extreme pessimism of the sector.

- Even though the overall sales of China property industry will likely continue to decline, the market is large enough that some developers could stand to gain massive market share.

- The company trades at 2.5x 2024E PE, and 71% discount to NAV, with expected growth in net profit in 2023 and 2024.

Vipshop’s strong results overshadowed by troubling outlook (Bamboo Works)

- The online discount retailer’s second-quarter results beat analyst expectations, but its third-quarter forecast was far gloomier as the Chinese economy sputters

- Vipshop Holdings’ (NYSE: VIPS) revenue increased 13.6% in the second quarter, and its net profit jumped 64%

- The company expects its revenue growth to slow sharply to 5% at best in the third quarter amid mounting signs of trouble for the Chinese economy

New Horizon Health finds formula for profits ahead of schedule (Bamboo Works)

- One of China’s leading makers of early cancer screening products recorded an adjusted profit in the first half of the year as its revenue more than tripled

- New Horizon Health Ltd (HKG: 6606 / FRA: 6YZ / OTCMKTS: NHZHF) posted a 61.3 million yuan adjusted profit in the first half of 2023, benefiting from soaring revenue for its three approved products

- The company sees big growth potential for its home-based cervical cancer screening product

With healthier finances, Clover Bio shifts to flu and RSV vaccines (Bamboo Works)

- The Chinese vaccine developer rebounded from a deep loss into profit in the first half of the year, boosted by a one-off gain from a Covid research grant

- Clover Biopharmaceuticals (HKG: 2197) posted a surge in first-half earnings after a $384 million grant for Covid vaccine development was belatedly folded into its accounts

- The company has turned its attention to flu vaccines after being hit by waning demand in the crowded Covid market

Wuxi Biologics (2269.HK) 23H1 – The Positives, the Negatives and the Outlook (Smart Karma) $

- The market is clearly satisfied with Wuxi Biologics‘ (HKG: 2269 / OTCMKTS: WXXWY / OTCMKTS: WXIBF) interim results. Growth of both non-COVID revenue and new projects were beyond expectations. This makes us look forward to 2023 full-year result.

- There’s a significant strength gap between WuXi Bio and Lonza/Samsung Biologics in undertaking commercial-stage orders, which puts WuXi Bio at a disadvantage in competition, making it more vulnerable to financing environment.

- It’s not impossible to restore the high growth before COVID, but WuXi Bio needs to meet two conditions. Instead of betting on a V-shaped reversal, it’s wiser to take profits in time.

China East Education returns to growth as short-term enrollments surge (Bamboo Works)

- The vocational educator’s revenue grew 4% in the first half of the year, reversing a 14% drop a year earlier when China’s tough Covid-control measures forced many of its schools to close

- China East Education (HKG: 0667 / FRA: ZX3) returned to revenue growth in the first half of 2023, but its profit fell as its costs increased more quickly

- The company’s shares have lost more than half of their value this year as investors worry that China’s economic uncertainty could dampen demand for vocational education services

End of Mandatory Lock-Up Periods for 49 Companies in Korea in September 2023 (Smart Karma) $

- We discuss the end of the mandatory lock-up periods for 49 stocks in Korea in September 2023, among which 7 are in KOSPI and 42 are in KOSDAQ.

- These 49 stocks on average could be subject to further selling pressures in September and could underperform relative to the market.

- Among these 49 stocks, top five market cap stocks include Kakao Games (KRX: 293490), SK Oceanplant (KRX: 100090), Korea Zinc (KRX: 010130), Fadu (KOSDAQ: 440110), andVaxcell-Bio Therapeutics (KOSDAQ: 323990).

[KE (BEKE US, BUY, TP US$24) TP Change]: Silver Lining Appear in Industry Cycle, Maintain BUY (Smart Karma) $

- KE Holdings (NYSE: BEKE) (Beike) [Beike is the leading integrated online and offline platform for housing transactions and services] reported 2Q23 GTV 5.6% lower than our estimate, revenue (2.6%)/0.4% vs. our estimate/consensus, and non-GAAP NI 21.8%/42.9% higher than our estimate/consensus.

- We think 3Q23 is the trough and expect a rebound in 4Q23 as more substantial supportive policies laying out in China.

- We maintain the stock as BUY rating and raised TP by US$2 to US$24/ADS

Doosan Robotics IPO Valuation Analysis (Smart Karma) $

- Our base case valuation per share of Doosan Robotics is 42,826 won, which is 65% higher than the high end of the IPO valuation range.

- We estimate Doosan Robotics to generate sales of 61.7 billion won (up 37.2% YoY) in 2023 and 97.7 billion won (up 58.2% YoY) in 2024.

- If Doosan Robotics is compared to Fanuc (TYO: 6954 / FRA: FUC / OTCMKTS: FANUF), Doosan Robotics’ valuation would be much lower. However, one could argue that Doosan Robotics should have higher valuation than Rainbow Robotics (KOSDAQ: 277810).

4 Attractive Singapore Stocks to Watch for in September (The Smart Investor)

- F J Benjamin (SGX: F10), or FJB, is a company that builds brands and management through retail and distribution channels.

- Yangzijiang Financial Holding Ltd (SGX: YF8 / OTCMKTS: YNGFF), or YZJF, provides wealth and fund management services that earn advisory income and recurring fee-based income.

- NetLink NBN Trust (SGX: CJLU / OTCMKTS: NETLF) designs, builds, owns and operates Singapore’s passive fibre network infrastructure for the Nationwide Broadband Network (NBN).

- SBS Transit (SGX: S61)is a bus and rail operator that operates more than 200 bus services along with a fleet of around 3,000 buses.

Singtel’s Strategic Reset: 5 Highlights from its Latest Investor Day (The Smart Investor)

Singtel (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF)

- The telco is planning to grow via different channels and through its myriad of divisions.

- Riding on tailwinds to grow

- Targeting double-digit ROIC

- Rejuvenate its core consumer business

- Providing a “One Optus” experience

- Building a regional green data centre platform

Our thoughts on Grab’s 2023 Q2 earnings (Momentum Works)

- “no secret, no silver bullet, just lots of fundamental little, little improvements”

- Grab Holdings Limited’s (NASDAQ: GRAB)deliveries GMV is finally growing again after four quarters of post-pandemic decline;

- Grab is offering more affordable mobility services (such as grab car-pooling) to expand its customer base (MTU) but also fend off low cost competitors;

- On-grab transactions for Grab’s payment as a percentage of total TPV increased – indeed the pivot of focus for GrabPay is ongoing;

- Grab must have been very glad for its earlier decision not to enter ecommerce;

- The cover of this quarter’s earnings presentation is interesting.

My Perfect Pitch (Value Zoomer) & Ossia International: trading at ~4x earnings, with hidden growth and a catalyst (ValueInvestingBlog.net)

- I found this idea on the blog of Myles Kuah, who can also be found on X (Twitter).

- I think Ossia International (SGX: O08)[Ossia has grown from a footwear manufacturer to a leading regional distributor and retailer of lifestyle, outdoors, luggage and accessories products] is a very attractive special situation and growth investment. I won’t spend too much time rehashing the same information from Myles’ blog, but instead focus on two areas that I think are key points to the undervaluation of the shares today:

- the SGX watch-list issue, with the delisting threat that comes along with it

- and the somewhat hidden growth of their investment in an associated company

- Ossia has an interest in two businesses: Great Alps Industries (100% owned) and a 19.8% stake in Pertama Holdings [a leading retailer of consumer electronics and home furnishings trading under the Harvey Norman brand of retail stores in Singapore and Malaysia]. Their stake in Pertama Holdings is by far their most valuable asset.

- VNG (VinaGame)[Prospectus] plans to offer nearly 22 million shares in the IPO and list on the Nasdaq, but will continue to be controlled by its founders

- The company started as a video game publisher and now runs Vietnam’s most popular messaging app, drawing comparisons to China’s Tencent

Tarczynski S.A. (TAR.WA) (Bebop Value) Partially $

- Founder led and owned micro cap branded snack sausage maker, selling for less than 50% of value, p/e of 5.81, EV/EBIT of 9.6, and dividend yield of 4.7%.

- Description: Tarczynski (WSE: TAR) is the largest branded Polish producer of dried pork sausages (kabanos) that has expanded into various meat and sausage snack products over the last few years. These include protein snacks, beef jerky, plant-based sausages, poultry snacks, frankfurters, ham fillets, and kid meat snacks. Its strategy revolves around strong marketing/branding and selling products at premium prices. It sells in Poland and internationally (primarily in Western Europe) and is headquartered in Ujezdziec Maly, Poland. Tarczynski was founded in 1989 and is 75% owned by the founder CEO and his wife.

Further Suggested Reading

$ = behind a paywall

China’s richer diet is straining the agricultural industry (Caixin) $

Also see: Global El Niño forecasts predict a Very Strong event for 2023/24 (Mintec)

- For years China had more than enough wheat and rice to feed its 1.4 billion people. But since the nation grew richer and diets shifted to more meat and dairy, the world’s second-most populous country is running out of enough arable land to keep up with the demand for high-protein food.

- The Ministry of Agriculture in April projected a downward trend in per capita grain consumption over the next decade and rapid growth in consumption of meat, dairy, fruit and seafood. That’s in line with trends in neighboring, higher-income Asian countries and regions with dietary patterns similar to those of China.

China’s banks set to cut interest rates on deposits again (Caixin) $

- China’s state-owned banks and other large commercial banks plan to lower the interest rates they pay on deposits starting Friday, kicking off a third round of cuts since September 2022 under government pressure to encourage spending over saving in support of the flagging economy.

- Several bankers told Caixin that their banks will lower the rates they pay on one-year time deposits by 0.1 of a percentage point, on two-year deposits by 0.2 of a percentage point, and on three- and five-year time deposits by 0.25 of a percentage point.

Here is what appears to be going on:

Tech suppliers in China skip seasonal hiring rush amid weak demand (Nikkei Asia) (Archived Article)

- Lack of usually lucrative temp work this summer also blamed on shifting supply chains

- China’s massive tech manufacturing industry usually ramps up hiring in summer, recruiting hundreds of thousands of temporary workers to help handle the rush of orders from Apple, Amazon, HP, Dell and others ahead of the year-end holiday shopping season.

The Alpha And Beta Of Emerging Markets Equities (Robeco)

- Robeco’s approach to emerging markets investing was initially met with considerable skepticism, but the live performance of our model has exceeded expectations. David Blitz, Robeco’s Chief Researcher, shares his thoughts on quant investing in emerging markets.

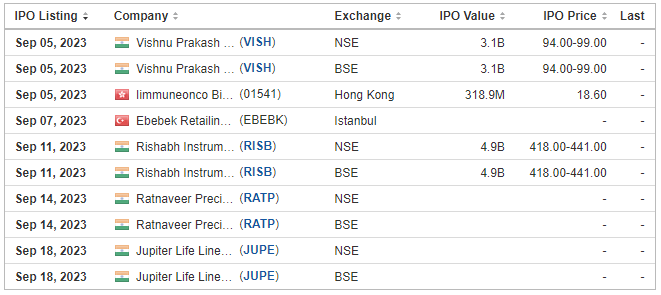

Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

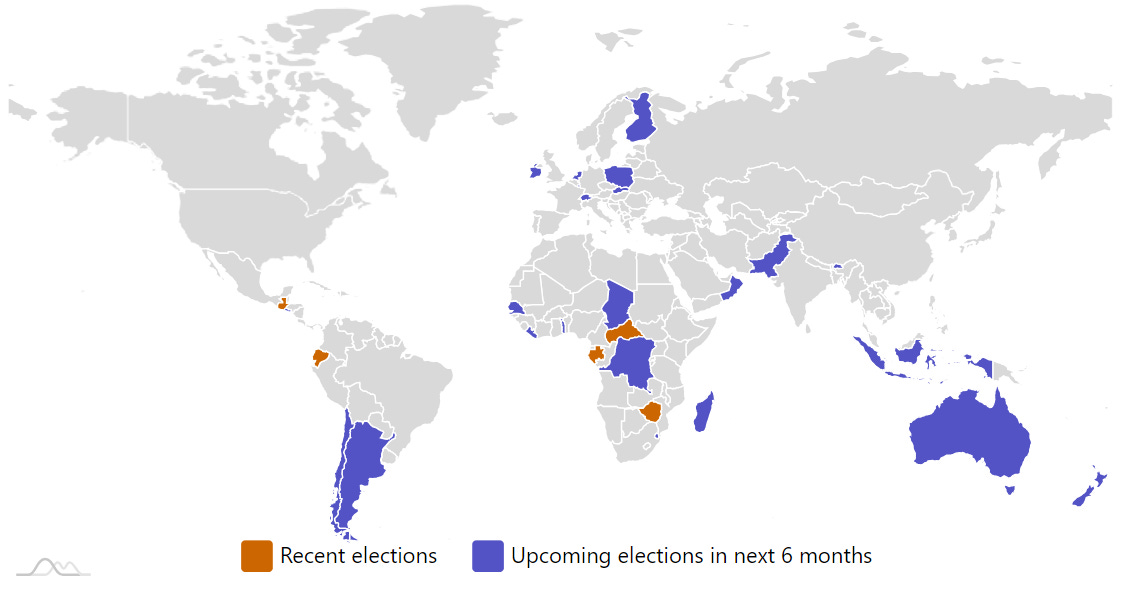

Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

SingaporeSingaporean PresidencySep 1, 2023 (d) Confirmed Sep 23, 2017- Slovakia Slovakian National Council Sep 30, 2023 (t) Confirmed Feb 29, 2020

- Pakistan Pakistani National Assembly Oct 14, 2023 (t) Date not confirmed Jul 25, 2018

- Poland Polish Sejm Oct 15, 2023 (t) Confirmed Oct 13, 2019

- Poland Polish Senate Oct 15, 2023 (t) Confirmed Oct 13, 2019

- Poland Referendum Oct 15, 2023 (t) Date not confirmed Sep 6, 2015

- Argentina Argentinian Chamber of Deputies Oct 22, 2023 (d) Confirmed Oct 24, 2021

- Argentina Argentinian Senate Oct 22, 2023 (d) Confirmed Nov 14, 2021

- Argentina Argentinian Presidency Oct 22, 2023 (d) Confirmed Aug 13, 2023

- Chile Referendum Dec 17, 2023 (t) Confirmed Sep 4, 2022

- Indonesia Indonesian Regional Representative Council Feb 14, 2024 (t) Confirmed Apr 17, 2019

- Indonesia Indonesian Presidency Feb 14, 2024 (t) Confirmed Apr 17, 2019

- Indonesia Indonesian House of Representatives Feb 14, 2024 (t) Confirmed Apr 17, 2019

- South Korea South Korean National Assembly Apr 10, 2024 (t) Confirmed Apr 15, 2020

- Panama Panamanian National Assembly May 5, 2024 (t) Confirmed May 5, 2019

- Panama Panamanian Presidency May 5, 2024 (t) Confirmed May 5, 2019

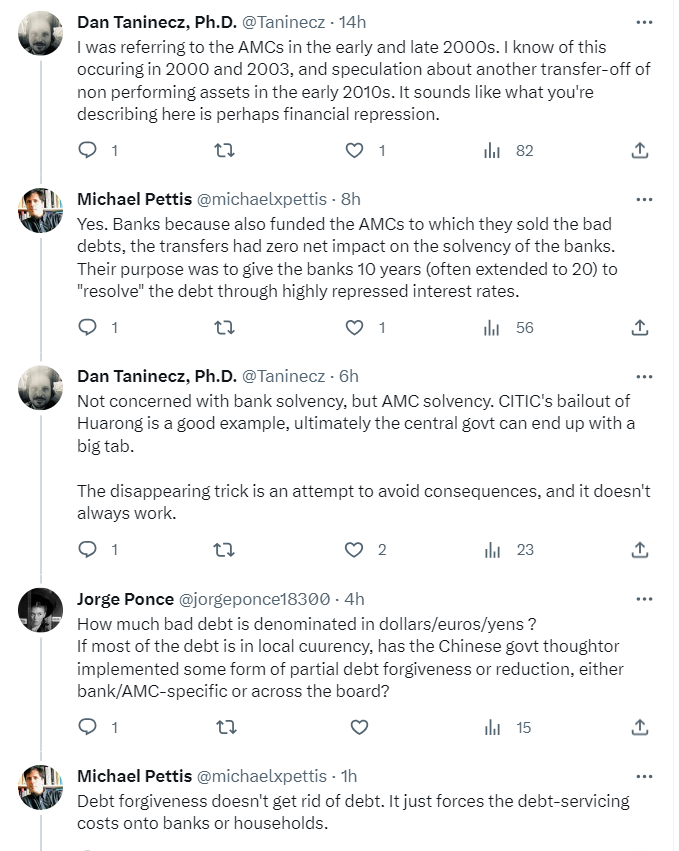

Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Solowin Holdings, Ltd.SWIN, 2.5M Shares, $4.00-4.00, $10.0 mil, 9/7/2023 Thursday

(Incorporated in the Cayman Islands)

Solowin is an exempted limited liability company incorporated under the laws of the Cayman Islands on July 23, 2021. As a holding company with no material operations of its own, Solowin conducts its operations primarily through its wholly owned subsidiary, Solomon JFZ, a limited liability corporation incorporated in Hong Kong.

Solomon JFZ is one of the few Chinese investor-focused versatile securities brokerage companies in Hong Kong. It offers a wide spectrum of products and services through its advanced and secured one-stop electronic platform. Solomon JFZ currently is primarily engaged in providing (i) securities related services, (ii) investment advisory services, (iii) corporate consultancy services and (iv) asset management services to the customers. It is licensed with the Hong Kong Securities and Futures Commission (“HKSFC”) and a participant of the Hong Kong Stock Exchange to carry out regulated activities including Type 1 (Dealing in Securities), Type 4 (Advising on Securities), Type 6 (Advising on Corporate Finance) and Type 9 (Asset Management). Solomon JFZ strictly follows the requirements of the HKSFC for internal regulation and risk control to maximize the safety of investors’ assets. It provides online account opening and trading services via its Front Trading and Back-office Clearing systems, in conjunction with Solomon Pro – a highly integrated application accessible via any mobile device, tablet, or desktop, all of which are licensed from third parties. With strong financial and technical capabilities, Solomon JFZ has been providing brokerage services to global Chinese investors residing both inside and outside the PRC and institutional investors in Hong Kong, and have been recognized and appreciated by users and industry professionals.

Solomon JFZ’s trading platform allows investors to trade over 10,000 listed securities and their derivative products listed on the Hong Kong Stock Exchange (HKSE), New York Stock Exchange (NYSE), Nasdaq, Shanghai Stock Exchange and Shenzhen Stock Exchange. In addition, it provides Hong Kong IPO underwriting, Hong Kong IPO Public Offer application and International Placing subscription, Hong Kong IPO margin financing services, Hong Kong Pre-IPO securities trading and US IPO subscription. Hong Kong IPO margin financing services refer to loans offered by a licensed financial institution to clients for the purpose of purchasing securities in an IPO before the issuers are listed on the Hong Kong Stock Exchange. The loan, commonly referred to as an IPO loan, enables clients to invest more than the required deposit of 5% or 10% of funds. The loan, which is short-term, interest-bearing, typically covers 90% or 95% of the investment amount and is repaid right after the allotment result release. Once the investor is allotted shares cost over the required deposit and a part of loan is used for the shares, the shares can be sold and the proceeds are utilized to repay the loan of the financial institution, with any remaining balance going to the investor. Our customers may also use Solomon JFZ’s platforms to trade various listed financial products, such as ETFs, Warrants and Callable Bull/Bear Contracts. Beside securities related service, Solomon JFZ also offers asset management services as an investment manager. Our High-Net-Worth customers may also subscribe private fund products through Solomon JFZ.

Our clients are mostly Chinese investors residing in Asia as well as institutional clients in Hong Kong, Australia and New Zealand. As of March 31, 2023, we had more than 20,000 users, including more than 15,400 clients who are users and have opened trading accounts with Solomon JFZ. We classify those who have registered on Solomon JFZ’s platform as users and those users who have opened accounts on Solomon JFZ’s platform as clients. We currently have over 1,500 active clients, who have assets in their trading accounts.

As of March 31, 2023, Solomon JFZ’s operations mainly consisted of four business segments: (i) securities related services, (ii) investment advisory services, (iii) corporate consultancy services and (iv) asset management services to the customers.

Note: Revenue and net income are in U.S. dollars for the fiscal year that ended March 31, 2023.

(Note: Solowin Holdings, Ltd. cut the size of its IPO by 33 percent to 2.5 million shares – down from 3.75 million shares – and kept the assumed IPO price at $4.00 on a price range of $4.00 to $6.00 to raise $10 million, according to an F-1/A filing dated July 7, 2023. The company filed its F-1 on April 28, 2023, without disclosing terms. Its original terms were 3.0 million shares on a $4.00-to-$6.00 price range to raise $15.0 million, according to an F-1/A filing dated May 22, 2023. The deal’s size was increased to 3.75 million shares at $4.00 to $6.00 to raise $18.75 million, in an F-1/A filing dated June 15, 2023. Solowin Holdings had submitted confidential IPO documents to the SEC on Dec. 23, 2022.)

Gamer Pakistan Inc.GPAK, 1.7M Shares, $4.00-5.00, $7.7 mil, 9/8/2023 Week of

We are an early-stage esports company focused on developing and organizing esports events in Pakistan. (Incorporated in Delaware)

We are a development-stage interactive esports event promotion and product marketing company, founded in November 2021. Our initial focus is on creating college, inter- university and professional esports events for both men’s and women’s teams, particularly esports opportunities with colleges and universities in Pakistan. The Government of Pakistan’s 2021-22 Pakistan Economic Survey estimated that from 2020-21 there were approximately 500,000 students enrolled in technical and vocational education, approximately 760,000 in degree-awarding colleges, and 1.96 million students in universities.1 Though the foregoing likely will remain our focus for at least 12 months, over time, we intend to expand the range of our esports offerings, expand to other markets and eventually consider live sports. We will endeavor to integrate competitive events that include our teams and leagues with regional and global teams and leagues sponsored by others.

Pakistan is a large market for esports. Pakistan is the fifth most populous country in the world, with a current population estimated to be approximately 231 million persons. The median age in Pakistan is 22.8 years, and 35.1% of the population is urban (77,437,729). Mobile cellular subscriptions have grown at an astounding rate in Pakistan, with 79.51% of the inhabitants having a mobile cellular subscription in 2020 compared to only 0.22% in 2000. Approximately 36.8 million persons in Pakistan have been estimated to play video games in 2022, and the number is expected to increase to 50.9 million by 2026.

We plan to conduct our operations in Pakistan through K2 Gamer (PVT) Ltd. (“K2 Gamer”), and Elite Sports Pakistan Pvt. Ltd. (“ESP”), each a company duly incorporated under the laws of Pakistan. Pursuant to agreements with the three owners of K2 Gamer, we acquired 90% ownership of K2 Gamer on July 10, 2023 when the transfer was approved by the Securities and Exchange Commission of Pakistan (“SECP”). We will account for the transfer as an acquisition of a business under the provisions of ASC 805. To date all activities have been conducted by K2 Gamer and ESP, and not the Company, although the Company has received public recognition as a sponsor for many of the tournaments.

As a result of the assignment to K2 Gamer by ESP of all of its rights with respect to the exploitation of esports, ESP is an affiliate of K2 Gamer and, as a result of the acquisition by us of 90% of the stock of K2 Gamer, ESP now is our affiliate as well. For purposes of this prospectus, we have assumed, except where otherwise stated, that K2 Gamer has been our subsidiary and that ESP has been our affiliate during the periods mentioned. Mr. Muhammed Jamal Qureshi is an owner of K2 Gamer and ESP as well as CEO and a director of K2 Gamer and ESP.

Esports are the competitive playing of video games by amateur and professional teams or individuals for cash and other prizes. Esports typically take the form of organized, multiplayer video games that include real-time strategy and competition, including virtual fights, first-person shooter and multiplayer online battle arena games. The games are played on dedicated hardware (consoles), personal computers (PCs), or a range of mobile devices including smart phones and tablets. Unlike games of chance or luck, esports are defined as competitive games of skill, timing, knowledge, experience, practice, attention and teamwork. Tournaments can be held using consoles, PCs, mobile devices, or a combination of the foregoing. Competitors participate at large in-person events, small in-person events and virtually from home or computer cafes.

Between November 2021 and November 2022, we organized and held 27 separate championships, including the first “Annual University Esports National Tournament and Championship on June 30 through July 1 of 2022. In December 2022 we held the week-long inaugural National Esports Free Fire Championship. During 2023, K2 Gamer and/or ESP are expected to organize and conduct at least 18 championships. There were no paying sponsors for these championships, as a result of which we recognized no revenue from them. We believe that we will be able to gain paying sponsors as the championships gain popularity.

*Note: Revenue and net loss figures are for the year ended Dec. 31, 2022.

(Note: Gamer Pakistan Inc. filed an S-1/A dated Aug. 17, 2023, disclosing that the number of shares that selling stockholders planned to offer had been cut to 1.17 million shares – down from 2.9 million shares. The company will NOT receive any proceeds from the sale of the selling stockholders’ shares. The IPO’s primary portion and size remain the same: The company is offering 1.7 million shares at $4.00 to $5.00 to raise $7.65 million.)

(Background: Gamer Pakistan Inc. filed its S-1 on July 12, 2023, and disclosed terms for its IPO: 1.7 million shares at $4.00 to $5.00 to raise $8.0 million. Selling stockholders are offering up to 2.9 million shares (2,290,429 shares) of common stock. The company will NOT receive any proceeds from the sale of the selling stockholders’ shares.)

Maison SolutionsMSS, 3.0M Shares, $4.00-4.00, $12.0 mil, 9/8/2023 Week of

Maison Solutions is a specialty Asian grocery retailer. (Incorporated in Delaware)

We are a fast-growing specialty grocery retailer offering traditional Asian food and merchandise to modern U.S. consumers, in particular to members of Asian-American communities. We are committed to providing Asian fresh produce, meat, seafood, and other daily necessities in a manner that caters to traditional Asian-American family values and cultural norms, while also accounting for the new and faster-paced lifestyle of younger generations and the diverse makeup of the communities in which we operate. To achieve this, we are developing a center-satellite stores network.

Our merchandise includes fresh and unique produce, meats, seafood and other groceries which are staples of traditional Asian cuisine and which are not commonly found in mainstream supermarkets, including a variety of Asian vegetables and fruits such as Chinese broccoli, bitter melon, winter gourd, Shanghai baby bok choy, longan and lychee; a variety of live seafood such as shrimp, clams, lobster, geoduck, and Alaska king crab, and Chinese specialty products like soy sauce, sesame oil, oyster sauce, bean sprouts, Sriracha, tofu, noodles and dried fish. With an in-house logistics team and strong relationships with local and regional farms, we are capable of offering high-quality specialty perishables at competitive prices.

Our multi-pronged approach allows us to provide customers with multiple shopping channels, including integrated online and offline operations, according to Maison Solutions Inc.’s website.

“Customers can place orders on our mobile app “FreshDeal24,” or through our WeChat Applet “Good Luck to Home” for either home delivery or in-store pickup,” the company’s website says.

*Note: Revenue and net income are for the 12 months that ended April 30, 2023.

(Note: Maison Solutions Inc. cut its IPO’s size by 25 percent to 3.0 million shares – down from 3.75 million shares – and kept the assumed IPO price at $4.00 – to raise $12.0 million, according to a post-effective amendment dated Aug. 1, 2023. In that same SEC filing, the company updated its financial statements for the year that ended April 30, 2023. Maison Solutions Inc. filed an S-1/A dated June 2, 2023, in which it increased the size of its IPO – to 3.75 million shares – up from 3.0 million shares – and kept the assumed IPO price at $4.00 – to raise $15 million. Under the new terms, Maison Solutions will raise 25 percent more than the $12 million in estimated IPO proceeds under its original terms. Background: Maison Solutions filed its S-1 on May 22, 2023, after submitting confidential IPO documents to the SEC on Dec. 23, 2022.)

Nature Wood Group LimitedNWGL, 0.9M Shares, $9.00-11.00, $9.2 mil, 9/8/2023 Week of

We are a holding company incorporated in the British Virgin Islands.

We are a global leading vertically integrated forestry company headquartered in Macau, a Special Administrative Region (S.A.R.) of China. We focus on FSC (Forest Stewardship Council) business operations. Our operations cover both up-stream forest management and harvesting, and down-stream wood-processing and distribution. We offer a broad line of products, including logs, decking, flooring, sawn timber, recycled charcoal, synthesized charcoal, machine-made charcoal and essential oils, primarily through our sales network in Europe, South Asia, South America, North America and China. According to the Frost & Sullivan Report, we are (i) the second-largest wood products export supplier; (ii) the second-largest wood products export supplier certified by the FSC; and (iii) the largest decking product supplier in Peru, in terms of export value in 2021. We are also the largest oak export supplier and the second-largest hardwood export supplier in France, in terms of export volume in 2021.

Our Group owns concession rights of forests in Peru which covered an area of approximately 615,333 hectares as of March 17, 2023. As of March 17, 2023, approximately 13.67% and 1.66% of our Forests are covered by Cumaru and Estoraque, respectively. Cumaru and Estoraque are valuable hardwood timber which produce strong and durable wood that are well suited for high value markets. In particular, Cumaru is commonly used for producing flooring, decking and other construction materials, while Estoraque is commonly used for producing flooring and furniture.

To ensure the sustainability of our forest resources, we establish a set of harvesting rules and operating standards. For instance, we typically only harvest timber meeting the minimum stem circumference requirements. Our standard of forestry operations was recognized by the FSC, an independent accreditation body that is dedicated to promoting responsible and sustainable forest management.

According to the Frost & Sullivan Report, we are one of the few forestry companies that have successfully implemented FSC-certified operations, including forest management, harvesting and manufacturing of wood products. We commenced our FSC business operations in 2016, when Grupo Maderero Amaz S.A.C., a subsidiary of our Group, first obtained FSC Chain of Custody (CoC) certification and began to sell FSC-certified products. As at the date of this prospectus, five subsidiaries of our Group (including Choi Chon Investment Company Limited, E&T Forestal S.A.C., Grupo Maderero Amaz S.A.C., Nuevo San Martin S.A.C. and Latinoamerican Forest S.A.C) have obtained FSC CoC certifications. We also have built a professional forest management team to implement FSC forest management. Our forest management team is led by our head of forest engineer who is qualified to carry out FSC forest management and the key members of our team have an average of over 8 years of experience in FSC forest management. According to the Frost & Sullivan Report, FSC-certified products can be sold at a premium of around 5% to 15% over non-FSC-certified products.

With the growing public concern about environmental protection, consumers are more willing to pay a premium to buy “green” products that are certified by reputable accreditation bodies or ecolabel organizations. As such, products certified by the FSC, one of the world’s most trusted accreditation body, have received wide acceptance across the world, especially the United States and Europe. Revenue generated from sales of FSC-certified products increased by 162.8% from approximately $3.7 million for the year ended December 31, 2020 to approximately $9.9 million for the year ended December 31, 2021, which further increased by 13.7% to approximately $11.2 million for the year ended December 31, 2022, which accounted for approximately 10.0%, 20.7% and 20.3% of our revenue of the respective periods. We believe that such growing trend will continue in the future.

Some of the logs we harvested will be sold to customers immediately after harvesting, others will be processed into a wide variety of products, such as decking and flooring, in our wood processing facilities. As at the date of this prospectus, our Group owns two facilities in Peru, and the Peru base has a monthly log-processing capacity of more than 6,000 m3 and a monthly export volume of up to 65 containers (approximately 1,560 m3).

To further capture the benefit of vertical integration of our manufacturing operation and to secure a stable supply of our wood materials, we sourced logs and semi-finished air-dried planks from local forest owners in Peru, and flooring and decking through sourcing from Gabon. In addition, we source logs through timber auctions or local forest owners in France. To secure a stable supply of logs, our forest management team would assist forest owners in Peru and France with forest management and harvest planning. Similar to logs harvested from our Forests, logs we procured from third parties are either sold directly to customers or further processed in our processing facilities.

We perform the manufacturing process for certain of our products at our Peru base and outsource part of the manufacturing process to third party manufacturers in Peru. We also provide original design manufacturer (ODM) services by combining our in-house product design and development expertise with our ODM partners. For the years ended December 31, 2022, 2021, and 2020, approximately 18.4%, 18.2% and 20.8% of our revenue from our products was generated from our ODM business respectively.

For the years ended December 31, 2022, 2021, and 2020, we generated revenue of approximately $55.3 million, $47.7 million and $37.5 million, respectively. Revenue from sales of logs, flooring and decking and sawn timber accounted for 50.2%, 21.7%, 24.9% and 3.2% of our total revenue for the year ended December 31, 2022 respectively, accounted for 44.4%, 25.0%, 25.2% and 5.4% of our total revenue for the year ended December 31, 2021 respectively, and accounted for 43.9%, 34.4%, 17.5% and 4.2% of our total revenue for the year ended December 31, 2020 respectively.

(Note: Nature Wood Group Limited filed an F-1/A dated Aug. 22, 2023, in which it removed Orientiert XYZ Securities as a joint book-runner – leaving Prime Number Capital in place as the sole book-runner. Nature Wood Group Limited disclosed terms for its IPO in an F-1/A filing dated Aug. 4, 2023: 915,000 American Depositary Shares (ADS) at $9.00 to $11.00 to raise $9.15 million. Each ADS represents eight ordinary shares. Nature Wood Group Limited filed its F-1 on April 25, 2023.)

Prospect Energy Holdings Corp.AMGSU, 7.5M Shares, $10.00-10.00, $75.0 mil, 9/8/2023 Week of

We are a blank check company focused on the Asia Pacific region, excluding China, and the clean energy sector. Each unit consists of one share of stock and one warrant redeemable for one share of stock. (Incorporated in the Cayman Islands)

While we may pursue a target in any industry, section or geography, we intend to focus our search for a target business in Asia Pacific, excluding China, (with emphasis on Canada and Australia) for companies engaged in the clean energy industry, concentrating on the utilization of “clean coal” or other evolving segments in the clean energy ecosystem, particularly the use of carbon, hydrogen and renewable energy. Other areas may include energy storage, distributed energy, zero-emission transportation, carbon utilization, low or carbon-free industrial applications and sustainable manufacturing.

We believe that clean energy and sustainability solutions are revolutionizing many traditional industries and creating numerous investment opportunities which are driven by important long-term global trends, such as the cost of carbon emissions, regulatory incentive programs, and consumers’ increasing value placed on clean energy products and services, in addition to advancements in technology providing for more cost-effective solutions and alternatives to fossil fuels. We believe that the regulatory frameworks incentivizing the adoption of sustainable practices and technologies will become increasingly favorable to the sectors that we are targeting. These trends provide long-term benefits for companies that develop and distribute services and products that take part of an integrated approach to the continued decarbonization of the economy.

We intend to target the growth-oriented subsectors of the clean and sustainable energy industry that present particularly attractive investment opportunities. We do not intend to acquire early-stage start-up companies, companies with speculative business plans or companies that are excessively leveraged. We are not, however, required to complete our initial business combination with a clean and sustainable energy business and, as a result, we may pursue a business combination beyond that sector and scope. We will seek to acquire high-quality businesses that can generate attractive, risk-adjusted returns for shareholders.

We believe our management team is uniquely positioned to source and evaluate deals globally, with strong relationships in Asia Pacific (and particularly in Canada and Australia), which may offer attractive growth prospects with advantageous valuation multiples. We believe that our expertise and experience in major worldwide markets, including Asia Pacific, give us a robust pool of targets and increasing the possibility to maximize returns. In addition, our management team has extensive expertise in the evolution of clean energy, especially in Asia Pacific, which will enable us to better evaluate and source target companies. Our management team is also experienced in executing complex financial structures for large scale projects in the energy industry in Asia Pacific, Canada and Australia which will give us access to leaders in the energy industry and the ability to facilitate future energy projects. We believe this approach, as well as our management team’s recognized track record of completing acquisitions across a variety of subsectors within the clean energy industry will provide meaningful opportunities to drive value creation for shareholders.

(Note: Prospect Energy Holdings Corp. slashed its SPAC IPO by 75 percent to 7.5 million units – down from 30.0 million units – at $10.00 each – to raise $75.0 million in an S-1/A dated Aug. 24, 2023. The S-1 was filed May 3, 2023.)

Quetta Acquisition Corp.QETAU, 6.0M Shares, $10.00-10.00, $60.0 mil, 9/8/2023 Week of

We are a newly formed blank check company, incorporated on May 1, 2023. (Incorporated in Delaware)

We intend to prioritize the evaluation of businesses in Asia (excluding China, Hong Kong, and Macau) that operate in the financial technology (FinTech) sector. We shall not undertake our initial business combination with any entity with its principal business operations in China (including Hong Kong and Macau).

(Quetta Acquisition Corp. filed the S-1 for its SPAC IPO on Aug. 21, 2023, and disclosed terms: 6.0 million units at $10.00 each to raise $60.0 million. Each unit consists of one share of common stock and one-tenth (1/10) of a right denominated in one share of our common stock, redeemable upon the consummation of the initial business combination.)

SIMPPLE Ltd.SPPL, 1.6M Shares, $5.25-6.25, $9.3 mil, 9/8/2023 Week of

We are a property tech (PropTech) business in Singapore. (Incorporated in the Cayman Islands)

Headquartered in Singapore, SIMPPLE LTD. is an advanced technology solution provider in the emerging property-technology (“PropTech”) space, focused on helping facility owners and managers manage their facilities autonomously. Over the past five years, the company has developed a proprietary ecosystem solution that automates workflow and the workforce in areas such as building maintenance, security surveillance and janitorial services. The products and services under the SIMPPLE Ecosystem are:

– SIMPPLE Software (A software platform made up of modules related to quality management, workflow management and people management)

– SIMPPLE PLUS (Robotic solutions in Cleaning and Security domains as well as IoT Devices and peripherals)

– SIMPPLE.AI (An Autonomic Intelligence (AI) Engine that automates workflow processes in a built environment setting)

In addition, the company offers professional services such as set-up and installation and systems consultation to its clients. On average, the solutions the company offers increase customer efficiency in asset maintenance, while also reducing insurance costs.

We were founded in 2016. Our initial focus was on the development of a robotic cleaning solution. As cleaning operations usually cover a large area of space, the then-existing robotic solutions and machinery were bulky and not fit for Singapore’s infrastructure. Through the design and development of minimal human intervention cleaning robotics, we were able to build a solution to match the specific facility cleaning needs of Singapore’s skyscraper- dominant environment. We understood that robotics should not be a standalone solution. Instead, we realized the merits of a fully automated Smart Building model with the integration of robotic solutions. We believe that our ecosystem-focused solution will create more value to building owners and facility managers as often times, data inputs alone are insufficient for efficient operations. Decision-making logic and intelligent task allocation to deployable assets must be built into the platform solution in order to achieve autonomous operations within a facility.

The SIMPPLE Ecosystem has market penetration across various industries in Singapore, including its adoption by 209 out of 432 schools – or slightly less than half of the schools in Singapore – as of April 2021. Out of the 29 hospitals in Singapore as of 2021, seven (7) hospitals have adopted the SIMPPLE Ecosystem in the past. Furthermore, 4 out of 6 (four out of six) autonomous universities in Singapore have also adopted the SIMPPLE Ecosystem in the past, along with leading property developers and facilities services companies in Singapore.

**Note: Revenue and net loss figures are in U.S. dollars (converted from Singapore dollars) for the year ended Dec. 31, 2022.

(Note: SIMPPLE Ltd. raised the price range of its micro-cap IPO to $5.25 to $6.25 – up from $5.00 to $6.00 – and kept the number of shares at 1.625 million shares – to raise $9.34 million, according to an F-1/A filing dated Aug. 14, 2023.)

(Background: SIMPPLE Ltd. raised the price range of its micro-cap IPO to $5.00 to $6.00 – up from $4.00 to $5.00 – and kept the number of shares at 1.625 million shares – to raise $8.94 million, according to an F-1/A filing dated July 12, 2023. Background: SIMPPLE Ltd. cut its IPO in an F-1/A dated May 17, 2023, to 1.625 million shares (1,625,000 shares) – down from 2.0 million shares – and kept the price range at $4.00 to $5.00 – to raise $7.31 million. SIMPPLE Ltd. filed its F-1 on March 31, 2023, and disclosed terms for its IPO: 2.0 million shares at $4.00 to $5.00 to raise $9.0 million. The company submitted confidential IPO documents to the SEC on Sept. 30, 2022.)

Healthy Green Group Holding Ltd.GDD, 2.0M Shares, $6.00-7.00, $13.0 mil, 9/25/2023 Week of

Healthy Green Group Holding Ltd. is a Hong Kong-based chain of 22 organic grocery stores under the Greendotdot brand. (Incorporated in the Cayman Islands) **Note: Investors in this offering (the IPO) are buying shares of the Cayman Islands (holding) company whereas all of our operations are conducted through our Operating Subsidiaries. At no time will the Company’s shareholders directly own shares of the Operating Subsidiaries.

We are a Hong Kong-based retailer principally engaged in the sale of natural and organic food under our “Greendotdot” brand. Our Group’s history can be traced back to 1999 when Mr. Wong and Ms. Cheuk started the business of marketing natural and organic foods. The same year, we launched our first retail store with the objective to introduce quality products from local and overseas suppliers to our customers. Over the years, we have been building our “Greendotdot” brand by sourcing, procuring, marketing and selling a wide variety of quality products, which can be broadly classified into (i) packaged foods; (ii) fresh foods; (iii) frozen foods; and (iv) other products such as honey, beverages, edible oils, seasonings and other non-food items.

We offer a diversified portfolio of over 600 products sourced from over 134 suppliers, which we market through established sales channels, including 22 retail stores in Hong Kong under our brand “Greendotdot” as of Dec. 31, 2022. The retail stores are strategically located in Metrorail stations, residential areas or shopping complexes, which are prime locations with high pedestrian traffic. Other established sales channels include our online sales platforms, exhibitions and through supermarkets and department stores, and wholesale sales to bulk-purchase customers.

According to the Frost & Sullivan Report, our Group ranked as the second-largest natural and organic food retail chain in Hong Kong in terms of our revenue, translating to a market share of approximately 7.9% in the natural and organic food market in Hong Kong in 2021. For the years ended Dec. 31, 2020, and 2021, and the six-month period ended June 30, 2022, our Group’s revenue amounted to approximately HK$166,853,000, HK$159,546,000 (US$20,527,000) and HK$80,430,000 (US$10,278,000), respectively. Our net profit was approximately HK$12,427,000, HK$4,013,000 (US$516,000) and HK$1,338,000 (US$170,000) for the respective years/period.

**Note: Revenue and net income (in the chart below) are in U.S. dollars for the year that ended Dec. 31, 2022.

(Note: Healthy Green Holding Ltd. filed an F-1/A dated April 28, 2023, in which it changed its listing venue to the NYSE – American Exchange from the NASDAQ and changed its proposed symbol to “GDD” from “HGRN,” which was the original proposed symbol for the NASDAQ listing.)

(Note: Healthy Green Holding Ltd. disclosed the terms for its IPO – 2.0 million shares at a price range of $6.00 to $7.00 to raise $13.0 million – in an F-1/A dated July 12, 2023. Healthy Green Holding Ltd. filed its F-1 on Feb. 16, 2023. The company submitted confidential IPO documents to the SEC on April 26, 2022.)

Emerging Market ETF Launches

Climate change and ESG are clearly the latest flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

- 05/18/2023 – Putnam Emerging Markets ex-China ETF PEMX – Value + growth stocks

- 05/11/2023 – JPMorgan BetaBuilders Emerging Markets Equity ETF BBEM– Large + midcap stocks

- 03/16/2023 – JPMorgan Active China ETF JCHI – Active, equity, China

- 03/03/2023 – First Trust Bloomberg Emerging Market Democracies ETF EMDM – Principles-based

- 1/31/2023 – Strive Emerging Markets Ex-China ETF STX – Passive, equity, emerging markets

- 1/20/2023 – Putnam PanAgora ESG Emerging Markets Equity ETF PPEM – Active, equity, ESG, emerging markets

- 1/12/2023 – KraneShares China Internet and Covered Call Strategy ETF KLIP – Active, equity, China, options overlay, thematic

- 1/11/2023 – Matthews Emerging Markets ex China Active ETF MEMX – Active, equity, emerging markets

- 12/13/2022 – GraniteShares 1.75x Long BABA Daily ETF BABX – Active, equity, leveraged, single stock

- 12/13/2022 – Virtus Stone Harbor Emerging Markets High Yield Bond ETF VEMY – Active, fixed income, junk bond, emerging markets

- 9/22/2022 – WisdomTree Emerging Markets ex-China Fund XC – Passive, equity, emerging markets

- 9/15/2022 – KraneShares S&P Pan Asia Dividend Aristocrats Index ETF KDIV – Passive, equity, Asia, dividend strategy

- 9/15/2022 – OneAscent Emerging Markets ETF OAEM – Active, Equity, emerging markets, ESG

- 9/9/2022 – Emerge EMPWR Sustainable Select Growth Equity ETF EMGC – Active, equity, emerging markets

- 9/9/2022 – Emerge EMPWR Unified Sustainable Equity ETF EMPW – Active, equity, emerging markets

- 9/8/2022 – Emerge EMPWR Sustainable Emerging Markets Equity ETF EMCH – Active, equity, emerging markets, ESG

- 7/14/2022 – Matthews China Active ETF MCH – Active, equity, China

- 7/14/2022 – Matthews Emerging Markets Equity Active ETF MEM – Active, equity, emerging markets

- 7/14/2022 – Matthews Asia Innovators Active ETF MINV – Active, equity, Asia

- 6/30/2022 – BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF XEMD – Passive, fixed income, emerging markets

- 5/2/2022 – AXS Short CSI China Internet ETF SWEB – Active, inverse, thematic

- 4/27/2022 – Dimensional Emerging Markets High Profitability ETF DEHP – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Core Equity 2 ETF DFEM – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Value ETF DFEV – Active, equity, emerging markets

- 4/27/2022 – iShares Emergent Food and AgTech Multisector ETF IVEG – Passive, equity, thematic [Mostly developed markets]

- 4/21/2022 – FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM – Passive, equity, ESG

- 4/6/2022 – India Internet & Ecommerce ETF INQQ – Passive, equity, thematic

- 2/17/2022 – VanEck Digital India ETF DGIN – Passive, India market, thematic

- 2/17/2022 – Goldman Sachs Access Emerging Markets USD Bond ETF GEMD – Passive, fixed income, emerging markets

- 1/27/2022 – iShares MSCI China Multisector Tech ETF TCHI – Passive, China, technology

- 1/11/2022 – Simplify Emerging Markets PLUS Downside Convexity ETF EMGD – Active, equity, options strategy

- 1/11/2022 – SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG – Passive, equity, ESG

Emerging Market ETF Closures/Liquidations

Frontier and emerging market highlights:

- 07/07/2023 – Emerge EMPWR Sustainable Emerging Markets Equity ETF – EMCH

- 06/23/2023 – Invesco PureBeta FTSE Emerging Markets ETF – PBEE

- 06/16/2023 – AXS Short China Internet ETF – SWEB

- 04/11/2023 – SPDR Bloomberg SASB Emerging Markets ESG Select ETF – REMG

- 3/30/2023 – Invesco BLDRS Emerging Markets 50 ADR Index Fund – ADRE

- 3/30/2023 – Invesco BulletShares 2023 USD Emerging Markets Debt ETF – BSCE

- 3/30/2023 – Invesco BulletShares 2024 USD Emerging Markets Debt ETF – BSDE

- 3/30/2023 – Invesco RAFI Strategic Emerging Markets ETF – ISEM

- 2/17/2023 – Direxion Daily CSI 300 China A Share Bear 1X Shares – CHAD

- 1/13/2023 – First Trust Chindia ETF – FNI

- 12/28/2022 – Franklin FTSE Russia ETF – FLRU

- 12/22/2022 – VictoryShares Emerging Market High Div Volatility Wtd ETF CEY

- 8/22/2022 – iShares MSCI Argentina and Global Exposure ETF AGT

- 8/22/2022 – iShares MSCI Colombia ETFI COL

- 6/10/2022 – Infusive Compounding Global Equities ETF JOYY

- 5/3/2022 – ProShares Short Term USD Emerging Markets Bond ETF EMSH

- 4/7/2022 – DeltaShares S&P EM 100 & Managed Risk ETF DMRE

- 3/11/2022 – Direxion Daily Russia Bull 2X Shares RUSL

- 1/27/2022 – Legg Mason Global Infrastructure ETF INFR

- 1/14/2022 – Direxion Daily Latin America Bull 2X Shares LBJ

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as some ETF lists are still being updated as of Summer 2022).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (September 4, 2023) was also published on our Substack.

Emerging Markets Investing Tips + Advice

Emerging Market Skeptic (Website)

Website List Updates + Site Map

Stocktwits @EmergingMarketSkptc

Similar Posts:

- Housebound Consumers Lift Lenovo to Record Revenues & Profits (HKEXnews)

- TOP Financial Group (NASDAQ: TOP): Hong Kong’s Latest Crazy Meme Stock

- China Internet Update (KraneShares)

- Emerging Market Links + The Week Ahead (September 12, 2022)

- Noah Holdings (NYSE: NOAH): A Chinese Wealth Management Firm Facing a “Crisis of Confidence” in the Sector

- Yale University Added $100M to the Vanguard FTSE Emerging Markets ETF (VWO) in 1Q2014 (P&I)

- GF Securities (HKG: 1776 / SHE: 000776 / FRA: 9GF): A Value Stock After Recent Scandals & Crackdowns?

- Korea & Taiwan Use Renminbi for Majority of Payments with China & Hong Kong (The Asset)

- Investing in Hong Kong ETFs / Hong Kong ETF List

- Fund Manager Consensus: Hong Kong Needs China More Than Vice Versa (AsianInvestor)

- Emerging Market Links + The Week Ahead (January 23, 2023)

- Investors Could Short Hong Kong to Hedge Long Shanghai Positions (BOCOM International)

- Emerging Market Links + The Week Ahead (September 19, 2022)

- Asian Banks Are Nibbling the Lunches of Global Banks (CCTV)

- ZJLD Group (HKG: 6979): IPO of the First Baijiu Maker to List Outside of China Flops