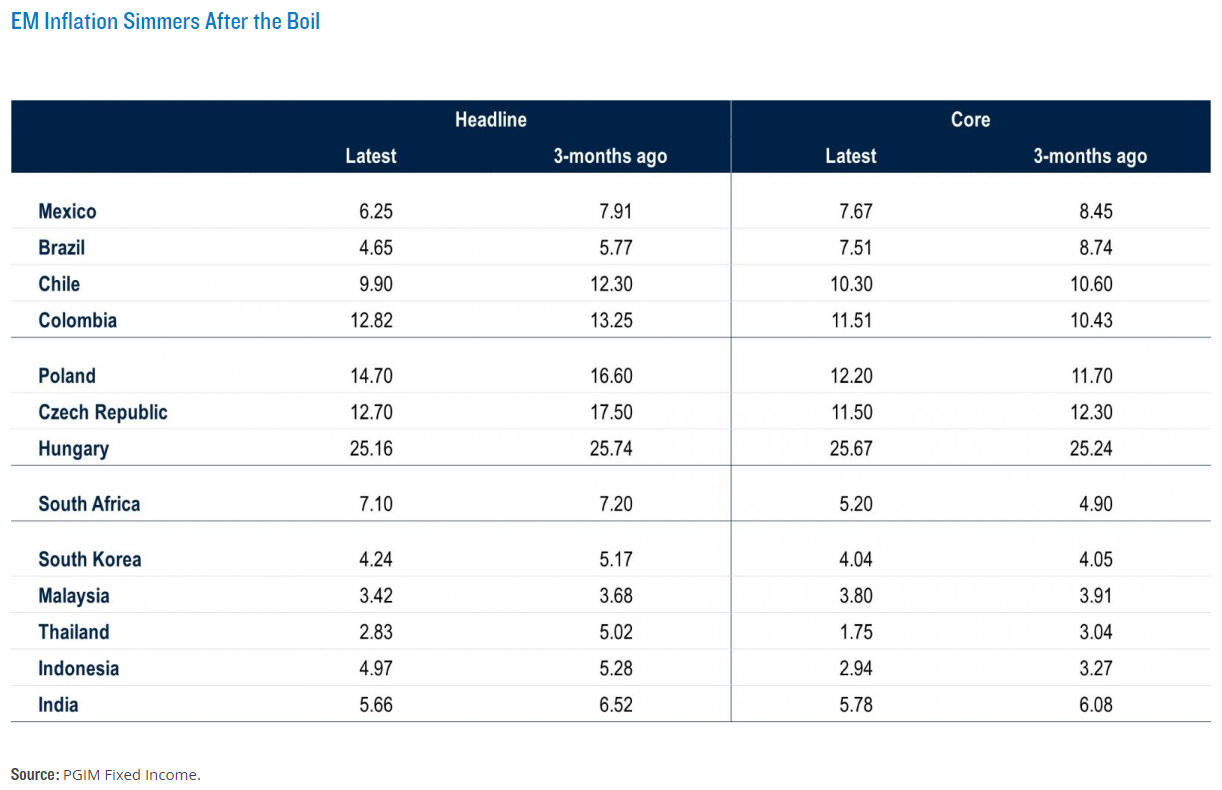

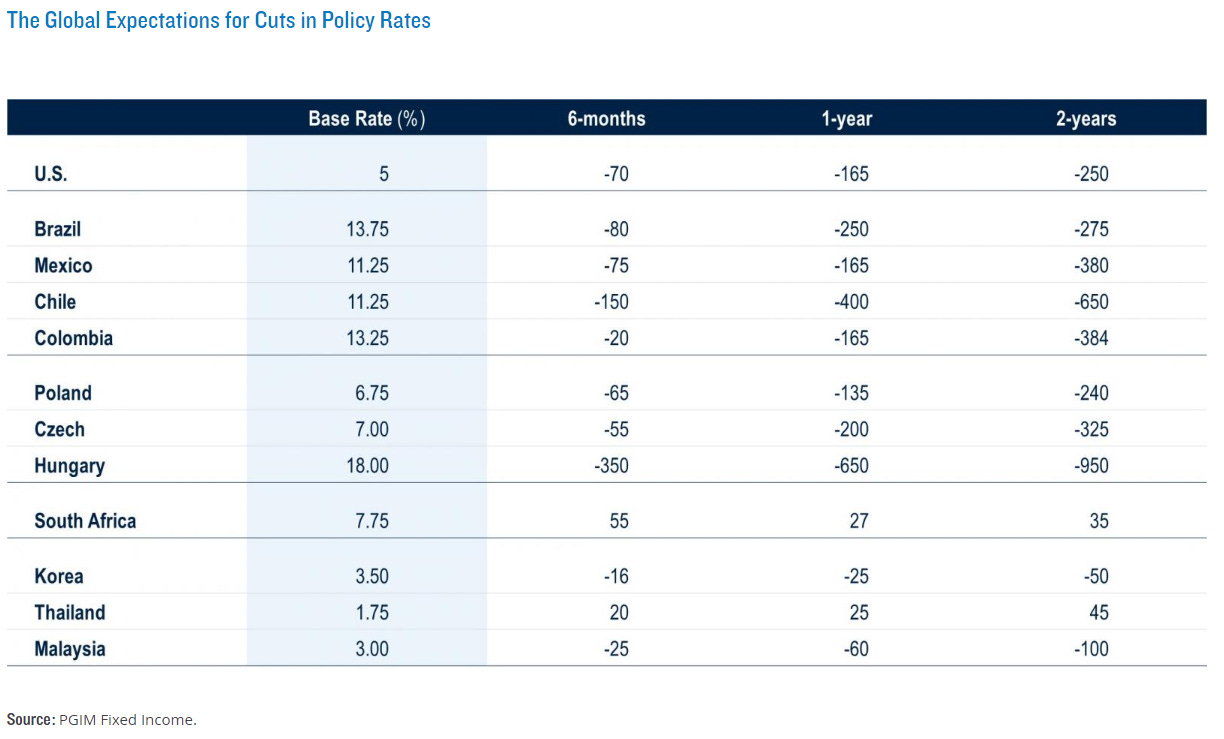

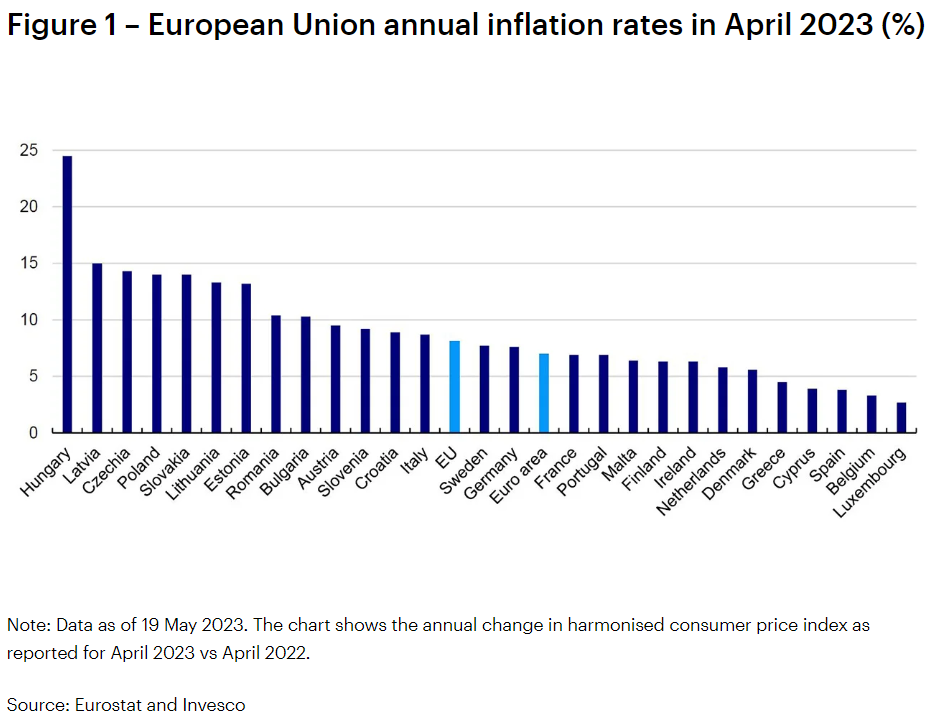

This week, we have included some useful charts from some PGIM Fixed Income and Invesco research pieces, including ones covering inflation rates, central bank rates (and rate predictions) and an Eastern European Union member country dividend yields within historical ranges chart.

Meanwhile, one Hong Kong based analyst has been quoted as saying:

“Many [investment] funds are… excluding… quitting China [equity] positions… [Among some investment funds…] “the whole China team has gone… that’s what we hear. So, actually Hong Kong financial markets are really scary these days…”

Some general emerging market investment advice from another research piece we note this week would also apply to China:

Investing in EM 2.0 necessitates laser focus on differentiation, diversification, income as a source of potential return and a preference for quality.

We will do fewer China stocks for our EM stock pick tear sheetsthan what was done last week which included some (mostly speculative and more geared for traders…) US-listed Chinese stocks mentioned in a FT-Asia Nikkei article as to having recently switched accountants to Public Company Accounting Oversight Board (PCAOB) approved ones (to ensure they can stay listed on US exchanges).

The other stock picks were Chinese semiconductor stocks who are said to be in position to benefit from the US-China chip war as they are being backed or subsidized by the Chinese government. They are also in position to gain local market share as their Chinese customers seek to nearshore and protect their supply chains from further conflict.

Finally, CMBI (part of China Merchants Bank) publishes a monthly research focus list of their best high conviction stock ideas (generally 20+ Chinese stocks). We have a post with the latest stock chart, company description, and data (or links to it plus the IR page) as a companion to the piece.

Subscribe Now Via Substack

Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- Fangdd Network (NASDAQ: DUO): Can the Online Marketplace Ride Out the Chinese Property Downturn?

- Mercurity Fintech Holdings (NASDAQ: MFH): Speculative Chinese Fintech, Blockchain and Bitcoin Stock

- ACM Research (NASDAQ: ACMR): Successfully Straddling the US-China Chip Conflict (So Far…)

- Legend Biotech (NASDAQ: LEGN): The J&J Partner Recently Surged on Leaked Data About It’s Multiple Myeloma Treatment

- Advanced Micro-Fabrication Equipment (SHA: 688012): China’s #2 Chip Tool Maker $

- Hua Hong Semiconductor (HKG: 1347 / FRA: 1HH / OTCMKTS: HHUSF): Plans a $2.6B Shanghai Share Sale to Fuel Expansion $

- NAURA Technology Group (SHE: 002371): A Potential US-China Chip Conflict Beneficiary $

- Semiconductor Manufacturing International Corp (SHA: 688981 / HKG: 0981 / FRA: MKN2): China’s Most Important Chipmaker $

- CMBI Research Focus List of China Stock Picks (May 2023) Mostly $

- COVERS: Li Auto, Great Wall Motor, Zoomlion Heavy Industry, Yancoal Australia, CR Gas, Xtep, Yum China, Xiabu Xiabu Catering (XBXB), CR Beer, Tsingtao, Prada SpA, Kweichow Moutai, Innovent Biologics, AK Medical, AIA, Tencent, Pinduoduo, NetEase, Kuaishou, CR Land, BOE Varitronix, Wingtech & Kingdee

Emerging Market Stock Picks / Stock Research

$ = behind a paywall

Alibaba Cloud: Price War Rages as Nationalization Looms in China (Smart Karma) $

- The potential spin-off listing of Alibaba Group (HKSE: 9988) Cloud faces significant challenges from various factors, making the timing particularly challenging for the spin-off.

- The Cloud Business is experiencing intensifying price competition, while simultaneously facing substantial regulatory risks, particularly with the Chinese Government’s plans to nationalize the cloud computing market.

- Due to the ongoing price war and the potential risk of nationalization, we believe that Alibaba Group (NYSE: BABA) Cloud’s fair value is substantially below $10bn.

What exactly are TikTok, Shopee, Lazada all trying to copy from Temu? (Momentum Asia)

Sea Limited (NYSE: SE) ownsShopeewhile Lazada (Wikipedia entry) is privately held.

- “Fully managed” consignment model is deemed superior to marketplace model

- Temu, Pinduoduo (NASDAQ: PDD)’s cross border affiliate, has taken the global ecommerce market by a storm. In April, its 8th month since launching in the US market, Temu’s US GMV was approaching US$400m. The platform has also expanded to be available in 10 markets.

- Temu’s quick traction obviously drew a lot of attention from its peers and competitors, in a typical Chinese fashion. Many ecommerce platforms seem to have concluded that Pinduoduo’s “全托管”(“fully managed” or “all inclusive”) model is at least worth trying.

- Under this model, sellers, manufacturers or brands will just need to agree on a price (to the platform), and ship the goods to the platform’s warehouses. The platform will handle everything else: front end marketing to consumers, logistics & fulfilment, as well as customer service.

Dividend restart still far for Macau ops: JP Morgan (GGR Asia)

See our Macau ADRs list.

- “I am cautiously optimistic that cash rich companies may resume dividend for fiscal year 2023 to be paid in 2024″, he [DS Kim, head of Asia gaming and leisure research at JP Morgan] said. “But if we get lucky, they may resume with the interim one that is going to be paid or is going to be announced in August 2023. But I would assign higher likelihood on the final [2023 dividend]“.

- He added: “For those operators with net debt, given their current leverage, in our view, would need to manage their balance sheet before thinking about returning capital [to investors].”

- “The good thing is that the Macau stocks look a little too cheap and the [recovery] momentum, fundamentals, cash flow, everything looks much better, versus any other time in the past three or four years. We cannot believe that the multiples, the valuation will stay at current level forever. So, especially for the quality blue chip names, we want to use this as an opportunity to build long positions,” the JP Morgan analyst said.

Macau stocks tied to China outlook: Bloomberg analyst (GGR Asia)

- Macau stocks in likelihood “have been punished too much because of China sentiment,” suggested Angela Hanlee, an analyst at Bloomberg Intelligence.

- The Hong Kong-based analyst stated: “Many [investment] funds are… excluding… quitting China [equity] positions.”

- Among some investment funds, “the whole China team has gone… that’s what we hear. So, actually Hong Kong financial markets are really scary these days,” she added.

Redington India – An under the radar compounder (Unfair Advantage)

- Redington (NSE: REDINGTON / BOM: 532805) is an IT hardware distributor with operations across India, Middle East, Turkey and Africa. It has very low debt, grown FCF at 20% p.a for last 10 years and is currently trading at 6.5% FCF yield. They distribute laptops, PCs, mobiles, networking, datacenter hardware and tablets from all major brands (Samsung, Apple, Lenovo etc.) to both enterprises, re-sellers. This is a hard-to-enter business, mainly because: 1/ Building and maintaining relationships with marquee brands require trust, consistent performance & time. 2/ Running a distribution business at scale requires an efficient supply-chain and strong execution (which is much harder than it sounds).

New Investment – Anglo Eastern Plantations (AEP.L) (Deep Value Investments Blog)

- Brief summary, Anglo Eastern Plantations(LON: AEP) is a family holding company involved in palm oil plantations which has had a generational change of management, hopefully leading to a change in strategy. Lim Siew Kim held 51% and died on 14th July 2022. She was the daughter of the patriarch of the large Malaysian Genting Group (mostly hotels) [Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY) / Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY)].

- I believe the change in management will lead to a change in how the company operates to a more shareholder-friendly model. In their latest announcement they said they would consider buying back shares.

- One of the things I like is that the whole board only gets paid a few hundred k. I am very very sick of managements being ridiculously paid, whilst taking zero risk and adding very little. It shows the advantage of a strong, controlling shareholder – in preventing snouts going in the trough. Having said that corruption is a problem in Indonesia and in the palm oil sector more generally, though I have no evidence / specific suspicion Anglo Eastern is involved.

Zomato (ZOMATO IN) | The Big Picture (Zero Hedge) $

- The street is excited about Zomato Limited(NSE: ZOMATO)‘s profitability, we are not.

- Zomato’s execution is strong, driving improved profitability despite the margin-dilutive Gold offering.

- Caution warranted due to market dynamics: slow growth, margin pressure, and increased competition.

MORAM – The natural gas market explained + Investment thesis Maurel & Prom (Investment theses in Small Caps & Macroeconomic analysis)

Investment thesis – Maurel & Prom (EPA: MAU / LON: 0F6L / FRA: ETX / OTCMKTS: EBLMY)

- E&P company focused in Africa, but with additional interests in France, Italy, Colombia and Venezuela.

- Combining some exciting prospects in Namibia with the upside from the sanction lifting in Venezuela plus an M&A halted in Nigeria pending resolution.

- We analyze in detail the three situations that can act as catalysts (Namibia, Nigeria and Venezuela) for the stock price and compare MAU with four of its peers (Vaalco, Panoro, BW Energy and Kosmos).

Further Suggested Reading

$ = behind a paywall

It’s Time to Disentangle from China (Yale Insights)

- As the risks of dependence on China become more apparent, a few companies are diversifying their supply chains. But inertia and short-term thinking are keeping many companies tethered to markets and suppliers in the world’s second-largest economy, write Yale SOM’s Jeffrey Sonnenfeld and Steven Tian and investor Kyle Bass.

The pulse on China’s economy and stocks (UBS AM)

- An uneven recovery has the potential to surprise on the upside

- More could be done to improve consumer and business confidence

- The impact of geopolitical tensions and trade sanctions

- The rotation toward state-owned enterprises (SOEs) due to low valuations

- The best time to invest has been when investors feel the most uncomfortable

How Taiwan became the indispensable economy (Asia Nikkei)

NOTE: Many good infographics and charts.

- Fearing a potential conflict in Asia, Western companies are looking to move production out of Taiwan. But severing ties with the self-ruled island will come at a high price for manufacturers.

Indonesian IPOs boom amid global volatility (The Asset)

- Growth prospects fueling activity, new economy, EV value chain attracting investors

- Companies listed in Indonesia raised around US$2.1 billion in IPO proceeds compared with US$1.2 billion during the same period last year. Indonesia is ranked second behind mainland China in terms of IPO proceeds in the Asia-Pacific region, ahead of markets such as Hong Kong, South Korea and India, according to data from Dealogic, May 2023 year to date.

- Just last month, Indonesian nickel company Trimegah Bangun Persada (Harita Nickel) raised 10 trillion rupiah (US$672 million) from its public offering. It was the largest IPO in 2023 so far for Indonesia. This was followed by Merdeka Battery Materials’ US$580 million listing that saw shares listed at the top of the offering range.

- The pipeline for IPOs in Indonesia, according to market reports, is expected to be robust, mostly coming from the consumer, technology and energy sectors. Some notable names include the upstream arm of Pertamina Hulu Energi, which plans to raise at least 20 trillion rupiah (US$1.36 billion) from investors, and state fertilizer firm Pupuk Kalimantan Timur.

Financial inclusion efforts in Mexico give way to new market highs (Franklin Templeton)

- Global investors might not be aware that Mexico’s stock market has been rising to new heights this year.

- Some consumer staples firms in Mexico’s stock market have been recent standouts. Tapping into the change that is underway in the payments space, some retailers are now playing a greater role in financial inclusion efforts through the rollout of alternative payment methods. For example, one of Latin America’s largest beverage and retail giants based in Mexico is leveraging access to customers of its ubiquitous convenience store chains with new digital debit cards that may help financial services penetration—a central government priority.

- Other new programs from Mexico’s retailers may offer products for remittances, loans to small businesses, and other traditional services. These efforts are widely seen as a positive for the country’s nascent digital economy. There is much room for growth, in our assessment, as only about 49% of individuals over the age of 15 held a bank account in 2022, up from 37% in 2017, according to the World Bank.

Emerging Markets 2.0: New Investment Mindset Required (Blackrock)

NOTE: Many good charts and graphics.

- Over the past 40 years, Emerging Markets (EM) have gone through a dizzying up and down. After being lauded as the new investment frontier,the asset class lost steam sometime after the Great Financial Crisis.

- We believe the loss of market momentum very much reflected a marked downshift in EM’s growth prospects. That, in turn, mirrored the plateauing of Chinese growth, de-globalization trends, rising EM indebtedness, and, like the advanced world, a sharp escalation in political polarization and volatility.

- The change in EM’s landscape does not mean the asset class is not attractive. EM still offers significant opportunities and value propositions. What it does mean is that EM 2.0 requires an entirely different investment mindset.

- Investing in EM 2.0 necessitates laser focus on differentiation, diversification, income as a source of potential return and a preference for quality. To successfully navigate the asset class, the investment process must rely on deep and rigorous investment research, employ the various asset allocation levers available to them, and, crucially, have sophisticated risk measurement and management tools.

A Brief History of Dollar Hatred (Money: Inside and Out Substack)

- The current wave of animosity towards the USD is not the first – and it will not be the last.

- Over the past 20 years, I have experienced 3 big waves of Dollar Hatred. I will discuss them below.

- And in the appendix, I will present some hard data pertaining to the current debate about de-dollarization.

- Animosity towards the dollar is elevated in 2023. But this is not in itself new, and the dollar is trading strongly, with price dynamics seemingly divorced from the media-narrative about de-dollarization. At least for now.

Assessing Central Bank Credibility In Emerging Markets (PGIM Fixed Income)

EM Local Markets: From Last Hike To First Cut (PGIM Fixed Income)

Eastern Europe: The Land Of The Rising Prices (Invesco)

EMD Quarterly Review Q1 2023 (Capital Group)

- Banking sector volatility didn’t prevent emerging market (EM) debt from rising over the quarter as investors focused on the macro tailwinds from China reopening alongside relatively strong fundamentals and high starting yields across many sovereign issuers.

- The sharp sell-off in EM debt in 2022 has resulted in attractive market valuations. We favour a tilt towards local currency markets, particularly across Latin America, where a slowdown in inflation coupled with expected policy easing will likely provide attractive total return opportunities.

- We currently see the most value in Latin American countries, such Colombia, Mexico and Brazil where interest rates have been raised early.

A New Era: How Critical Minerals are Driving the Global Energy Transition (Sprott)

- An overview of the critical minerals needed for the global energy transition to decrease our dependence on fossil fuels in favor of lower-carbon, renewable and nuclear energy sources

Note: Many good charts…

- Since 2007, the annual In Gold We Trust report has been regarded as the standard work for every interested gold investor. But the In Gold We Trust report is much more.

- Each year we undertake a comprehensive macroeconomic analysis and examine the trends of the present, learn from the past with an eye on the future. To understand them, fundamental workings of the financial and economic system must be explored and critiqued. Every year, the In Gold We Trust report looks at the top issues in the financial world. In its method of analysis, it roughly follows the Austrian school of economics.

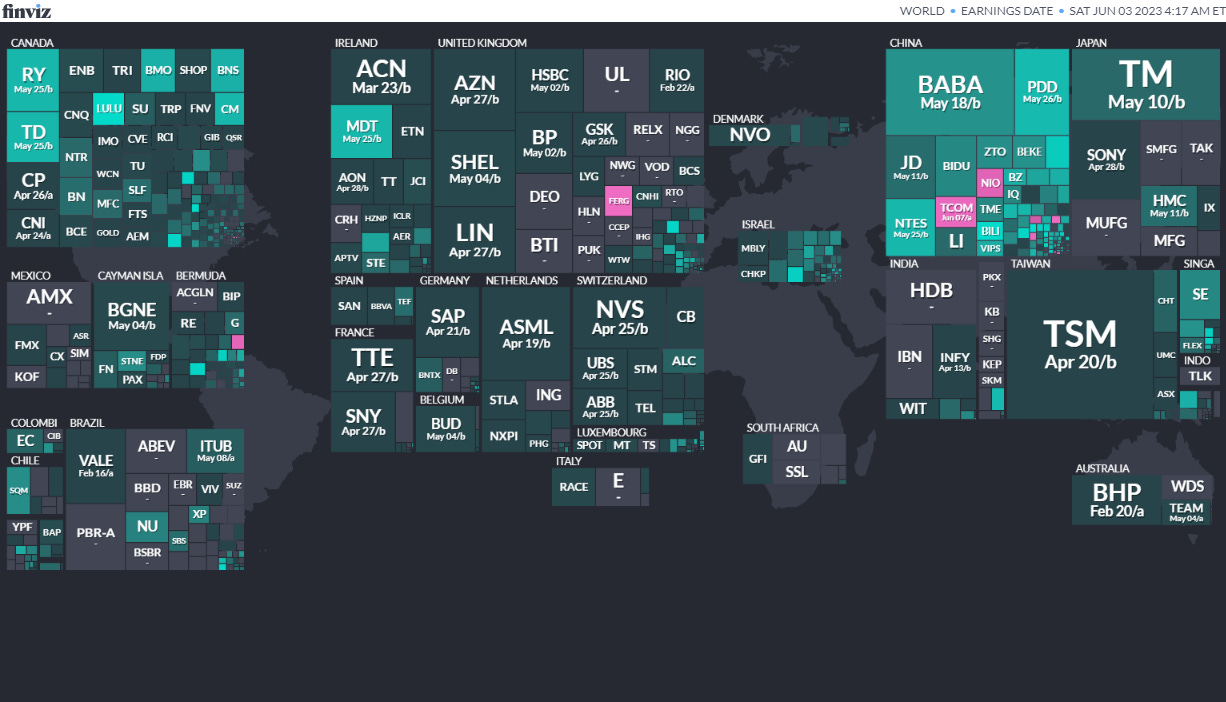

Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

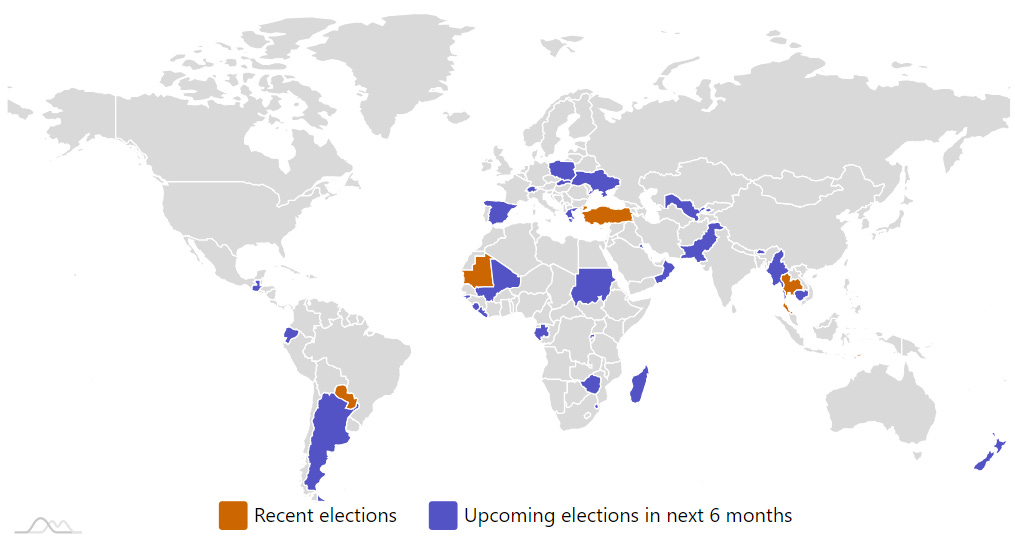

Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

TurkeyTurkish PresidencyMay 28, 2023 (t) Confirmed May 14, 2023- Kuwait Kuwaiti National Assembly Jun 6, 2023 (t) Confirmed Sep 29, 2022

- Singapore Singaporean Presidency Jun 13, 2023 (t) Date not confirmed Sep 23, 2017

- Greece Greek Parliament Jun 25, 2023 (t) Confirmed May 21, 2023

- Uzbekistan Uzbekistani Presidency Jul 9, 2023 (t) Confirmed Dec 31, 2021

- Cambodia Cambodian National Assembly Jul 23, 2023 (d) Confirmed Jul 29, 2018

- Argentina Argentinian Presidency Aug 13, 2023 (d) Confirmed Oct 22, 2023

- Zimbabwe Zimbabwean National Assembly Aug 23, 2023 (d) Confirmed Jul 30, 2018

- Zimbabwe Zimbabwean Presidency Aug 23, 2023 (d) Confirmed Jul 30, 2018

- Pakistan Pakistani National Assembly Oct 1, 2023 (t) Date not confirmed Jul 25, 2018

- Argentina Argentinian Chamber of Deputies Oct 22, 2023 (d) Confirmed Oct 24, 2021

- Argentina Argentinian Senate Oct 22, 2023 (d) Confirmed Nov 14, 2021

- Argentina Argentinian Presidency Oct 22, 2023 (d) Confirmed Aug 13, 2023

- Ukraine Ukrainian Supreme Council Oct 29, 2023 (d) Confirmed Jul 21, 2019

- Poland Polish Sejm Oct 31, 2023 (t) Date not confirmed Oct 13, 2019

- Poland Polish Senate Oct 31, 2023 (t) Date not confirmed Oct 13, 2019

Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Maison SolutionsMSS, 3.0M Shares, $4.00-4.00, $12.0 mil, 6/14/2023 Wednesday

Maison Solutions is a specialty Asian grocery retailer. (Incorporated in Delaware)

We are a fast-growing specialty grocery retailer offering traditional Asian food and merchandise to modern U.S. consumers, in particular to members of Asian-American communities. We are committed to providing Asian fresh produce, meat, seafood, and other daily necessities in a manner that caters to traditional Asian-American family values and cultural norms, while also accounting for the new and faster-paced lifestyle of younger generations and the diverse makeup of the communities in which we operate. To achieve this, we are developing a center-satellite stores network.

Our merchandise includes fresh and unique produce, meats, seafood and other groceries which are staples of traditional Asian cuisine and which are not commonly found in mainstream supermarkets, including a variety of Asian vegetables and fruits such as Chinese broccoli, bitter melon, winter gourd, Shanghai baby bok choy, longan and lychee; a variety of live seafood such as shrimp, clams, lobster, geoduck, and Alaska king crab, and Chinese specialty products like soy sauce, sesame oil, oyster sauce, bean sprouts, Sriracha, tofu, noodles and dried fish. With an in-house logistics team and strong relationships with local and regional farms, we are capable of offering high-quality specialty perishables at competitive prices.

(Note: Maison Solutions filed its S-1 on May 22, 2023, after submitting confidential IPO documents to the SEC on Dec. 23, 2022.)

AGIIPLUS INC.AGII, 4.5M Shares, $4.50-6.00, $23.6 mil, 6/19/2023 Week of

Note: AgiiPlus Inc., or AgiiPlus, is not an operating company but a Cayman Islands holding company with operations conducted by its subsidiaries, including subsidiaries in China. Investors in our securities are not purchasing equity interests in AgiiPlus’ operating entities in China but instead are purchasing equity interests in a Cayman Islands holding company. (Incorporated in the Cayman Islands)

AgiiPlus’ vision is to build the future of work and to connect businesses with technology, data, services, workspaces and more.

Through its subsidiaries, AgiiPlus is, according to the Frost & Sullivan Report, one of the fastest-growing work solutions providers with a one-stop solution capability in China and Singapore. By leveraging its proprietary technologies, AgiiPlus, through its subsidiaries, offers transformative integrated working solutions to its customers, including brokerage and enterprise services, customizable workspace renovations with smart building solutions, and high-quality flexible workspaces with plug-in software and on-demand services.

AgiiPlus has established an innovative business model called “S²aaS — Space & Software As A Solution,” which combines “Software As A Service”, or SaaS, and “Space As A Service.” This business model relies on proprietary technology, SaaS-based systems, and high-quality physical workspaces to provide customers with integrated work solutions for optimal work efficiency.

AgiiPlus, through its subsidiaries, has created an integrated platform connecting onsite workspaces and digital services through technology. Through its subsidiaries, AgiiPlus offers office leasing and enterprise services under the brand “Tangtang,” and, through its subsidiaries, AgiiPlus maintains the Distrii app, the proprietary official app for workspace members, offering AgiiPlus’ workspace members a seamless experience beyond physical spaces with easy access to enterprise services offered by AgiiPlus’ subsidiaries. As of Dec. 31, 2021, AgiiPlus’ subsidiaries had 35,771 enterprise customers and 322,252 digitally registered members.

Founded in 2016, AgiiPlus has established a network of workspaces in China and Singapore through its subsidiaries. Through Shanghai Distrii Technology Development Co., Ltd., a PRC subsidiary, AgiiPlus offers enterprise customers flexible and cost-effective space solutions in centrally located business districts in tier-one and new tier-one cities in China and Singapore. As of Dec. 31, 2021, through its subsidiaries, AgiiPlus maintained a network of 61 Distrii workspaces that covered seven different cities, namely Shanghai, Beijing, Nanjing, Suzhou, Jinan and Xiong’an in China, and Singapore, with a total managed area of about 256,291 square meters (approximately 2.8 million square feet) and approximately 41,455 workstations in total.

In addition, AgiiPlus’ asset-light model offers design, build, management and operating services to landlords who bear the costs in building and launching new spaces. This asset-light model allows AgiiPlus’ subsidiaries to economically expand and scale up while enabling landlords to turn their spaces into revenue-generating properties backed by professional services offered by AgiiPlus’ subsidiaries and AgiiPlus’ brand image. As of Dec. 31, 2021, through its subsidiaries, AgiiPlus had eight workspaces under the asset-light model, with a total managed area of about 22,947 square meters (approximately 247,000 square feet) and approximately 4,161 workstations available for members.

**Note: Revenue and net loss figures are in U.S. dollars (converted from China’s renminbi) for the year ended Dec. 31, 2022.

(Note: AgiiPlus Inc. cut the size of its IPO by 40 percent in an F-1/A filing dated March 22, 2023: The number of Class A ordinary shares was cut to 4.5 million shares – down from 8.7 million shares previously – and the price range was increased to $4.50 to $6.00 – up from $4.00 to $5.00 – to raise $23.63 million. The new terms cut the IPO’s estimated proceeds by 40 percent from the initial estimate of $39.15 million under the original terms – 8.7 million shares at $4.00 to $5.00 – that were disclosed in an F-1/A filing dated Nov. 7, 2022. The F-1 was filed on Sept. 16, 2022; confidential filing was submitted on June 17, 2022.)

Emerging Market ETF Launches

Climate change and ESG are clearly the latest flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

- 03/16/2023 – JPMorgan Active China ETF JCHI – Active, equity, China

- 03/03/2023 – First Trust Bloomberg Emerging Market Democracies ETF EMDM – Principles-based

- 1/31/2023 – Strive Emerging Markets Ex-China ETF STX – Passive, equity, emerging markets

- 1/20/2023 – Putnam PanAgora ESG Emerging Markets Equity ETF PPEM – Active, equity, ESG, emerging markets

- 1/12/2023 – KraneShares China Internet and Covered Call Strategy ETF KLIP – Active, equity, China, options overlay, thematic

- 1/11/2023 – Matthews Emerging Markets ex China Active ETF MEMX – Active, equity, emerging markets

- 12/13/2022 – GraniteShares 1.75x Long BABA Daily ETF BABX – Active, equity, leveraged, single stock

- 12/13/2022 – Virtus Stone Harbor Emerging Markets High Yield Bond ETF VEMY – Active, fixed income, junk bond, emerging markets

- 9/22/2022 – WisdomTree Emerging Markets ex-China Fund XC – Passive, equity, emerging markets

- 9/15/2022 – KraneShares S&P Pan Asia Dividend Aristocrats Index ETF KDIV – Passive, equity, Asia, dividend strategy

- 9/15/2022 – OneAscent Emerging Markets ETF OAEM – Active, Equity, emerging markets, ESG

- 9/9/2022 – Emerge EMPWR Sustainable Select Growth Equity ETF EMGC – Active, equity, emerging markets

- 9/9/2022 – Emerge EMPWR Unified Sustainable Equity ETF EMPW – Active, equity, emerging markets

- 9/8/2022 – Emerge EMPWR Sustainable Emerging Markets Equity ETF EMCH – Active, equity, emerging markets, ESG

- 7/14/2022 – Matthews China Active ETF MCH – Active, equity, China

- 7/14/2022 – Matthews Emerging Markets Equity Active ETF MEM – Active, equity, emerging markets

- 7/14/2022 – Matthews Asia Innovators Active ETF MINV – Active, equity, Asia

- 6/30/2022 – BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF XEMD – Passive, fixed income, emerging markets

- 5/2/2022 – AXS Short CSI China Internet ETF SWEB – Active, inverse, thematic

- 4/27/2022 – Dimensional Emerging Markets High Profitability ETF DEHP – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Core Equity 2 ETF DFEM – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Value ETF DFEV – Active, equity, emerging markets

- 4/27/2022 – iShares Emergent Food and AgTech Multisector ETF IVEG – Passive, equity, thematic [Mostly developed markets]

- 4/21/2022 – FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM – Passive, equity, ESG

- 4/6/2022 – India Internet & Ecommerce ETF INQQ – Passive, equity, thematic

- 2/17/2022 – VanEck Digital India ETF DGIN – Passive, India market, thematic

- 2/17/2022 – Goldman Sachs Access Emerging Markets USD Bond ETF GEMD – Passive, fixed income, emerging markets

- 1/27/2022 – iShares MSCI China Multisector Tech ETF TCHI – Passive, China, technology

- 1/11/2022 – Simplify Emerging Markets PLUS Downside Convexity ETF EMGD – Active, equity, options strategy

- 1/11/2022 – SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG – Passive, equity, ESG

Emerging Market ETF Closures/Liquidations

Frontier and emerging market highlights:

- 06/23/2023 – Invesco PureBeta FTSE Emerging Markets ETF – PBEE

- 3/30/2023 – Invesco BLDRS Emerging Markets 50 ADR Index Fund – ADRE

- 3/30/2023 – Invesco BulletShares 2023 USD Emerging Markets Debt ETF – BSCE

- 3/30/2023 – Invesco BulletShares 2024 USD Emerging Markets Debt ETF – BSDE

- 3/30/2023 – Invesco RAFI Strategic Emerging Markets ETF – ISEM

- 2/17/2023 – Direxion Daily CSI 300 China A Share Bear 1X Shares – CHAD

- 1/13/2023 – First Trust Chindia ETF – FNI

- 12/28/2022 – Franklin FTSE Russia ETF – FLRU

- 12/22/2022 – VictoryShares Emerging Market High Div Volatility Wtd ETF CEY

- 8/22/2022 – iShares MSCI Argentina and Global Exposure ETF AGT

- 8/22/2022 – iShares MSCI Colombia ETFI COL

- 6/10/2022 – Infusive Compounding Global Equities ETF JOYY

- 5/3/2022 – ProShares Short Term USD Emerging Markets Bond ETF EMSH

- 4/7/2022 – DeltaShares S&P EM 100 & Managed Risk ETF DMRE

- 3/11/2022 – Direxion Daily Russia Bull 2X Shares RUSL

- 1/27/2022 – Legg Mason Global Infrastructure ETF INFR

- 1/14/2022 – Direxion Daily Latin America Bull 2X Shares LBJ

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as some ETF lists are still being updated as of Summer 2022).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (June 5, 2023) was also published on our Substack.

Emerging Markets Investing Tips + Advice

Emerging Market Skeptic (Website)

Website List Updates + Site Map

Stocktwits @EmergingMarketSkptc

Similar Posts:

- Emerging Market Links + The Week Ahead (June 27, 2022)

- Emerging Market Links + The Week Ahead (June 20, 2022)

- Emerging Market Links + The Week Ahead (June 6, 2022)

- Emerging Market Links + The Week Ahead (January 23, 2023)

- Emerging Market Links + The Week Ahead (May 30, 2022)

- Emerging Market Links + The Week Ahead (September 5, 2022)

- Emerging Market Links + The Week Ahead (August 29, 2022)

- Emerging Market Links + The Week Ahead (November 21, 2022)

- Emerging Market Links + The Week Ahead (October 10, 2022)

- EM Fund Stock Picks & Country Commentaries (June 27, 2023)

- Emerging Market Links + The Week Ahead (August 22, 2022)

- Emerging Market Links + The Week Ahead (June 12, 2023)

- Emerging Market Financial Services ETF List

- Emerging Market Links + The Week Ahead (August 1, 2022)

- Emerging Market Links + The Week Ahead (January 2, 2023)