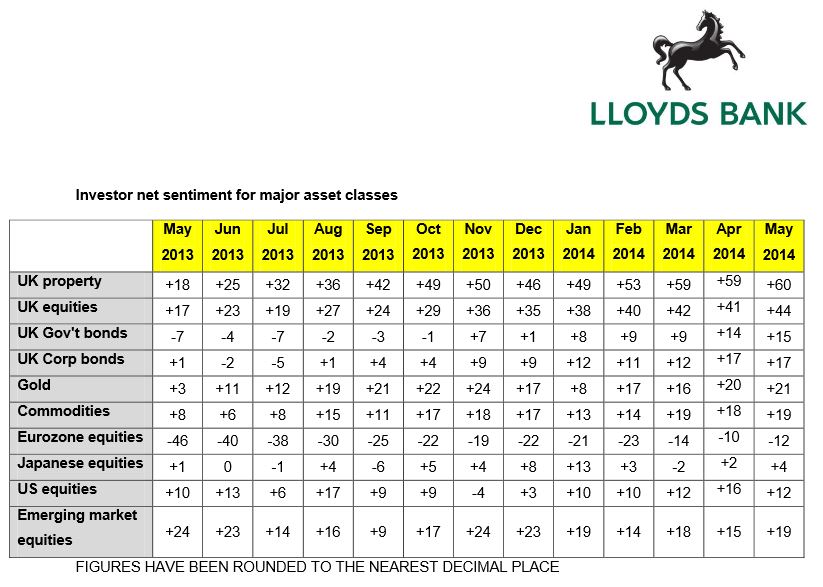

The latest Lloyds Bank investor sentiment survey reveals more confidence in emerging market stocks and less confidence in US stock that is possibly due to a combination of weather-related slowdown and concerns over possible overvaluation:

See the summary of Investor confidence in emerging markets may be turning here and the full press release here.

Similar Posts:

- Investor Sentiment Survey: What Emerging Market Investors Think (Franklin Templeton)

- YPO CEO Survey: UAE Business Confidence Declines Significantly (YPO)

- Brazil Consumer Confidence Falls in Latest Nielsen Survey

- 87% in China & 80% in India Say Their Economies Are Good (Pew)

- Nielsen Global Survey of Consumer Confidence for Q1 2015

- YPO CEO Survey: Africa CEO Confidence at 5-year Low (YPO)

- Societe Generale Survey: Fund Managers Turning Bearish on Emerging Markets (CNBC)

- Lessons From a Decade of Chinese Stock Trading (WSJ)

- India Ranks Highest in Latest Nielsen Consumer Confidence Survey

- YPO CEO Survey: Asia CEO Confidence at 2-year Low (YPO)

- EM Fund Stock Picks & Country Commentaries (February 4, 2024)

- 49% of UK Investment Professionals Think Developed Country Equities are Overvalued (funds europe)

- YPO CEO Survey: Brazil CEO Confidence Stagnates (YPO)

- Survey: Fund Managers Now Overweight on Emerging Market Equities (Live Mint)

- Pekao (WSE: PEO / FRA: BP1): Poland’s Second Largest Bank Positioned for a Polish Growth Slowdown