EM fund Middle East, Eastern Europe and Mexico stock picks are in focus this week as we look closer at some annual reports for fiscal 2022 while waiting for more December fund factsheets and commentaries to drop. Although annual reports tend to drop several weeks after the fiscal year end, they still contain interesting stock picks and valuable commentary about them.

It is worth noting that not owning Saudi Aramco for ESG purposes was not a good investment idea in 2022 (although that fund talked up “energy transition” opportunities involving South African mining stocks). However, stock picks in newer markets or sectors of the Middle East have offered strong returns as the region’s economies continue to diversify.

In an African frontier market, there is an electricity distribution stock who’s concession will expire in 2025 and not be renewed. However, they are contractually entitled to compensation for unrecovered investment which amounts to approximately three times the current market capitalisation.

Finally, investor sentiment for Eastern Europe is down, but there is still value to be found in the region. One fund even mentioned a (now beaten down) London listed stock pick who’s mining operating base is in central Ukraine.

Subscribe Now Via Substack

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

For a further disclaimer and an explanation of the reasoning behind these posts: DISCLAIMER: EM Fund Stock Picks & Country Commentaries Posts.

Note: Where possible, company links are to their respective investor relations or corporate pages. Region and country links are to our ADR or ETF pages where there are further country specific resources (e.g. links to local stock markets and media websites). Please report any bad links in the comments section.

[All pay-walled posts have tickers for major stock exchanges (NOTE: Some OTC tickers will be left off IF they see little trading activity) linked to sites such as Finvix, Google Finance (set to open as a 1 year chart), or where ever else stock quotes can be found. Posts starting in March 2023 contain as many 1-year charts (for the main ticker) as possible.]

Asia

For November, the Fidelity Asian Values Plc (LON: FAS) update noted (emphasis is mine):

Of late, investors seem to be rotating out of growth stocks and into value names in the Asian small cap space and this trend should continue as small cap value stocks remain at a significant discount to small cap growth stocks in Asia.

East Asia

China

The Utilico Emerging Markets Trust plc (LON: UEM) December update mentioned Chindata – a NASDAQ listed “carrier-neutral hyperscale data center solution provider” operating in various Asia-Pacific emerging markets. The Company has energy efficient data centres in China, Malaysia, India, and Thailand with Bytedance (owner of the Tik Tok social media platform and Douyin, its Chinese equivalent) as its principal customer. Chindata was up 11.3% after strong results in November.

UEM’s update also mentioned shares of China Gas Holdings (China’s largest trans-regional, integrated energy supplier and service provider) had continued their recovery.

The December update for The Scottish Oriental Smaller Companies Trust plc (LON: SST) mentioned food and beverage manufacturerUni-President China had reported steady growth in its food and beverage segment. This growth should receive a further boost from China’s reopening plans.

The China Fund, Inc (NYSE: CHN) recently posted its Annual Report for the year ended October 31, 2022. The report noted how CIFI Holdings Group (“CIFI”), a property developer focused on building houses near the outer perimeter of tier-one cities, was a poor performer. However, CHN remained confident / optimistic on CIFI’s long-term prospects as the company has an “enviable” nationwide footprint, giving it a strong base for future growth. In the long term, CHN expects demand for real estate to recover.

On the other hand, Pinduoduo (one of China’s largest ecommerce platforms that started its businesses with a focus on lower-tier cities and price sensitive consumers directly through its interactive shopping experience) was a good performer.

The Annual Report noted how more Chinese internet platform companies have begun to adapt to the new regulations, including by trying to set a path to profitability. CHN sees more encouraging signs of monetization efforts as platform companies in China continue to be dominant businesses. While there will be a moderation of growth, CHN does not think that regulations will derail these businesses from growth entirely.

SE Asia

Singapore registered Pangolin Asia Fund’s December update made these interesting stock picking observations:

Managements who can maintain a focus on profitability, core strengths while prioritising the interests of all shareholders are not so common. Those that do some (but not all) of the above are in the majority. It’s rare to be able to identify those we can trust not to get distracted by bankers offering deals or being tempted into noncore businesses; the superstars are those who realise that by returning all the excess cash their core competencies generate, they diminish the risk of spending it badly elsewhere.

And:

Where we operate, finding those that fit the bill is not so easy. But there are some. And there are those who come close. In these cases, we try to encourage them to keep on the straight and narrow, often by asking difficult questions at AGMs. Some just can’t or won’t get it. But those that do often see a sharp increase in the price the market is prepared to pay for their earnings…

…Part of our job is to determine whether a company is in the 4% or the 96%. And to ask, educate and cajole managements who are on the cusp of our parameters, to make the changes (normally in cash and balance sheet administration) that will elevate their companies from being good to great. This requires a change in mindset – too scary a leap for many.

Indonesia

SST’s December update noted Avia Avian (a manufacturer, wholesaler, and marketer of paint and coating materials) declined on concerns about slower growth.

In early December, BlackRock Frontiers Investment Trust plc (LON: BRFI) posted its Annual Reportfor the year ended September 30, 2022. The Annual Report noted that Indonesia is one of their most preferred countries over the medium to long term thanks to steady GDP growth expectations of 5%+ over the next decade and structural market reforms that should boost potential GDP. Tactically, the country has benefited from the huge boom in coal and palm oil prices over the past year and continues to report an impressive current account surplus.

As for Indonesian stocks, BRFI mentioned retail conglomerate Mitra Adiperkasa had benefited from a strong recovery as the economy reopened post COVID. The Company has also continued to take market share.

BRFI then noted that conglomerate Astra International (Southeast Asia’s largest independent automotive group controlled by Hong Kong’s Jardine Matheson) benefited from the same trends, showing strong recovery through the year. September 2022 retail unit sales volumes were up 31% year-on-year and the company has also achieved an increase in market share from 51% to 56%. As noted last week, I suggest reading Joe Studwell’s Asian Godfathers and How Asia Works as Jardine controlled Astra and the auto industry are talked about extensively in both books.

Finally, the BRFIAnnual Report briefly mentioned these Indonesian stocks:

- Indocement Tunggal Prakarsa – a manufacturer and seller of cement and ready-mix concrete with the following segments: Cement, Ready-Mix Concrete, and Aggregates Quarries.

- Bank Rakyat – one of the largest banks in Indonesia. It specialises in small scale and microfinance style borrowing from and lending to its approximately 30 million retail clients through over 4,000 branches, units, and rural service posts.

Malaysia

The Pangolin Asia Fund December update had also made this interesting observation:

Our investible universe, once management competence has been accounted for, is a small percentage of the listed companies. But there are still plenty. As I’ve stated before, there are close to 1,000 listed companies in Malaysia and if only 4% of them are any good, that still gives us 40 names to play with.

In addition, BRFI’s Annual Report mentioned supply chain recalibration away from China along with the return of Chinese tourists as being themes for Malaysia (NOTE: BRFI owns Genting – a multinational resort and hotel operator with integrated resorts and entertainment facilities in Malaysia but also abroad, including the UK, the US, and the Bahamas).

Finally, BRFI also commented how there is “nascent, but interesting, start-up ecosystem emerging in the country.”

Thailand

BRFI’s Annual Report noted that Thailand is one part of the region where they are more bearish. In fact, they exited convenience store chain CP ALL (part of the Charoen Pokphan Group conglomerate which is also written about in Studwell’s books); oil and gas giants PTT Global Chemical (Thailand’s largest integrated petrochemical and refining business) and Thai Oil(fully integrated refining and petrochemicals); and Kasikornbank on concerns about the country’s macro environment.

Along with the Philippines, BRFI expressed concerns that current high inflation will cause their respective central banks to raise interest rates substantially as their economic recoveries remain relatively weak.

South Asia

India

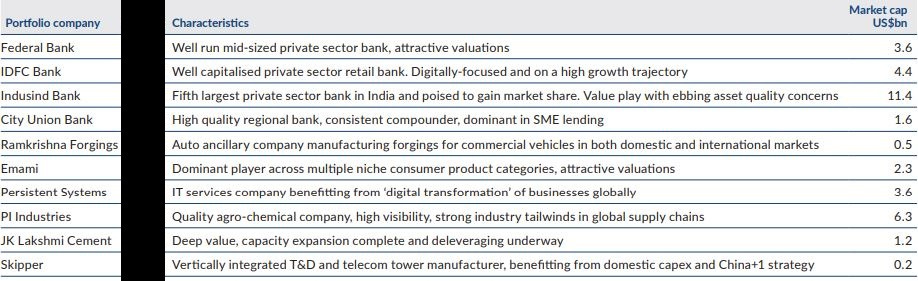

The December update for the India Capital Growth Fund (LON: IGC) noted it was a volatile month for Indian stocks. All sector indices (except metals) posted negative returns with power, IT, and auto correcting the most. This occurred despite strong inflows of US$2.9 billion from Domestic Institutional Investors (DIIs) and outflows of US$167 million from Foreign Institutional Investors (FIIs).

As for Indian stocks, the December update noted The Skipper (telecom infrastructure), Ramkrishna Forgings(forging manufacturing), and JK Lakshmi Cements(grey and white cement) were strong performers. The update also profiled Uniparts – a recently listed auto ancillary company manufacturing engineered products for the “off-highway” segment:

The company’s key products are 3-point linkages (3PL) for the tractor market and precision machined products (PMP) for construction and mining equipment. 3PLs are highly customised products, which link the tractor to the equipment behind it, whilst PMPs are articulated joints (also customised), which are both structural and load-bearing. Uniparts offers integrated product development from concept all the way to validation and testing, and over 80% of its revenues are from exports. The company has gained market share due to cost competitiveness (sales from its export model) as well as better supply chain management (through its warehousing channel), achieving 94% fulfilment for Caterpillar during Covid. Uniparts is also a beneficiary of multinationals adopting a “China+1” strategy as its newer products in the ATV/UTV (all-terrain vehicle/utility task vehicle) segment are now enjoying a larger addressable market opportunity. Between FY 22 – FY 25, Ocean Dial forecast Unipart’s revenues to compound at 18% CAGR and profits to compound at CAGR of 16%, delivery an expected return on capital of approximately 27%.

SST’s December update noted that shares of auto parts stock Mahindra CIE had risen after it announced the sale of its German forging operations to focus on the more profitable parts of its business. On the other hand, shares of Colgate-Palmolive (India) weakened as investors recycled capital into North Asia.

Central Asia

Kazakhstan

BRFI’s Annual Report mentioned KASPIwhich offers the largest payments, marketplace, and fintech ecosystem in Kazakhstan. The Company began as a bank but expanded into peer-to-peer payments and online marketplaces, particularly proving vital for businesses during the lockdowns of 2020. BRFI noted the company is working on expanding into other markets in Central Asia and has seen strong growth – particularly in its marketplace and payments business.

Middle East

In early December, Barings Emerging EMEA Opportunities PLC (LON: BEMO) posted its Annual Report for the fiscal year ended September 30, 2022. The Annual Report noted that not owning Saudi Aramco(the world’s largest integrated oil and gas company) during the fiscal year for ESG purposes had hit performance as shares rallied sharply due to high oil prices. On the other hand, some investments in the newer markets of the Middle East were some of the best performers in absolute terms – not only in EMEA, but across equity markets globally.

Some of the strongest performers were Middle Eastern Banks, which rallied thanks to rising interest rates, an improving economic picture, and increased mortgage issuances.

BEMO also noted that high energy prices have significantly strengthened the fiscal backdrop across Middle Eastern economies. Many of these countries now forecast strong economic growth whilst at the same time benefitting from low inflation. This combination is extremely rare in the current global climate.

Finally, Middle East representation in major indices is rising and there is burgeoning IPO market that is broadening the investment opportunity and deepening local capital markets.

Qatar

BEMO’s Annual Report noted the Qatar National Bankperformed well with quarterly results pointing to a significant increase in net interest margins. The bank is the largest bank in Qatar with a dominant market share in both lending and deposits. BEMO also commented they have a strong management team with a long history and good track record.

BRFI’s Annual Report also mentioned they are expecting a re-acceleration of loan growth for Qatar National Bank. They noted the stock has been a relative laggard in Qatar and compared to other financials in the region.

In addition, BRFI mentioned the Qatar Gas Transport Company (also known as Nakilat) – a shipping and maritime company holding the world’s largest liquefied natural gas (LNG) shipping fleet comprised of 69 LNG carriers. In addition to its core shipping activities, Nakilat also provides ship repair and offshore fabrication services. The Company was a strong performer as the tight energy environment which meant they were able to raise the rental pricing for its fleet. BRFI also thinks they will benefit from expansion of Qatar’s north fields in a bid to increase domestic gas production.

Saudi Arabia

BEMO’s Annual Report noted thatincreased mortgage issuances have benefitted the Saudi National Bank and Al Rajhi(another Saudi bank) as they have some of the highest market shares of mortgage loans in the sector – accounting for more than 50% combined.

The Saudi National Bank is the largest bank in Saudi Arabia originating from merger of NCB and Samba in April 2021. It provides a range of financial services from personal and corporate banking to brokerage and investment banking in Saudi Arabia. It also has an international presence in the Middle East, South Asia, and Turkey. According to BEMO, there are still synergies to be delivered from the 2021 merger.

Al Rajhi in particular (35%+ mortgage market share) hasseen extensive growth in interest margins from rapidly rising property ownership in Saudi Arabia. Its also the number one Islamic bank globally supported by an extensive branch network, stable retail deposit franchise and FinTech initiatives. This includes Emkan – its new consumer financing subsidiary.

BRFI’s Annual Report also noted how Saudi Arabian banks had a very strong year and they mentioned Riyad Bank (one of the largest financial institutions in Saudi Arabia and the Middle East with 237 branches) and Saudi British Bank (an associate of HSBC Group and the leading international bank in Saudi Arabia). Both banks have seen substantial increases in earnings due to strong loan growth and rising margins.

BEMO’s Annual Report noted how shares of the local exchange Tadawul (the parent company of the operator of one of the largest exchanges in the world) are benefitting from the broadening and deepening of the Saudi Arabia’s capital markets, the rising number of IPOs, and increased participation of international investors. Diversification into other asset classes has also provided further growth potential.

BRFI’s Annual Report noted that grocery store operator Abdullah Al Othaim Markets (which operates supermarkets, hypermarkets, convenience stores, and wholesale outlets plus has a small presence in Egypt) did well as the Saudi domestic landscape evolves from mom-and-pop stores to a more premium supermarket ecosystem. The Company is looking to disrupt the current landscape which is largely dominated by mom-and-pop stores.

Finally, BEMO’s Annual Report briefly mentioned:

- Saudi Basic Industries (SABIC) – the country’s dominant petrochemical chemical company. It benefits from long-term fixed-price feedstock contracts and a diversified asset base.

- Saudi Telecom offers a variety of ICT solutions. The Company has steady revenue growth and a strong balance sheet to support dividends. Longer-term catalysts include monetisation of infrastructure assets and growth of STC Pay – their mobile wallet service.

BRFI’s Annual Report also briefly mentioned their participation in the IPO of Al Nahdi Medical – the largest retail pharmacy chain in Saudi Arabia, operating more than 1,150 stores in 144 cities and towns across the Kingdom along with a growing number in the UAE.

Turkey

UEM’s December update briefly mentionedTurkish stockTAV which operates 15 airports in 8 countries (providingduty free, catering, ground handling, IT, security and lounge services).

BEMO’s Annual Report noted negative returns from Turkey during the fiscal year. This was led by online shopping platform Hepsiburada as the company reported earnings short of market expectations. Whilst the local inflationary picture has been challenging for Turkish corporates, BEMO expects the company to benefit from the underpenetrated Turkish ecommerce market.

On the other hand, there were pockets of good stock selection in Turkey. Local conglomerate Koc’s diversified asset base (it’s one of the top 500 largest companies in the world and is focused on four main industries – energy, finance, consumer durables, and automotive) and exposure to a number of export businesses drive solid earnings – offering some resilience amidst a tougher economic backdrop.

United Arab Emirates (UAE)

BEMO’s andBRFI’s Annual Reports both noted real estate stock Emaar Properties was a top performer. The Company offers both development and property management services plus its diversified across several property types, including commercial and residential, as well as malls and hospitality.

BEMOnotedEmaar Properties had a good performance following consistently solid earnings and increases in profit margins. This has been supported by a strong management team, the easing of COVID restrictions, and a resumption of economic activity. For the longer term, Emaar Propertiesshould benefit from the ongoing structural and social reform in the UAE.

BRFIadded that property transaction values hit a nine-year high in September 2022 due to rising demand. Emaar Properties has been able to sell down historic inventories and generate significant cash flows as the market has boomed. This is a reflection of a longer-term rebranding of Dubai and the UAE as an expatriate hub for finance professionals or for crypto enthusiasts.

First Abu Dhabi Bank was briefly mentioned by BEMOas a leading bank in the UAE and one of the largest across the Middle East. The bank has a diversified business model split across investment, commercial, consumer, and private banking.

Finally, BRFI’s annual report also noted:

- Fertiglobe (the UAE’s biggest nitrogen fertilizer and ammonia producer and distributor) has been an outstanding performer since its October 2021 IPO.

- Air Arabia (the Middle East and North Africa’s first and largest Low Cost Carrier covering 170 destinations) was another outstanding performer as the UAE was one of the first countries to fully reopen its borders post COVID.

Africa

UEM’s December update mentioned Umeme – the main Ugandan electricity distribution company which had an IPO over ten years ago and posted strong share price gains in December. During the month, the Ugandan government formally notified Umeme that its concession, which expires in 2025, would not be renewed. Umeme is contractually entitled to compensation for unrecovered investment which amounts to approximately three times the current market capitalisation.

South Africa

BEMO’s Annual Report mentioned anumber of exciting stock specific opportunities in South Africa, particularly amongst companies with a role to play in the energy transition:

- Anglo American, the world’s largest producer of platinum as well as a major producer of diamonds, copper, nickel, iron ore and steelmaking coal. The company is an industry champion in the production of nickel, a key input in the production of electric batteries, as well as other energy transition metals such as copper. Shares have experienced both a period of protracted appreciation as commodity prices rose, and then a period of depreciation as a weakening economic environment dragged near-term commodity price outlooks lower. Despite this volatility, BEMO believes the company (over the medium term) will benefit from being a major producer of platinum which has a significant role to play in the energy transition via its use in hydrogen-powered fuel cell electric vehicles, as well as in the production of green hydrogen via electrolysis.

- Impala Platinum, a leading producer of platinum group metals (PGMs), structured around six mining operations and Impala Refining Services, a toll refining business. They also supply platinum and palladium to carmakers globally to support the production of catalytic converters, which help reduce vehicle emissions whilst also acting as a key component within hydrogen power cells.

- Telecoms group MTN (which has a platform focused on Africa with 270 million subscribers across Africa and the Middle East) was one of the stronger performers earlier in the year thanks to a consumer base who rely almost exclusively on mobile devices. This performance was backed by solid growth in voice, data and fintech services. However, in the near term, the share price had retreated a bit as investors weighed macro concerns in some of the company’s bigger markets, such as Nigeria and Ghana, alongside currency weakness. It was also noted how MTN’s subsidiary MoMo is the leading African mobile money fintech ecosystem with more than 60 million active users. Long term growth is driven by increasing mobile and internet penetration across the region.

- Firstrand which, through its portfolio of integrated financial services businesses, operates in South Africa, certain markets in sub-Saharan Africa, the UK, and India, was briefly mentioned. The Company offers a diverse range of services such as transactional, lending, insurance, and investment products.

The Annual Report also mentioned multinational technology investor Naspers was a performance detractor as its largest holding Tencent was impacted by broader weakness across the technology sector and uncertainty regarding the outlook for the Chinese economy. Despite the headwinds, BEMO believes the regulatory risk surrounding the Chinese technology sector may have peaked as seen in renewed game approvals (a key component of growth within Tencent’s business) by the local regulator.

Otherwise, South Africa’s overall performance during the fiscal year was mixed in light of an often-volatile commodity, currency, and macro environment. There is also a risk of social unrest. However, inflationary pressures are less severe in the region than in many other parts of the world, and the monetary policy backdrop is stable.

Eastern Europe & Emerging Europe

BEMO’s Annual Report commented that the outlook in Eastern Europe is understandably less rosy, given the proximity of the region to the ongoing conflict in Ukraine. Stock market valuations there are largely reflecting a deterioration in investor sentiment, which, over the medium term, may provide good opportunities for investors.

It was also noted that certain EU member states are well placed to take advantage of nearshoring trends by providing lower cost skilled labour, strong regulatory protection, and lower delivery times for the end consumers.

Greece

Both BEMO’s andBRFI’s Annual Reports noted good returns from the National Bank of Greece as the company produced strong core operating profits alongside cost reductions. The National Bank of Greece now operates with a strong capital base and a level of non-performing loans (NPL’s) comparable to banks in developed Europe.

BRFI’s Annual Report briefly mentionedGreek utility Terna Energy which builds and operates renewable energy source facilities focusing in wind and solar energy as well as hydroelectric projects. It’s also active in the management and exploitation of waste and biomass. The Company was a good performer as the transition to renewable energy continued.

Finally, BRFI noted howGreece started the year as a top pick given the tourist revival over summer 2022. However, they have chosen to rotate positions into Poland and Hungary.

Hungary

BEMO’s Annual Report noted thatstock markets moved lower in response to broad based tax and tariff increases designed to fund the country’s increasingly burdensome social transfers. This included windfall taxes on the banking sector which negatively impacted banks such as OTP. BRFI’s Annual Report also mentioned that 15% of OTP’s business was in Russia and Ukraine.

BRFI then noted that budget airline Wizz Air Holdings had been a very poor performer. Shares were impacted by recessionary fears and rising fuel costs. However and as I noted last week, BRFI’s November updated mentioned the airline had a good performance after posting strong financial results and guidance driven by improving passenger traffic.

Finally, BRFI’s Annual Report observed that given the actions they have seen from the Hungarian government and central bank in looking to rein in spending and liquidity over the past few months, they believe there is value in Hungary.

Poland

UEM’s December update noted that the share price of InPost(Europe’s leading out of home delivery partner) was up by 12.1% reflecting improved sentiment.

BRFI’s Annual Report mentioned the Polish stock market was currently trading at the lowest level since 2003. They believe that many Polish shares are discounted in price.

BEMO’s Annual Report noted that insurance group PZU (one of the largest financial institutions in Poland and in Central and Eastern Europe) and bank PKO (Poland’s largest bank with 1,100 branches in the country and abroad) were weak due to headwinds facing the Polish banking sector as the government imposed populist measures. This included a windfall tax on the sector more broadly, alongside a one-year moratorium on mortgage payments.

However, BEMO noted that PZU occupies a dominant market position in a sector that stands to benefit over the medium term from increasing insurance penetration and rising interest rates. In addition, PZU has strategic stakes in the financial stocks Pekao and Alior which are involved in bancassurance, wealth management and fintech.

Finally, BRFI’s Annual Report mentioned clothing retailer LPP (thelargest fashion company in Central and Eastern Europe) was a very poor performer. Russia represented around 30% of revenues and had been expected to represent approximately half of the expansion plan for 2022.

Ukraine

BRFI’s Annual Report mentioned iron ore producer Ferrexpo – the third largest exporter of iron ore pellets in the world with an operating base in central Ukraine. Shares have performed poorly for obvious reasons. Nevertheless, BRFI noted that Ferrexpo has been able to continue exporting product albeit at a lower rate through the year. Their latest Q4 production report and trading update confirms this and it does appear that shares have stabilized a bit on the London market.

Latin America

Argentina

BRFI’s Annual Report briefly noted they had visited Argentina where they have no exposure. However, they are excited by the work the country is currently undertaking to increase its pipeline capacity for oil exports. They see a significant increase in export earnings as a game changer for the country.

Brazil

UEM’s December update noted that stocks were down in Brazil. Specifically, waste treatment and recovery stockOrizonwas down by 13.7% and Brazilian government controlled Eletrobras (which operates in the areas of generation, transmission and distribution of electricity) was down by 11.9%.

Chile

UEM’s December update briefly mentioned thatEngie Energia Chile(electric generation, gas and transmission, and renewable energy) was up by 6.6%. No further explanation was given as to why.

BRFI’s Annual Report also mentioned buying Banco Santander Chile (the largest bank in the Chilean market in terms of loans and assets) on the belief that interest rates are likely near peak.

Colombia

BRFI’s Annual Report noted oil exporter Ecopetrol – the largest company in Colombia and one of the main integrated energy companies in the American continent. In Colombia, Ecopetrol is responsible for more than 60% of the hydrocarbon production of most transportation, logistics, and hydrocarbon refining systems, and it holds leading positions in the petrochemicals and gas distribution segments. BRFI specifically mentioned the Company’s free cash flow yields look quite attractive under a higher-for-longer oil price regime.

Mexico & Central America

The December update for The Mexico Fund, Inc (NYSE: MXF) noted the MSCI Mexico Index registered a decrease of 7.4% and the Mexican peso depreciated 1.2% during the month. Mexico’s Central Bank (“Banxico”) also increased its overnight interest rate by 50 basis points to 10.50% to maintain an attractive spread to the U.S. interest rate of 600 basis points.

UEM’s December update noted that Mexican airports, Grupo Aeroportuario del Pacífico (GAP) (operates 12 airports in the Pacific region of Mexico) and Grupo Aeroportuario del Centro Norte (OMA) (which holds the concessions to operate, manage, and develop 13 international airports in central and northern Mexico) both declined by 10.4% – reflecting weakness in the Mexican stock market.

In mid-December, The Mexico Fund, Inc also posted its Annual Report for the fiscal year ended October 31, 2022. The fund increased its position in the consumer sector due to a resilient consumption environment, high cash flow generation, and strong balance sheets. On the other hand, they decreased their position in the communications sector (to take advantage of strong share price increases) and the industrial sector.

During the fund’s fiscal year, there were sharp increases in the share prices of Grupo Aeroportuario del Centro Norte (OMA), Alpek (petrochemicals and one of the largest integrated PTA and PET producers), and Corporación Inmobiliaria Vesta (industrial buildings and distribution centers) and decreases in the share prices of Grupo Televisa (the world’s leading Spanish-language media and content company), and Grupo México(copper mining, railroads, and infrastructure).

There were also share price increases in Grupo Financiero Inbursa(financial services), Grupo Financiero Banorte (the second largest financial group in Mexico), and Fibra Uno (the first and largest REIT in Mexico) while Ternium (flat steel production) and Orbia Advance Corporation (polymer solutions, building and infrastructure, precision agriculture, connectivity solutions, and fluorinated solutions) saw decreases.

The MXF Annual Report ended by noting:

The outlook for the Mexican equity market is relatively favorable as Mexican macroeconomic variables are strong, public finances remain solid and absolute and relative interest rates are attractive, translating in a strong exchange rate.

Finally, BRFI’s Annual Report mentioned Panama based Copa airline and how the regional carrier continues to benefit from the tourism rebound.

That’s it for this week. Hopefully, this post has provided some interesting stock pick or investing ideas to further investigate on your own. Any feedback or comments would be appreciated.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

EM Fund Stock Picks & Country Commentaries (January 17, 2023) was also published on our Substack.

Emerging Markets Investing Tips + Advice

Emerging Market Skeptic (Website)

Website List Updates + Site Map

Stocktwits @EmergingMarketSkptc

Similar Posts:

- EM Fund Stock Picks & Country Commentaries (January 31, 2023)

- EM Fund Stock Picks & Country Commentaries (March 21, 2023)

- EM Fund Stock Picks & Country Commentaries (June 13, 2023)

- EM Fund Stock Picks & Country Commentaries (January 10, 2023)

- EM Fund Stock Picks & Country Commentaries (February 14, 2023)

- Credit Suisse: Saudi Arabia and Qatar Set to Lose Big After UBS Deal (Middle East Eye)

- EM Fund Stock Picks & Country Commentaries (May 19, 2024)

- EM Fund Stock Picks & Country Commentaries (June 30, 2024)

- EM Fund Stock Picks & Country Commentaries (February 7, 2023)

- EM Fund Stock Picks & Country Commentaries (May 2, 2023)

- EM Fund Bank & Financial Stock Picks (Q1 2023)

- EM Fund Stock Picks & Country Commentaries (July 25, 2023)

- EM Fund Stock Picks & Country Commentaries (December 20, 2023)

- EM Fund Stock Picks & Country Commentaries (January 7, 2024)

- EM Fund Stock Picks & Country Commentaries (April 18, 2023)

1 thought on “EM Fund Stock Picks & Country Commentaries (January 17, 2023)”