There have been several interesting articles about the US Dollar and the ominous warning signs coming out of emerging markets. Meanwhile, WisdomTree will be launching the WisdomTree Emerging Markets ex-China Fund for investors who want emerging market exposure that avoids the mounting problems in China. Likewise, India is looking like a good bet in a world full of problems plus its politically well settled.

Meanwhile, Brazil’s elections are coming and the western media (in unison) is saying Jair Bolsonaro is behind in their polls (Note: They were also way off with their predictions for the recent results of the vote for Chile’s new Constitution). As stated in the past, its hard to find any objective Brazil election coverage given how much the western media hates Bolsonaro, while many foreign investors tend to like Luiz Inacio Lula da Silva. Foreign investors remember the go-go years under his rule that enriched investors rather than the decade long crash and corruption scandals that Brazilians tend to remember that followed his rule.

Finally, the Bretton Goods Substack has an interesting book review (Gambling on Development) that’s worth reading by emerging and frontier market investors. The book’s core thesis: “Economic development is dependent on the deal between elites of a country.”

Subscribe Now Via Substack

Suggested Reading

$ = behind a paywall

Emerging Markets Start Sending Out Warning Signals Against The Soaring Dollar (Zero Hedge)

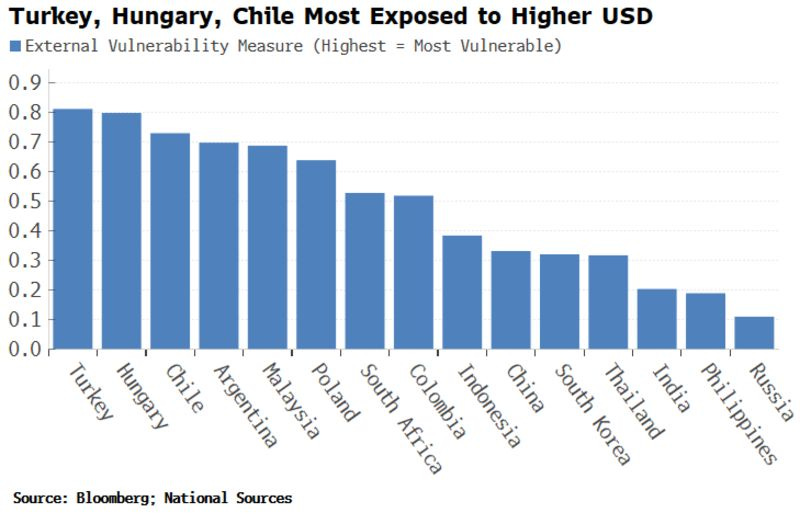

- Bloomberg’s Simon White today looks at Turkey and Chile, which “are sending an ominous signal for broader EM equity returns” and may be the first EMs to break as a result of the soaring dollar.

- Chile and especially Turkey have among the highest and fastest rising levels of inflation.

- But now both Turkey and Chile’s stock markets are suddenly tumbling. There are reasons specific to each country that might explain this – a rout in Turkish bank stocks, political and social unrest in Chile. But both countries are facing an increasingly intolerable reversal in capital flows, compounded by rising energy prices and, in Chile’s case, falling copper prices.

Emerging-Market Capital Outflow Risk Rises With US Dollar (Bloomberg)

- I created an External Vulnerability Measure based on the IMF’s reserve adequacy score. This version has three inputs: reserve adequacy with respect to exports, short-term debt (the latter is the Greenspan-Guidotti ratio), and the current account.

- The measure has Turkey, Chile, Hungary and Argentina as the most vulnerable to capital outflow.

It’s Not Just the Dollar: Global Fiat Money Is a Mess (Mises Institute)

- On this episode of Radio Rothbard, Ryan McMaken and Joseph Solis-Mullen take a look at brewing debt crises in emerging markets and how the dollar still looks good when compared to other global currencies.

How a Strong Dollar Affects International Currencies & Commodities (CME Group)

- As the ”invoicing” currency of the world, when the U.S. dollar appreciates, other currencies essentially depreciate

- The reliance on commodities is particularly high for oil exporters such as Brazil, Mexico and Russia, and on metal and agricultural exporters such as South Africa and Chile.

Global Rate Hikes Raise Contagion Risk Beyond Emerging Markets. Here’s Where to Look. (Barron’s)

- The average sovereign spread of the 15 largest frontier economies has soared to a distressed level of 1000 basis points over U.S. Treasuries, notes Gavekal analyst Victor Tsui in a note to clients. A strong dollar makes it harder for indebted countries to finance their liabilities since their own currencies are worth less—and that in turn can hit confidence in their ability to repay their debt thereby adding even more pressure on their currency—what Tsui describes as a “self-reinforcing downward spiral.” While these countries aren’t heavily represented in equity investors’ portfolios, Tsui notes they make up almost a fifth of the JP Morgan EMBI global diversified index, creating “a sizable risk of contagion” to the broader emerging market debt ecosystem if stresses rise further.

Top Emerging Markets Hiking Interest Rates Last Week: Indonesia, UAE & More (Investing.com)

NOTE: Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status).

- Indonesia: The country’s central bank announced a higher-than-expected interest rate hike on Thursday by 50 bps to 4.25%.

- United Arab Emirates: It announced a 75 bps interest rate hike, at par with the Fed to 3.15%.

- South Africa: The South African Reserve Bank hiked the repurchase rate by 75bps to 6.25% for the 6th consecutive time.

- Saudi Arabia: The Saudi Central Bank hiked rates by 75 bps to 3.25%.

- Philippines: The country’s central bank undertook the highest interest rate hike in over 3 years by 50 bps to 4.25%.

- Taiwan: The central bank raised interest rates by 12.5 bps for the third consecutive quarter.

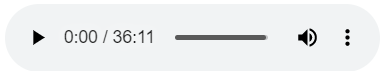

Unpacking Your Portfolio’s Exposure to China (WisdomTree)

- As the Chinese market continues growing, investors with broad EM exposure have been left with a 33% position in a market that has an incredible amount of both headwinds and tailwinds, making it complicated to implement their specific asset allocation views.

- WisdomTree is launching XC – the WisdomTree Emerging Markets ex-China Fund – which will track the WisdomTree Emerging Markets ex-China Index, which rebalances on an annual basis and provides investors with exposure to non-state-owned companies (non-SOEs) in emerging market countries excluding China.

- Excluding China from a broad EM universe has considerable consequences in terms of fundamentals, sector and country exposures.

Five Myths About China. And why they will get us killed. (American Mind)

- Myth #1: America is making China rich, and can weaken it by reducing imports, investment, and so forth.

- Myth #2: China depends on stolen American technology.

- Myth #3: China faces demographic collapse.

- Myth #4: China wants to take over Taiwan because it is led by an expansionist Marxist-Leninist party that hates and fears democracy.

- Myth #5: We can deter China by shifting military forces to Asia and adding to conventional capabilities.

India Is the ‘Best Bet’ in the Global Economy, Says Conglomerate Exec (CNBC)

- The Hinduja Group is headquartered in India though it owns businesses across many industrial sectors and has a presence in nearly 40 countries, including the United Kingdom, Switzerland and the United States. Its flagship business is Ashok Leyland, one of India’s leading commercial vehicle manufacturers.

- Ashok Hinduja explained: “We see a recession coming in U.S., recession coming in U.K., in Europe, problems in China, [a] problem in Southeast Asia under the fear of China-Taiwan. So looking to the overall scene, we focus now [on] India as an emerging market.”

- “India, politically, is well settled,” the chairman told CNBC’s Tanvir Gill.

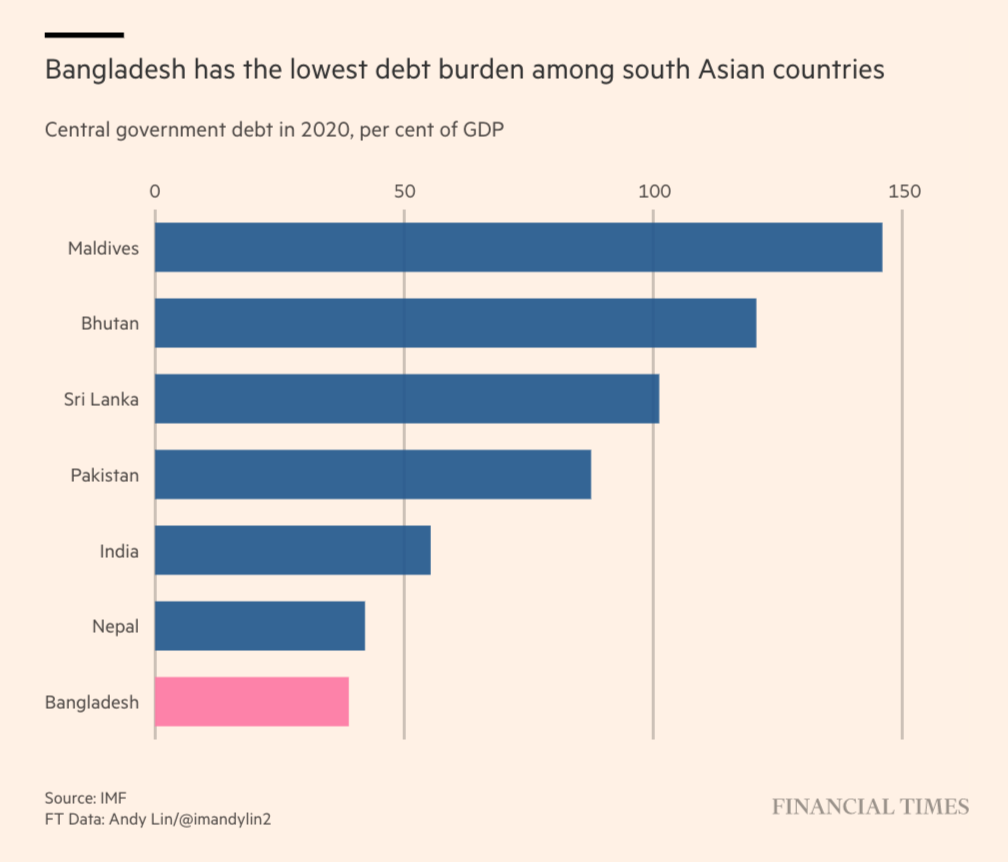

Chartbook #153: The South Asian Polycrisis (Chartbook Substack)

Note: Good overview of the problems South Asia faces.

- Throughout the 2022 crisis period, the giant of South Asia, India has remained outside the headlines. It has, experienced the shock to energy prices that the entire world has gone through. India’s import bill for fossil fuels has surged and the rupee has fallen to historic lows.

Investors Love and Hate Lula a Decade After He Made Them Very Rich (Bloomberg)

- Those eyeing his comeback are split into two camps: locals who loathe him and foreigners who welcome his return.

- His handpicked successor was impeached; the economy tanked; poverty soared; and a corruption scandal rocked the country, ultimately landing him in jail for 580 days.

- Bruno Coutinho’s, the co-founder and chief executive of Rio de Janeiro-based Mar Asset Management, playbook for a Lula presidency: Buy liquid, large-cap stocks, which figure to attract much of the foreign money that pours into the market, as well as consumer stocks, which should benefit from his administration’s push to bolster household spending. Emy Shayo, an equity strategist at JPMorgan Chase & Co., sees it much the same way. She puts retailers, especially grocery stores, that cater to lower-income Brazilians high on her recommendation list if Lula wins.

- Healthcare was seen as more important in Europe and Asia (both 95%) compared to the US (75%).

- Technology, telecoms and IT were more important in Asia (93%) compared to Europe (81%) and the US (75%).

- For investors in Asia, emerging market population growth was deemed an ‘extremely important’ aspect of demographic change for investment strategy by half of respondents (51%), compared with 21% in Europe and 15% in the US.

- Diversity and equality was deemed to be an ‘extremely important’ aspect by 30% of US investors, compared with 24% in Asia and 17% in Europe.

- Institutional investors indicated that Equities (52%), Real Estate (50%) and Infrastructure (47%) were the asset classes indicated as most likely to benefit from allocations as a result of demographic change.

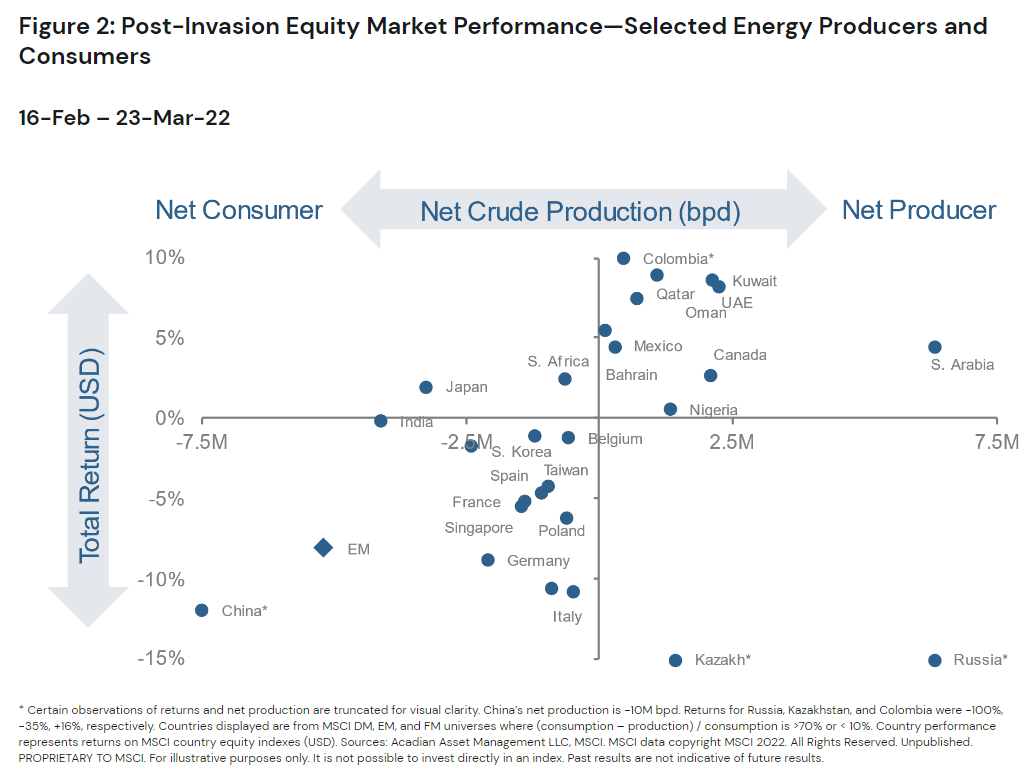

Reflections on the Ukraine Crisis: Watershed for EM Investing? (Acadian)

- Latent energy risk in the highest-profile EM benchmark should be viewed as a flaw in an active strategy.

Gambling on Development Review – How the politics of countries matters for development (Bretton Goods Substack)

Note: The book has aninteresting take on emerging-frontier market development:

- Economic development is dependent on the deal between elites of a country. In most poor countries, elites choose to extract resources from the economy because the policies that lead to development can endanger their political position.

- When elites decide to have pro-growth policies, they’re taking a risk that it will work out and benefit them personally. Most elites do not want to take this risk, and would rather enjoy the spoils of corruption instead.

- Some circumstances like the possibility of losing legitimacy (e.g. China after the Cultural Revolution) can force elites to focus on economic growth. But this doesn’t guarantee it. Elites also have to ration state capacity wisely and be open to correcting course for countries to escape extreme poverty.

- In Egypt, Thailand and Pakistan, their militaries have coerced the government into giving them large amounts of power and economic resources. The ensuing elite bargain is that the country’s economic resources are used to further the interests of the military, while civilian leaders do not have much power. This doesn’t lead to much economic development because policy is usually skewed to help the military, large amounts of tax money is used on military spending and so, the economy’s resources are used primarily for the military’s ends. In some countries the political elites loot whatever resources exist in a competitive free-for-all between them.

- It is really important to understand that an extractive elite is the default.

Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

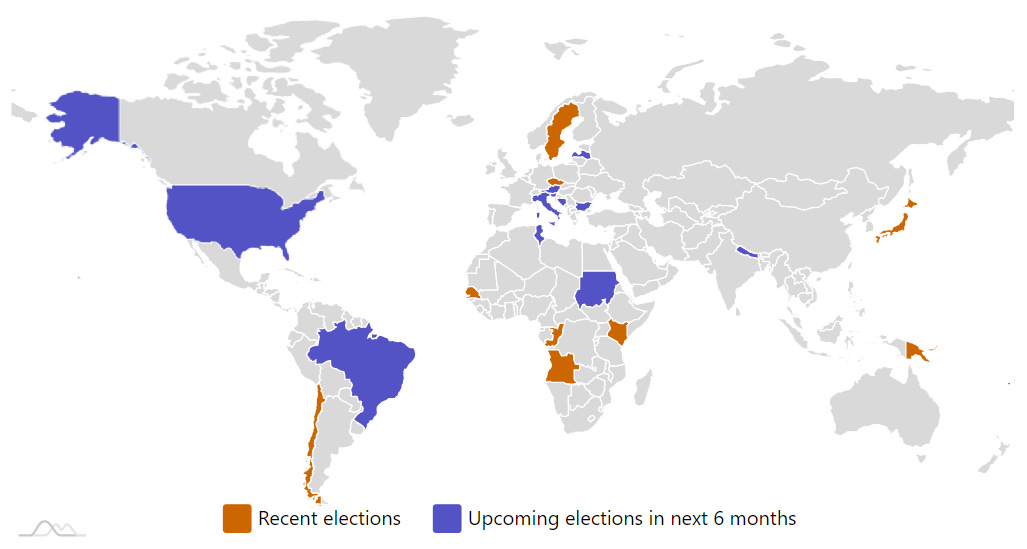

Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

- Brazil President Oct 2, 2022 (d) Confirmed Oct 30, 2022

- Brazil Brazilian Federal Senate Oct 2, 2022 (t) Confirmed Oct 7, 2018

- Brazil Brazilian Chamber of Deputies Oct 2, 2022 (d) Confirmed Oct 7, 2018

- Bosnia and Herzegovina Bosnia and Herzegovina House of Representatives Oct 2, 2022 (d)

- Bosnia and Herzegovina Chairman of the Presidency Oct 2, 2022 (d)

- Nepal House of Representatives of Nepal Nov 20, 2022 (d) Confirmed May 13, 2022

- Fiji Fijian House of Representatives Nov 30, 2022 (d) Date not confirmed Sep 17, 2014

- Bahrain Bahraini Council of Representatives Nov 30, 2022 (t) Date not confirmed Dec 1, 2018

- Tunisia Tunisian Assembly of People’s Representatives Dec 17, 2022 (d) Confirmed Oct 6, 2019

Check out: Thoughts for Investors: Bongbong Marcos Wins the 2022 Philippines Elections in a Landslide

IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Wuxin Technology Holdings, Inc.WXT, 6.0M, $4.50-6.50, $33.0 mil, 9/23/2022 Postponed

- We are on a mission to enable and accelerate the digital transformation of Chinese and global businesses that depend on physical operations by providing Internet of Things (the “IoT”) connectivity solutions. (Incorporated in the Cayman Islands)We are not a Chinese operating entity but a Cayman holding company with operations conducted by our subsidiaries in China. Our operating entity, Wuxin Technology, is a high-tech enterprise engaged in the IoT industry, which was formed in 2005 and is headquartered in Shenzhen, China. The IoT describes the network of physical objects — “things” — that are embedded with sensors, software, and other technologies for the purpose of connecting and exchanging data with other devices and systems over the internet.To realize our vision, we have developed and pioneered the ant delete center (“ADC”) protocol, which is a wireless, decentralized and ad hoc protocol derived from the foraging principle of ant colonies and allows an IoT network of numerous nodes to efficiently detect the shortest path of data transmission and decentralize the control. Compared with those adopting traditional protocol architecture of centralized control, our products with ADC protocol have advantages of lower cost, higher reliability, longer transmission distance, and faster deployment. ADC protocol also standardizes protocol stack and application layer, which is the interface between the IoT devices and the network that they communicate to, lowering the technical barrier for those industrial segments which could have been unable to enter the IoT ecosystem otherwise.We sell ADC chips, modules, antennas, controllers, smart hardware, smart household devices, and other smart products. We provide integrated solutions for IoT engineering and cloud platforms for customers.

YanGuFang International Group Co., Ltd.YGF, 5.0M, $5.00-7.00, $30.0 mil, 9/26/2022 Week of

- We are a holding company incorporated as an exempted company on May 28, 2020, under the laws of the Cayman Islands. As a holding company with no material operations of our own, we conduct substantially all of our operations through our PRC (People’s Republic of China) subsidiary and VIEs in China. We are primarily engaged in the production, research and development, and sales of oat and grain products through our own sales team and distribution network. We are driven by a creative and experienced management team, led by Junguo He, our chairman and CEO, with a focus on the healthy food industry and a fresh take on our mission, building from our deep understanding of and commitment to oat-based food science.Our mission is to build a new type of healthy food company with core values of safety, health, nutrition and sustainability, supported by our advocates of scientific diet structure and different approaches to our brand and commercial strategy.In 2014, we produced a new kind of oat germ groats in the form of whole grains through our patented equipment, which brought healthier oat products to the daily diets of the consumers.Our commitment to oats has resulted in core technical advancements that enable us to unlock the breadth of our product portfolio, which is broadly categorized into oat series products (including, but not limited to, oat germ groats, oatmeal, oat flour, oat bran, some of which are organic or green food series) and oat nutrient and health series products (including, but not limited to, oat peptide series, dietary fiber powder, oat biscuits, oil series, oat hand cream and soap, and oat toothpaste). Based on our vision and understanding of oats, we also source products from third party suppliers that complement our product portfolio.We seek to build our market position both in the PRC and internationally. In the PRC market, our business operations cover many provinces and cities of China, including but not limited to, Beijing, Shanghai, Jiangsu, Zhejiang, Fujian, Guangdong, Inner Mongolia, and Anhui.We also seek to establish our presence internationally and currently sell our products through a distributor in Thailand. As part of our plan to expand our international footprint, we expect to commence sales of our products in the United States during the second half of 2022.

ParaZero Technologies Ltd.PRZO, 3.0M, $5.20-7.20, $18.9 mil, 9/30/2022 Friday

- We are an aerospace company that is focused on drone safety systems and engaged in the business of designing, developing, and providing what we believe are best-in-class autonomous parachute safety systems for commercial drones, also known as unmanned aerial systems or UAS. (Incorporated in Israel)……We have a global distribution footprint and have forged partnerships all around the world, including India, South Korea, the United States, Latin America and Europe. We sell our drone safety systems as off-the-shelf solutions, as well as perform integrations with original equipment manufacturers, or OEMs, offering customized, bespoke safety solutions for a large variety of aerial platforms.Our technology has been sold to and used by some of the world’s top companies and organizations, including drone companies such as LIFT Aircraft, Airobotics, SpeedBird Aero and Doosan Corporation, and other leading brandss such as CNN, The New York Times, Hensel Phelps, Verizon Media (Skyward), Fox Television, the Chicago Police Department and Fortis Construction.

ETF Launches

Climate change and ESG are clearly the latest flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

- KraneShares Launches S&P Pan Asia Dividend Aristocrats ETF on NYSE (Ticker: KDIV)KDIV tracks the S&P Pan Asia Dividend Aristocrats Index, which provides exposure to companies in China, Japan, Australia, and other Asian countries that have paid and increased their dividends over a sustained period. Studies by S&P Dow Jones Indices have shown that over the long-term, dividend-paying companies have outperformed their corresponding broad market indexes on a risk-adjusted basis1. KDIV gives investors access to the S&P Dividend Aristocrats methodology applied to the Pan Asia region, one of the fastest-growing areas in the world.

- 7/14/2022 – Matthews China Active ETF MCH – Active, equity, China

- 7/14/2022 – Matthews Emerging Markets Equity Active ETF MEM – Active, equity, emerging markets

- 7/14/2022 – Matthews Asia Innovators Active ETF MINV – Active, equity, Asia

- 6/30/2022 – BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF XEMD – Passive, fixed income, emerging markets

- 5/2/2022 – AXS Short CSI China Internet ETF SWEB – Active, inverse, thematic

- 4/27/2022 – Dimensional Emerging Markets High Profitability ETF DEHP – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Core Equity 2 ETF DFEM – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Value ETF DFEV – Active, equity, emerging markets

- 4/27/2022 – iShares Emergent Food and AgTech Multisector ETF IVEG – Passive, equity, thematic [Mostly developed markets]

- 4/21/2022 – FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM – Passive, equity, ESG

- 4/6/2022 – India Internet & Ecommerce ETF INQQ – Passive, equity, thematic

- 2/17/2022 – VanEck Digital India ETF DGIN – Passive, India market, thematic

- 2/17/2022 – Goldman Sachs Access Emerging Markets USD Bond ETF GEMD – Passive, fixed income, emerging markets

- 1/27/2022 – iShares MSCI China Multisector Tech ETF TCHI – Passive, China, technology

- 1/11/2022 – Simplify Emerging Markets PLUS Downside Convexity ETF EMGD – Active, equity, options strategy

- 1/11/2022 – SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG – Passive, equity, ESG

ETF Closures/Liquidations

Frontier and emerging market highlights:

- 8/22/2022 – iShares MSCI Argentina and Global Exposure ETF AGT

- 8/22/2022 – iShares MSCI Colombia ETFI COL

- 6/10/2022 – Infusive Compounding Global Equities ETF JOYY

- 5/3/2022 – ProShares Short Term USD Emerging Markets Bond ETF EMSH

- 4/7/2022 – DeltaShares S&P EM 100 & Managed Risk ETF DMRE

- 3/11/2022 – Direxion Daily Russia Bull 2X Shares RUSL

- 1/27/2022 – Legg Mason Global Infrastructure ETF INFR

- 1/14/2022 – Direxion Daily Latin America Bull 2X Shares LBJ

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as some ETF lists are still being updated as of Summer 2022).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer: EmergingMarketSkeptic.Substack.com and EmergingMarketSkeptic.com provides useful information that should not constitute investment advice or a recommendation to invest. In addition, your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content.

Emerging Market Links + The Week Ahead (September 26, 2022) was also published on our Substack.

Emerging Markets Investing Tips + Advice

Emerging Market Skeptic (Website)

Website List Updates + Site Map

Stocktwits @EmergingMarketSkptc

Similar Posts:

- Gambling on Development Review – How the Politics of Countries Matters for Development (Bretton Goods Substack)

- Emerging Market Links + The Week Ahead (June 6, 2022)

- Emerging Market Links + The Week Ahead (September 5, 2022)

- Emerging Market Links + The Week Ahead (October 10, 2022)

- Sleeping Giants – The Case for Emerging Markets (Robeco Webinar)

- Infographic: Countries Not Using the US Dollar for Trade (Sputnik)

- Emerging Market Links + The Week Ahead (August 1, 2022)

- Emerging Market Links + The Week Ahead (November 21, 2022)

- Emerging Market Links + The Week Ahead (May 30, 2022)

- Emerging Market Links + The Week Ahead (October 3, 2022)

- Emerging Market Links + The Week Ahead (June 27, 2022)

- Emerging Market Links + The Week Ahead (September 19, 2022)

- Emerging Market Links + The Week Ahead (August 22, 2022)

- Emerging Market Links + The Week Ahead (November 14, 2022)

- Emerging Market Links + The Week Ahead (January 23, 2023)