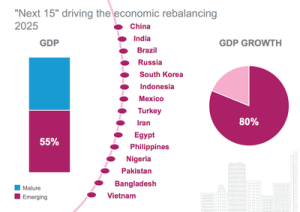

Luxury Daily recently had an extensive article citing McKinsey’s LuxuryScope “The glittering power of cities for luxury growth” report which predicts that growth will extend beyond China and the other BRICs to include what they call the “Next 15.” These additional 11 countries are set to drive 80% of emerging market growth even though they only account for 25% of the global GDP.

Moreover and as emerging markets continue to grow, 600 of the world’s top cities will be responsible for nearly 85% luxury apparel market growth in 2025. McKinsey further suggested that within the next 15 years, approximately 400 “second-tier” cities will yield wealth equivalent to the United States economy today.

And while a significant amount of these emerging city markets are located in China, brands still must extend their retail footprint within the Next 15’s smaller cities where growth potential is high as the 100 highest-growing cities (such as Pune, India; Harbin, China; and Luanda, Angola) will grow significantly in comparison to megacities such as Shanghai and Moscow.

To be successful in these emerging frontier market and emerging market cities, McKinsey suggests a “city-by-city” strategy that allows brand to readjust business models, resource allocations and organizational structure.

To read the whole article, The “Next 15″ will drive 80pc of emerging market growth by 2025: report, go to the website of Luxury Daily while the McKinsey report entitled The glittering power of cities for luxury growth, can be downloaded from the website of McKinsey & Co.

Similar Posts:

- As Emerging Market Growth Slows, Moody’s Thinks Advance Economies Will Drive Global Growth

- The Golden Era for Investing Could Be Ending (Bloomberg)

- Both Apple and Android Use is Growing in Chinese Third-tier Cities (Tech in Asia)

- Almost 2/3rds of Twitter Users Will Soon Be in Emerging Markets (eMarketer)

- Asia and Emerging Markets Had the Worst Dividend Growth Rates for 1Q2014 (FE Trustnet)

- Ways to Become Over Exposed to Emerging Markets Without Knowing It (FE Trustnet)

- Alibaba and JD.com Battle for the Next Big Emerging Market: Inland China (Quartz)

- The World in 2050 (PWC)

- Why Investing in Emerging Market Infrastructure Makes Sense (Wealth Daily)

- Economic Prospects in Several Emerging Asia Countries (Wells Fargo Securities)

- How Much Should You Invest in Emerging Markets? (The Telegraph)

- HSBC Emerging Markets Index: EM Lose Pace in July Despite Manufacturing Pick-up (HSBC)

- Three Reasons Why Investors Should Buy Frontier Market Stocks (The BlackRock Blog)

- Aging will Reduce Economic Growth Worldwide in the Next Two Decades (Moody’s)

- Global Smartphone Shipments to Reach 1.2Bn This Year on Emerging Market Strength (Juniper Research)