We have some new additions to the BRICs, but no new BRICs currency. I suppose more and more countries will simply find alternatives to using the US Dollar (for trade…) e.g. it probably makes more sense for large countries such as China, Saudi Arabia, and India to just use their own currencies for trading with each other rather than create a whole new currency from scratch (other than for trade settlements…) that might just become another troubled Euro. Plus China (like the EU and the USA…) has mounting economic problems…

Professor Edward Luttwak has written an interesting article for UnHeard entitled: Has Xi Jinping bankrupted China?I don’t know that much about Luttwak, but he has prognosticated enough for Wikipedia to have entry about him and for The Guardian to have done a lengthy piece (The Machiavelli of Maryland) some years ago. Irrespective of Luttwak’s credibility (subject to debate…), his piece talked about China’s wasteful infrastructure spending and how the tech and private tutoring industry crackdowns has hurt employment prospects for China’s youth.

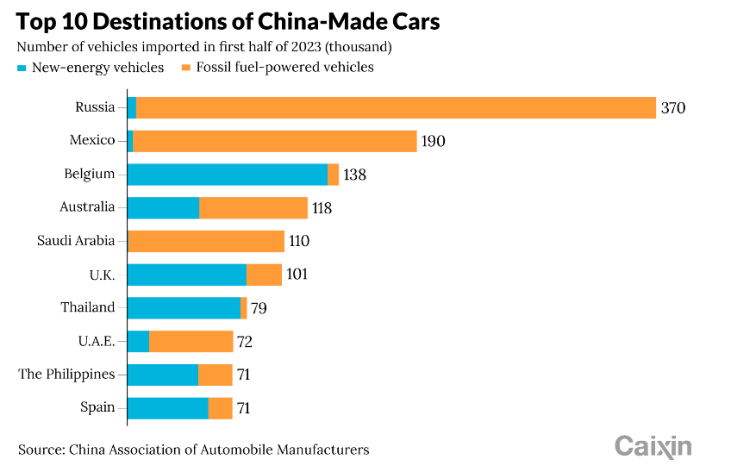

Caixin has also reported that as the Chinese property sector hits the skids, it’s triggering a liquidity crisis for municipal and provincial borrowers that poses risks to the country’s financial system. At the same time, there bright spots as Caixin has reported that China has overtaken Japan as the world’s biggest auto exporter – at least as of Q2 this year.

In other news, Pinduoduo’s [PDD Holdings] (NASDAQ: PDD) Temu has entered SE Asia – apparently to mainly challenge SHEIN. However, Southeast Asia’s incumbent marketplaces Shopee [Sea Limited (NYSE: SE)] and Lazada [Alibaba (NYSE: BABA)] will probably need to take strong measures to defend their market leadership positions in the region.

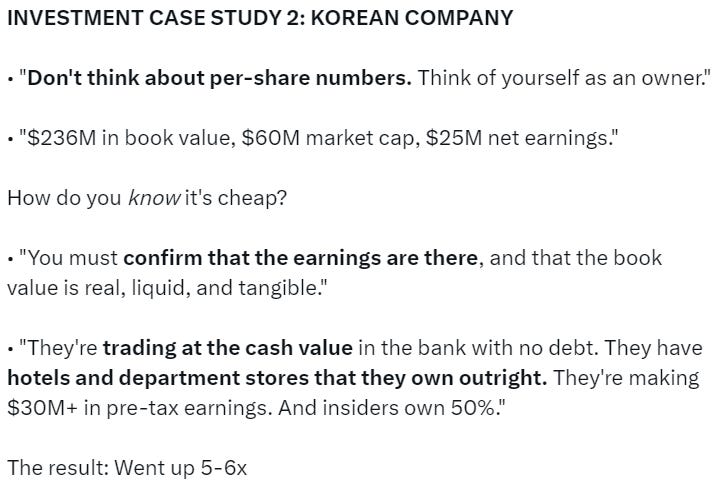

Finally, someone had tweeted a good summary plus the video of an hour+ value investing lecture given by Li Lu (the founder and Chairman of Himalaya Capitalwhich focuses on publicly traded companies in the USA and Asia)that’s worth listening to.

Subscribe Now Via Substack

Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- Vesta (BMV: VESTA / NYSE: VTMX): The Mexico Nearshoring Industrial Real Estate Stock Continues to Rise $

- CMBI Research China & Hong Kong Stock Picks (July 2023)

- Includes: Tencent Music Entertainment Group, Prada SpA, Binjiang Service Group, SANY International, Aac Technologies Holdings, Bilibili, Cutia Therapeutics, Nayuki Holdings, Kuaishou, Sunny Optical, Xtep, BeiGene, Inner Mongolia Yili Industrial Group Co, ANTA Sports Products, Q Technology (Group) Company, Tencent, China MeiDong Auto Holdings, BYD Electronic International, iQIYI, JD.com, Zhejiang Dingli Machinery, Joinn Laboratories China, Baidu, Yancoal Australia, Ping An Healthcare and Technology, Intron Technology Holdings, Akeso, Chow Tai Fook Jewelry Group, New Horizon Health Ltd, Alibaba, CR Beer, China Tourism Group Duty Free, Cloud Music, China Yongda Automobile Services Holding, Horizon Construction Development, NIO Inc, Sinotruk Hong Kong Ltd, Weichai Power, Guangzhou Automobile Group, BYD Company & Geely Automobile Holdings.

- Plus high conviction stocks ideas e.g.: Li Auto, Great Wall Motor, SANY International, Zhejiang Dingli, CR Power, CR Gas, Atour, Midea, Yum China, CR Beer, Tsingtao, Prada SpA, Kweichow Moutai, Innovent Biologics, AK Medical, AIA, Tencent, Pinduoduo, NetEase, Alibaba, Kuaishou, CR Land, BOE Varitronix, Wingtech & Kingdee

Emerging Market Stock Picks / Stock Research

$ = behind a paywall

Weak electronics demand squeezes SMIC margins (Bamboo Works)

- China’s leading semiconductor manufacturer faces continued earnings pressure as the U.S. tightens sanctions and global demand for consumer electronics falters

- Semiconductor Manufacturing International Corporation (SMIC) (SHA: 688981 / HKG: 0981 / FRA: MKN2) expects third-quarter revenue to grow 3% to 5% quarter on quarter, but predicts a seventh straight quarterly fall in gross margin to between 18% and 20%

- The chip maker’s revenue and net profit in the second quarter beat market estimates

Ping An Insurance – Dramatic Worsening Key Areas, Big Bank Exposure, Macro Insurance Stats Are Poor (Smart Karma) $

Ping An (HKG: 2318 / OTCMKTS: PNGAY)

There is considerable worsening in net profit, including from key divisions

Despite rising assets for Health and Life, profit in this core division is down a lot

Banking exposure is significant, with a poor outlook, and making Ping An less pure

ZhongAn rides China’s early 2023 upswing back to profits (Bamboo Works)

- The digital insurer says it returned to the black, as it clocked its fastest revenue growth since 2017 in the first seven months of this year

- ZhongAn (HKG: 6060 / FRA: 1ZO) expects to post a net profit of at least 200 million yuan for the first half of 2023, reversing a loss in the year-ago period

- The online insurer’s gross written premiums grew 37% year-on-year in the first seven months of 2023, the fastest rate in six years

Anta Sports (2020 HK): Most Resilient In Industry Down-Cycles (Smart Karma) $

- ANTA Sports Products (HKG: 2020 / FRA: AS7 / OTCMKTS: ANPDY / OTCMKTS: ANPDF) reported a set of resilient earnings in 1H23, with net profit up 32% yoy.

- Management reconfirmed 2023 guidance for Fila and Anta at double-digit retail sales growth, and increased 2023 guidance for other brands to 40% yoy compared to 30% before.

- Anta’s sales growth has been the most resilient in previous industry down-turns in China. China macro worries should not be overly read through to Anta’s future results.

VIPShop (VIPS US): Attractive Value Play Underappreciated by Investors Looking for Growth (Smart Karma) $

- Over the last decade, Vipshop Holdings (NYSE: VIPS) proved it is the undisputed leader in China’s online discount retail business with the longest streak of profitability and impressive ROE among China internet names.

- Investors are misplaced to look to the stock for growth. Rather, it is cash cow in mature business with deep moat and run by disciplined management who cares about shareholders.

- Trading at 4.5x our FY23 earnings excluding net cash, it valuation is attractive even compared to depressed sector comps. Expect 20% CAGR of return by 2025 driven by intrinsic value.

Pop Mart (9992 HK): Short-Term Trading Opportunity On International Expansion (Smart Karma) $

- Pop Mart International Group (HKG: 9992 / FRA: 735) presents an interesting story of a Chinese domestic brand going overseas, and potentially being successful overseas (at least in the short-term).

- A recent case of a Chinese brand achieving success overseas is MINISO Group Holding (NYSE: MNSO), and shareholders of Miniso have been richly rewarded.

- Pop Mart trades at a PE of 24x based on estimated 2024 earnings, with around 30% expected net profit growth in 2024E.

Zhongsheng Group (881 HK): Could Be A Winner In The Long Run, But No Short-Term Visibility (Smart Karma) $

- China MeiDong Auto Holdings (HKG: 1268 / FRA: 55M / OTCMKTS: CMEIF) announced a profit warning this morning, expecting a 90% decline in net profit for 1H23.

- Luxury auto dealer in China is facing major uncertainties in its business model, with no visibility in the near term.

- However, Zhongsheng Group Holdings (HKG: 0881 / FRA: 5Z0 / OTCMKTS: ZSHGY / ZHSHF) currently employs the best long-term strategy amidst industry transformation. Suggest to keep a close eye on the name.

KS (Kuaishou 1024 HK): 2Q23, First Net Profit Since IPO, Growth Accelerated, Buy (Smart Karma) $

NOTE: Kuaishou Technology (HKG: 1024 / LON: 0A74 / OTCMKTS: KUASF / KSHTY) is a leading partly state-owned content community and social platform and China’s first short video platform.

- The total revenue growth rate accelerated significantly to 28% YoY in 2Q23.

- The high-margin businesses grew more rapidly than the low margin business.

- Gross Merchandise Value and Active user base still increased strongly.

An Update on 2023H1 Results of Activation Group (9919 HK) (Oriental Value)

Activation Group Holdings (HKG: 9919)

- Earnings highlights and commentaries from luxury brands on China

- Activation Group Holdings (HKG: 9919) unveiled its first-half financial results for 2023 on August 10th, 2023. In this article, we will provide an overview of Activation’s performance during this period and share thoughts on its future prospects.

Temu has entered Southeast Asia, challenging Shopee, Lazada & TikTok Shop (Momentum Works)

- Just like Temu’s other launches, the Philippine entry was coupled with up to 90% discounts plus free shipping and free returns for the consumers. We took a brief view of the product selection, which seems to be somewhat differentiated from what you usually see on Shopee and Lazada.

- With TikTok Shop’s aggressive expansion and Temu’s entry, the landscape of ecommerce platforms in Southeast Asia has been disrupted.

- Although for now Temu seems to be mainly targeting SHEIN (which has been doing well in Thailand and the Philippines), Southeast Asia’s incumbent marketplaces Shopee [Sea Limited (NYSE: SE)] and Lazada [Alibaba (NYSE: BABA)] probably need to take strong measures to defend their market leadership.

SEA Ltd: The Prodigal Son – Is Mr Market Stupid? (Value Investing Substack)

- 2Q Deep-Dive: Positive 6M23 Ecom Contribution + Fortress Balance Sheet + 11% TAM Growth + 12.5x Earnings Multiple

- Chapters:

- Shopee — 40% market share in SEA (the Next China) E-Commerce

- The Prodigal SEA Returns

- P&L (E-Commerce): 2Q Revenues, GP & Contribution

- P&L (Group): 2Q Operating Profit & Adjusted EBITDA

- Cash Flow Statement (2Q)

- Balance Sheet (2Q)

- Valuation: 12.5x Earnings Multiple? (50% Margin of safety x2)

- Summary — Is Mr Market stupid?

4 Singapore Stocks That Announced Strategic Reviews: How Have Their Share Prices Fared? (The Smart Investor)

- Strategic reviews can help a business to shed unprofitable divisions and focus on fast-growing ones. We look at four companies that announced such reviews and how they have performed thus far.

High Dividend Yield Battle: Daiwa House Logistics Trust Vs OUE Commercial REIT (The Smart Investor)

- Daiwa House Logistics Trust (SGX: DHLU), or DHLT, is a Japan-focused industrial REIT that owns a portfolio of modern logistics properties in the land of the rising sun.

- OUE Commercial REIT (SGX: TS0U / FRA: OUE1), or OUECR, on the other hand, owns a portfolio of commercial, retail, and hospitality assets in both Singapore and Shanghai.

- We compare these two REITs in different sub-segments to see which makes the more attractive investment.

NagaWorld to win from Cambodia tourism comeback: chair (GGR Asia)

Note: NagaCorp (HKG: 3918 / FRA: N9J / OTCMKTS: NGCRF)

- Mr McNally’s comments were in NagaCorp’s interim report for the trading period to June 30, filed with the Hong Kong Stock Exchange on Thursday.

- In mid-July, NagaCorp reported a net profit of US$83.0 million for the first half of 2023, up 57.4 percent from a year ago.

- The same month, the firm said at a press conference in Hong Kong, that it still plans to move ahead with construction of Naga 3, an addition to the NagaWorld gaming complex. That is despite the project having been pushed back by four years.

Yalla bets on hardcore gamers in bid to jumpstart growth (Bamboo Works)

- The Middle Eastern social networking and gaming company recently launched its first two games targeting serious players after months of testing, hoping they can become a major new growth driver

- Yalla Group’s (NYSE: YALA) revenue grew 4.1% in the second quarter, while its profit rose by a stronger 38.9% thanks in part to big gains in interest income

- The Middle Eastern social networking and gaming company is hoping to rekindle its earlier strong double-digit growth with its recent launch of two games targeting more serious players

LiveChat (Text): A Unique Horizontal Software Provider (Fundasy Investor)

LiveChat Software (WSE: LVC / FRA: 886)

- How did a small Polish software company manage to grow its revenues from $1.75M to $73.2M (USD) over the course of 10 years? With over 37,000 customers, what is the product differentiation or market fit?

- Furthermore, how did the company over that 10 years, without any dilution, maintain an average profit margin of over 50% and returned over $480 million to shareholders without some sort of competitive advantage? ($1B market cap today)

- What is the secret to the company’s efficient growth and is it a scalable method that will continue in the future?

MercadoLibre: Opportunity Meets Execution (The Wolf of Harcourt Street)

- MercadoLibre (NASDAQ: MELI) Q2 2023 Earnings Analysis

- Contents

- Financial Highlights

- Wall Street Expectations

- MercadoLibre Marketplace

- Mercado Envíos

- Mercado Pago

- Mercado Credito

- Financial Analysis

- Conclusion

Further Suggested Reading

$ = behind a paywall

Beijing issues draft rules for AI prescriptions and telemedicine (The China Project)

- Beijing’s municipal government plans to restrict the use of artificial intelligence (AI) in the healthcare sector, according to a report yesterday by the Beijing Daily, the official newspaper of the Chinese Communist Party’s Beijing branch.

- The Chinese health care system has been plagued by corruption, especially when it comes to prescriptions. Drug firms have been caught offering bribes and incentives for doctors and hospitals to prescribe their products, while health care organizations depend on the sale of medicines to remain commercially viable.

- Chinese authorities have recently stepped up a sweeping anti-corruption campaign in the healthcare sector, in a bid to clean up a history of dubious ties between pharmaceutical companies, hospital chiefs, doctors, and other services in the industry.

Western companies warn of hit from China’s sluggish rebound (FT) (Archived Article)

- Corporate updates document worries about weak post-pandemic recovery of world’s second-largest economy

Logistics groups seek Asian bases to help clients offshore from China (FT) (Archived Article)

- Trend is fuelled by cash reserves swollen by high pandemic-era earnings

Has Xi Jinping bankrupted China? (UnHeard)

The entire article is well worth reading…

- In China, in fact, the only wealth-destroying disease has been the very thing that every tourist and even some experts have admired immensely: the proliferation of a hugely impressive, mostly well-designed and well-built infrastructure, from high-speed trains that now reach even into Laos while connecting some 550 cities in 33 provinces, to the motorways that link every part of China, some all the way up mountains and into deserts, to the roughly 250 full-service airports (in 1976 only eight had enough runway for our small Trident jet), to the immense ports which imported 95 million metric tons of soya beans alone in 2021, when the Port of London handled 50 million tons of everything.

- The immediate issue now is not what might have been, had the capital been used to reduce poverty, but the way the money was found in the first place. Some was collected from taxes, but much more was found by adding to the immense debt mountain that now paralyses the investments of the private building firms that built skyscrapers and gigantic apartment blocks all over China, as well as the uniquely Chinese semi-private municipal and provincial joint ventures that built factories and infrastructural projects. The latter’s money came from the loans of the local branches of state banks, whose managers could not just say no to local party bosses, who could choose to invite them to sumptuous dinners in pretty company or to lock them up for corruption investigations as they saw fit.

- Also very much Xi Jinping’s personal responsibility was the abrupt collapse in the demand for new graduates in the entire high-tech sector, which followed the disappearance of China’s most dynamic entrepreneur Alibaba’s founder Jack Ma.

Cover Story: China’s ‘hidden debt’ of local governments threatens national economy

- China’s local government financing arms — and the real estate industry that supports them — have long been viewed as two important drivers for the nation’s economy. Now, after years of rapid growth, the property sector has hit the skids, triggering a liquidity crisis for municipal and provincial borrowers that poses risks to the country’s financial system.

- More than 80% of local government financing vehicles, or LGFVs, do not have enough operating cash to cover interest payments on their debt, according to estimates by UBS. These entities are state-owned companies set up to finance infrastructure projects including highways and bridges.

Will China Be the Next Japan? (KonichiValue – Japanvalueinvest.com)

- A tale of two housing crises: Charting the path from Tokyo’s turmoil to Beijing’s bubble.

- The narratives of Japan in the late 1980s and China of the 2020s intertwine with a series of uncanny resemblances:

- In a direct comparison between the scope of each country’s property bubble:

- China’s situation, however, differs from Japan’s in several significant ways:

In Depth: China’s auto exports belie roadblocks to conquering Europe, U.S. (Caixin) $

- Chinese firms are buying foreign brands or investing in overseas assembly as a workaround to protectionism and growing competition.

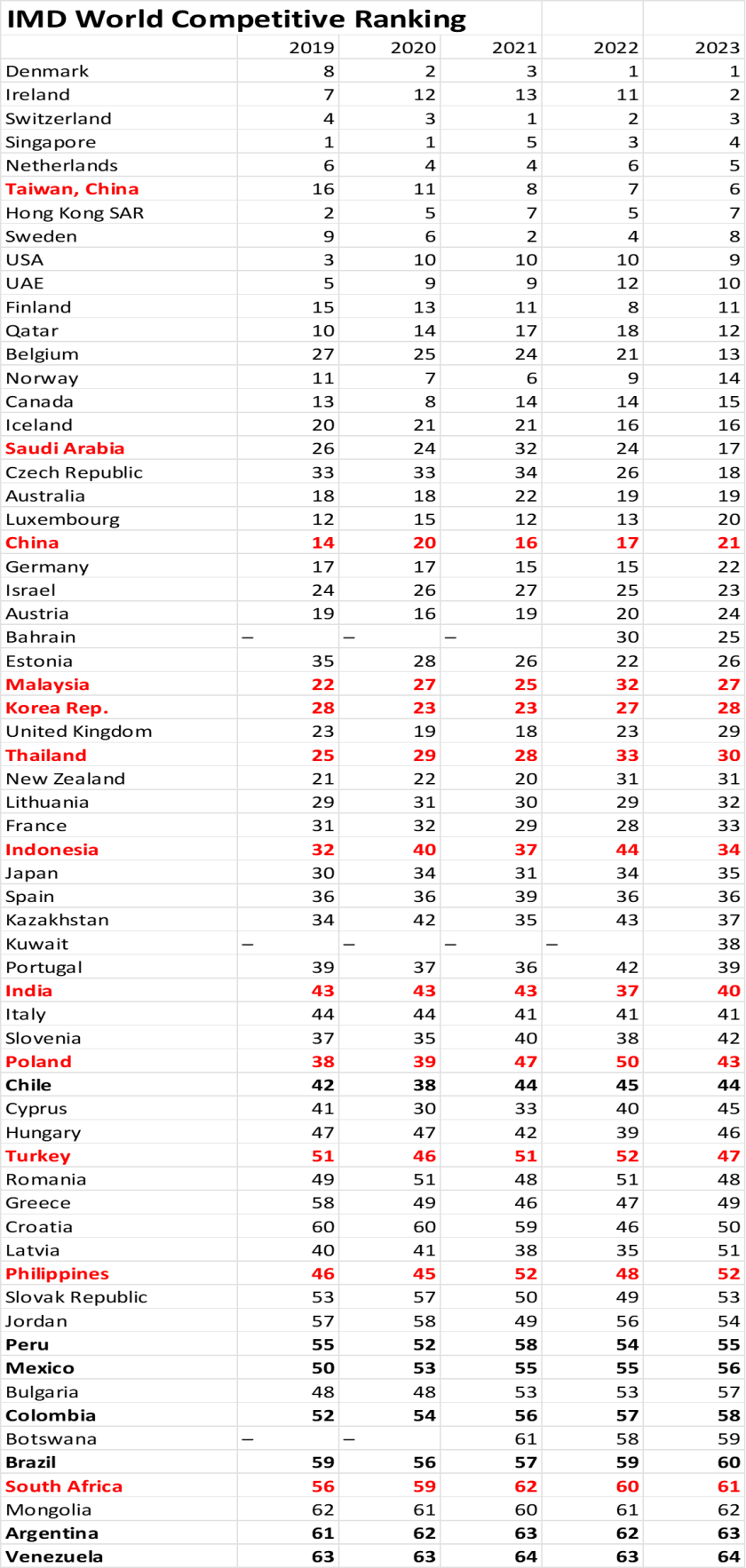

Stages of Development; Current Implications for Emerging Markets Part2 (The Emerging Markets Investor)

Sections covering the United States, Brazil, Korea, China, Thailand, Malaysia, India & Vietnam.

- In a previous post (link) the stages of development were discussed in the context of the transition from a traditional rural society to a modern capitalistic consumer-driven economy. Initially, abundant labor and high returns on capital spark lengthy periods of “miraculous” growth. Later, as labor becomes scarce and the technology frontier is approached, returns on capital decline and GDP growth has to be driven by household consumption. In this post, the factors of production (labor and capital) are looked at in detail.

The Persistent Decline of Latin American Competitiveness (The Emerging Markets Investor)

Li Lu: Best Lecture EVER For Stock Market Investors | Value Investing (YouTube)

This video along with the lengthy tweet from Brandon summarizing it are worth watching and reading:

- Li Lu is the founder and Chairman of Himalaya Capital, a multi-billion-dollar investment firm that primarily focuses on long-term investment opportunities in Asia and the U.S. He has been running the firm’s principal fund, Himalaya Capital Investors, LP, continuously since January 1, 1998, and is recognized by many people (including Charlie Munger) as one of the best value investors of all time. In this video, Mr Li Lu gives one of the best lectures ever, mainly directed at Value Investors.

Excerpts from a good Twitter summary of the talk:

Note:

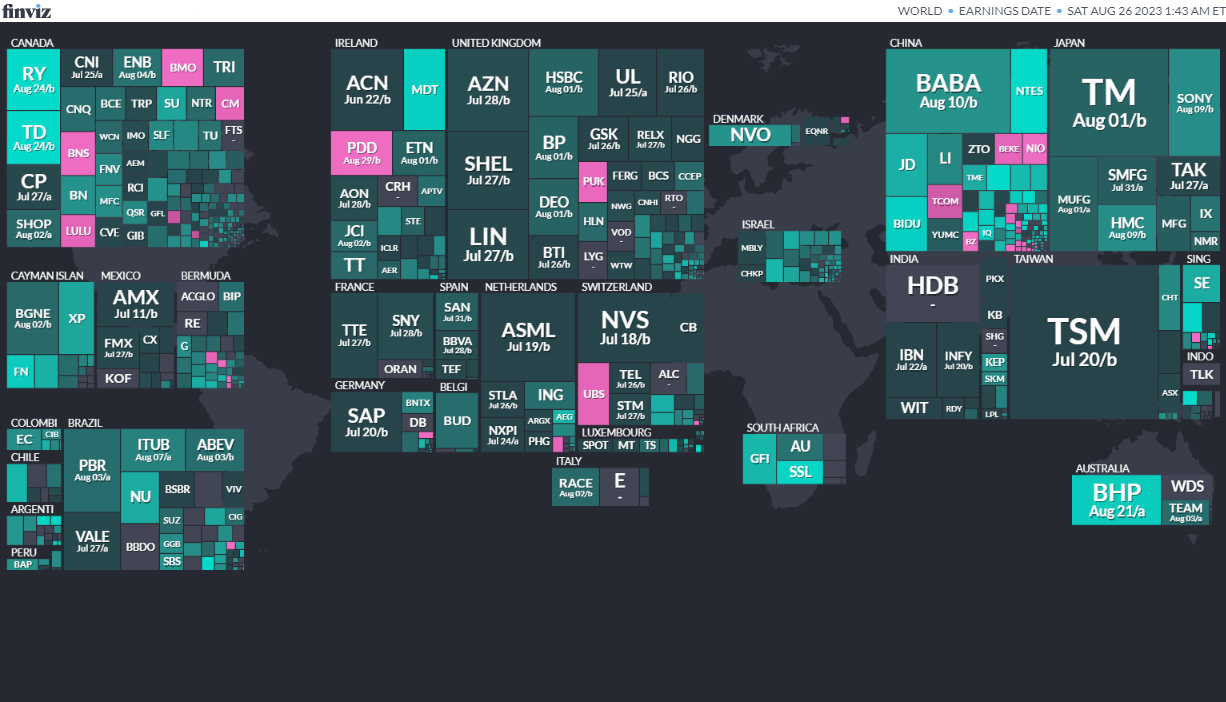

Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

EcuadorEcuadorian PresidencyAug 20, 2023 (t) Confirmed Apr 11, 2021EcuadorEcuadorian National CongressAug 20, 2023 (t) Confirmed Feb 7, 2021EcuadorReferendumAug 20, 2023 (t) Confirmed Feb 5, 2023ZimbabweZimbabwean National AssemblyAug 23, 2023 (d) Confirmed Jul 30, 2018ZimbabweZimbabwean SenateAug 23, 2023 (d) Confirmed Jul 30, 2018ZimbabweZimbabwean PresidencyAug 23, 2023 (d) Confirmed Jul 30, 2018- Singapore Singaporean Presidency Sep 1, 2023 (d) Confirmed Sep 23, 2017

- Slovakia Slovakian National Council Sep 30, 2023 (t) Confirmed Feb 29, 2020

- Pakistan Pakistani National Assembly Oct 14, 2023 (t) Date not confirmed Jul 25, 2018

- Argentina Argentinian Chamber of Deputies Oct 22, 2023 (d) Confirmed Oct 24, 2021

- Argentina Argentinian Senate Oct 22, 2023 (d) Confirmed Nov 14, 2021

- Argentina Argentinian Presidency Oct 22, 2023 (d) Confirmed Aug 13, 2023

- Poland Polish Sejm Oct 31, 2023 (t) Confirmed Oct 13, 2019

- Poland Polish Senate Oct 31, 2023 (t) Confirmed Oct 13, 2019

- Poland Referendum Oct 31, 2023 (t) Date not confirmed Sep 6, 2015

- Chile Referendum Dec 17, 2023 (t) Confirmed Sep 4, 2022

- Indonesia Indonesian Regional Representative Council Feb 14, 2024 (t) Confirmed Apr 17, 2019

- Indonesia Indonesian Presidency Feb 14, 2024 (t) Confirmed Apr 17, 2019

- Indonesia Indonesian House of Representatives Feb 14, 2024 (t) Confirmed Apr 17, 2019

- South Korea South Korean National Assembly Apr 10, 2024 (t) Confirmed Apr 15, 2020

- Panama Panamanian National Assembly May 5, 2024 (t) Confirmed May 5, 2019

- Panama Panamanian Presidency May 5, 2024 (t) Confirmed May 5, 2019

Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Solowin Holdings, Ltd.SWIN, 2.5M Shares, $4.00-4.00, $10.0 mil, 8/28/2023 Week of

(Incorporated in the Cayman Islands)

Solowin is an exempted limited liability company incorporated under the laws of the Cayman Islands on July 23, 2021. As a holding company with no material operations of its own, Solowin conducts its operations primarily through its wholly owned subsidiary, Solomon JFZ, a limited liability corporation incorporated in Hong Kong.

Solomon JFZ is one of the few Chinese investor-focused versatile securities brokerage companies in Hong Kong. It offers a wide spectrum of products and services through its advanced and secured one-stop electronic platform. Solomon JFZ currently is primarily engaged in providing (i) securities related services, (ii) investment advisory services, (iii) corporate consultancy services and (iv) asset management services to the customers. It is licensed with the Hong Kong Securities and Futures Commission (“HKSFC”) and a participant of the Hong Kong Stock Exchange to carry out regulated activities including Type 1 (Dealing in Securities), Type 4 (Advising on Securities), Type 6 (Advising on Corporate Finance) and Type 9 (Asset Management). Solomon JFZ strictly follows the requirements of the HKSFC for internal regulation and risk control to maximize the safety of investors’ assets. It provides online account opening and trading services via its Front Trading and Back-office Clearing systems, in conjunction with Solomon Pro – a highly integrated application accessible via any mobile device, tablet, or desktop, all of which are licensed from third parties. With strong financial and technical capabilities, Solomon JFZ has been providing brokerage services to global Chinese investors residing both inside and outside the PRC and institutional investors in Hong Kong, and have been recognized and appreciated by users and industry professionals.

Solomon JFZ’s trading platform allows investors to trade over 10,000 listed securities and their derivative products listed on the Hong Kong Stock Exchange (HKSE), New York Stock Exchange (NYSE), Nasdaq, Shanghai Stock Exchange and Shenzhen Stock Exchange. In addition, it provides Hong Kong IPO underwriting, Hong Kong IPO Public Offer application and International Placing subscription, Hong Kong IPO margin financing services, Hong Kong Pre-IPO securities trading and US IPO subscription. Hong Kong IPO margin financing services refer to loans offered by a licensed financial institution to clients for the purpose of purchasing securities in an IPO before the issuers are listed on the Hong Kong Stock Exchange. The loan, commonly referred to as an IPO loan, enables clients to invest more than the required deposit of 5% or 10% of funds. The loan, which is short-term, interest-bearing, typically covers 90% or 95% of the investment amount and is repaid right after the allotment result release. Once the investor is allotted shares cost over the required deposit and a part of loan is used for the shares, the shares can be sold and the proceeds are utilized to repay the loan of the financial institution, with any remaining balance going to the investor. Our customers may also use Solomon JFZ’s platforms to trade various listed financial products, such as ETFs, Warrants and Callable Bull/Bear Contracts. Beside securities related service, Solomon JFZ also offers asset management services as an investment manager. Our High-Net-Worth customers may also subscribe private fund products through Solomon JFZ.

Our clients are mostly Chinese investors residing in Asia as well as institutional clients in Hong Kong, Australia and New Zealand. As of March 31, 2023, we had more than 20,000 users, including more than 15,400 clients who are users and have opened trading accounts with Solomon JFZ. We classify those who have registered on Solomon JFZ’s platform as users and those users who have opened accounts on Solomon JFZ’s platform as clients. We currently have over 1,500 active clients, who have assets in their trading accounts.

As of March 31, 2023, Solomon JFZ’s operations mainly consisted of four business segments: (i) securities related services, (ii) investment advisory services, (iii) corporate consultancy services and (iv) asset management services to the customers.

Note: Revenue and net income are in U.S. dollars for the fiscal year that ended March 31, 2023.

(Note: Solowin Holdings, Ltd. cut the size of its IPO by 33 percent to 2.5 million shares – down from 3.75 million shares – and kept the assumed IPO price at $4.00 on a price range of $4.00 to $6.00 to raise $10 million, according to an F-1/A filing dated July 7, 2023. The company filed its F-1 on April 28, 2023, without disclosing terms. Its original terms were 3.0 million shares on a $4.00-to-$6.00 price range to raise $15.0 million, according to an F-1/A filing dated May 22, 2023. The deal’s size was increased to 3.75 million shares at $4.00 to $6.00 to raise $18.75 million, in an F-1/A filing dated June 15, 2023. Solowin Holdings had submitted confidential IPO documents to the SEC on Dec. 23, 2022.)

SIMPPLE Ltd.SPPL, 1.6M Shares, $5.25-6.25, $9.3 mil, 8/29/2023 Tuesday

We are a property tech (PropTech) business in Singapore. (Incorporated in the Cayman Islands)

Headquartered in Singapore, SIMPPLE LTD. is an advanced technology solution provider in the emerging property-technology (“PropTech”) space, focused on helping facility owners and managers manage their facilities autonomously. Over the past five years, the Company has developed a proprietary ecosystem solution that automates workflow and the workforce in areas such as building maintenance, security surveillance and janitorial services. The products and services under the SIMPPLE Ecosystem are:

– SIMPPLE Software (A software platform comprising modules related to quality management, workflow management and people management)

– SIMPPLE PLUS (Robotic solutions in Cleaning and Security domains as well as IoT Devices and peripherals)

– SIMPPLE.AI (Next generation facilities management Autonomic Intelligence Engine that automates workflow processes in a built environment setting)

In addition, the Company offers professional services, such as set-up and installation and systems consultation, to its clients. On average, the solutions the Company offers increase customer efficiency in asset maintenance, while also reducing insurance costs.

We were founded in 2016, and our initial focus was on the development of a robotic cleaning solution. As cleaning operations usually cover a large area of space, the then-existing robotic solutions and machinery were bulky and not fit for Singapore’s infrastructure. Through the design and development of minimal human intervention cleaning robotics, we were able to build a solution to match the specific facility cleaning needs of Singapore’s skyscraper- dominant environment. We understood that robotics should not be a standalone solution. Instead, we realized the merits of a fully automated Smart Building model with the integration of robotic solutions. We believe that our ecosystem-focused solution will create more value to building owners and facility managers as often times, data inputs alone are insufficient for efficient operations. Decision-making logic and intelligent task allocation to deployable assets must be built into the platform solution in order to achieve autonomous operations within a facility.

The SIMPPLE Ecosystem has market penetration across various industries in Singapore, including being adopted by 209 out of 432, or slightly less than half of the schools in Singapore as of April 2021. Out of the 29 hospitals in Singapore as of 2021, 7 hospitals have adopted the SIMPPLE Ecosystem in the past. Furthermore, 4 out of 6 autonomous universities in Singapore, and leading property developers and facilities services companies in Singapore have also adopted the SIMPPLE Ecosystem in the past.

**Note: Revenue and net loss figures are in U.S. dollars (converted from Singapore dollars) for the year ended June 30, 2022.

(Note: SIMPPLE Ltd. raised the price range of its micro-cap IPO to $5.25 to $6.25 – up from $5.00 to $6.00 – and kept the number of shares at 1.625 million shares – to raise $9.34 million, according to an F-1/A filing dated Aug. 14, 2023.)

(Background: SIMPPLE Ltd. raised the price range of its micro-cap IPO to $5.00 to $6.00 – up from $4.00 to $5.00 – and kept the number of shares at 1.625 million shares – to raise $8.94 million, according to an F-1/A filing dated July 12, 2023. Background: SIMPPLE Ltd. cut its IPO in an F-1/A dated May 17, 2023, to 1.625 million shares (1,625,000 shares) – down from 2.0 million shares – and kept the price range at $4.00 to $5.00 – to raise $7.31 million. SIMPPLE Ltd. filed its F-1 on March 31, 2023, and disclosed terms for its IPO: 2.0 million shares at $4.00 to $5.00 to raise $9.0 million. The company submitted confidential IPO documents to the SEC on Sept. 30, 2022.)

Maison SolutionsMSS, 3.0M Shares, $4.00-4.00, $12.0 mil, 8/31/2023 Thursday

Maison Solutions is a specialty Asian grocery retailer. (Incorporated in Delaware)

We are a fast-growing specialty grocery retailer offering traditional Asian food and merchandise to modern U.S. consumers, in particular to members of Asian-American communities. We are committed to providing Asian fresh produce, meat, seafood, and other daily necessities in a manner that caters to traditional Asian-American family values and cultural norms, while also accounting for the new and faster-paced lifestyle of younger generations and the diverse makeup of the communities in which we operate. To achieve this, we are developing a center-satellite stores network.

Our merchandise includes fresh and unique produce, meats, seafood and other groceries which are staples of traditional Asian cuisine and which are not commonly found in mainstream supermarkets, including a variety of Asian vegetables and fruits such as Chinese broccoli, bitter melon, winter gourd, Shanghai baby bok choy, longan and lychee; a variety of live seafood such as shrimp, clams, lobster, geoduck, and Alaska king crab, and Chinese specialty products like soy sauce, sesame oil, oyster sauce, bean sprouts, Sriracha, tofu, noodles and dried fish. With an in-house logistics team and strong relationships with local and regional farms, we are capable of offering high-quality specialty perishables at competitive prices.

Our multi-pronged approach allows us to provide customers with multiple shopping channels, including integrated online and offline operations, according to Maison Solutions Inc.’s website.

“Customers can place orders on our mobile app “FreshDeal24,” or through our WeChat Applet “Good Luck to Home” for either home delivery or in-store pickup,” the company’s website says.

*Note: Revenue and net income are for the 12 months that ended April 30, 2023.

(Note: Maison Solutions Inc. cut its IPO’s size by 25 percent to 3.0 million shares – down from 3.75 million shares – and kept the assumed IPO price at $4.00 – to raise $12.0 million, according to a post-effective amendment dated Aug. 1, 2023. In that same SEC filing, the company updated its financial statements for the year that ended April 30, 2023. Maison Solutions Inc. filed an S-1/A dated June 2, 2023, in which it increased the size of its IPO – to 3.75 million shares – up from 3.0 million shares – and kept the assumed IPO price at $4.00 – to raise $15 million. Under the new terms, Maison Solutions will raise 25 percent more than the $12 million in estimated IPO proceeds under its original terms. Background: Maison Solutions filed its S-1 on May 22, 2023, after submitting confidential IPO documents to the SEC on Dec. 23, 2022.)

Gamer Pakistan Inc.GPAK, 1.7M Shares, $4.00-5.00, $8.0 mil, 9/5/2023 Week of

We are an early-stage esports company focused on developing and organizing esports events in Pakistan. (Incorporated in Delaware)

We are a development-stage interactive esports event promotion and product marketing company, founded in November 2021. Our initial focus is on creating college, inter- university and professional esports events for both men’s and women’s teams, particularly esports opportunities with colleges and universities in Pakistan. The Government of Pakistan’s 2021-22 Pakistan Economic Survey estimated that from 2020-21 there were approximately 500,000 students enrolled in technical and vocational education, approximately 760,000 in degree-awarding colleges, and 1.96 million students in universities.1 Though the foregoing likely will remain our focus for at least 12 months, over time, we intend to expand the range of our esports offerings, expand to other markets and eventually consider live sports. We will endeavor to integrate competitive events that include our teams and leagues with regional and global teams and leagues sponsored by others.

Pakistan is a large market for esports. Pakistan is the fifth most populous country in the world, with a current population estimated to be approximately 231 million persons. The median age in Pakistan is 22.8 years, and 35.1% of the population is urban (77,437,729). Mobile cellular subscriptions have grown at an astounding rate in Pakistan, with 79.51% of the inhabitants having a mobile cellular subscription in 2020 compared to only 0.22% in 2000. Approximately 36.8 million persons in Pakistan have been estimated to play video games in 2022, and the number is expected to increase to 50.9 million by 2026.

We plan to conduct our operations in Pakistan through K2 Gamer (PVT) Ltd. (“K2 Gamer”), and Elite Sports Pakistan Pvt. Ltd. (“ESP”), each a company duly incorporated under the laws of Pakistan. Pursuant to agreements with the three owners of K2 Gamer, we acquired 90% ownership of K2 Gamer on July 10, 2023 when the transfer was approved by the Securities and Exchange Commission of Pakistan (“SECP”). We will account for the transfer as an acquisition of a business under the provisions of ASC 805. To date all activities have been conducted by K2 Gamer and ESP, and not the Company, although the Company has received public recognition as a sponsor for many of the tournaments.

As a result of the assignment to K2 Gamer by ESP of all of its rights with respect to the exploitation of esports, ESP is an affiliate of K2 Gamer and, as a result of the acquisition by us of 90% of the stock of K2 Gamer, ESP now is our affiliate as well. For purposes of this prospectus, we have assumed, except where otherwise stated, that K2 Gamer has been our subsidiary and that ESP has been our affiliate during the periods mentioned. Mr. Muhammed Jamal Qureshi is an owner of K2 Gamer and ESP as well as CEO and a director of K2 Gamer and ESP.

Esports are the competitive playing of video games by amateur and professional teams or individuals for cash and other prizes. Esports typically take the form of organized, multiplayer video games that include real-time strategy and competition, including virtual fights, first-person shooter and multiplayer online battle arena games. The games are played on dedicated hardware (consoles), personal computers (PCs), or a range of mobile devices including smart phones and tablets. Unlike games of chance or luck, esports are defined as competitive games of skill, timing, knowledge, experience, practice, attention and teamwork. Tournaments can be held using consoles, PCs, mobile devices, or a combination of the foregoing. Competitors participate at large in-person events, small in-person events and virtually from home or computer cafes.

Between November 2021 and November 2022, we organized and held 27 separate championships, including the first “Annual University Esports National Tournament and Championship on June 30 through July 1 of 2022. In December 2022 we held the week-long inaugural National Esports Free Fire Championship. During 2023, K2 Gamer and/or ESP are expected to organize and conduct at least 18 championships. There were no paying sponsors for these championships, as a result of which we recognized no revenue from them. We believe that we will be able to gain paying sponsors as the championships gain popularity.

*Note: Revenue and net loss figures are for the year ended Dec. 31, 2022.

(Note: Gamer Pakistan Inc. filed an S-1/A dated Aug. 17, 2023, disclosing that the number of shares that selling stockholders planned to offer had been cut to 1.17 million shares – down from 2.9 million shares. The company will NOT receive any proceeds from the sale of the selling stockholders’ shares. The IPO’s primary portion and size remain the same: The company is offering 1.7 million shares ar $4.00 to $5.00 to raise $8.0 million.)

(Background: Gamer Pakistan Inc. filed its S-1 on July 12, 2023, and disclosed terms for its IPO: 1.7 million shares at $4.00 to $5.00 to raise $8.0 million. Selling stockholders are offering up to 2.9 million shares (2,290,429 shares) of common stock. The company will NOT receive any proceeds from the sale of the selling stockholders’ shares.)

Nature Wood Group LimitedNWGL, 0.9M Shares, $9.00-11.00, $9.2 mil, 9/5/2023 Week of

We are a holding company incorporated in the British Virgin Islands.

We are a global leading vertically integrated forestry company headquartered in Macau, a Special Administrative Region (S.A.R.) of China. We focus on FSC (Forest Stewardship Council) business operations. Our operations cover both up-stream forest management and harvesting, and down-stream wood-processing and distribution. We offer a broad line of products, including logs, decking, flooring, sawn timber, recycled charcoal, synthesized charcoal, machine-made charcoal and essential oils, primarily through our sales network in Europe, South Asia, South America, North America and China. According to the Frost & Sullivan Report, we are (i) the second-largest wood products export supplier; (ii) the second-largest wood products export supplier certified by the FSC; and (iii) the largest decking product supplier in Peru, in terms of export value in 2021. We are also the largest oak export supplier and the second-largest hardwood export supplier in France, in terms of export volume in 2021.

Our Group owns concession rights of forests in Peru which covered an area of approximately 615,333 hectares as of March 17, 2023. As of March 17, 2023, approximately 13.67% and 1.66% of our Forests are covered by Cumaru and Estoraque, respectively. Cumaru and Estoraque are valuable hardwood timber which produce strong and durable wood that are well suited for high value markets. In particular, Cumaru is commonly used for producing flooring, decking and other construction materials, while Estoraque is commonly used for producing flooring and furniture.

To ensure the sustainability of our forest resources, we establish a set of harvesting rules and operating standards. For instance, we typically only harvest timber meeting the minimum stem circumference requirements. Our standard of forestry operations was recognized by the FSC, an independent accreditation body that is dedicated to promoting responsible and sustainable forest management.

According to the Frost & Sullivan Report, we are one of the few forestry companies that have successfully implemented FSC-certified operations, including forest management, harvesting and manufacturing of wood products. We commenced our FSC business operations in 2016, when Grupo Maderero Amaz S.A.C., a subsidiary of our Group, first obtained FSC Chain of Custody (CoC) certification and began to sell FSC-certified products. As at the date of this prospectus, five subsidiaries of our Group (including Choi Chon Investment Company Limited, E&T Forestal S.A.C., Grupo Maderero Amaz S.A.C., Nuevo San Martin S.A.C. and Latinoamerican Forest S.A.C) have obtained FSC CoC certifications. We also have built a professional forest management team to implement FSC forest management. Our forest management team is led by our head of forest engineer who is qualified to carry out FSC forest management and the key members of our team have an average of over 8 years of experience in FSC forest management. According to the Frost & Sullivan Report, FSC-certified products can be sold at a premium of around 5% to 15% over non-FSC-certified products.

With the growing public concern about environmental protection, consumers are more willing to pay a premium to buy “green” products that are certified by reputable accreditation bodies or ecolabel organizations. As such, products certified by the FSC, one of the world’s most trusted accreditation body, have received wide acceptance across the world, especially the United States and Europe. Revenue generated from sales of FSC-certified products increased by 162.8% from approximately $3.7 million for the year ended December 31, 2020 to approximately $9.9 million for the year ended December 31, 2021, which further increased by 13.7% to approximately $11.2 million for the year ended December 31, 2022, which accounted for approximately 10.0%, 20.7% and 20.3% of our revenue of the respective periods. We believe that such growing trend will continue in the future.

Some of the logs we harvested will be sold to customers immediately after harvesting, others will be processed into a wide variety of products, such as decking and flooring, in our wood processing facilities. As at the date of this prospectus, our Group owns two facilities in Peru, and the Peru base has a monthly log-processing capacity of more than 6,000 m3 and a monthly export volume of up to 65 containers (approximately 1,560 m3).

To further capture the benefit of vertical integration of our manufacturing operation and to secure a stable supply of our wood materials, we sourced logs and semi-finished air-dried planks from local forest owners in Peru, and flooring and decking through sourcing from Gabon. In addition, we source logs through timber auctions or local forest owners in France. To secure a stable supply of logs, our forest management team would assist forest owners in Peru and France with forest management and harvest planning. Similar to logs harvested from our Forests, logs we procured from third parties are either sold directly to customers or further processed in our processing facilities.

We perform the manufacturing process for certain of our products at our Peru base and outsource part of the manufacturing process to third party manufacturers in Peru. We also provide original design manufacturer (ODM) services by combining our in-house product design and development expertise with our ODM partners. For the years ended December 31, 2022, 2021, and 2020, approximately 18.4%, 18.2% and 20.8% of our revenue from our products was generated from our ODM business respectively.

For the years ended December 31, 2022, 2021, and 2020, we generated revenue of approximately $55.3 million, $47.7 million and $37.5 million, respectively. Revenue from sales of logs, flooring and decking and sawn timber accounted for 50.2%, 21.7%, 24.9% and 3.2% of our total revenue for the year ended December 31, 2022 respectively, accounted for 44.4%, 25.0%, 25.2% and 5.4% of our total revenue for the year ended December 31, 2021 respectively, and accounted for 43.9%, 34.4%, 17.5% and 4.2% of our total revenue for the year ended December 31, 2020 respectively.

(Note: Nature Wood Group Limited filed an F-1/A dated Aug. 22, 2023, in which it removed Orientiert XYZ Securities as a joint book-runner – leaving Prime Number Capital in place as the sole book-runner. Nature Wood Group Limited disclosed terms for its IPO in an F-1/A filing dated Aug. 4, 2023: 915,000 American Depositary Shares (ADS) at $9.00 to $11.00 to raise $9.15 million. Each ADS represents eight ordinary shares. Nature Wood Group Limited filed its F-1 on April 25, 2023.)

Prospect Energy Holdings Corp.AMGSU, 7.5M Shares, $10.00-10.00, $75.0 mil, 9/5/2023 Week of

We are a blank check company focused on the Asia Pacific region, excluding China, and the clean energy sector. Each unit consists of one share of stock and one warrant redeemable for one share of stock. (Incorporated in the Cayman Islands)

While we may pursue a target in any industry, section or geography, we intend to focus our search for a target business in Asia Pacific, excluding China, (with emphasis on Canada and Australia) for companies engaged in the clean energy industry, concentrating on the utilization of “clean coal” or other evolving segments in the clean energy ecosystem, particularly the use of carbon, hydrogen and renewable energy. Other areas may include energy storage, distributed energy, zero-emission transportation, carbon utilization, low or carbon-free industrial applications and sustainable manufacturing.

We believe that clean energy and sustainability solutions are revolutionizing many traditional industries and creating numerous investment opportunities which are driven by important long-term global trends, such as the cost of carbon emissions, regulatory incentive programs, and consumers’ increasing value placed on clean energy products and services, in addition to advancements in technology providing for more cost-effective solutions and alternatives to fossil fuels. We believe that the regulatory frameworks incentivizing the adoption of sustainable practices and technologies will become increasingly favorable to the sectors that we are targeting. These trends provide long-term benefits for companies that develop and distribute services and products that take part of an integrated approach to the continued decarbonization of the economy.

We intend to target the growth-oriented subsectors of the clean and sustainable energy industry that present particularly attractive investment opportunities. We do not intend to acquire early-stage start-up companies, companies with speculative business plans or companies that are excessively leveraged. We are not, however, required to complete our initial business combination with a clean and sustainable energy business and, as a result, we may pursue a business combination beyond that sector and scope. We will seek to acquire high-quality businesses that can generate attractive, risk-adjusted returns for shareholders.

We believe our management team is uniquely positioned to source and evaluate deals globally, with strong relationships in Asia Pacific (and particularly in Canada and Australia), which may offer attractive growth prospects with advantageous valuation multiples. We believe that our expertise and experience in major worldwide markets, including Asia Pacific, give us a robust pool of targets and increasing the possibility to maximize returns. In addition, our management team has extensive expertise in the evolution of clean energy, especially in Asia Pacific, which will enable us to better evaluate and source target companies. Our management team is also experienced in executing complex financial structures for large scale projects in the energy industry in Asia Pacific, Canada and Australia which will give us access to leaders in the energy industry and the ability to facilitate future energy projects. We believe this approach, as well as our management team’s recognized track record of completing acquisitions across a variety of subsectors within the clean energy industry will provide meaningful opportunities to drive value creation for shareholders.

(Note: Prospect Energy Holdings Corp. slashed its SPAC IPO by 75 percent to 7.5 million units – down from 30.0 million units – at $10.00 each – to raise $75.0 million in an S-1/A dated Aug. 24, 2023. The S-1 was filed May 3, 2023.)

Quetta Acquisition Corp.QETAU, 6.0M Shares, $10.00-10.00, $60.0 mil, 9/5/2023 Week of

We are a newly formed blank check company, incorporated on May 1, 2023. (Incorporated in Delaware)

We intend to prioritize the evaluation of businesses in Asia (excluding China, Hong Kong, and Macau) that operate in the financial technology (FinTech) sector. We shall not undertake our initial business combination with any entity with its principal business operations in China (including Hong Kong and Macau).

(Quetta Acquisition Corp. filed the S-1 for its SPAC IPO on Aug. 21, 2023, and disclosed terms: 6.0 million units at $10.00 each to raise $60.0 million. Each unit consists of one share of common stock and one-tenth (1/10) of a right denominated in one share of our common stock, redeemable upon the consummation of the initial business combination.)

Healthy Green Group Holding Ltd.GDD, 2.0M Shares, $6.00-7.00, $13.0 mil, 9/25/2023 Week of

Healthy Green Group Holding Ltd. is a Hong Kong-based chain of 22 organic grocery stores under the Greendotdot brand. (Incorporated in the Cayman Islands) **Note: Investors in this offering (the IPO) are buying shares of the Cayman Islands (holding) company whereas all of our operations are conducted through our Operating Subsidiaries. At no time will the Company’s shareholders directly own shares of the Operating Subsidiaries.

We are a Hong Kong-based retailer principally engaged in the sale of natural and organic food under our “Greendotdot” brand. Our Group’s history can be traced back to 1999 when Mr. Wong and Ms. Cheuk started the business of marketing natural and organic foods. The same year, we launched our first retail store with the objective to introduce quality products from local and overseas suppliers to our customers. Over the years, we have been building our “Greendotdot” brand by sourcing, procuring, marketing and selling a wide variety of quality products, which can be broadly classified into (i) packaged foods; (ii) fresh foods; (iii) frozen foods; and (iv) other products such as honey, beverages, edible oils, seasonings and other non-food items.

We offer a diversified portfolio of over 600 products sourced from over 134 suppliers, which we market through established sales channels, including 22 retail stores in Hong Kong under our brand “Greendotdot” as of Dec. 31, 2022. The retail stores are strategically located in Metrorail stations, residential areas or shopping complexes, which are prime locations with high pedestrian traffic. Other established sales channels include our online sales platforms, exhibitions and through supermarkets and department stores, and wholesale sales to bulk-purchase customers.

According to the Frost & Sullivan Report, our Group ranked as the second-largest natural and organic food retail chain in Hong Kong in terms of our revenue, translating to a market share of approximately 7.9% in the natural and organic food market in Hong Kong in 2021. For the years ended Dec. 31, 2020, and 2021, and the six-month period ended June 30, 2022, our Group’s revenue amounted to approximately HK$166,853,000, HK$159,546,000 (US$20,527,000) and HK$80,430,000 (US$10,278,000), respectively. Our net profit was approximately HK$12,427,000, HK$4,013,000 (US$516,000) and HK$1,338,000 (US$170,000) for the respective years/period.

**Note: Revenue and net income (in the chart below) are in U.S. dollars for the year that ended Dec. 31, 2022.

(Note: Healthy Green Holding Ltd. filed an F-1/A dated April 28, 2023, in which it changed its listing venue to the NYSE – American Exchange from the NASDAQ and changed its proposed symbol to “GDD” from “HGRN,” which was the original proposed symbol for the NASDAQ listing.)

(Note: Healthy Green Holding Ltd. disclosed the terms for its IPO – 2.0 million shares at a price range of $6.00 to $7.00 to raise $13.0 million – in an F-1/A dated July 12, 2023. Healthy Green Holding Ltd. filed its F-1 on Feb. 16, 2023. The company submitted confidential IPO documents to the SEC on April 26, 2022.)

Emerging Market ETF Launches

Climate change and ESG are clearly the latest flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

- 05/18/2023 – Putnam Emerging Markets ex-China ETF PEMX – Value + growth stocks

- 05/11/2023 – JPMorgan BetaBuilders Emerging Markets Equity ETF BBEM– Large + midcap stocks

- 03/16/2023 – JPMorgan Active China ETF JCHI – Active, equity, China

- 03/03/2023 – First Trust Bloomberg Emerging Market Democracies ETF EMDM – Principles-based

- 1/31/2023 – Strive Emerging Markets Ex-China ETF STX – Passive, equity, emerging markets

- 1/20/2023 – Putnam PanAgora ESG Emerging Markets Equity ETF PPEM – Active, equity, ESG, emerging markets

- 1/12/2023 – KraneShares China Internet and Covered Call Strategy ETF KLIP – Active, equity, China, options overlay, thematic

- 1/11/2023 – Matthews Emerging Markets ex China Active ETF MEMX – Active, equity, emerging markets

- 12/13/2022 – GraniteShares 1.75x Long BABA Daily ETF BABX – Active, equity, leveraged, single stock

- 12/13/2022 – Virtus Stone Harbor Emerging Markets High Yield Bond ETF VEMY – Active, fixed income, junk bond, emerging markets

- 9/22/2022 – WisdomTree Emerging Markets ex-China Fund XC – Passive, equity, emerging markets

- 9/15/2022 – KraneShares S&P Pan Asia Dividend Aristocrats Index ETF KDIV – Passive, equity, Asia, dividend strategy

- 9/15/2022 – OneAscent Emerging Markets ETF OAEM – Active, Equity, emerging markets, ESG

- 9/9/2022 – Emerge EMPWR Sustainable Select Growth Equity ETF EMGC – Active, equity, emerging markets

- 9/9/2022 – Emerge EMPWR Unified Sustainable Equity ETF EMPW – Active, equity, emerging markets

- 9/8/2022 – Emerge EMPWR Sustainable Emerging Markets Equity ETF EMCH – Active, equity, emerging markets, ESG

- 7/14/2022 – Matthews China Active ETF MCH – Active, equity, China

- 7/14/2022 – Matthews Emerging Markets Equity Active ETF MEM – Active, equity, emerging markets

- 7/14/2022 – Matthews Asia Innovators Active ETF MINV – Active, equity, Asia

- 6/30/2022 – BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF XEMD – Passive, fixed income, emerging markets

- 5/2/2022 – AXS Short CSI China Internet ETF SWEB – Active, inverse, thematic

- 4/27/2022 – Dimensional Emerging Markets High Profitability ETF DEHP – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Core Equity 2 ETF DFEM – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Value ETF DFEV – Active, equity, emerging markets

- 4/27/2022 – iShares Emergent Food and AgTech Multisector ETF IVEG – Passive, equity, thematic [Mostly developed markets]

- 4/21/2022 – FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM – Passive, equity, ESG

- 4/6/2022 – India Internet & Ecommerce ETF INQQ – Passive, equity, thematic

- 2/17/2022 – VanEck Digital India ETF DGIN – Passive, India market, thematic

- 2/17/2022 – Goldman Sachs Access Emerging Markets USD Bond ETF GEMD – Passive, fixed income, emerging markets

- 1/27/2022 – iShares MSCI China Multisector Tech ETF TCHI – Passive, China, technology

- 1/11/2022 – Simplify Emerging Markets PLUS Downside Convexity ETF EMGD – Active, equity, options strategy

- 1/11/2022 – SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG – Passive, equity, ESG

Emerging Market ETF Closures/Liquidations

Frontier and emerging market highlights:

- 07/07/2023 – Emerge EMPWR Sustainable Emerging Markets Equity ETF – EMCH

- 06/23/2023 – Invesco PureBeta FTSE Emerging Markets ETF – PBEE

- 06/16/2023 – AXS Short China Internet ETF – SWEB

- 04/11/2023 – SPDR Bloomberg SASB Emerging Markets ESG Select ETF – REMG

- 3/30/2023 – Invesco BLDRS Emerging Markets 50 ADR Index Fund – ADRE

- 3/30/2023 – Invesco BulletShares 2023 USD Emerging Markets Debt ETF – BSCE

- 3/30/2023 – Invesco BulletShares 2024 USD Emerging Markets Debt ETF – BSDE

- 3/30/2023 – Invesco RAFI Strategic Emerging Markets ETF – ISEM

- 2/17/2023 – Direxion Daily CSI 300 China A Share Bear 1X Shares – CHAD

- 1/13/2023 – First Trust Chindia ETF – FNI

- 12/28/2022 – Franklin FTSE Russia ETF – FLRU

- 12/22/2022 – VictoryShares Emerging Market High Div Volatility Wtd ETF CEY

- 8/22/2022 – iShares MSCI Argentina and Global Exposure ETF AGT

- 8/22/2022 – iShares MSCI Colombia ETFI COL

- 6/10/2022 – Infusive Compounding Global Equities ETF JOYY

- 5/3/2022 – ProShares Short Term USD Emerging Markets Bond ETF EMSH

- 4/7/2022 – DeltaShares S&P EM 100 & Managed Risk ETF DMRE

- 3/11/2022 – Direxion Daily Russia Bull 2X Shares RUSL

- 1/27/2022 – Legg Mason Global Infrastructure ETF INFR

- 1/14/2022 – Direxion Daily Latin America Bull 2X Shares LBJ

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as some ETF lists are still being updated as of Summer 2022).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (August 28, 2023) was also published on our Substack.

Emerging Markets Investing Tips + Advice

Emerging Market Skeptic (Website)

Website List Updates + Site Map

Stocktwits @EmergingMarketSkptc

Similar Posts:

- Housebound Consumers Lift Lenovo to Record Revenues & Profits (HKEXnews)

- TOP Financial Group (NASDAQ: TOP): Hong Kong’s Latest Crazy Meme Stock

- Emerging Market Links + The Week Ahead (January 23, 2023)

- The Spoils of Trade War: Asia’s Winners and Losers in US-China Clash (SCMP)

- Publicly Listed Stock Exchange Stocks (Mid-2024)

- China Internet Update (KraneShares)

- Investing in Hong Kong ETFs / Hong Kong ETF List

- Emerging Market Links + The Week Ahead (August 22, 2022)

- GF Securities (HKG: 1776 / SHE: 000776 / FRA: 9GF): A Value Stock After Recent Scandals & Crackdowns?

- Emerging Market Links + The Week Ahead (September 12, 2022)

- Emerging Market Links + The Week Ahead (January 2, 2023)

- Emerging Market Links + The Week Ahead (March 13, 2023)

- Emerging Market Links + The Week Ahead (January 16, 2023)

- Emerging Market Links + The Week Ahead (August 1, 2022)

- Emerging Market Links + The Week Ahead (February 20, 2023)