Holy Week and Easter are over while Ramadan will continue until April 10th.

In an interesting piece of recent news, Xi has apparently told American investors that “China is planning and implementing a series of major steps for comprehensively deepening reform” while FT has noted how some of the most troubled emerging markets (like Turkey, Argentina, Egypt, Nigeria and Kenya) are now carrying out radical reforms. Of course, action will speak louder than words and it remains to be seen what China will do…

Finally, Thailand is said to be looking at legalizing casino gambling which is predicted to lift tourism spending. However, opponents of such a move say (among other problems legalized gambling would bring) that certain countries (no doubt China…) would then be forced to limit the number of visitors allowed to visit Thailand. Obviously China would not want its citizens gambling outside of Macau where they can be more closely monitored while casinos in Cambodia, Malaysia, the Philippines and Singapore casinos might be be impacted by such a move.

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- 🇹🇼 E Ink Holdings (TPE: 8069): Moving Beyond ePaper & the Amazon Kindle into Digital Retail Pricing Labels $

- Taiwan based E Ink Holdings (TPE: 8069) is an electronic paper (ePaper) & electronic ink stock. Amazon Kindle, wearables, etc. plus retailers like Wal-Mart (for digital labels) use the technology.

- 🌏 EM Fund Stock Picks & Country Commentaries (March 31, 2024) $

- India and China valuation gap, the case for South Africa ahead of elections, positive dividend trends across geographies, the Saudi exchange stock, Latin America fund updates, Budweiser APAC, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 China’s ‘battery king’ dismisses solid-state EV commercialisation as years away (FT) $ 🗃️

- Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750) chief Robin Zeng says much-vaunted tech for electric vehicles is impractical and unsafe

🇨🇳 Xiaomi’s secret to surviving the EV price war — over $18 billion in cash, CEO says (Caixin) $

- By harnessing its financial strength and supply chain management capabilities, Xiaomi (HKG: 1810 / FRA: 3CP / OTCMKTS: XIACF) (小米集团) will survive in China’s cutthroat electric vehicle (EV) market, which is embroiled in a brutal price war, its CEO said during a group interview.

- The Beijing-headquartered smartphone giant has “a cash reserve of more than 130 billion yuan ($18 billion)” which will enable it to “navigate through the intensifying competition” in China’s crowded EV market over the next five years, Lei Jun told reporters on Thursday.

🇨🇳 BYD (1211 HK): Strong Revenue in 2023 and to Change Strategy in 2024 (SmartKarma) $

- Total revenue increase by 42% and automobile revenue increased by 49% in 2023.

- The gross margin improved significantly in 2023, especially in 4Q23.

- We believe BYD Company (HKG: 1211 / SHE: 002594 / OTCMKTS: BYDDY / BYDDF) will move its focus from ‘low price for sales volume’ to ‘development of new vehicle models’.

🇨🇳 Shein profits double to over $2bn ahead of planned listing (FT) $ 🗃️

- Fast-fashion group is seeking Chinese approval for IPO in New York or London

🇨🇳 Alibaba is giving up on Hema and offline retail? (Momentum Works)

- Last week, Alibaba (NYSE: BABA) announced that Hou Yi, the founder of Hema (or “Freshippo”) retail chain, will retire as CEO, replaced by CFO Yan Xiaolei.

- The news came amid intense speculation earlier in the week that Hema and Sun Art Retail, two offline retail groups under Alibaba, would be sold to COFCO, a state owned food giant. Both Hema and Sun Art denied this.

- Hema, with its premium positioning, fresh seafood, facial recognition checkout, and own-branded seasonal produce, was once a sensation in China’s “new retail revolution”. What is happening now?

- Some thoughts:

🇨🇳 MT / Meituan (3690 HK): 2023 – Broke Even for First Year (SmartKarma) $

🇨🇳 So-Young dolls up with pivot to high-end services (Bamboo Works)

- The cosmetic services social media platform is developing its own clinics as well as a premium platform for high-end users

- So-Young International Inc (NASDAQ: SY) reported an annual profit last year, reversing two years of losses, as its revenue rose 19%

- The company’s new So-Young Prime service for high-end users helped to fuel a 22.2% revenue jump in its information services segment last year

🇨🇳 Dada Nexus (Turtles all the way down!)

- Well busy week, I did more digging on Dada Nexus (NASDAQ: DADA) (previously mentioned here when it was trading just under $1.7 and closed here at $2.6). The company owns Dada Now, a crowd sourced last mile delivery service and JD Daojia or JDDJ, an on demand retail platform with over 200k stores and brand owners that also provides other functions such as online delivery inventory look-up for store employees, crm services such as membership passes etc.

- I was going to write a more in depth report, but then I found this detailed write-up by Pyramids and Pagodas from December last year. So I will provide more of a summary and focus on some points not mentioned in that write-up.

- I think perception around this stock is too negative due to recent fraud discoveries (which had no real negative impact on profitability), JD losing share and just general negative China sentiment.

🇨🇳 SPONSORED: What’s behind SF Intra-city’s big annual profit growth (Bamboo Works)

- China’s largest third-party on-demand delivery service provider recorded a profit for the year that met market expectations

- Hangzhou Sf Intra-City Industrial Co Ltd (HKG: 9699) reported revenue of 12.4 billion in 2023, up 21.1%, with an increase of over 30% in the order volume, and net profit of 64.9 million yuan

- The company’s gross profit increased by 94%, reaching 794.7 million yuan, and its gross profit margin rose by 2.4 percentage points to 6.4%.

🇨🇳 ZG Group and Aquila aim to score Hong Kong’s first SPAC merger success (Bamboo Works)

- The Chinese steel-trading platform is applying to trade on the Hong Kong stock market after merging with its shell company partner

- The deal between Aquila Acquisition (HKG: 7836 / FRA: T81) and ZG Group has a negotiated value of up to HK$10 billion

- ZG’s cash and cash equivalents were just 129 million yuan at the end of January

🇨🇳 China Resources pays $1.6 billion for control of chip packaging giant (Caixin) $

- State-owned conglomerate China Resources Group plans to pay 11.7 billion yuan ($1.6 billion) for a controlling stake in integrated circuit packaging leader JCET Group (SHA: 600584), as a giant industry investment fund steps back.

- Pan Shi Hong Kong Co. Ltd., a subsidiary of China Resources, will acquire a combined 22.53% of JCET from the semiconductor company’s biggest shareholders China Integrated Circuit Industry Investment Fund Co. Ltd. and SilTech Semiconductor (Shanghai) Co. Ltd., Shanghai-listed JCET said in an exchange filing Tuesday.

🇨🇳 Goldwind’s profit tumbles as China sales start to deflate (Bamboo Works)

- The leading wind turbine maker’s profit fell 83% in the second half of last year, as revenue from its core China market started to contract

- Xinjiang Goldwind Science Technology (HKG: 2208 / SHE: 002202 / FRA: CXGH / OTCMKTS: XJNGF / XNJJY)’s revenue growth slowed to 5.4% in the second half of last year from 15.4% in the first half, as sales in its core China market began to contract

- The company’s inventory rose sharply last year as the Chinese wind power market slows after several years of big growth

🇨🇳 Chart of the Day: ‘Big Three’ airlines’ billion-yuan losses (Caixin) $

- China’s “big three” state-owned airlines remained in the red in 2023, despite narrowing losses from 2022, according to their annual reports, as international travel continued to lag pre-pandemic levels.

- Profitability remained some ways away for the carriers. Shanghai-based China Eastern Airlines Corp. (SHA: 600115 / HKG: 0670 / FRA: CIAH / OTCMKTS: CHEAF / CHNEY) reported the largest loss among the trio — 8.17 billion yuan ($1.13 billion) for 2023, even as its revenue leapt 145.6% to 113.7 billion yuan, according to stock exchange filings released Thursday. Guangzhou-based China Southern Airlines Co. Ltd. (SHA: 600029 / HKG: 1055 / FRA: ZNHH / OTCMKTS: CHKIF), the country’s largest carrier by number of passengers, booked a deficit of 4.2 billion yuan for 2023. Still, its revenue jumped 83.7% to 159.9 billion yuan.

🇨🇳 [Atour Lifestyle (ATAT US,BUY,TP US$37.5) Review]:Still a Quality Growth Story in the Next Two Years (SmartKarma) $

- Atour Lifestyle Holdings (NASDAQ: ATAT) reported C4Q23 revenue vs. our estimate/consensus by 18%/21% and guided a robust 30% yoy revenue growth for 2024, outpacing the consensus by 12% and our estimate by 7%

- C4Q23 operating margin decline was due to one-off leased hotel impairment and seasonality in retail marketing. We foresee stable margin in 2024;

- We maintain our BUY rating and keep our TP at US$37.5, implying a 2024 P/E of 34x, vs. currently trading at 16x.

🇨🇳 Anta Sports (2020 HK): 2024 High Conviction Update – Earnings Beat In 2H23 (SmartKarma) $

- At noon time today, ANTA Sports Products (HKG: 2020 / FRA: AS7 / OTCMKTS: ANPDY / OTCMKTS: ANPDF) released strong 2023 results which beat expectations.

- Anta currently trades at a forward PE of 18x based on estimated 2024 earnings (assuming a conservative 15% yoy growth in 2024 earnings).

- I expect the company’s net profit to grow 15-20% CAGR in 2024-2026. Anta’s historical forward PE is around 24x since 2017.

🇨🇳 Shenzhou Intl (2313 HK): Higher Visibility Into Restocking Cycle (SmartKarma) $

- Shenzhou International (HKG: 2313) reported 2023 results yesterday. 2H23 continued to be weak, with sales down 6% yoy. Net profit grew 10% yoy in 2H23.

- Most importantly, the company sounded quite bullish on 2024 during the results briefing, which greatly improves the visibility in the order recovery thesis of the company.

- I continue to believe that Shenzhou is the best proxy for gaining exposure to the global sportswear sector, especially given the improved visibility now.

🇨🇳 China Lilang stitches together growth from new retail, casual wear combo (Bamboo Works)

- Despite a significant decline in China’s apparel sector last year, the menswear maker recorded double-digit revenue and profit growth

- China Lilang Ltd (HKG: 1234 / FRA: 5LX)’s revenue rose 14.8% last year to 3.54 billion yuan, while its profit jumped by 18.4% to 530 million yuan

- The menswear maker is exploring opening overseas stores as it considers expanding beyond China

🇨🇳 Starbucks is staying out of China’s coffee price war, founder says (Caixin) $

- As a price war intensifies in China’s coffee market, Starbucks Corp (NASDAQ: SBUX). Founder Howard Schultz said the U.S. coffee chain isn’t joining in with local affordable brands’ steep discounting.

- Starbucks has to “recognize that competition is happening,” but “I’m not spending one minute of my time worrying about” it and will strictly focus on the business itself, Schultz said Saturday at a forum hosted by the School of Management of Fudan University in Shanghai.

🇨🇳 Yiren Digital (NYSE: YRD) (Small Cap Value Investing with Phil)

- When your earnings increase by 74% YoY and your P/E is still below 2

- Yiren Digital (NYSE: YRD) is engaged in 3 key sectors:

- Financial Services: Offering revolving loan services to individuals, families, and businesses. These services facilitate balanced repayment and consumption plans to enhance financial health.

- Life & Property Insurance: Providing tailored insurance solutions to meet diverse needs across education, healthcare, retirement planning, asset protection, and business expansion.

- Consumption and Lifestyle: Meeting a broad spectrum of quality-of-life requirements through membership perks and a range of products and services. This includes entertainment, travel, skincare, and other amenities to cater to varied lifestyle preferences.

🇨🇳 Luzhou Bank’s profit growth looks sweet, but could mask souring loans (Bamboo Works)

- The regional bank’s profit grew strongly last year largely on non-operational investment gains, amid signs of increasing defaults on its loans

- Luzhou Bank (HKG: 1983)’s profit rose 23% last year, buoyed by investment gains, even as its net interest income shrank

- While the company’s bad-loan ratio declined, its loans at the greatest risk of default increased

🇨🇳 Legend Biotech Corporation: Initiation of Coverage – Can They Flourish In The Competitive CAR-T Therapy Market? – Major Drivers (SmartKarma) $

- This is our first report on biopharma player, Legend Biotech (NASDAQ: LEGN).

- The company’s Q4 earnings call displayed a balance of positive and negative performance aspects for the company.

- Starting with positive highlights, the outlook is promising for their lead therapy, CARVYKTI, which has received a positive opinion from the Committee for Medicinal Products for Human Use for expansion into earlier lines of treatment.

🇨🇳 Akeso marks profit milestone with swift rights issue (Bamboo Works)

- Buoyed by bumper earnings, the biotech has announced a share placement to raise HK$1.17 billion to invest in developing its portfolio of anti-cancer drugs

- Akeso (HKG: 9926 / FRA: 4RY / OTCMKTS: AKESF) swung to an annual profit of 1.94 billion yuan, boosted by licensing income of 2.92 billion yuan

- The next highly anticipated product in the firm’s drug pipeline is ivonescimab, the first PD-1/VEGF bispecific antibody to enter Phase III clinical trials

🇭🇰 Pax Global (0327.HK) 2023 results disappoint but show promise in some areas (Pyramids and Pagodas)

- Shares flat despite revenue and profit miss, while margins land at the top-end of guidance with management seeking to return more value to shareholders

- Last week, Pax Global Technology Ltd (HKG: 0327 / FRA: P8X / OTCMKTS: PXGYF) hosted their FY23A earnings call, coinciding with the release of their results for the year. We wrote about the Company in November 2022, prior to the release of their results for that year, which were largely in-line with consensus estimates.

- Our fundamental thesis on the point of sale (PoS) market remains bullish and we still believe that PAX remains a viable route to capitalize on this growth. According to Nilson Report, PAX ranked third in total shipments behind Chinese peers Newland Digital Technology Co Ltd (SHE: 000997) and Wuhan Tianyu Information Industry Co Ltd (SHE: 300205), but the majority of these two competitors’ shipments are largely within China (under APAC). PAX remains the top global payment terminal provider excluding APAC.

🇭🇰 1475:HK Reputable consumer staple brand with huge TAM trading at EV/EBIT under 8 (One foot hurdle)

- Nissin Foods manufactures and sells instant noodles and has a small distribution business distributing Ready-To-Drink juices, coffee, and cookies. Nissin Foods Holdings Co Ltd (TYO: 2897 / FRA: NF2 / OTCMKTS: NFPDF) owns 72.05% of Nissin Foods Co Ltd (HKG: 1475 / FRA: 4NS) and this relationship provides 1475:HK a unique opportunity to access valuable resources that are not available to other competitors.

- Nissin Foods(1475:HK) is a subsidiary of Nissin Foods Holdings(2897:TYO) that is trading near a 52-week low albeit displaying strong fundamentals. Net income from 2014 to 2022 grew at a CAGR of 9.2% yet the EV/EBIT is just under 8. The valuation is simply too silly. Nissin Foods also appears to have decent growth space. If someone is willing to stomach ugly headlines and turbulence, I believe it is going to provide good performance.

🇭🇰 I went through the financials of every stock in HK – Part 1 (Roiss’ Conclusions)

Note: Mentions a number of stocks BUT no links to their IR or ticker pages.

- Things I didn’t buy, but that might be interesting.

- So I went through the financials of every stock in HK, searching for companies that were either incredibly cheap, had great Free Cash Flow and Book Value growth or exceptional shareholder returns.

- After sorting through the companies a few times, I started to look at companies qualitative as well.

- Today I will show you which ones I passed on, that might be interesting to you.

🇭🇰 Hang Seng Bank: Mixed Prospects (Seeking Alpha) $

- Lower interest rates are expected to have a mixed impact on Hang Seng Bank (HKG: 0011 / 80011 / OTCMKTS: HSNGY)’s 2024 financial performance.

- There is uncertainty associated with the realization of HSNGF’s potential catalysts such as credit cost reduction and higher shareholder capital return.

- I award a Hold rating to Hang Seng Bank, as I deem the stock to be fairly valued.

🇭🇰 Wharf Real Estate Investment: Expecting A Better 2024 (Rating Upgrade) (Seeking Alpha) $

- Wharf Real Estate Investment Company Ltd (HKG: 1997 / FRA: 4WF / OTCMKTS: WRFRF) is expected to achieve solid top line expansion this year, thanks to resilient luxury retail demand and an increase in Mainland Chinese visitors for Hong Kong.

- The company’s FY 2024 earnings are likely to be boosted by a decrease in interest costs, driven by lower benchmark interest rates and deleveraging.

- I revise my rating for Wharf REIC from a Hold to a Buy, as I think that the company’s favorable 2024 prospects aren’t fully priced into the stock’s valuations yet.

🇲🇴 🇭🇰 Paradise Ent posts US$8mln profit in 2023, revenue doubles (GGRAsia)

- Macau-based gaming equipment supplier and casino services firm Paradise Entertainment Ltd (HKG: 1180 / FRA: LIL3 / OTCMKTS: PDSSF) reported a profit attributable to its owners of just under HKD65.8 million (US$8.4 million) for full-year 2023. That was an improvement on the HKD154.6-million loss recorded in 2022, according to a Tuesday filing.

- The 2023 result was on revenue that rose 113.0 percent year-on-year, to HKD634.3 million. Costs of sales and services increased by just 14.6 percent year-on-year, to HKD309.7 million.

- Paradise Entertainment, which supplies casino equipment under the LT Game brand, also has a service agreement for a satellite gaming venue at Casino Kam Pek Paradise in downtown Macau, with SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) as its licence partner.

🇲🇴 Technical sales, services boost Asia Pioneer revenue in 2023 (GGRAsia)

- Hong Kong-listed Asia Pioneer Entertainment Holdings Ltd (HKG: 8400) reported revenue of nearly HKD29.7 million (US$3.8 million) in full-year 2023, an increase of 182.5 percent from the prior year. Such revenue represented about 36.3 percent of the 2019 levels, before the onset of the Covid-19 pandemic.

- Net loss after tax was about HKD1.9 million in 2023, an improvement on the HKD14.7-million loss in the prior year.

- The group, via its Asia Pioneer Entertainment arm, is authorised in Macau to distribute electronic gaming equipment to the city’s six casino licensees, and also provides such technology to land-based casinos in other parts of the Asia-Pacific region. The group additionally gives technical support and consultancy on gaming equipment.

🇲🇴 Fitch rating for MGM, hails ‘strong reduction’ in leverage (GGRAsia) + Fitch Assigns MGM Resorts and MGM China First-Time ‘BB-‘ IDR; Outlook Stable (FitchRating)

- Fitch Ratings Inc is once again giving an issuer default rating (IDR) for casino developer MGM Resorts International (NYSE: MGM) and its unit, MGM China Holdings Ltd (HKG: 2282 / FRA: M04 / OTCMKTS: MCHVF / MCHVY), assigning a ‘BB-’. The ratings agency said on Monday that the casino group’s outlook was “stable”, reflecting “Fitch’s expectation that MGM’s leverage will remain stable, and that liquidity is sufficient to fund future growth opportunities”.

🇲🇴 Ponte 16 operator posts profit in 2023, revenue down (GGRAsia)

- Success Universe Group Ltd (HKG: 0487), an investor in Macau casino hotel Ponte 16 (pictured), posted a net profit of HKD169.3 million (US$21.6 million) for full-year 2023, compared with a net loss of nearly HKD287.1 million in the prior year.

- Group-wide revenue stood at HKD101.9 million last year, down 11.2 percent from 2022; costs for the reporting period fell by 16.8 percent year-on-year, to HKD85.1 million, said the Hong Kong-listed company in a Wednesday filing.

- Success Universe is a joint venture partner, with a unit of casino concessionaire SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY), in Ponte 16, a property at Macau’s Inner Harbour district. The gaming venue is considered a “satellite” casino of SJM Holdings.

🇹🇼 Asian Dividend Gems: Taidoc Technology (Asian Dividend Stocks) $

- Taidoc Technology (TPE: 4736) is an attractive small cap health care stock in Taiwan. It has a solid dividend yield, strong balance sheet, and stable profits and free cash flow.

- The company’s core business includes clinical equipment and professional instruments including diagnostic, telehealth, and blood sugar and blood pressure monitoring devices.

🇰🇷 Hana Tour Service: Major Shareholders Including IMM PE Likely to Sell Their Shares (Douglas Research Insights) $

- Hanatour Service Inc (KRX: 039130), the number one travel platform in Korea, announced that IMM PE (controlling shareholder of the company) is planning to sell its controlling stake.

- The total stake in the company that is up for sale could rise to 27.78%, including stakes held by Hana Tour founder Park Sang-hwan and co-founder Kwon Hee-seok.

- Potential buyers of the controlling stake in Hana Tour include Yanolja, Hotels.com [Expedia Group Inc (NASDAQ: EXPE)], Booking.com [Booking Holdings Inc (NASDAQ: BKNG)], and Trip.com (NASDAQ: TCOM).

🇰🇷 Lotte Tour Development: A Major Asset Revaluation Resulting in More Than 8X Increase in Equity (Douglas Research Insights) $

- Lotte Tour Development (KRX: 032350) announced that it will conduct a major asset revaluation which could positively impact its share price.

- The company’s assets will increase to 2.39 trillion won and equity will increase to 569.3 billion won (up more than 8x) at end of 1Q 2024 due to asset revaluation.

- As a result of the asset revaluation, the company’s balance sheet will improve significantly and this likely result in many investors taking another look at the company for potential investments.

🇰🇷 Samsung C&T: Why Is Lee Seo-Hyun Returning as the President? (Douglas Research Insights) $

- On 29 March, it was reported that Lee Seo-Hyun has been appointed as the President of Samsung C&T Corp (KRX: 028260), returning to the company after more than five years.

- Lee Seo-Hyun is the third child of the late Samsung Chairman Lee Kun-Hee. She will be in charge of the overall strategic planning of Samsung C&T.

- Many investors will likely to question this move, since they may question her ability to make strategic decisions that are in the best interests of all the minority investors.

🇰🇷 Hanmi Science: NPS Sides With Mother (Chairwoman) And Daughter (Douglas Research Insights) $

- After the market close on 26 March, it was reported that National Pension Service (NPS) has decided it will side with Chairwoman Young-Sook Song (mother) and her daughter Ju-Hyun Lim.

- As a result, Chairwoman Young-Sook Song (mother) and Ju-Hyun Lim have secured 40.86% of the shares, which is slightly higher than the ownership of her two sons (38.4%).

- In the near term, this battle for the control of the company could have a positive impact on Hanmi Science (KRX: 008930)‘s share price.

🇰🇷 SillaJen Rights Offering Worth 34% of Outstanding Shares (Douglas Research Insights) $

- On 22 March, [biotechnology company] SillaJen Inc (KOSDAQ: 215600) announced that it will conduct a rights offering worth about 129 billion won for R&D and financials improvement.

- The rights offering size is 34.5 million shares, representing 34% of total outstanding shares. The expected rights offering price is 3,750 won which is 26% lower than current price.

- We would not subscribe to this rights offering and we remain negative on the company.

🇰🇷 Alteogen: Block Deal Sale of About 3% of Shares (Douglas Research Insights) $

- On 27 March, Alteogen announced that Jeong Hye-shin, former [biotechnology company] Alteogen (KOSDAQ: 196170) Chief Strategy Officer (CSO), sold 1.6 million shares of Alteogen stock in after-hours trading in block deal sale.

- The block deal sale price was 197,770 won. Alteogen’s share price declined by 10.9% today to 195,600 won. Block deal sale amount was about 316 billion won.

- This block deal sale combined with the sharp recent, share price increase are likely to result in a near-term consolidation of its share price in the next several months.

🇰🇷 Kum Yang: Auditor Raises Flags on Viability as a Going Concern + Chairman Ryu Could Sell Shares (Douglas Research Insights) $

- On 28 March, the external auditor of [global manufacturer and supplier of a comprehensive range of eco-friendly chemical materials] Kumyang Co Ltd (KRX: 001570) (Samil PriceWaterhouseCoopers) raised warnings about the viability of Kum Yang as a going concern.

- The auditor also mentioned increasing probability of Chairman Ryu of Kum Yang potentially selling a portion of his shares to raise further capital.

- It is RARE for an auditor to raise concerns about a company’s viability of the entity as a going concern. This is likely to negatively impact Kum Yang’s share price.

🇰🇷 End of Mandatory Lock-Up Periods for 46 Companies in Korea in April 2024 (Douglas Research Insights) $

- We discuss the end of the mandatory lock-up periods for 46 stocks in Korea in April 2024, among which 6 are in KOSPI and 40 are in KOSDAQ.

- These 46 stocks on average could be subject to further selling pressures in April and could underperform relative to the market.

- The top three market cap stocks including those of which at least 1% of outstanding shares could be sold in April include APR Corp (KRX: 278470), Angel Robotics (KOSDAQ: 455900), and Samhyun (KOSDAQ: 437730).

🇸🇬 Hongkong Land’s Share Price is Scraping a Multi-Year Low: Can the Property Giant See a Rebound? (The Smart Investor)

- The property development cum investment firm’s share price continues its decline. Can investors hope for a rebound anytime soon?

- Investors in Hongkong Land Holdings (SGX: H78 / LON: HKLJ / FRA: HLH / OTCMKTS: HKHGF / HNGKY), or HKL, are going through a tough time.

- Revenue and profits are under pressure

- Investment properties holding the fort

- Weaker contributions from development properties

- Encouraging business development efforts

- Get Smart: A robust pipeline of projects

🇸🇬 Singapore Post Has Unveiled its Strategic Review: 5 Aspects Investors Should Know About (The Smart Investor)

- The postal service provider plans to transform its business over the next few years.

- Singapore Post Limited (SGX: S08 / FRA: SGR / OTCMKTS: SPSTY / SPSTF), or SingPost, has unveiled its long-awaited strategic review.

- The postal service provider saw its share price plumb a new all-time low last month as investors fretted over its prospects.

- Let us dive deeper into each aspect.

- Reorganisation of the SingPost Group

- Capital investments to drive growth and unlock value

- Becoming a logistics market leader in Singapore

- Scaling up its capabilities and presence in Australia

- Building its technology footprint

🇸🇬 Centurion Corp (CENT SP) – Paving the Way for Workers and Students (SmartKarma) $

- A recent Smartkarma Corporate Webinar | Centurion: Quality Housing for Workers and Students the World Over, showcased Centurion Corporation Ltd (SGX: OU8), a leader in purpose-built accommodation for workers and students.

- The company is a leader in purpose-built worker accommodation in Singapore and Malaysia and a major player in purpose-built student accommodation in Australia, the UK, and the US.

- The outlook for both worker and student accommodation looks positive for the coming two years. Valuations look attractive with Centurion Corp trading at a 56% discount to NAV.

🇮🇩 Mitra Adiperkasa (MAPI IJ) – Pushing Retail Boundaries (SmartKarma) $

- Mitra Adiperkasa (IDX: MAPI / FRA: QGI) finished the year with strong sales growth of +17.4% YoY in 4Q2023 with solid growth across all segments and improving margins.

- The company continues to add to its 150-strong brand portfolio in Indonesia, as well as extending its reach further in Southeast Asia and growing its omnichannel capabilities.

- MAPI remains our top retail pick in Indonesia with its focus on the resilient upper-middle segment in Indonesia and increasing regional exposure. Valuations remain attractive at 12.5x FY2024E PER.

🇮🇳 Shipping Corporation of India Land & Assets Ltd.: Demerger and a Value Bet (SmartKarma) $

- Discover Shipping Corporation of India Land & Assets (SCILAL) (NSE: SCILAL / BOM: 523598)’s debut in the stock market after demerger form Shipping Corporation of India (NSE: SCI / BOM: 523598), its strategic disinvestment, and the hidden value within its diverse asset portfolio.

- Real Estate Assets in company and future outlook by management of SCILAL over the years going forward.

- The market value of assets is twice more than the book value. Value bet but can take longer time to monetize the same.

🇮🇳 IFN: Avoid The ‘Froth’, But Buy The Dip (Seeking Alpha) $

- The India Fund, Inc. (NYSE: IFN) has performed well in 2024, with a +36.5% increase from the October ’23 low to the March high accompanied by an attractive dividend.

- Concerns about valuations and “froth” have caused IFN to make a large dip of over -7%.

- The dip may be worth buying if it drops further to around $17.50.

🇮🇱 Cheap, big margins, niche, growth, industry leading, aligned management and clean B/Sheet (Special Situations Global Equities)

- Qualitau (TLV: QLTU) tests semiconductors to check for faults, using in-house patient protected machinery and class leading service staff. Their main operations are based in USA and serve the largest chip manufacturers in the world. They are listed on the TASE in Tel Aviv and founded and run by an Israeli team.

- I see it as a picks and shovels play at the growth in chip requirements as the digital age takes hold. They provide testing units/ equipment that is patient protected, and the servicing and testing itself with highly trained technicians.

🇿🇲 REIZ Plc completes US$65mn acquisition of Zambia malls (Capital Markets Africa)

- Real Estate Investments Zambia (REIZ) Plc (LuSE: REIZ), the sole real estate company listed on the Lusaka Securities Exchange (LuSE), has announced the acquisition of three shopping malls for a sum total of US$65mn. The deal is part of a corporate restructure which aims to create Zambia’s first real estate investment trust (REIT).

- SA Corporate Real Estate Limited (JSE: SAC), which is a listed REIT on the Johannesburg Stock Exchange (JSE), owns 50% of Premier LM&C Mauritius Limited, which in turn owns 99.9% of LM&C Properties Limited.

🇵🇱 Dino Polska: Adding on Weakness (Fundasy Investor)

- Although the initial results are not exactly inspiring, I am writing this to you intentionally after the stock dropped 11% on Friday after a solid, although not spectacular, earnings report to document the process.

- This post will cover this idea: Why I added to my Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY) on Friday.

- A big hiccup for new store growth is the fact that stores from Planning to Opening day take approximately 2 years to complete. This means that for stores to open today, the Planning had to have started in early 2022, when the macro background looked much less certain.

🌎 Despegar: The Booking Holdings Of Latin America With More Catalysts And Growth (Seeking Alpha) $

- Despegar.com Corp (NYSE: DESP) is a rapidly growing online travel company that trades at multiples way below peers.

- The company is now profitable with accelerating revenues and cash flow.

- It is rapidly gaining market share in a growing market that is underpenetrated.

- Despegar has an unusually large number of catalysts that should lead to significantly higher revenues and earnings.

🌎 Portfolio Spotlight: Millicom (No Deep Dives)

- Millicom (NASDAQ: TIGO) is a Latin American telecom company. It generates over half of its profits in Guatemala and Colombia, but it also operates in several other countries

- Stock left for dead after compelling investment pitch turned sour and Cable Cowboy CEO disappointed investors.

- French telecom titan rapidly acquired a 30% stake in 2023 and put some of his guys on the board. Current CEO will leave mid 2024.

- With elevated capex behind them, combined with cost savings, the company will finally generate substantial FCF: it has a projected NTM FCF yield of 16.2%

- Bonus: monetization of their tower assets, which could be a significant catalyst in accelerating into debt paydown and buybacks

🌎 Liberty Latin America (Emerging Value)

- Libery Latin America (NASDAQ: LILAK), is a fixed and mobile telecoms company with a footprint around the Caribbean, operating like a holding company with subsidiaries. It has a large b2b segment at 32% of revenue which is interesting.

- Liberty Latin America is a company I have been investigating. This is a company following the John Malone model. They utilise debt to consolidate the cable industry, have complex accounting with acquisition costs and depreciation causing low profits, and repurchase shares while paying no dividends.

🇧🇷 Most Of JBS Segments Are Back On Track (Seeking Alpha) $

- JBS SA (BVMF: JBSS3 / OTCMKTS: JBSAY) has recovered profitability in most of its segments, with the exception of US beef, which is still in a low portion of its cycle.

- The company has reduced debt and extended maturities at attractive terms, improving its financial position.

- JBS is planning a full ADR listing in the US, which would open the stock for index funds and potentially increase liquidity.

🇧🇷 Luiz Inácio Lula da Silva steps up interventions in Brazil’s largest companies (FT) $ 🗃️

- Government involvement in Petrobras (NYSE: PBR / PBR-A) and Vale (NYSE: VALE) alarms investors as president calls market ‘voracious dinosaur’

- In addition, Brasília has pushed to reverse an element of the privatisation of power utility Eletrobras Participacoes S/A (BVMF: LIPR3) by previous far-right president Jair Bolsonaro.

🇧🇷 Eletrobras: A New Era; Buy While The Market Pays No Attention To This Giant (Seeking Alpha) $

- Eletrobras Participacoes S/A (BVMF: LIPR3) is a dominant player in the Brazilian energy market, and recently underwent privatization that changed the company’s direction.

- The company stands out for a significant cost reduction, and an expectation of increased revenue after important regulatory changes were made in Brazil.

- Despite this, the analysis reveals that Eletrobrás operates with an EV/EBITDA discount compared to its peers, without a strong justification for this.

🇧🇷 CEMIG: Remote Chance Of Federalization Opens Up A Great Buying Point (Seeking Alpha) $

Companhia Energética de Minas Gerais (CEMIG) (NYSE: CIG)

- The company has been delivering excellent results since its turnaround in 2019, with cost reduction, lower leverage, and prospects for further improving its EBITDA margin.

- Despite this, the company is traded below the multiples of its international peers, even though it is the most profitable and has the best return on equity.

- The discount compared to peers is due to the political risk, which increased with the news of the company’s possible federalization, but which in my view is a buying opportunity.

🇧🇷 A Financial Powerhouse In Latin America: Mini Deep Dive On Nu Holdings (Seeking Alpha) $

- Nu Holdings Ltd (NYSE: NU) has achieved significant growth in Brazil, characterized by a large customer base, high usage rates, low operational costs, and strengthening existing relationships with additional products.

- The company is strategically expanding into new Latin American markets like Colombia and Mexico, set to replicate success in Brazil.

- Nu Holdings is positioned for continued growth; already becoming a highly profitable business that is still undervalued by most metrics.

- The company is firing on all cylinders with a seasoned management team and strong balance sheet which will allow Nu Holdings to pursue growth new opportunities.

🇧🇷 Embraer: Moving Into Harvesting Mode (Seeking Alpha) $

- Management has successfully turned around Embraer SA (BVMF: EMBR3 / NYSE: ERJ) in the last few years, repairing the company’s balance sheet and leading the company to profitable growth in all of its segments.

- The company’s leadership has made clear that it is now looking to “harvest” these efforts by monetizing the company’s product portfolio.

- Profitability looks to be at an inflection point leading to a potential rerating of the stock driven by both earnings growth and multiple expansion.

- Valuing ERJ at 8x 2026E EBITDA results in a target stock price of $44 implying more than 60% upside from its current stock price. Hence, we assign a STRONG BUY rating on the stock.

🇧🇷 Embraer: Filling The Boeing Gap? (Seeking Alpha) $

- Embraer SA (BVMF: EMBR3 / NYSE: ERJ) has completed a multi-year turnaround, with an improved cost structure and EBITDA margins of over 10%.

- Embraer is guiding for 20% revenue and EBITDA growth in 2024.

- The stock has performed well, with potential for positive surprises in the commercial aircraft segment and the hidden asset of its eVTOL subsidiary, Eve Holdings.

🇲🇽 All Eyes On Undervalued Media Company Grupo Televisa (Seeking Alpha) $

- Grupo Televisa (NYSE: TV) is an undervalued media company with a diverse business model and high barriers to entry.

- The company focuses on producing Spanish-speaking content and has a large global audience and reach.

- The cable and Sky segments make up a significant portion of Grupo Televisa’s revenue, while other businesses have been spun off into Ollamani SAB (BMV: AGUILCPO).

- Shares are a buy with a price target of $8.

🇲🇽 Grupo Aeroportuario del Sureste: Upgrading The Stock To Strong Buy (Seeking Alpha) $

- Grupo Aeroportuario del Sureste (ASUR) (NYSE: ASR) stock has performed well, outperforming the broader market with a 21.7% return.

- ASR reports lower revenues and EBITDA, but adjusted figures show positive growth.

- ASR’s 2024-2028 investment plan and tariff increases suggest significant upside for ASR stock.

🇵🇦 Copa Holdings: Risks And Upside Present, But Valuation Completely Misaligned (Seeking Alpha) $

- Copa Holdings (NYSE: CPA)’s revenue growth has been underwhelming (+3%), as has its margin development, with considerable volatility as Copa has navigated industry disruption and growth in LatAm.

- Irrespective of this, we believe Copa is now well-placed. Its growth trajectory is healthy due to a solid pipeline of volume growth, while industry demand is expected to be strong.

- Copa’s margins are market-leading, with analysts expecting it to maintain this. We see this as the biggest risk, albeit there is limited evidence to suggest a collapse.

- Copa’s near-term performance will continue to soften due to macroeconomic conditions but should maintain growth. We see this as an inevitable normalization.

- The company’s valuation is completely depressed, irrespective of risks and the slowdown expected, implying an upside in our view.

📰🔬 Further Suggested Reading

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Xi vows major steps to create world class business environment (Caixin) $

- President Xi Jinping met with representatives from the American business and academic communities this week, telling them that China has a series of reform measures in the works that will create “broader development space” for U.S. and other foreign businesses.

- “China is planning and implementing a series of major steps for comprehensively deepening reform,” Xi said at the meeting Wednesday, reiterating that reform and opening up is a key element for contemporary China in catching up with the times, according to a statement from the foreign ministry.

🇨🇳 Xi Jinping tells US CEOs that China’s growth prospects remain ‘bright’ (FT) $ 🗃️

- Beijing seeks to revive investor confidence as concerns mount about oversupply and potential dumping

🇨🇳 In Depth: China IPO Slowdown Pits Startups Against Investors (Caixin) $

- China’s depressed stock markets and a slowdown in IPO registration by regulators have sent a chill through the world of private equity (PE) and venture capital (VC) firms, whose funds have traditionally chosen listing as the most popular exit channel for their Chinese investments.

- The market downturn has spelled trouble for many IPO hopefuls and created a rift between them and their PE/VC investors that is increasingly leading to arbitration or litigation when companies fail to follow an agreed timetable to go public and allow funds to exit.

🇨🇳 Chinese-made EVs set to take 25% of European market this year (FT) $ 🗃️

- EU car manufacturers warn that a wave of cheaper models from China will undercut those produced by local companies

🇨🇳 China’s COMAC wide-body C929 jet in ‘detailed design stage’, official says (Reuters) 🗃️

- Chinese state-owned planemaker Commercial Aircraft Corporation of China (COMAC)’s first wide-body jet is in its “detailed design stage”, an executive said on Tuesday, following a report from the jet’s fuselage manufacturer aiming to deliver the first fuselage section by September 2027.

🇹🇭 Thai casinos could lift tourism spend by 52pct: report (GGRAsia)

- Average spending of tourists in Thailand could increase by 52 percent, to THB65,050 (US$1,785) per trip, were casino resorts to be built in that nation, reported Bloomberg, citing information in a casino legalisation study by Thai lawmakers reportedly due to be submitted to the country’s parliament on Thursday (March 28).

- It has been separately reported that an actual bill on casino legalisation would be submitted that day to the House of Representatives, the lower house of the National Assembly.

🇹🇭 Casino plan draws House opposition (Bangkok Post)

- The government should have looked at what happened in overseas countries which legalised casinos, in terms of social problems and whether their tax revenue rose as significantly as expected, he said. Singapore, Malaysia and the Philippines have all seen tax revenue decrease, not increase, he said.

- Worse still, several countries whose citizens now top Thailand’s chart of international visitors have clearly said they would be left with no choice but to limit the number of visitors to Thailand if the country legalises casinos, according to Mr Chaichana.

🇮🇩 Who gains from India’s endless election? (FT) $ 🗃️

- Voting across India will take six weeks, stretching the already limited resources of opposition parties

🇧🇷 Brazil Value Talks: Thalis Saint’Yves (Brazil Stocks) $

- Multiplied Invested Capital by 9,500x in 17 Years

- Today we are starting a new section here in our space, where I will interview Brazilian investors that I admire.

- Thalis currently manages his own stock portfolio in Brazil.

- In 17 years, from 2007 to 2023, Thalis’ portfolio yielded an incredible 952,046.06%, that is, it multiplied the invested capital by 9,521x!

🌐 The weakest links in the global economy are on the mend (FT) $ 🗃️

- Some of the most prominent beleaguered nations are now carrying out radical reforms

- They include most prominently Turkey, Argentina, Egypt, Nigeria and Kenya, and they carry some weight. All five of these reforming countries are in the 40 largest emerging economies, so their turn for the better is reinforcing the global economic recovery as well.

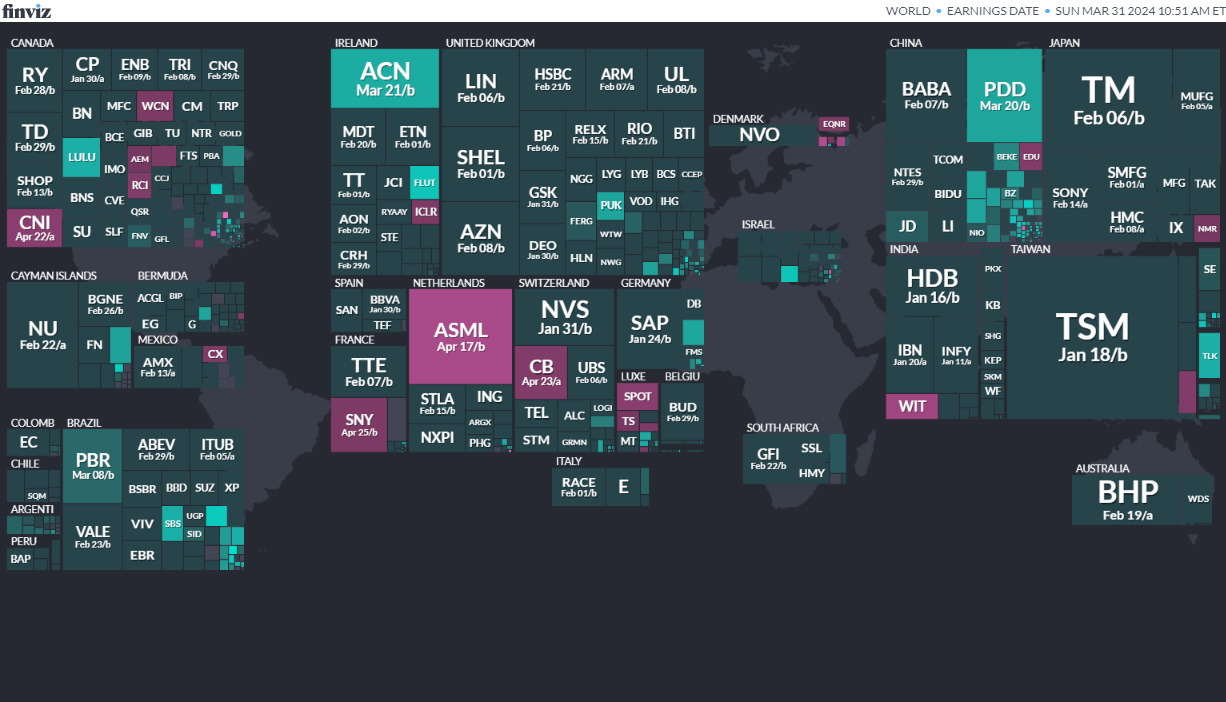

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

- Kuwait Kuwaiti National Assembly Apr 4, 2024 (d) Confirmed Jun 6, 2023

- South Korea South Korean National Assembly Apr 10, 2024 (d) Confirmed Apr 15, 2020

- Croatia Croatian Assembly Apr 17, 2024 (d) Confirmed Jul 5, 2020

- India Indian People’s Assembly Apr 19, 2024 (d) Date not confirmed Apr 11, 2019

- Ecuador Referendum Apr 21, 2024 (d) Confirmed Aug 20, 2023

- Panama Panamanian National Assembly May 5, 2024 (t) Confirmed May 5, 2019

- Panama Panamanian Presidency May 5, 2024 (t) Confirmed May 5, 2019

- South Africa South African National Assembly May 29, 2024 (d) Confirmed May 8, 2019

- Mexico Mexican Senate Jun 2, 2024 (t) Date not confirmed Jul 1, 2018

- Mexico Mexican Chamber of Deputies Jun 2, 2024 (t) Date not confirmed Jun 6, 2021

- Mexico Mexican Presidency Jun 2, 2024 (t) Date not confirmed Jul 1, 2018

- Mongolia Mongolian State Great Hural Jun 28, 2024 (d) Confirmed Jun 24, 2020

- Venezuela Venezuela Presidency Jul 28, 2024 (d) Confirmed May 20, 2018

- Czech Republic Czech Senate Sep 30, 2024 (t) Date not confirmed Sep 23, 2022

- Romania Romanian Presidency Sep 30, 2024 (t) Date not confirmed Nov 24, 2019

- Sri Lanka Sri Lankan Presidency Sep 30, 2024 (t) Date not confirmed Nov 16, 2019

- Georgia Georgian Parliament Oct 26, 2024 (d) Confirmed Oct 31, 2020

- Uruguay Uruguayan Presidency Oct 27, 2024 (t) Date not confirmed

- Uruguay Uruguayan Chamber of Representatives Oct 27, 2024 (t) Date not confirmed

- Uruguay Uruguayan Chamber of Senators Oct 27, 2024 (t) Date not confirmed

- Jordan Jordanian House of Deputies Oct 31, 2024 (t) Date not confirmed Nov 10, 2020

- Georgia Georgian Presidency Nov 30, 2024 (t) Date not confirmed Nov 28, 2018

- Romania Romanian Senate Nov 30, 2024 (t) Date not confirmed Dec 6, 2020

- Romania Romanian Chamber of Deputies Nov 30, 2024 (t) Date not confirmed Dec 6, 2020

- Namibia Namibian Presidency Nov 30, 2024 (t) Date not confirmed Nov 27, 2019

- Namibia Namibian National Assembly Nov 30, 2024 (t) Date not confirmed Nov 27, 2019

- Uzbekistan Uzbekistani Legislative Chamber Dec 31, 2024 (t) Tentative Dec 22, 2019

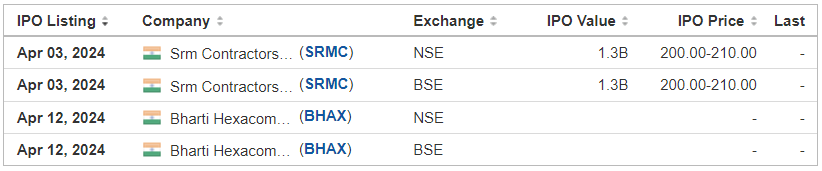

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

U-BX Technology Ltd. UBXG EF Hutton, 2.0M Shares, $5.00-5.00, $10.0 mil, 3/28/2024 Priced

U-BX was incorporated on June 30, 2021, in the Cayman Islands. U-BX does not have material operations of its own. We conduct business through the PRC Operating Entities. (Incorporated in the Cayman Islands)

Since U-BX China’s establishment in 2018, the PRC Operating Entities have used AI-driven technology to provide value-added services to the insurance industry, including insurance carriers and brokers.

Our PRC Operating Entities’ business primarily consists of providing the following three services/products: i) digital promotion services, ii) risk assessment services, and iii) value-added bundled benefits. We help our institutional clients obtain visibility on various social media platforms and generate our revenue based on consumers’ clicks, views or our clients’ promotion time through those channels. We have also developed a unique algorithm and named it the “Magic Mirror” to calculate payout risks for insurance carriers to underwrite auto insurance coverage. Utilizing our proprietary algorithmic model, we are able to generate individualized risk reports based on the vehicle brand, model, travel area, and vehicle age. In turn, we are able to generate revenue based on the number of assessment reports we provide to the insurance carriers. Lastly, to help major insurance carriers or brokers attract their customers, we sell bundled benefits, including car wash, maintenance plan or parking notification, to these carriers, which they may then pass onto their customers for either low or no cost. In addition to servicing institutional customers, we provide up-to-date insurance-related information to individual consumers through our mini-application embedded in other social media platforms. The information is provided to educate consumers and insurance brokers about the insurance industry, thus helping us build a stronger brand image with the general public.

At present, our client base consists of more than 300 city-level property and auto insurance carriers nationwide, in addition to approximately 200,000 insurance brokers that use our products and services to conduct business on a daily basis. Some of our clients include large corporations such as the People’s Insurance Company of China, Dajia Property Insurance Co., Ltd., China Pacific Property Insurance Co., Ltd., China Life Property Insurance Co., Ltd., Yongcheng Property Insurance Co., Ltd., and Huatai Insurance Brokers Co., Ltd.

Note: For its fiscal year ended June 30, 2021, U-BX Technology Ltd. reported a net loss of US$9,562 on revenue of US$72.3 million.

Note: For its fiscal year ended June 30, 2022, U-BX Technology Ltd. reported a net loss of US$49,022 on revenue of US$86.68 million.

Note: For its fiscal year ended June 30, 2023, U-BX Technology Ltd. swung to a net profit from a net loss in its FY ended June 30, 2022.

Note: For its fiscal year ended June 30, 2023, U-BX Technology Ltd. reported net income of $0.21 million (net income of $205,911) on revenue of $94.32 million (revenue of $94,318,710). Note: U-BX Technology Ltd. filed an F-1/A dated Dec. 5, 2023, in which it updated its financial statements through the fiscal year that ended June 30, 2023.

(Note: U-BX Technology Ltd. priced its small IPO on March 27, 2024, in sync with the terms in the prospectus: 2.0 million shares at $5.00 to raise $10.0 million.)

(Note: U-BX Technology Ltd. changed its sole book-runner to EF Hutton, replacing Prime Number Capital, in an F-1/A filing dated Feb. 12, 2024.)

(Note: U-BX Technology Ltd. filed an F-1/A dated Nov. 17, 2023, in which it slashed the IPO’s size by 60 percent – cutting the number of shares to 2.0 million – down from 5.0 million – and kept the assumed IPO price at $5.00 – to raise $10 million. In that Nov. 17, 2023, filing with the SEC, U-BX Technology changed its sole book-runner to Prime Number Capital, which replaced Boustead Securities, the original underwriter.)

(Background Note: U-BX Technology Ltd. tweaked the terms of its IPO in an F-1/A filing dated Aug. 5, 2022, by stating the assumed offering price is $5.00, the top of its previous $4.00-to-$5.00 range – and kept the number of shares at 5.0 million shares, to raise $25.0 million. Note: In an F-1/A filing dated July 19, 2022, U-BX Technology cut the size of its IPO by reducing the number of shares to 5.0 million shares, down from 6.0 million shares, and decreasing the price range to $4.00 to $5.00, down from $4.50 to $5.50, to raise $22.5 million. The new terms represented a 25 percent reduction in the IPO’s estimated proceeds, based on mid-point pricing. Note: U-BX Technology Ltd. filed its F-1 on Jan. 28, 2022, in which it disclosed that it intended to offer 6.0 million ordinary shares at a price range of $4.50 to $5.50 to raise $30.0 million – with Boustead Securities as its sole underwriter. In October 2021, U-BX Technology Ltd. submitted its confidential IPO filing to the SEC.)

Zhibao Technology ZBAO EF Hutton, 1.2M Shares, $4.00-6.00, $6.0 mil, 4/2/2024 Tuesday

We launched the first digital insurance brokerage platform in China in 2020, powered by our proprietary PaaS (Platform as a Service). (Incorporated in the Cayman Islands)

We are a leading and high-growth InsurTech company primarily engaged in providing digital insurance brokerage services in China.

We operate substantially all of our business through its PRC Subsidiaries, or Zhibao China Group, in particular Zhibao China and Sunshine Insurance Brokers.

2B2C (“to-business–to-customer”) digital embedded insurance is our innovative business model, which Zhibao China Group pioneered in China.

2B2C digital embedded insurance refers to our one-stop customized insurance brokerage model conducted through Zhibao China Group, under which we provide proprietary and customized insurance solutions to be digitally embedded in the existing customer engagement matrix of business entities (our “business channels” or “B channels”) to reach and serve such B channels’ existing pool of end customers (“end customers” or “C”). Each B channel encompasses a specific scenario where its end customers also have potential, untapped insurance needs. For example, a Chinese travel agency (our B channel) has an average of 100,000 Chinese tourists traveling to the U.S. for tourism every year. We believe this presents an untapped scenario-specific opportunity for international travel accident insurance needs for a pool of 100,000 Chinese tourists as end customers. These end customers might otherwise have to search for and purchase insurance separately or might not purchase insurance at all. After Zhibao China Group reaches an agreement with such travel agency to become one of our B channels, they build and embed a travel insurance solution across this travel agency’s matrix of digital channels, including its website, App, Douyin (the Chinese equivalent of TikTok), WeChat Mini Program, and other social media accounts. Consequently, we, through Zhibao China Group, may pinpoint the 100,000-strong customer base and provide insurance brokerage services which are specifically and accurately tailored to the insurance needs of these end customers.

Note: For the fiscal year that ended June 30, 2023, Zhibao Technology Inc. reported a net loss of $5.9 million on revenue of $19.6 million.

(Note: Zhibao Technology Inc. is offering 1.2 million Class A ordinary shares at a price range of $4.00 to $6.00 to raise $6.0 million in its initial public offering. This is a NASDAQ listing. Background: Zhibao Technology Inc. filed its F-1 without disclosing terms on Sept. 8, 2023. The Shanghai-based InsurTech company submitted its confidential IPO documents to the SEC on March 23, 2023.)

Mobile-health Network Solutions MNDR Network 1 Financial, 2.3M Shares, $4.00-5.00, $10.1 mil, 4/3/2024 Wednesday

(Incorporated in the Cayman Islands)

Our Mission

To be our users’ trusted companion on their lifelong healthcare journey by providing a seamless healthcare experience from start to finish, which is affordable, accessible and easy to understand to both users and healthcare providers.

Our Business

We have set up one of the smartest integrated all-in-one patient care-centric platforms in the region to deliver affordable care to users. We are a leading telehealth solutions provider in Singapore in terms of the number of countries covered by our MaNaDr platform, including countries in the APAC region.

We are a leading telehealth solutions provider in Singapore in terms of various matrices, such as the number of patient consultations per day and the ranking of our mobile application, according to Frost & Sullivan. According to Frost & Sullivan, we have the largest number of teleconsultations per day in the six months ending May 2023, and are amongst the fastest-growing telehealth solutions providers in Singapore. Our MaNaDr mobile application has received a 4.8 and 4.9 star rating on the Apple App Store and Google Play Store in Singapore respectively as of June 14, 2023. According to Frost & Sullivan, on a combined basis, MaNaDr was the most reviewed and highest rated mobile application in Singapore as of June 14, 2023 and has the largest number of teleconsultations per day in the six months ending May 2023.

We provide our services on our MaNaDr platform, which is accessible via our mobile application and website. We serve both the community of users, by offering personalized and reliable medical attention to users worldwide, as well as the community of healthcare providers, by allowing them to have a broader reach to users through virtual clinics without any start-up costs and the ability to connect to a global network of peer-to-peer support groups and partners. Through our mobile application, we offer users with a range of seamless and hassle-free telehealth solutions, which encompasses teleconsultation services, including the issuance of electronic medical certificates and delivery of medications to users’ homes, as well as other personalized services such as weight management programs. Furthermore, we have set up one of the smartest 24/7 virtual care ecosystems and support groups to help users navigate the complexities faced in receiving correct and timely care, according to Frost & Sullivan. With MaNaChat, the 24/7 customer support service, we operate Singapore’s only in-app live group chat service and have one of the fastest response times in Singapore and globally to support users.

As of December 31, 2022, we had 58 employees globally, with 29 employees who are based in Singapore and 29 employees who are based in Vietnam.

Note: Net loss and revenue are for the fiscal year that ended June 30, 2023.

(Note: Mobile-health Network Solutions filed its F-1 to go public and disclosed terms for its small-cap IPO in a filing dated Feb. 22, 2024: The company intends to offer 2.25 million shares of stock at a price range of $4.00 to $5.00 to raise $10.13 million.)

🏁 Emerging Market ETF Launches

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

- 03/19/2024 – Avantis Emerging Markets ex-China Equity ETF AVXC – Active, equity, ex-China

- 03/15/2024 – Polen Capital China Growth ETF PCCE – Active, equity, China

- 03/04/2024 – Simplify Tara India Opportunities ETF IOPP – Active, equity, India

- 02/07/2024 – Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares XXCH – Equity, leveraged, China

- 01/11/2024 – Matthews Emerging Markets Discovery Active ETF MEMS – Active, equity, small caps

- 01/10/2024 – Matthews China Discovery Active ETF MCHS – Active, equity, small caps

- 11/07/2023 – Global X MSCI Emerging Markets Covered Call ETF EMCC – Equity, leverage

- 11/07/2023 – Avantis Emerging Markets Small Cap Equity ETF AVEE – Active, equity, small caps

- 09/22/2023 – Matthews Asia Dividend Active ETF ADVE – Active, equity, Asia

- 09/22/2023 – Matthews Pacific Tiger Active ETF ASIA – Active, equity, Asia

- 09/22/2023 – Matthews Emerging Markets Sustainable Future Active ETF EMSF – Active, equity, ESG

- 09/22/2023 – Matthews India Active ETF INDE – Active, equity, India

- 09/22/2023 – Matthews Japan Active ETF JPAN – Active, equity, Japan

- 09/22/2023 – Matthews Asia Dividend Active ETF ADVE – Active, equity, Asia

- 08/25/2023 – KraneShares Dynamic Emerging Markets Strategy ETF KEM – Active, equity, emerging markets

- 08/18/2023 – Global X India Active ETF NDIA – Active, equity, India

- 08/18/2023 – Global X Brazil Active ETF BRAZ – Active, equity, Brazil

- 07/17/2023 – Matthews Korea Active ETF MKOR – Active, equity, South Korea

- 05/18/2023 – Putnam Emerging Markets ex-China ETF PEMX – Active, value, growth stocks

- 05/11/2023 – JPMorgan BetaBuilders Emerging Markets Equity ETF BBEM – Passive, large + midcap stocks

- 03/16/2023 – JPMorgan Active China ETF JCHI – Active, equity, China

- 03/03/2023 – First Trust Bloomberg Emerging Market Democracies ETF EMDM – Principles-based

- 1/31/2023 – Strive Emerging Markets Ex-China ETF STX – Passive, equity, emerging markets

- 1/20/2023 – Putnam PanAgora ESG Emerging Markets Equity ETF PPEM – Active, equity, ESG, emerging markets

- 1/12/2023 – KraneShares China Internet and Covered Call Strategy ETF KLIP – Active, equity, China, options overlay, thematic

- 1/11/2023 – Matthews Emerging Markets ex China Active ETF MEMX – Active, equity, emerging markets

- 12/13/2022 – GraniteShares 1.75x Long BABA Daily ETF BABX – Active, equity, leveraged, single stock

- 12/13/2022 – Virtus Stone Harbor Emerging Markets High Yield Bond ETF VEMY – Active, fixed income, junk bond, emerging markets

- 9/22/2022 – WisdomTree Emerging Markets ex-China Fund XC – Passive, equity, emerging markets

- 9/15/2022 – KraneShares S&P Pan Asia Dividend Aristocrats Index ETF KDIV – Passive, equity, Asia, dividend strategy

- 9/15/2022 – OneAscent Emerging Markets ETF OAEM – Active, Equity, emerging markets, ESG

- 9/9/2022 – Emerge EMPWR Sustainable Select Growth Equity ETF EMGC – Active, equity, emerging markets

- 9/9/2022 – Emerge EMPWR Unified Sustainable Equity ETF EMPW – Active, equity, emerging markets

- 9/8/2022 – Emerge EMPWR Sustainable Emerging Markets Equity ETF EMCH – Active, equity, emerging markets, ESG

- 7/14/2022 – Matthews China Active ETF MCH – Active, equity, China

- 7/14/2022 – Matthews Emerging Markets Equity Active ETF MEM – Active, equity, emerging markets

- 7/14/2022 – Matthews Asia Innovators Active ETF MINV – Active, equity, Asia

- 6/30/2022 – BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF XEMD – Passive, fixed income, emerging markets

- 5/2/2022 – AXS Short CSI China Internet ETF SWEB – Active, inverse, thematic

- 4/27/2022 – Dimensional Emerging Markets High Profitability ETF DEHP – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Core Equity 2 ETF DFEM – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Value ETF DFEV – Active, equity, emerging markets

- 4/27/2022 – iShares Emergent Food and AgTech Multisector ETF IVEG – Passive, equity, thematic [Mostly developed markets]

- 4/21/2022 – FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM – Passive, equity, ESG

- 4/6/2022 – India Internet & Ecommerce ETF INQQ – Passive, equity, thematic

- 2/17/2022 – VanEck Digital India ETF DGIN – Passive, India market, thematic

- 2/17/2022 – Goldman Sachs Access Emerging Markets USD Bond ETF GEMD – Passive, fixed income, emerging markets

- 1/27/2022 – iShares MSCI China Multisector Tech ETF TCHI – Passive, China, technology

- 1/11/2022 – Simplify Emerging Markets PLUS Downside Convexity ETF EMGD – Active, equity, options strategy

- 1/11/2022 – SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG – Passive, equity, ESG

🚽 Emerging Market ETF Closures/Liquidations

Frontier and emerging market highlights:

- 02/16/2024 – Global X MSCI China Real Estate ETF – CHIH

- 02/16/2024 – Global X MSCI China Biotech Innovation ETF – CHB

- 02/16/2024 – Global X MSCI China Utilities ETF – CHIU

- 02/16/2024 – Global X MSCI Pakistan ETF – PAK

- 02/16/2024 – Global X MSCI China Materials ETF – CHIM

- 02/16/2024 – Global X MSCI China Health Care ETF – CHIH

- 02/16/2024 – Global X MSCI China Financials ETF – CHIX

- 02/16/2024 – Global X MSCI China Information Technology ETF – CHIK

- 02/16/2024 – Global X MSCI China Consumer Staples ETF – CHIS

- 02/16/2024 – Global X MSCI China Industrials ETF – CHII

- 02/16/2024 – Global X MSCI China Energy ETF – CHIE

- 02/14/2024 – BNY Mellon Sustainable Global Emerging Markets ETF – BKES

- 01/26/2024 – The WisdomTree Emerging Markets ESG Fund – RESE

- 11/11/2023 – Global X China Innovation ETF – KEJI

- 11/11/2023 – Global X Emerging Markets Internet & E-commerce ETF – EWEB

- 11/09/2023 – Franklin FTSE South Africa ETF – FLZA

- 10/27/2023 – Simplify Emerging Markets Equity PLUS Downside Convexity – EMGD

- 10/20/2023 – WisdomTree India ex-State-Owned Enterprises Fund – IXSE

- 10/20/2023 – WisdomTree Chinese Yuan Strategy Fund – CYB

- 10/20/2023 – Loncar China BioPharma ETF – CHNA

- 10/18/2023 – KraneShares Emerging Markets Healthcare Index ETF – KMED

- 10/18/2023 – KraneShares MSCI China ESG Leaders Index ETF – KSEG

- 10/18/2023 – KraneShares CICC China Leaders 100 Index ETF – KFYP

- 10/16/2023 – Strategy Shares Halt Climate Change ETF – NZRO

- 09/20/2023 – VanEck China Growth Leaders ETF – GLCN

- 08/28/2023 – Asian Growth Cubs ETF – CUBS

- 08/01/2023 – VanEck Russia ETF – RSX

- 07/07/2023 – Emerge EMPWR Sustainable Emerging Markets Equity ETF – EMCH

- 06/23/2023 – Invesco PureBeta FTSE Emerging Markets ETF – PBEE

- 06/16/2023 – AXS Short China Internet ETF – SWEB

- 04/11/2023 – SPDR Bloomberg SASB Emerging Markets ESG Select ETF – REMG

- 3/30/2023 – Invesco BLDRS Emerging Markets 50 ADR Index Fund – ADRE

- 3/30/2023 – Invesco BulletShares 2023 USD Emerging Markets Debt ETF – BSCE

- 3/30/2023 – Invesco BulletShares 2024 USD Emerging Markets Debt ETF – BSDE

- 3/30/2023 – Invesco RAFI Strategic Emerging Markets ETF – ISEM

- 2/17/2023 – Direxion Daily CSI 300 China A Share Bear 1X Shares – CHAD

- 1/13/2023 – First Trust Chindia ETF – FNI

- 12/28/2022 – Franklin FTSE Russia ETF – FLRU

- 12/22/2022 – VictoryShares Emerging Market High Div Volatility Wtd ETF CEY

- 8/22/2022 – iShares MSCI Argentina and Global Exposure ETF AGT

- 8/22/2022 – iShares MSCI Colombia ETFI COL

- 6/10/2022 – Infusive Compounding Global Equities ETF JOYY

- 5/3/2022 – ProShares Short Term USD Emerging Markets Bond ETF EMSH

- 4/7/2022 – DeltaShares S&P EM 100 & Managed Risk ETF DMRE

- 3/11/2022 – Direxion Daily Russia Bull 2X Shares RUSL

- 1/27/2022 – Legg Mason Global Infrastructure ETF INFR

- 1/14/2022 – Direxion Daily Latin America Bull 2X Shares LBJ

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (April 1, 2024) was also published on our Substack.

Emerging Markets Investing Tips + Advice

Emerging Market Skeptic (Website)

Website List Updates + Site Map

Stocktwits @EmergingMarketSkptc

Similar Posts:

- Housebound Consumers Lift Lenovo to Record Revenues & Profits (HKEXnews)

- China Internet Update (KraneShares)

- Global Smartphone Shipments to Reach 1.2Bn This Year on Emerging Market Strength (Juniper Research)

- Didi Ekes Out 1% Gain After New York IPO Pop Fizzles (Nikkei Asia)

- FPA Crescent (FPACX) Fund Makes Some Interesting Emerging Market Stock Bets (Kiplinger)

- Yale University Added $100M to the Vanguard FTSE Emerging Markets ETF (VWO) in 1Q2014 (P&I)

- Tech Sector Can Power Emerging Market Portfolios (FE Trustnet)

- Emerging Market Links + The Week Ahead (August 1, 2022)

- Emerging Market Links + The Week Ahead (May 29, 2023)

- Emerging Market Links + The Week Ahead (January 16, 2023)

- Emerging Market Links + The Week Ahead (September 5, 2022)

- Emerging Market Links + The Week Ahead (April 24, 2023)

- Emerging Market Links + The Week Ahead (May 8, 2023)

- Vietnamese Verses Chinese Retail Investors (AFC)

- Emerging Market Links + The Week Ahead (August 15, 2022)