Its now confirmed that China has been buying gold by the ton as they prepare for global multipolarity (and maybe more?) while India looks well prepared for growth in an increasingly multipolar world.

Meanwhile, Latin America (see our Latin America ADRs, Latin America Closed-End Funds and Latin America ETFs lists) faces a growing debt problem that could hit late next year or 2024. In the mean time, Peru’s fundamentals remain strong despite more political turmoil and uncertainty (see our Peru ADRs and Peru ETFs lists) while Argentina’s Cristina Fernández faces a ban on holding public office as the country’s economic situation continues to worsen (see our Argentina ADRs and Argentina ETFs lists).

Finally, the stars may be aligning for emerging markets next year depending on the strength of the US Dollar. However, emerging market investors will still need to have a disciplined allocation strategy.

Subscribe Now Via Substack

Suggested Reading

$ = behind a paywall

China Confirms It Is “Mystery” Massive Gold Buyer With First Official Purchase In 3 Years (Zero Hedge)

- One month ago, we sparked a frenzy across precious metals circles when we reported that a “mystery” buyer had bought some 300 tons of gold, roughly three quarters of what would be a record 399 tons of central bank gold purchases in the third quarter.

Gold channeling East – How much does China really own? Feat. London Paul Live From The Vault -Ep103 (Kinesis Money Youtube) 1:14 Hours

- 00:00 Start

- 02:46 London Paul explains the “multipolar” world

- 07:04 The return of sound money?

- 14:00 What’s going on in the world right now

- 28:30 Does China have the power to control global inflation?

- 36:27 How is the gold market changing?

- 48:35 What happens when gold gets repriced?

Global Thematics: What’s Behind India’s Growth Story? (Morgan Stanley) Podcast includes Transcript

Note: See our India ADRs, India Closed-End Funds and India ETFs lists.

- Mike, the full global trends of demographics, digitalization, decarbonization and deglobalization that we keep discussing about in our research files are favoring this new India. The new India, we argue, is benefiting from three idiosyncratic factors.

- The first one is India is likely to increase its share of global exports thanks to a surge in offshoring.

- Second, India is pursuing a distinct model for digitalization of its economy, supported by a public utility called India Stack. Operating at population scale India stack is a transaction led, low cost, high volume, small ticket size system with embedded lending. The digital revolution has already changed the way India handles documents, the way it invests and makes payments and it is now set to transform the way it lends, spends and ensures. With private credit to GDP at just 57%, a credit boom is in the offing, in our view.

- The third driver is India’s energy consumption and energy sources, which are changing in a disruptive fashion with broad economic benefits. On the back of greater access to energy, we estimate per capita energy consumption is likely to rise by 60% to 1450 watts per day over the next decade.

- We are anticipating a wave of manufacturing CapEx owing to government policies aimed at lifting corporate profits share and GDP via tax cuts, and some hard dollars on the table for investing in specific sectors. Multinationals are more optimistic than ever before about investing in India, and that’s evident in the all-time high that our MNC sentiment index shows, and the government is encouraging investments by building both infrastructure as well as supplying land for factories. The trends outlined in Morgan Stanley’s Multipolar World Thesis, a document that you have co authored, Mike, and the cheap labor that India is now able to offer relative to, say, China are adding to the mix. Indeed, the fact is that India is likely to also be a big consumption market, a hard thing for a lot of multinational corporations to ignore. We are forecasting India’s per capita GDP to rise from $2,300 USD to about $5,200 USD in the next ten years. This implies that India’s income pyramid offers a wide breadth of consumption, with the number of rich households likely to quintuple from 5 million to 25 million, and the middle class households more than doubling to 165 million. So all these are essentially aiding the story on India becoming a factory to the world. And the evidence is in the sharp jump in FDI that we are already seeing, the daily news flows of how companies are ramping up manufacturing in India, to both gain access to its market and to export to other countries.

- Three sectors are worth highlighting here. The coming credit boom favors financial services firms. The rise in per capita income and discretionary income implies that consumer discretionary companies should do well. And finally, a large CapEx cycle could lead to a boom for industrial businesses. So financials, consumer discretionary and industrials.

Daily Voice | This wealth manager feels India’s growth outlook may be lowered on likely drop in global earnings (Moneycontrol)

- Raghvendra Nath of Ladderup Wealth Management expects FII flow to increase over the next year considering the opportunity that Indian markets provide to investors.

- We think the auto industry has largely bottomed out. Along with price increases and growing finance costs, which continued to have an impact on auto sales, the semi-conductor supply continued to operate as a headwind for the automotive industry.

- In the coming years, coal will continue to be a crucial commodity for India, thus it’s critical that production maintains up with demand to prevent imports. The availability of coal and the summertime are two elements that have a significant impact on the electricity business.

Vietnam: It’s time to level up (Noahpinion Substack)

- Economic reforms led to a burst of spectacular growth, but the country needs a lot more if it wants to get rich.

- I’ve been writing a series of posts focusing on various countries’ economic development, generally trying to apply the lens of the “industrialist” theory of development — the framework laid out by Ha-Joon Chang, Joe Studwell, and a few others. Today I thought I’d cover another successful case: Vietnam.

Analysis: Peru markets take in political drama as investors focus on fundamentals (Reuters)

Note: See our Peru ADRs and Peru ETFs lists.

- “You have fairly high credit ratings – on the back of low debt to GDP ratio – a high level of international reserves, a large share of debt in local currency, a current account deficit almost fully covered by foreign direct investment,” said Alejo Czerwonko, CIO for Emerging Markets Americas at UBS Global Wealth Management.“So much political uncertainty is never welcome, yet the reason why markets have historically shrugged off political developments in Peru has to do with the fact that the country’s fundamentals are decently strong.”

Cristina Fernández may not go to jail but verdict upends Argentina’s politics (Guardian)

Note: See our Argentina ADRs and Argentina ETFs lists.

- But on Tuesday she was sentenced to six years in prison in a verdict, which if upheld on appeal, will also ban her from holding public office for the rest of her life.Fernández immediately announced that she would not run for president, or any other kind of elected office, in the 2023 elections. The court’s ruling appeared to have abruptly sidelined the country’s most powerful – and most polarising – politician since Juan and Eva Perón, leaving many Argentinians wondering: what will come next?

- Amid a worsening economic panorama, deep divides have emerged in their Frente de Todos coalition this year over issues including a March deal to renegotiate a large sovereign debt owed to the IMF. While Alberto has pursued a market-calming, conciliatory strategy, Cristina has pushed for a more hardline approach to the Washington-based lender.

Latin America and the coming global debt crisis (Latin America Risk Report Substack)

Note: See our Latin America ADRs, Latin America Closed-End Funds and Latin America ETFs lists.

- Global Poor Lose Services as Developing Countries Face Higher Debt Payments (WSJ) $ and Defaults Loom as Poor Countries Face an Economic Storm (NYT)

- Despite not being the epicenter of the crisis, Latin American countries face payment crises, political backlash, and international tension as debt pressures mount worldwide.

- The problems in Latin America won’t hit immediately and will continue to build for many months.

- The debt payment problem will build across 2023, peaking with a payment crisis in some countries in the final quarter of next year or the first half of 2024.

- In terms of problems hitting earlier, Argentina is the biggest concern as the political campaign and election could accelerate the economic crisis.

This Emerging Markets Manager Keeps Outperforming With This Strategy (Institutional Investor)

- Edinburgh-based Stewart Investors is betting that companies in emerging markets — unlike their developed market peers — will be able to build sustainability into their processes from the start.

- Stewart Investors, which has $17 billion in assets under management, doesn’t invest in markets that are highly regulated, due to the often cozy ties that exist between the government and company owners in some emerging countries. Many companies are often controlled by governments or families in the developing world. “We think any business that can be destroyed with the stroke of a regulator’s pen is, in the final analysis, not a strong one,” Nelson said.

Investors look to emerging markets as planets align for end of U.S. dollar bull market (The Globe & Mail)

- Amundi’s Upadhyaya is focusing on the currencies of high-yielding emerging market countries that have balanced current accounts and smaller budget deficits, including the Brazilian real, Peruvian sol= and Indian rupee.Some emerging markets offer attractive yield even adjusted for inflation. For instance, the inflation-adjusted yield on the U.S. 10-year Treasuries is at 1.08%, compared with 6.07% for the Brazilian equivalent.

A Simple Allocation Strategy for Including EM Stocks in Global Portfolios (The Emerging Markets Investor)

- Any investor in emerging market bonds or stocks, unless he or she is a dedicated portfolio manager with a mandate to outperform an EM index on a short term basis (1-3years), should operate under the following assumptions.1.“Buy-and-hold” does not work in EM.2. Risk always trumps valuation in EM stocks and bonds.3. EM stocks are liquidity-driven trending assets.4. The U.S. dollar drives returns and is negatively correlated to EM stocks and bonds.

Frontier Markets Book List (Krish’s Garden on Notion)

- This book list consists of readings which provide a broad overview of various topics relating to frontier markets. It is meant to be an incomplete first pass at high level resources.

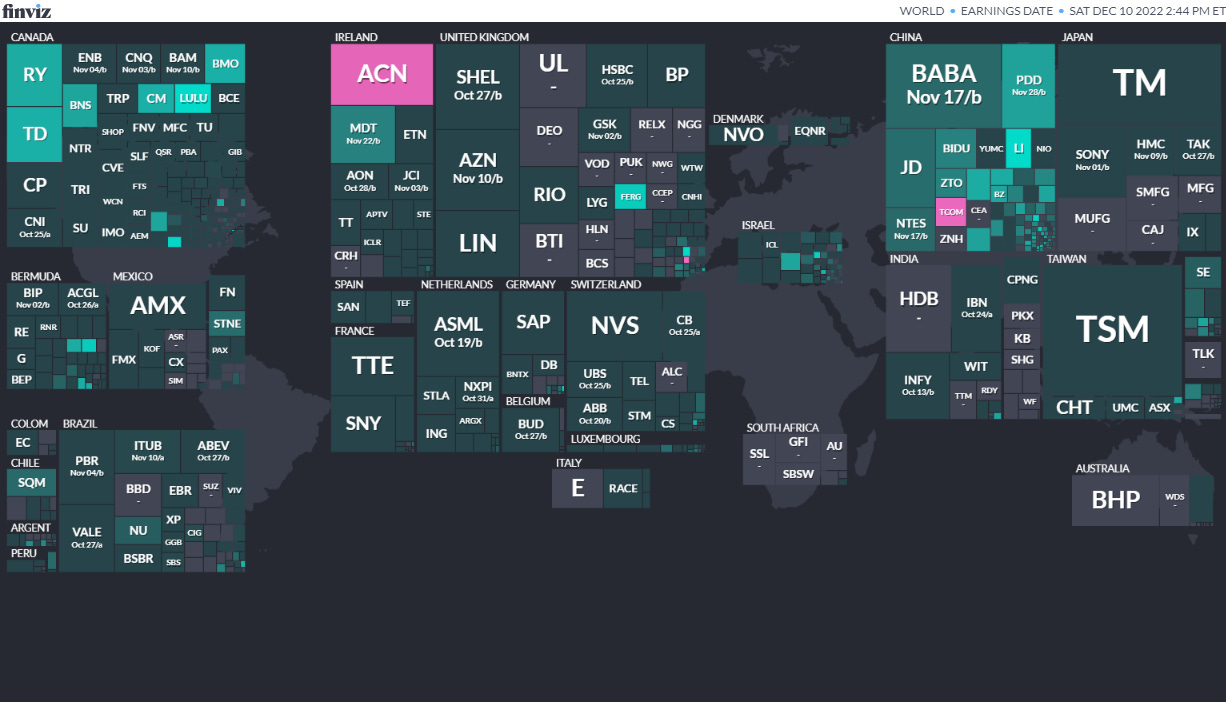

Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

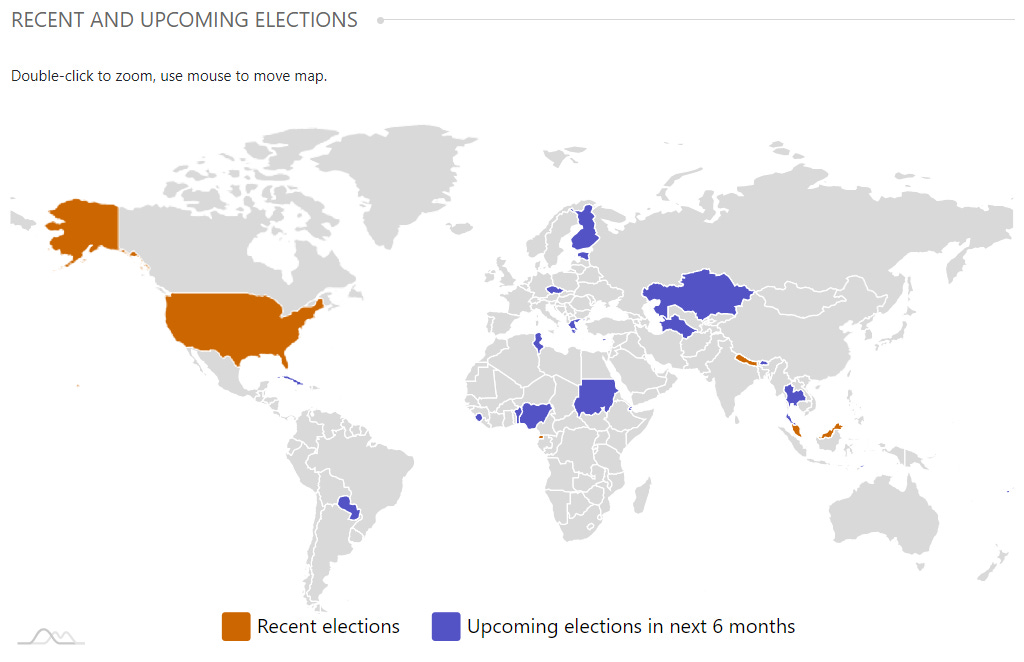

Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

- Fiji Fijian House of Representatives Dec 14, 2022 (d) Date not confirmed

- Tunisia Tunisian Assembly of People’s Representatives Dec 17, 2022 (d) Confirmed Oct 6, 2019

- Czechia President Jan 13, 2023 (d) Confirmed Jan 26, 2018

- Cyprus President Feb 5, 2023 (d) Confirmed Feb 4, 2018

- Nigeria Nigerian House of Representatives Feb 25, 2023 (d) Confirmed Feb 23, 2019

- Nigeria Nigerian Senate Feb 25, 2023 (d) Confirmed Feb 23, 2019

- Nigeria President Feb 25, 2023 (d) Confirmed

IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Erayak Power Solution Group Inc.RAYA, 3.0M Shares, $4.00-4.00, $12.0 mil, 12/13/2022 Tuesday

- Erayak Power Solution Group Inc. was formed in 2019 under the laws of the Cayman Islands. We conduct business primarily through our wholly owned subsidiaries, Zhejiang Leiya and Wenzhou New Focus, in the People’s Republic of China, or the PRC. Our company specializes in the manufacturing, research and development (“R&D”), and wholesale and retail of power solution products. Zhejiang Leiya’s product portfolio includes sine wave and off-grid inverters, inverter and gasoline generators, battery and smart chargers, and custom-designed products. Our products are customized and built to order, or BTO. Our BTO business model maximizes our flexibility in production scheduling, material procurement and delivery to meet our customers’ unique demands.Our products are used principally in agricultural and industrial vehicles, recreational vehicles (“RVs”), electrical appliances and outdoor living products. Our primary office is located in Zhejiang province, where we serve a large customer base throughout PRC and expand our reach to international clients. Our goal is to be the premier power solutions brand and a solution for mobile life and outdoor living. We seek to leverage our flexibility and passion for quality to provide a personalized mobile living solution for each customer.Since the founding of Zhejiang Leiya in 2009, it has grown to be a manufacturer that not only designs, develops and mass produces our own brand of premium power solution products, but has also established e-commerce channels in the retail chain. We, through our PRC subsidiaries, also offer our products in Japan, England, Germany, France, Spain, Switzerland, Sweden, the Netherlands, the U.S., Canada, Mexico, Australia, Dubai and nine other countries. Zhejiang Leiya manufactures all of our products in factories operating under quality management systems accredited by the International Organization for Standardization (ISO 9001:2015).We generated revenue mostly from three types of products: (1) inverters constituted approximately 82% and 86% of our total revenue for the fiscal years ended December 31, 2021, and 2020, respectively; (2) chargers, which generated approximately 7.52% and 7.39% of our total revenue for the fiscal years ended December 31, 2021, and 2020, respectively; (3) gasoline generators generated approximately 8.28% and 4.91% of our total revenue for the fiscal years ended December 31, 2021, and 2020, respectively.

Cadrenal Therapeutics, Inc.CVKD, 1.4M Shares, $5.00-5.00, $7.0 mil, 12/16/2022 Friday

- (**Note: Selling stockholders have registered to offer 1.7 million shares (1,704,783 shares) of common stock to be sold pursuant to a separate resale prospectus. We will not receive any proceeds from the sale of the common stock to be sold by the Selling Stockholders.)We are focused on developing tecarfarin, a novel therapy with orphan drug indication, designed for the prevention of systemic thromboembolism (blood clots) of cardiac origin in patients with end-stage renal disease, or ESRD, and atrial fibrillation (irregular heartbeat), or AFib. We secured the rights to tecarfarin on April 1, 2022, via an asset purchase agreement from HESP LLC, a wholly owned subsidiary of Horizon Technology Finance Corp., which in turn had bought tecarfarin and the other assets of Espero Biopharma, Inc.We intend to complete the clinical development of tecarfarin and seek FDA approval for the drug. We intend to initiate our pivotal Phase 3 clinical trial in the second half of 2023, subject to completion of this offering and funding from additional financings, which we believe will be our remaining pivotal trial based upon the latest feedback that the prior owner of tecarfarin had with FDA in 2019.We have licensed out the rights to tecarfarin for several Asian markets, including China, to Lee’s Pharmaceutical Holdings Limited, an integrated research-driven and market-oriented biopharmaceutical publicly listed company based in Hong Kong with over 25 years’ experience in the pharmaceutical industry in China. Lee’s Pharmaceutical Holdings Limited is developing tecarfarin as an anti-thrombotic for patients with mechanical heart valves. In 2020 and 2021, Lee’s Pharmaceutical Holdings Limited completed two Phase 1 studies in China and Hong Kong; the company is currently preparing for its Phase 2 trial.

CBL International LimitedBANL, 3.8M Shares, $4.00-4.80, $16.7 mil, 12/16/2022 Friday

- We are an established marine fuel logistics company providing a one-stop solution for vessel refueling, which is referred to as bunkering facilitator in the bunkering industry, in the Asia Pacific. (Incorporated in the Cayman Islands)We purchase and arrange our suppliers to actually deliver marine fuel to our customers, some of which we provide certain credit term of payment while we also receive payment credit from our suppliers. We rely on the permits and licenses of our suppliers for the actual delivery of marine fuel at each port. Since the establishment of our Group in 2015, container liner operators have been identified as our target customers. Container liner operators provide liner services which operate on a schedule with a fixed port rotation and fixed frequency, which is similar to bus operation under which buses go on fixed routes and calling at fixed stops for passengers to board and alight. Knowing the nature of the business of our target customers, we continually look to broaden our operations by (a) expanding our servicing network to cover more ports; and (b) providing more value-added services to tailor for our customers’ growing demands with respect to vessel refueling.Our operations are based in Malaysia, Hong Kong and Singapore, but nearly all of our revenues were generated from China and Hong Kong (based on the location at which the marine fuel is delivered to the customer). For FY2020, FY2021 and the six months ended June 30, 2022, revenue generated from services provided in ports in China and Hong Kong accounted for a total of 88.8%, 95.9% and 92%, respectively, of our total revenue; whilst revenue generated from services provided in ports in Malaysia and Singapore accounted for a total of 10.7%, 2.9% and 7%, respectively, of our total revenue. Although we deliver our services mainly in China and Hong Kong, nearly all our customers are international container liner operators from outside of China and Hong Kong: of our five largest customers from whom we generated 92.9%, 83.6% and 77% respectively of our total revenue for FY2020, FY2021 and the six months ended June 30, 2022, three customers are Taiwanese companies, one is a German company, and one is a Singaporean company.

ParaZero Technologies Ltd.PRZO, 1.6M Shares, $4.25-6.25, $8.4 mil, 12/16/2022 Friday

- We are an aerospace company that is focused on drone safety systems and engaged in the business of designing, developing, and providing what we believe are best-in-class autonomous parachute safety systems for commercial drones, also known as unmanned aerial systems or UAS. (Incorporated in Israel)Our company was founded by a group of aviation professionals, together with veteran drone operators, to address the drone industry’s safety challenges. Our goal is to enable the drone industry to realize its greatest potential through increasing safety and mitigating operational risk.Our unique patented technology for drones, the SafeAir system, is designed to protect hardware, people and payload in the event of an in-flight failure. The SafeAir system is a smart parachute system that monitors UAS flight in real time, identifies critical failures and autonomously triggers a parachute in the event that certain parameters indicative of a free fall are present. The system contains a flight termination system, a black box to enable post-deployment analysis, and a warning buzzer to alert people of a falling drone. In addition to being fully autonomous, the SafeAir system includes a separate remote control for manual parachute deployment capability.We have a global distribution footprint and have forged partnerships all around the world, including India, South Korea, the United States, Latin America and Europe. We sell our drone safety systems as off-the-shelf solutions, as well as perform integrations with original equipment manufacturers, or OEMs, offering customized, bespoke safety solutions for a large variety of aerial platforms.Our technology has been sold to and used by some of the world’s top companies and organizations, including drone companies such as LIFT Aircraft, Airobotics, SpeedBird Aero and Doosan Corporation, and other leading brands such as CNN, The New York Times, Hensel Phelps, Verizon Media (Skyward), Fox Television, the Chicago Police Department and Fortis Construction.

Intchains Group Ltd.ICG, 3.6M Shares, $7.00-9.00, $28.6 mil, 12/19/2022 Week of

- We are a provider of integrated solutions consisting of high-performance ASIC chips and ancillary software and hardware for blockchain applications. (Incorporated in the Cayman Islands)We utilize a fabless business model and specialize in the front-end and back-end of IC design, which are the major components of the IC product development chain. We have established strong supply chain management with a leading foundry, which helps to ensure our product quality and stable production output.Our products consist of high-performance ASIC chips that have high computing power and superior power efficiency as well as ancillary software and hardware, which cater to the evolving needs of the blockchain industry. We have built a proprietary technology platform named “Xihe” Platform, which allows us to develop a wide range of ASIC chips with high efficiency and scalability. We design our ASIC chips in-house, which enables us to leverage proprietary silicon data to deliver products reflecting the latest technological developments ahead of our competitors. As of Dec. 31, 2021, we had completed a total of seven tape-outs using our “Xihe” Platform for 22nm ASIC chips, achieving a 100% success rate for all our tape-outs.Our strong commitment to advanced research and development enables us to innovate continuously and create ASIC chips with superior performance to power ratio at reasonable cost. According to Frost & Sullivan, we have a leading market share in ASIC chips designed for several key blockchain algorithms including Blake2bsha3, sha512MD160, Cryptonight V4, Eaglesong and Blake2s, in terms of the accumulative computing power sold for the years ended Dec. 31, 2019, 2020 and 2021. We will continue to devote significant resources to design and tailor our ASIC chips for use in high-technology applications.

AlphaVest AcquisitionATMVU, 6.0M Shares, $10.00-10.00, $60.0 mil, 12/20/2022 Tuesday

- We intend to focus our search on businesses throughout Asia. However, we will not consummate our initial business combination with an entity or business with China operations consolidated through a variable interest entity (“VIE”) structure. (Incorporated in the Cayman Islands)

ETF Launches

Climate change and ESG are clearly the latest flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

- 9/22/2022 – WisdomTree Emerging Markets ex-China Fund XC – Passive, equity, emerging markets

- 9/15/2022 – KraneShares S&P Pan Asia Dividend Aristocrats Index ETF KDIV – Passive, equity, Asia, dividend strategy

- 9/15/2022 – OneAscent Emerging Markets ETF OAEM – Active, Equity, emerging markets, ESG

- 9/9/2022 – Emerge EMPWR Sustainable Select Growth Equity ETF EMGC – Active, equity, emerging markets

- 9/9/2022 – Emerge EMPWR Unified Sustainable Equity ETF EMPW – Active, equity, emerging markets

- 9/8/2022 – Emerge EMPWR Sustainable Emerging Markets Equity ETF EMCH – Active, equity, emerging markets, ESG

- 7/14/2022 – Matthews China Active ETF MCH – Active, equity, China

- 7/14/2022 – Matthews Emerging Markets Equity Active ETF MEM – Active, equity, emerging markets

- 7/14/2022 – Matthews Asia Innovators Active ETF MINV – Active, equity, Asia

- 6/30/2022 – BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF XEMD – Passive, fixed income, emerging markets

- 5/2/2022 – AXS Short CSI China Internet ETF SWEB – Active, inverse, thematic

- 4/27/2022 – Dimensional Emerging Markets High Profitability ETF DEHP – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Core Equity 2 ETF DFEM – Active, equity, emerging markets

- 4/27/2022 – Dimensional Emerging Markets Value ETF DFEV – Active, equity, emerging markets

- 4/27/2022 – iShares Emergent Food and AgTech Multisector ETF IVEG – Passive, equity, thematic [Mostly developed markets]

- 4/21/2022 – FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM – Passive, equity, ESG

- 4/6/2022 – India Internet & Ecommerce ETF INQQ – Passive, equity, thematic

- 2/17/2022 – VanEck Digital India ETF DGIN – Passive, India market, thematic

- 2/17/2022 – Goldman Sachs Access Emerging Markets USD Bond ETF GEMD – Passive, fixed income, emerging markets

- 1/27/2022 – iShares MSCI China Multisector Tech ETF TCHI – Passive, China, technology

- 1/11/2022 – Simplify Emerging Markets PLUS Downside Convexity ETF EMGD – Active, equity, options strategy

- 1/11/2022 – SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG – Passive, equity, ESG

ETF Closures/Liquidations

Frontier and emerging market highlights:

- 12/21/2022 – VictoryShares Emerging Market High Div Volatility Wtd ETF CEY

- 8/22/2022 – iShares MSCI Argentina and Global Exposure ETF AGT

- 8/22/2022 – iShares MSCI Colombia ETFI COL

- 6/10/2022 – Infusive Compounding Global Equities ETF JOYY

- 5/3/2022 – ProShares Short Term USD Emerging Markets Bond ETF EMSH

- 4/7/2022 – DeltaShares S&P EM 100 & Managed Risk ETF DMRE

- 3/11/2022 – Direxion Daily Russia Bull 2X Shares RUSL

- 1/27/2022 – Legg Mason Global Infrastructure ETF INFR

- 1/14/2022 – Direxion Daily Latin America Bull 2X Shares LBJ

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as some ETF lists are still being updated as of Summer 2022).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer: EmergingMarketSkeptic.Substack.com and EmergingMarketSkeptic.com provides useful information that should not constitute investment advice or a recommendation to invest. In addition, your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content.

Emerging Market Links + The Week Ahead (December 12, 2022) was also published on our Substack.

Emerging Markets Investing Tips + Advice

Emerging Market Skeptic (Website)

Website List Updates + Site Map

Stocktwits @EmergingMarketSkptc

Similar Posts:

- Emerging Market Links + The Week Ahead (May 30, 2022)

- Emerging Market ETF Lists

- Investing in Latin America ETFs / Latin America ETF Lists

- Emerging Market Links + The Week Ahead (June 6, 2022)

- Emerging Market Links + The Week Ahead (June 27, 2022)

- Emerging Market Closed-End Funds List

- Emerging Market Links + The Week Ahead (July 18, 2022)

- Investing in Latin America ETFs / Latin America ETF Lists (Region Wide)

- Investing in South America ETFs / South America ETF Lists

- Investing in Central America ETFs / Central America ETF Lists

- Emerging Market Links + The Week Ahead (August 29, 2022)

- Emerging Market Links + The Week Ahead (September 5, 2022)

- Emerging Market Links + The Week Ahead (June 20, 2022)

- Emerging Market Links + The Week Ahead (May 16, 2022)

- Emerging Market Links + The Week Ahead (December 26, 2022)