Its hard to believe that anyone can dethrone Amazon. But Pinduoduo’s (PDD Holdings (NASDAQ: PDD)) Temu (among other Chinese eCommerce players) have quietly launched the “Amazon eCommerce siege war” as Amazon lets go of the vast “sinking markets” (e.g. lower-income-segments of the population) with an average order value of less than $40. This has opened the door for Chinese eCommerce players who compete to offer the lowest prices.

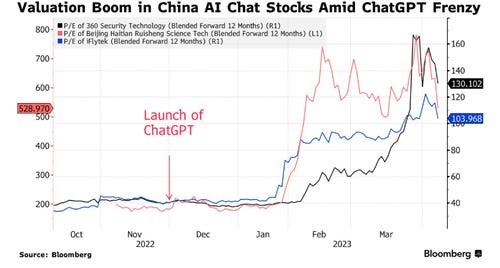

Meanwhile, Apple is tripling iPhone production in India as their split with China accelerates. In fact, a quarter of all iPhone manufacturing could be produced in India by 2025. This comes as one Chinese state-owned newspaper has warned the AI sector has “signs of a valuation bubble” and urged regulators to “strengthen the monitoring and crackdown on hot spots and speculation concepts.”

For emerging market investing tips: Mobius Capital Partners has recently done a Strategy Update & India Report webinar worth watching as it had some good insights concerning emerging market stock selection (e.g. they pointed out there are 35,000 listed businesses in EMs to potentially invest in). They also covered their recent visit to India.

Finally, I have started using the Thread function (and posting them on the new Twitter-like Substack Notes which is worth checking out if you haven’t already) for some short research tear sheets (see EM Stock Pick Tear Sheets) on individual emerging market stocks – as in what they do, some key numbers, charts, and additional resources (website, IR page, etc.). The format may be subject to change (e.g. depending on the website, there is often conflicting data or no chart available for certain EM stock picks).

For now, they are not paywalled or being emailed out so as to not flood inboxes. I believe subscribers are able to adjust their subscriptions manually to include them in emails or on the App.

Subscribe Now Via Substack

Emerging Market Stock Pick Tear Sheets

- Persistent Systems (NSE: PERSISTENT / BOM: 533179): One of India’s Fastest Growing IT Firms

- MINISO Group Holding (NYSE: MNSO): Asia’s Notorious Copycat Retailer

- MapMyIndia (NSE: MAPMYINDIA / BOM: 543425): Maps Every Door in India

- Bairong Inc (HKG: 6608 / FRA: 6B5): AI/Digital Transformation Services for Chinese Banks

Emerging Market Stock Picks / Stock Research

$ = behind a paywall

Inside Temu: the fiery culture and a perpetual efficiency machine (Momentum Works)

Note: Nasdaq listed PDD Holdings (NASDAQ: PDD)is the multinational commerce group that owns and operates a portfolio of businesses, including Pinduoduo and Temu, an eCommerce marketplace in North America allowing Chinese vendors to sell their products directly to US consumers.

- The reason why these two companies have made such aggressive goals in parallel may be that they see an important window: currently, Amazon is busy raising its average order value, letting go of the vast ‘sinking markets’ 下沉市场 (i.e.: lower-income-segments of the population) with an average order value of less than $40. For Chinese cross-border ecommerce players, this is a rare opportunity. At the same time, SHEIN, TikTok, Shopee, Alibaba, and others have joined the fray of cross border ecommerce. The “Amazon ecommerce siege war” is quietly beginning, and Temu is leading the charge.

- In China, Pinduoduo relied on internal competition to gradually eat away the market share of Taobao andJD.com(NASDAQ: JD). Now, history is repeating itself in the overseas market, with Amazon as the new opponent.

Also see: Why Chinese Apps Are the Favorites of Young Americans (WSJ) – “It isn’t just the algorithms, but lessons from a competitive culture…Seven-month-old Temu was the most downloaded app across U.S. app stores during the first three weeks of March…”

Activation Group (9919 HK) (Oriental Value)

- Activation Group Holdings (HKG: 9919)

- A cheap pick-and-shovel play on Chinese luxury consumption.

- Activation Group is a leading event planning and organizing agency in China, with a focus on international luxury brands.

Webinar: Strategy Update & India Report (Mobius Capital Partners) 49 Minutes

- Mobius Capital Partners

- MCP’s founding partner Carlos Hardenberg and India analyst Swathi Seshadri reported on their recent trip to India where they met with companies across sectors as well as experts from MCP’s network, including economists and policymakers.

- 35,000 listed businesses in EMs to potentially invest in.

- They prefer stocks with at-least $1-2M a day in turnover (ideally $2-3M to $8-9M+ a day).

- Invest in China via Korean companies as the latter offer more robust business models, stable management teams, better business models, etc.

- Invest in Taiwanese IC design, etc. businesses that operate globally.

- 32 Min – Persistent Systems (NSE: PERSISTENT / BOM: 533179) – a digital engineering and enterprise modernization partner set up by a returnee to India.

- 34 Min – CE Info Systems Ltd (MapMyIndia) (NSE: MAPMYINDIA / BOM: 543425) – car maps, etc. for Uber, delivery vehicles, etc. They came across the company by talking to car makers before it’s IPO.

- How they find stocks: Formalized screens (name by name in country, etc) + other channels (travel, trade fairs, etc).

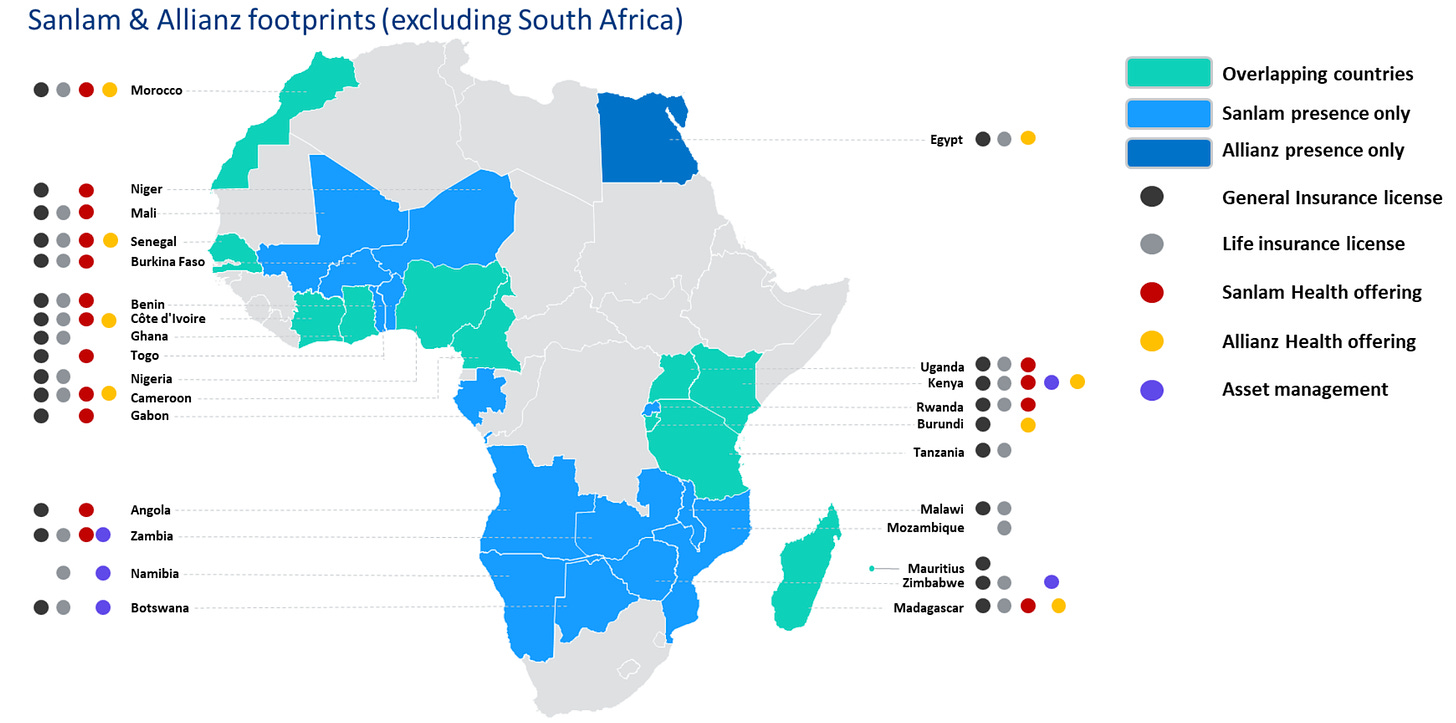

Sanlam. Africa’s Insurer (Emerging Value) Partly $

Note: We have covered them a few times as a fund holding.

Toya SA (TOA) (Eloy Fernández Deep Research)

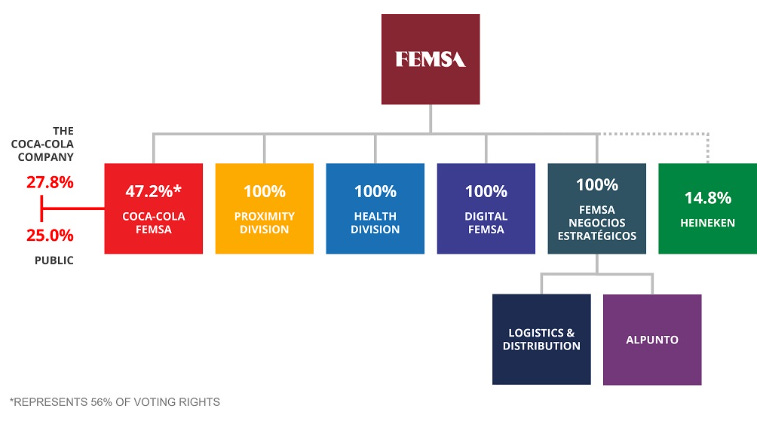

Coca-Cola FEMSA: Valuation Starting To Run Out Of Fizz (Porchester Papers)

NOTE: Coca-Cola Femsa SAB de CV (NYSE: KOF). The parent company is Fomento Económico Mexicano (FEMSA) (BMV: FEMSAUBD). We have covered it as a fund holding a few times. Note the structure (the CVS chain is actually under Proximity – not the NYSE listing):

- Deep Dive into the World’s Largest Coca-Cola Bottler

Gralado – LATAM Stocks Investment Analysis #14 (LATAM Substack)

- Gralado is a Uruguayan company that owns the operating rights to the Tres Cruces bus terminal and shopping mall, both of which are the largest in the country.

- First, there just are not very many public equities listed on the Montevideo stock exchange. The full list has 21 companies, but it appears to be somewhat out of date, as some companies are no longer listed or have been acquired. Second, not all of the companies listed have good financial disclosures or if they do, I couldn’t find them. And finally, I didn’t want to cover another food company (I have covered a lot of LATAM food companies) or a large multinational bank like Scotiabank. This left me with few options.Luckily I found an interesting real estate and infrastructure company that I think will serve as a good case study to learn more about the Uruguayan economy and investing in Uruguay.

Further Suggested Reading

$ = behind a paywall

Apple Triples iPhone Production In India As Split With China Accelerates (Zero Hedge)

- Bloomberg pointed out Apple is devising a plan to simultaneously produce the next generation of iPhones in India and China late in the second half of 2023 — this will be the first time it begins iPhone assembly in both countries. And if trends persist, a quarter of all iPhone manufacturing could be produced in India by 2025.

China AI Stocks Plunge As State Media Warns Of “Valuation Bubble” (Zero Hedge)

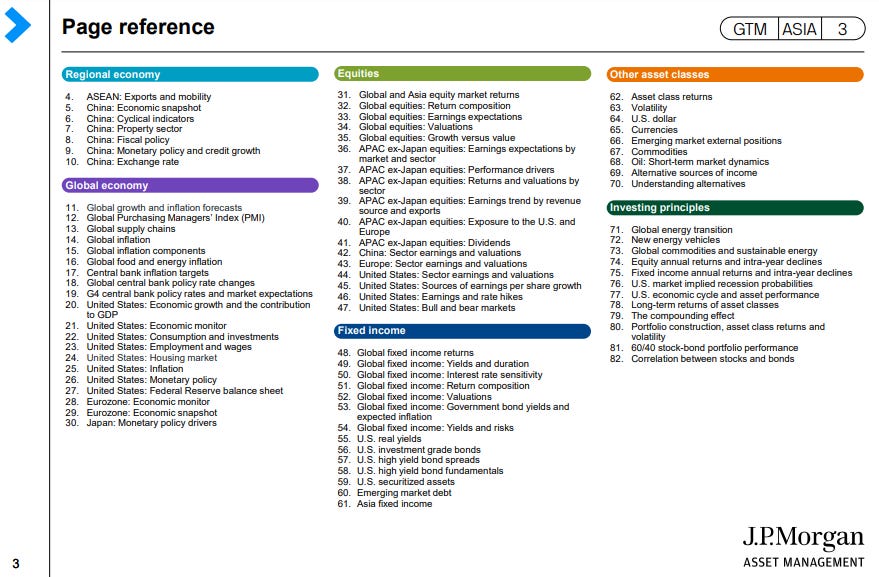

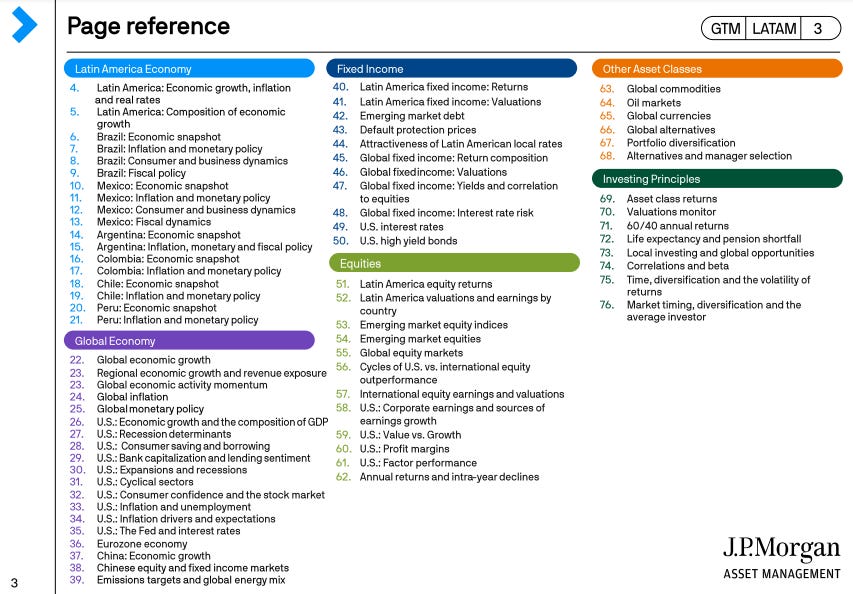

Asia Q2 2023 Guide to the Markets (J.P. Morgan) PDF File

Latin America Q2 2023 Guide to the Markets (J.P. Morgan) PDF File

Dubai court orders KPMG to pay $231mn for Abraaj fund audit failure (FT)

Note: Yet another international Big Four audit failure. Wikipedia: “The Abraaj Group was a private equity firm operating in six continents that is currently in liquidation due to accusations of fraud.[1] The firm was founded by Pakistani businessman Arif Naqvi and was based in Dubai, United Arab Emirates.”

- Group of investors had sued saying they lost money because of poor-quality audit work.

- The award is one of the largest ever against an accounting firm and exceeds KPMG Lower Gulf’s revenues of $210mn in its most recent financial year.

Mexico hails ‘new nationalisation’ as Iberdrola sells $6bn of power assets and pivots to US (FT)

- Spanish group was a target for leftist president López Obrador.

- Iberdrola is selling the bulk of its Mexican power-generating assets to a state-owned fund for $6bn, using the proceeds to accelerate its investments in the US and Europe.

- Citing the large green investment incentives in the US’s Inflation Reduction Act, he said: “The US is probably the country that brings more opportunities for the medium and long term.”

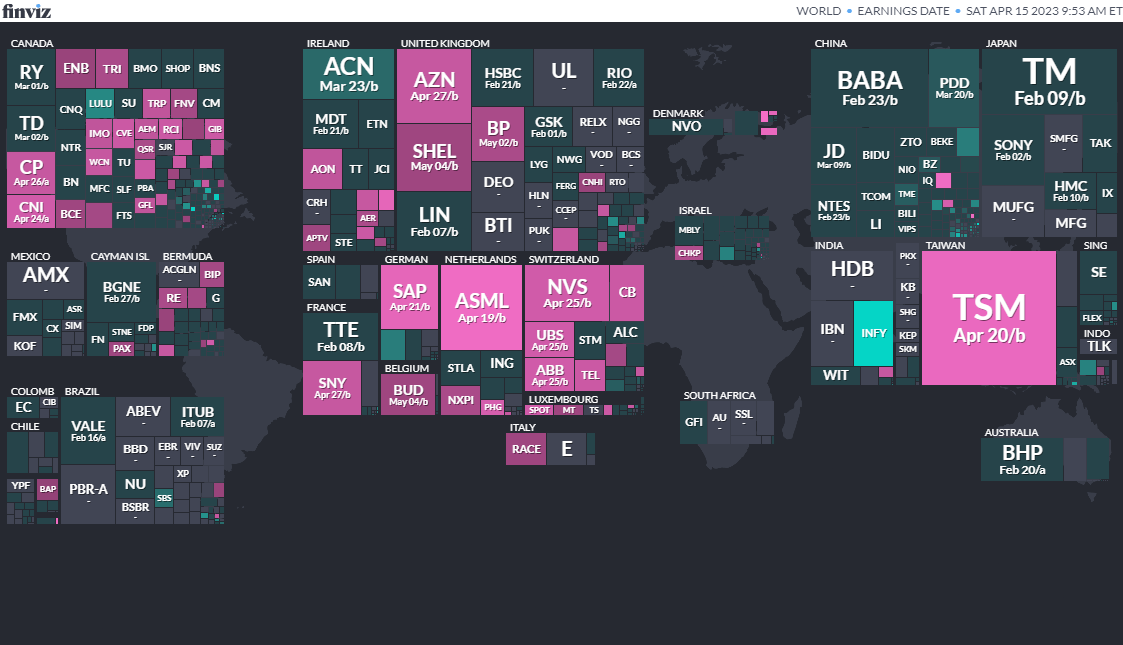

Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

- Paraguay Paraguayan Chamber of Senators Apr 30, 2023 (d) Confirmed Apr 22, 2018

- Paraguay Presidency of Paraguay Apr 30, 2023 (d) Confirmed Apr 22, 2018

- Paraguay Paraguayan Chamber of Deputies Apr 30, 2023 (d) Confirmed Apr 22, 2018

- Thailand Thai House of Representatives May 14, 2023 (t) Confirmed Mar 24, 2019

- Turkey Grand National Assembly of Turkey May 14, 2023 (d) Confirmed Jun 24, 2018

- Turkey Presidency of Turkey May 14, 2023 (d) Confirmed Jun 24, 2018

- Greece Greek Parliament May 21, 2023 (d) Confirmed Jul 7, 2019

- Cambodia Cambodian National Assembly Jul 23, 2023 (d) Confirmed Jul 29, 2018

- Pakistan Pakistani National Assembly Jul 31, 2023 (t) Date not confirmed Jul 25, 2018

- Zimbabwe Presidency of Zimbabwe Jul 31, 2023 (t) Date not confirmed Jul 30, 2018

- Zimbabwe Zimbabwean National Assembly Jul 31, 2023 (t) Date not confirmed Jul 30, 2018

- Pakistan Pakistani National Assembly Jul 31, 2023 (t) Date not confirmed Jul 25, 2018

Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Top KingWin Ltd.TCJH, 3.0M Shares, $4.00-5.00, $14.0 mil, 4/18/2023 Tuesday

Top KingWin offers financial advisory and other services to small and medium-sized enterprises (SMEs) in China. (Incorporated in the Cayman Islands)

We provide a number of important business services in China to young and emerging companies including (i) corporate business training services, which mainly focus on advanced knowledge and new perspectives on the capital markets, (ii) corporate consulting services, which mainly focus on various aspects of fundraising, and (iii) advisory and transaction services. Our main clients are entrepreneurs and executives in small and medium enterprises (“SMEs”) in China.

Corporate business training, corporate consulting, and advisory and transaction services constituted approximately 7%, 23% and 70% of our business, respectively, during the nine months ended Sept. 30, 2022.

Supported by the rapid economic growth and friendly business policies in China, the number of SMEs in China has significantly increased from 2016 to 2021. According to Frost & Sullivan, an independent market research firm, from 2016 to 2021, the number of SMEs in China increased from 13.9 million to 26.8 million with a compound annual growth rate (“CAGR”) of 14.0%. Frost & Sullivan expects the number of SMEs in China will steadily increase at 9.8% CAGR from 2021 to 2026. We believe that the increasing number of SMEs provide a solid foundation for the future development of our business.

With the increase in the number of companies entering the China market, most industries in China are becoming more competitive. Therefore founders, senior management teams and key employees of companies have an increasing awareness for professional business education in order to enhance their professional knowledge, boost their company’s strategic growth and allow the company to stay competitive in today’s economy.

China’s economy is shifting from traditional real estate investment and manufacturing to new economy industries such as internet-driven or technology-driven industries. Currently, the new economy industry has been a vital driving force in the growth of the economy in China. According to Frost & Sullivan, from 2016 to 2021, the market size of new economy industries by revenue in China experienced significant growth with 28.2% CAGR, which was much higher than the synchronized growth rate of 8.9% in China’s nominal GDP, attaining $4.0 trillion (RMB25.2 trillion) by the end of 2021. We believe that the rapid growth of new economy industries benefits the development of our business. Our mission is to provide comprehensive services to address client needs throughout all phases of their development and growth.

**Note: Revenue and net income figures are in U.S. dollars for the 12 months that ended Sept. 30, 2022.

(Top KingWin Ltd. filed its F-1 on Jan. 18, 2023, in which it disclosed terms for its IPO. The company submitted its confidential IPO documents to the SEC on Aug. 26, 2022.)

U Power Ltd.UCAR, 2.5M Shares, $6.00-8.00, $17.5 mil, 4/18/2023 Tuesday

We are an electric vehicle (EV) battery-swapping technology company. (Holding company incorporated in the Cayman Islands)

We are a vehicle sourcing service provider in China, with a vision to becoming an EV market player primarily focused on our proprietary battery-swapping technology, or UOTTA technology, which is an intelligent modular battery-swapping technology designed to provide a comprehensive battery power solution for EVs.

Since our commencement of operations in 2013, we have principally engaged in the provision of vehicle sourcing services. We broker sales of vehicles between automobile wholesalers and buyers, including small and medium sized vehicle dealers (“SME dealers”) and individual customers primarily located in the lower-tier cities in China, which are smaller and less developed than the tier-1 or tier-2 cities. To that end, we have focused on building business relationships with our sourcing partners and have developed a vehicle sourcing network. As of the date of this prospectus, our vehicle sourcing network consisted of approximately 100 wholesalers and 30 SME dealers located in lower-tier cities in China.

Beginning in 2020, we gradually shifted our focus from the vehicle sourcing business to the development of our proprietary battery-swapping technology, or UOTTA technology. According to Frost & Sullivan, the PRC government will focus on promoting the electrification of commercial vehicles in the next few years, and it is expected that the sales volume of electric commercial vehicles will grow from 164.7 thousand units in 2021 to 431.0 thousand units in 2026 at a CAGR of 21.2% in China, and with the increasing penetration rates of electric commercial vehicles and the expanding battery-swapping infrastructure network, the market size by revenue of battery swapping solutions for electric commercial vehicle is expected to increase from approximately RMB8,661.5 million in 2021 to RMB176,615.1 million in 2026, representing a CAGR of 82.8%. In order to capture the opportunities arising from such growth, our plan is to develop a comprehensive EV battery power solution based on UOTTA technology, which mainly consists of: (i) vehicle-mounted supervisory control units that monitor the real-time status of an EV’s battery packs; (ii) customized vehicle control units (“VCUs”), which upload real-time data of the electric vehicle, such as its battery status, real-time location and safety status, to our data platform, using Bluetooth and/or Wi-Fi technologies; and (iii) our data management platform, which collects and synchronizes real-time information of the EVs uploaded by their respective VCUs, as well as information on the availability and locations of compatible UOTTA battery-swapping stations that assist drivers in locating the nearest compatible UOTTA battery-swapping station(s) available when the EV’s battery is determined to be lower than a certain level; and (iv) UOTTA battery-swapping stations designed for precise positioning, rapid disassembly, compact integration and flexible deployment of battery swapping for compatible EVs.

We have established in-house capabilities in the innovation of EV battery-swapping technology. Through our research and development efforts, we are developing an intellectual property portfolio. As of the date of this prospectus, we had 14 issued patents and 24 pending patent applications in China. Our research and development team is committed to technology innovation. As of the date of the prospectus, our research and development team consisted of 34 personnel and is led by Mr. Rui Wang and Mr. Zhanduo Hao, each of whom has experience of over 20 years in the electric power sector.

In 2021, leveraging years of automobile industry experience, we started cooperating with major automobile manufacturers to jointly develop UOTTA-powered EVs, by adapting selected EV models with our UOTTA technology. According to Frost & Sullivan, compared with passenger EV drivers, drivers of commercial-use EVs experience more range anxiety and are more motivated to shorten, or even eliminate, time spent on recharging EVs, therefore, we intend to primarily focus on developing commercial-use UOTTA-powered EVs, such as ride-hailing passenger EVs, small logistics EVs, light electric trucks, and heavy electric trucks, and their compatible UOTTA battery-swapping stations. As of the date of this prospectus, we have entered into cooperating agreements with two major Chinese automobile manufacturers, FAW Jiefang Qingdao Automotive Co., Ltd, and HUBEI TRI-RING Motor Co., Ltd, to jointly develop UOTTA-powered electric trucks. We also have engaged with two battery-swapping station manufacturers to jointly develop and manufacture UOTTA battery-swapping stations that are compatible with UOTTA-powered EVs. Our UOTTA battery-swapping stations are designed for precise positioning, rapid disassembly, compact integration and flexible deployment, allowing battery replacement within several minutes. As of the date of this prospectus, we realized sales of five battery-swapping stations. In August 2021, we completed the construction of our own battery-swapping station factory in Zibo City, Shandong Province (the “Zibo Factory”), which commenced manufacturing UOTTA battery-swapping stations in January 2022. We are also in the process of constructing another factory in Wuhu city, Anhui province (the “Wuhu Factory”), which is expected to commence production in 2023. In order to provide a comprehensive battery power solution based on UOTTA technology, we are in the process of developing a data management platform that connects UOTTA-powered EVs and stations, and assists the UOTTA-powered EV drivers in locating the closest compatible UOTTA swapping-stations on their routes. In January 2022, we started operating a battery-swapping station, pursuant to our station cooperation agreement with Quanzhou Xinao Transportation Energy Development Co., Ltd (“Quanzhou Xinao”), a local gas station operator in Quanzhou City, Fujian Province. Although we have made significant progress in entering into the EV market, there is no assurance that we will be able to execute our business plan to expand into the EV market as we have planned.

**Note: U Power Ltd. reported a net loss of $6.84 million on revenue of $1.75 million for the 12 months that ended June 30, 2022.

(Note: U Power Ltd. disclosed that WestPark Capital is the sole book-runner – and AMTD is no longer a joint book-runner teamed with WestPark Capital – according to an F-1/A filing dated March 27, 2023. U Power Ltd. disclosed terms for its IPO on March 8, 2023, in an F-1/A filing: 2.5 million shares at $6.00 to $8.00 to raise $17.5 million. U Power filed its F-1 on Dec. 22, 2022, and updated the filing with an F-1/A on Feb. 14, 2023 – without disclosing IPO terms.)

Wang & Lee GroupWLGS, 1.6M Shares, $5.00-5.00, $8.0 mil, 4/20/2023 Thursday

We are, through our, indirectly wholly owned HK SAR subsidiary, WANG & LEE CONTRACTING LIMITED, a construction prime contractor and a construction subcontractor engaging in the installation of Electrical & Mechanical Systems (“E&M”), which includes low voltage (220v/phase 1 or 380v/phase 3) electrical system, mechanical ventilation and air-conditioning system, fire service system, water supply and sewage disposal system installation and fitting out for the public and private sectors. (Incorporated in the British Virgin Islands)

WANG & LEE CONTRACTING LIMITED is also able to provide design and contracting services to all trades in the construction industry. Our clients range from small startups to large companies.

Nowadays, buildings are going certifiably green. As we have become more conscious of the effect our installation and works have on the environment and on us directly, organizations have developed voluntary methods of rating the environmental impact and efficiency of buildings, and other similar structures. Assessments take place both during design and after completion. Existing structures or commercial interior spaces can also be rated. Our team provides every effort to be environmentally conscious, focusing on designs that promote energy and water efficiency, indoor environment quality, and the responsible discharge of wastes.

WANG & LEE CONTRACTING LIMITED has been providing construction contracting services in HK SAR for almost 40 years.

**Note: Revenue and net loss figures are in U.S. dollars for the 12 months that ended June 30, 2022.

**Note: The downturn in Hong Kong’s construction industry in 2020 followed three years of successive contractions of real output, with political uncertainty and widespread social unrest hampering activity in the sector. In 2020, disruption due to the coronavirus (COVID-19) pandemic, as well as subsequent lockdown measures and tensions as a result of continued political intervention from China, further exacerbated the challenges faced by the industry.

(Note: Wang & Lee Group filed an F-1/A dated March 21, 2023, in which it cut the size of its IPO in half to 1.6 million shares – down from 4.0 million shares – and raised the assumed IPO price to $5.00 – up from $4.00 – to raise $8.0 million. Wang & Lee Group filed an F-1/A on Jan. 9, 2023, in which it updated its financial statements for the period that ended June 30, 2022. Wang & Lee Group filed its F-1 on June 21, 2022, and disclosed terms for its IPO: 4.0 million shares at $4.00 each to raise $16.0 million.)

Jayud Global Logistics Ltd.JYD, 1.5M Shares, $4.00-5.00, $6.8 mil, 4/21/2023 Friday

We are one of the leading Shenzhen-based end-to-end supply chain solution providers in China, with a focus on providing cross-border logistics services. According to the Frost & Sullivan Report, in 2021, we ranked fifth in terms of the revenues generated from providing an end-to-end cross-border supply chain solution among all end-to-end supply chain solution providers based in Shenzhen. Headquartered in Shenzhen, a key component of the Guangdong-Hong Kong-Macau Greater Bay Area, or the Greater Bay Area, in China, we benefit from the unique geographical advantages of providing high degree of support for ocean, air and overland logistics. A well-connected transportation network enables us to significantly increase efficiency and reduce transportation costs. As one of the most open and dynamic regions in China, Shenzhen is home to renowned enterprises and the gathering place of cross-border e-commerce market players, which provides us with a large customer base and enables us to develop long-term in-depth relationships with our customers. In addition, the sustained and steady growth of local economy and supportive government policies have backed up our development and brought us great convenience in daily operations.

According to the Frost & Sullivan Report, the global end-to-end cross-border supply chain solution market experienced soaring growth during the past two years, with its total revenue surging to US$537.8 billion for the year ended Dec. 31, 2021, from US$211.8 billion for the year ended Dec. 31, 2020.

In line with this increase, we experienced rapid growth in 2020 and 2021 as well as (in) the six months ended June 30, 2022.

Our revenue generated from end-to-end cross-border logistics services increased to US$61.2 million (RMB390.2 million) for the year ended Dec. 31, 2021 – up 85.1 percent from about US$30.7 million (approximately RMB210.8 million) for the year ended Dec. 31, 2020.

Total revenues increased by approximately RMB255.3 million, or 87.9%, from approximately RMB290.3 million for the year ended December 31, 2020 to approximately RMB545.6 million (US$85.6 million) for the year ended December 31, 2021, primarily attributable to a huge growth of our freight forwarding services and stable development of our supply chain management and other value-added services.

We have established a global operation nexus to support our business. We own logistic facilities strategically located throughout major transportation hubs in China and globally. As of June 30, 2022, we have established a presence in 12 provinces (including provincial municipalities) in mainland China, such as Shenzhen of Guangdong province, Nanjing of Jiangsu province, Ningbo and Yiwu of Zhejiang province, Beijing, Shanghai, Tianjin, as well as some major global transportation hubs such as Hong Kong.

Our global freight network covers various major trade lanes across the world, including Asia-North America, Asia-Europe and Intra-Asia trade lines. As of June 30, 2022, our footprints spread across six continents and over 16 countries, such as Thailand, Singapore, India, the Philippines, Hamburg, the United Kingdom, and the United States.

**Note: Revenue and net income are in U.S. dollars for the 12 months that ended June 30, 2022.

(Note: Jayud Global Ltd. filed an F-1/A on March 21, 2023, and disclosed its IPO terms: 1.5 million shares at $4.00 to $5.00 to raise $6.75 million. Jayud Global filed its F-1 for an IPO on Feb. 17, 2023, to raise up to $12.0 million; terms not disclosed.)

Emerging Market ETF Launches

Climate change and ESG are clearly the latest flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

- 1/31/2023 – Strive Emerging Markets Ex-China ETF STX – Passive, equity, emerging markets

- 1/20/2023 – Putnam PanAgora ESG Emerging Markets Equity ETF PPEM – Active, equity, ESG, emerging markets

- 1/12/2023 – KraneShares China Internet and Covered Call Strategy ETF KLIP – Active, equity, China, options overlay, thematic

- 1/11/2023 – Matthews Emerging Markets ex China Active ETF MEMX – Active, equity, emerging markets

- 12/13/2022 – GraniteShares 1.75x Long BABA Daily ETF BABX – Active, equity, leveraged, single stock

- 12/13/2022 – Virtus Stone Harbor Emerging Markets High Yield Bond ETF VEMY – Active, fixed income, junk bond, emerging markets

- 9/22/2022 – WisdomTree Emerging Markets ex-China Fund XC – Passive, equity, emerging markets

- 9/15/2022 – KraneShares S&P Pan Asia Dividend Aristocrats Index ETF KDIV – Passive, equity, Asia, dividend strategy

- 9/15/2022 – OneAscent Emerging Markets ETF OAEM – Active, Equity, emerging markets, ESG

- 9/9/2022 – Emerge EMPWR Sustainable Select Growth Equity ETF EMGC – Active, equity, emerging markets

- 9/9/2022 – Emerge EMPWR Unified Sustainable Equity ETF EMPW – Active, equity, emerging markets

- 9/8/2022 – Emerge EMPWR Sustainable Emerging Markets Equity ETF EMCH – Active, equity, emerging markets, ESG

- 7/14/2022 – Matthews China Active ETF MCH – Active, equity, China

- 7/14/2022 – Matthews Emerging Markets Equity Active ETF MEM – Active, equity, emerging markets

- 7/14/2022 – Matthews Asia Innovators Active ETF MINV – Active, equity, Asia

- 6/30/2022 – BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF XEMD – Passive, fixed income, emerging markets

- 5/2/2022 – AXS Short CSI China Internet ETF SWEB – Active, inverse, thematic

- 4/27/2022 – Dimensional Emerging Markets High Profitability ETF DEHP – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Core Equity 2 ETF DFEM – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Value ETF DFEV – Active, equity, emerging markets

- 4/27/2022 – iShares Emergent Food and AgTech Multisector ETF IVEG – Passive, equity, thematic [Mostly developed markets]

- 4/21/2022 – FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM – Passive, equity, ESG

- 4/6/2022 – India Internet & Ecommerce ETF INQQ – Passive, equity, thematic

- 2/17/2022 – VanEck Digital India ETF DGIN – Passive, India market, thematic

- 2/17/2022 – Goldman Sachs Access Emerging Markets USD Bond ETF GEMD – Passive, fixed income, emerging markets

- 1/27/2022 – iShares MSCI China Multisector Tech ETF TCHI – Passive, China, technology

- 1/11/2022 – Simplify Emerging Markets PLUS Downside Convexity ETF EMGD – Active, equity, options strategy

- 1/11/2022 – SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG – Passive, equity, ESG

Emerging Market ETF Closures/Liquidations

Frontier and emerging market highlights:

- 3/30/2023 – Invesco BLDRS Emerging Markets 50 ADR Index Fund – ADRE

- 3/30/2023 – Invesco BulletShares 2023 USD Emerging Markets Debt ETF – BSCE

- 3/30/2023 – Invesco BulletShares 2024 USD Emerging Markets Debt ETF – BSDE

- 3/30/2023 – Invesco PureBeta FTSE Emerging Markets ETF – PBEE

- 3/30/2023 – Invesco RAFI Strategic Emerging Markets ETF – ISEM

- 2/17/2023 – Direxion Daily CSI 300 China A Share Bear 1X Shares – CHAD

- 1/13/2023 – First Trust Chindia ETF – FNI

- 12/28/2022 – Franklin FTSE Russia ETF – FLRU

- 12/22/2022 – VictoryShares Emerging Market High Div Volatility Wtd ETF CEY

- 8/22/2022 – iShares MSCI Argentina and Global Exposure ETF AGT

- 8/22/2022 – iShares MSCI Colombia ETFI COL

- 6/10/2022 – Infusive Compounding Global Equities ETF JOYY

- 5/3/2022 – ProShares Short Term USD Emerging Markets Bond ETF EMSH

- 4/7/2022 – DeltaShares S&P EM 100 & Managed Risk ETF DMRE

- 3/11/2022 – Direxion Daily Russia Bull 2X Shares RUSL

- 1/27/2022 – Legg Mason Global Infrastructure ETF INFR

- 1/14/2022 – Direxion Daily Latin America Bull 2X Shares LBJ

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as some ETF lists are still being updated as of Summer 2022).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (April 17, 2023) was also published on our Substack.

Emerging Markets Investing Tips + Advice

Emerging Market Skeptic (Website)

Website List Updates + Site Map

Stocktwits @EmergingMarketSkptc

Similar Posts:

- Tech Sector Can Power Emerging Market Portfolios (FE Trustnet)

- Yale University Added $100M to the Vanguard FTSE Emerging Markets ETF (VWO) in 1Q2014 (P&I)

- Emerging Market Links + The Week Ahead (March 20, 2023)

- Emerging Market Links + The Week Ahead (April 10, 2023)

- Emerging Market Links + The Week Ahead (April 3, 2023)

- Emerging Market Links + The Week Ahead (May 16, 2022)

- Housebound Consumers Lift Lenovo to Record Revenues & Profits (HKEXnews)

- Emerging Market Links + The Week Ahead (January 16, 2023)

- Emerging Market Links + The Week Ahead (April 24, 2023)

- Emerging Market Links + The Week Ahead (September 12, 2022)

- Which Emerging Markets Have the Most Leveraged Stocks? (Bloomberg)

- Emerging Market Links + The Week Ahead (October 3, 2022)

- Emerging Market Links + The Week Ahead (January 23, 2023)

- Emerging Market Links + The Week Ahead (May 30, 2022)

- Emerging Market Links + The Week Ahead (February 6, 2023)